Changes in trading volume tend to exacerbate stock price increases or decreases.

U.S. stocks were hit hard on Monday (August 5), with the S&P 500 index plunging 3%, the biggest single-day drop since 2022. High valuations, weak employment data and the unwinding of yen carry trades have triggered investor panic.

Stocks rebounded on Tuesday, with the S&P 500 closing up about 1%, but market sentiment remains nervous, with the VIX fear index continuing to remain above 25, at a high this year.

The yen, corporate earnings and concerns about a recession all contributed to Monday's sharp drop in U.S. stocks, but there is another "culprit" that is not talked about enough: sluggish trading volume.

History shows that changes in trading volume could exacerbate stock market volatility in the coming weeks.

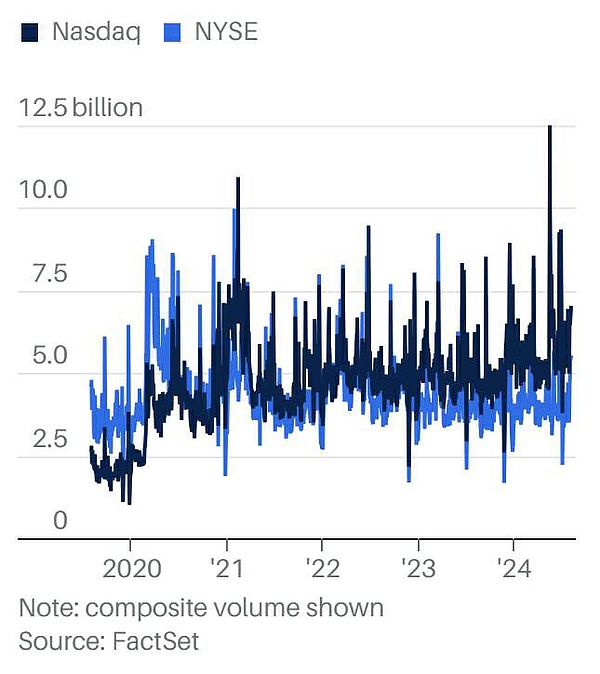

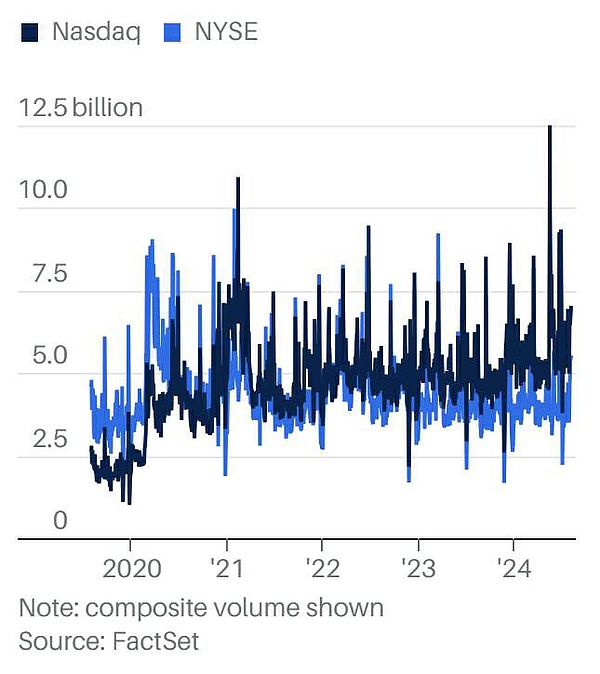

Nasdaq's trading volume has recently surpassed that of the New York Stock Exchange

"The sharp stock market volatility in recent trading days has been amplified by the lack of liquidity in August," said Jim Reid, an analyst at Deutsche Bank Research, in a report released on Tuesday.

August is usually the quietest month of the year, with about 9.3 billion shares changing hands every day on major U.S. exchanges, down nearly 30% from the peak of 13.2 billion shares in March, according to Dow Jones Market Data.

Every August, Wall Street people in the northeastern United States usually go to the beach for vacation, and with fewer trading desk managers, the number of buyers and sellers in the market has decreased.

That, in turn, means lower liquidity. On days like Monday when there are a lot of potential sellers scrambling to unload stocks, a scarcity of buyers can cause stock prices to fall quickly, and such declines tend to be self-reinforcing.

(A similar situation has occurred recently in the real estate market, where a shortage of potential sellers has caused home prices to spiral upward despite factors such as rising interest rates.)

August is usually a month of low trading, but last week was particularly low as investors took a “wait-and-see” stance after the Federal Reserve’s meeting on Wednesday, Steve Sosnick, a strategist at Interactive Brokers, told Barron’s on Tuesday. Volumes rose sharply late last week and then peaked on Monday.

These phenomena can be seen in the changes in trading volume of the SPDR S&P 500 Trust (SPY), the largest exchange-traded fund in the market by assets. The ETF has averaged about 81 million shares a day over the past three years, according to FactSet. Before Monday, daily volume fell to 47 million shares in July, and on Monday, nervous investors suddenly pushed trading volume up to 146 million shares.

This was the ETF's highest volume day since the beginning of 2023, but from a long-term perspective, daily trading volume of 150 million shares or more is not unprecedented during periods of increased stock market volatility, with more than a dozen such trading days in 2022.

Sosnick pointed out that traders may return to the market starting in September. However, historically, stock trading volume in September and October has only risen slightly, and Dow Jones Market Data shows that the average daily trading volume of U.S. stocks does not usually exceed 10 billion shares before November.

Of course, traders may have to return early this year, especially if stocks see more sharp declines, and there are many factors that make investors nervous.

The market is still largely holding on to the hope that the Federal Reserve can achieve a "soft landing" and reduce inflation while avoiding a recession, but this hope seems to be becoming increasingly slim. Data from the futures market shows that the probability of the Federal Reserve cutting interest rates by 50 basis points in September has risen to more than 60%, indicating that the Fed may have to take more decisive action than most investors thought a few weeks ago.

The upcoming US presidential election adds another major uncertainty. After Vice President Kamala Harris recently joined the race, the two presidential candidates are currently neck and neck in the polls.

Yardeni Research said in a report released on Monday: "We still expect the S&P 500 to fall below its all-time high set on July 16 before the November election." The agency believes that once the election dust settles, the S&P 500 will set new highs, but also admits that "the premise is that many things cannot go wrong."

Edmund

Edmund