The hottest news today is that Russia allows cryptocurrency mining! It is a milestone event that will go down in history.

According to TASS, Russian President Vladimir Putin signed the Russian law on the legalization of cryptocurrency mining on August 8, indicating that the BRICS alliance has reached an important development node in the field of digital currency.

Let's take a look at the main contents of the bill:

New concepts such as digital currency mining, mining pools, and mining infrastructure operators are introduced, and mining is regarded as part of economic activities rather than simply issuing digital currencies.

Only Russian legal persons and individual businesses registered with the Russian digital department can legally mine.

Ordinary citizens who do not exceed the government's energy consumption limit can also conduct small-scale mining without registration.

Foreign digital financial assets are allowed to be traded on Russian blockchain platforms. If they pose a threat to financial stability, the Russian Central Bank has the right to ban the issuance of individual digital assets.

Miners are required to provide the government with information on the digital currencies they mine to ensure compliance.

This is not the first law passed by Russia this year to support cryptocurrencies. As early as the end of July, Russia decided to allow the use of cryptocurrencies for payments in international trade in response to Western sanctions.

What does it mean for Russia to open up to cryptocurrencies?

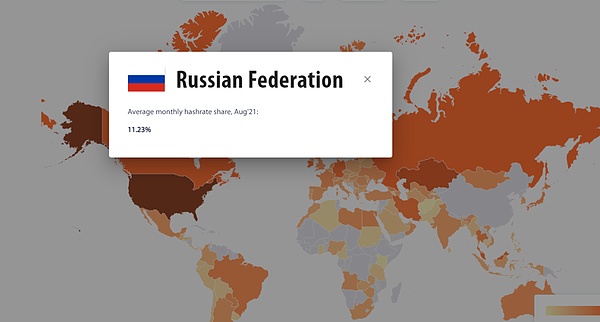

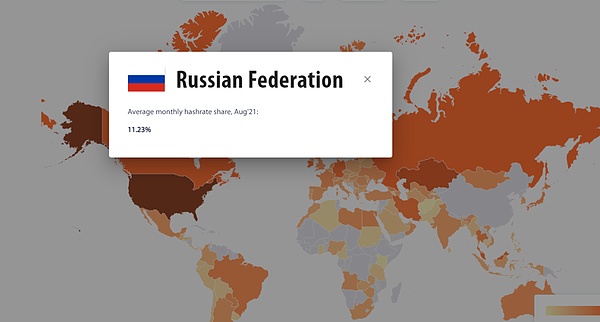

You should know that Russia's participation in the Bitcoin field is actually quite significant, and it can be called a big player. As early as 2021, Cambridge Centre for Alternative Finance data statistics showed that the United States is the world's largest consumer of Bitcoin electricity, accounting for 35.40%.

Following closely are Kazakhstan (18%), Russia (11.23%), Canada (9.6%) and Ireland (4.7%). By July 2024, cryptocurrency mining in Russia will account for 1.6% of the country's electricity consumption.

Looking at the above data, if the crypto market is compared to a large game, Russia seems to have long been an advanced player out of the novice village. However, this is not the case. Russia has been wavering on its cryptocurrency policy in recent years.

Before 2017, the Russian government and the central bank were highly vigilant about cryptocurrencies, believing that they were risky and were mainly worried that they might be used for illegal activities, such as money laundering.

In 2019, Russia began to explore how to effectively regulate cryptocurrencies. In terms of regulatory policy, the Ministry of Finance tends to be more relaxed, while the central bank advocates strict control and even recommends banning the use of private cryptocurrencies.

By 2020, Russia passed the "Law on Digital Financial Assets", which recognizes cryptocurrencies as property but prohibits their use to pay for goods and services, marking the initial establishment of the legal status of cryptocurrencies.

Over time, the Russian government's attitude towards cryptocurrencies has gradually become more positive in the past two years. On December 14, 2023, the Russian Ministry of Finance proposed a new bill aimed at legalizing Bitcoin (BTC) mining and establishing a mechanism for selling mined currencies.

The bill contains provisions prohibiting cryptocurrency advertising, requiring cryptocurrency sales through foreign platforms, and prohibiting the use of Russia's information infrastructure.

By May 2024, Anton Gorelkin, Chairman of the State Duma Financial Market Committee, expressed opposition to a complete ban on the circulation of cryptocurrencies, emphasizing the importance of regulating cryptocurrency trading platforms within the legal framework.

Until today, Russia has officially legalized cryptocurrency mining.

From cautious to open, Russia's attitude towards cryptocurrency mining can be described as a 180-degree reversal! Putin's series of policy adjustments reflect his determination to seek new growth points and occupy a place in the global digital economy.

Let's think about what exactly is the reason for such a big reversal in Russia's attitude? It can be roughly summarized as follows:

1. The need to respond to Western sanctions

As Russia's relations with Western countries become increasingly tense, it has been subject to a series of economic sanctions. Using cryptocurrencies for cross-border payments and transactions can help Russia bypass sanctions and enhance its trade capabilities with other countries, especially non-Western countries.

2. Seeking new economic growth points

The Russian government realizes that cryptocurrencies and blockchain technology have huge economic potential. By legalizing cryptocurrency mining and trading, new sources of tax revenue can be brought to the country. The Ministry of Finance estimates that starting in 2023, tax revenue from cryptocurrency trading and mining activities could reach 2.5 billion rubles (about $340 million) per year.

3. Give full play to its own advantages

Russia has certain advantages in energy and computing power, which provides good conditions for cryptocurrency mining. In 2022, President Putin emphasized in a meeting with the government that Russia has advantages in cryptocurrency mining due to the presence of experts in this field and surplus electricity.

4. Gradual improvement of the regulatory framework

Russia began to explore how to effectively regulate cryptocurrencies in 2019. Although the Ministry of Finance and the Central Bank had differences on specific policies, this laid the foundation for subsequent policy changes. The "Law on Digital Financial Assets" passed in 2020 also marked an important step for Russia in the legal status of cryptocurrencies.

In short, Russia's new regulations on cryptocurrency mining are not accidental, but after a series of policy discussions and preparations, the government has gradually opened its arms to the cryptocurrency industry.

With such a major positive blessing, Bitcoin did not disappoint the market. Yesterday, it climbed from $55,000 to $61,000 in one day, setting the second largest market value increase in history in a single day! ! The first market value increase occurred in the last bull market on February 8, 2021, with an intraday increase of 19.54%!

Looking to the future, with the further improvement of cryptocurrency policies and changes in the international market, Russia may play an increasingly important role in the global digital economy.

The price fluctuations of digital assets such as Bitcoin will continue to attract investors' attention, and Russia's policy orientation will have a profound impact on the global cryptocurrency market, and it is also an important challenge facing Russia.

With the support of world leaders such as Trump and Putin for Bitcoin, cryptocurrency is gradually being recognized by mainstream governments. This shift marks Bitcoin's move from the periphery to the center, and continues to inject new impetus into the diversified development of the global economy in the international financial market.

Joy

Joy