比特币回调至 66,500 美元,以太坊跌破 2,700 美元:市场健康调整还是趋势逆转?

比特币昨日触及 69,546 美元高点后回落,盘中最低跌至 66,500 美元,令部分投资者出局。以太坊跌幅更大,回到 2,640 美元的关键盘整区。市场在短期内面临健康调整或是深度回调,仍有待观察。

Alex

Alex

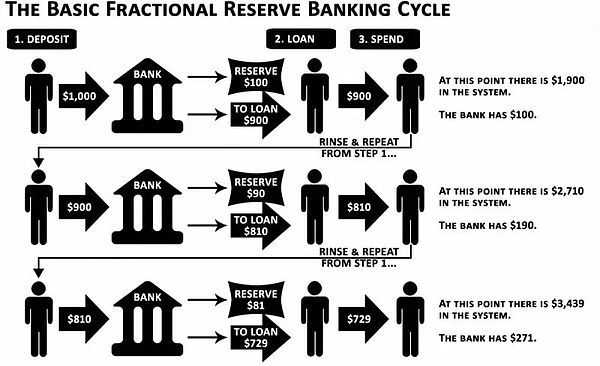

Ponzi scheme, this is a word often used by traditional finance (TradFi) to describe cryptocurrencies. People in the traditional financial circle are proud that they invest in a "safe" and "robust" monetary system. However, they may not know that since the early 19th century, banks have actually been a naked embodiment of a Ponzi scheme. Let's learn about this little-known system - fractional-reserve banking (the "fractional reserve system").

The fractional reserve system is a system that allows banks to lend far more than they actually hold in reserves. The reserve ratio is the minimum proportion of customer deposits that banks must retain, and the remainder can be used for lending. This system enables banks to create money through lending, because new loans generate new deposits and expand the money supply. So how does this system become a Ponzi scheme? In fact, this system relies on the continuous increase of new deposits to maintain its operation, similar to a Ponzi scheme. When the bank does not have enough deposits flowing in (new deposits cannot cover withdrawal demands), the system collapses and a bank run occurs.

The reserve requirement ratio (set by the Federal Reserve) is typically 10%, but at the time of writing (mid-March 2023) it is 0%. This means that in theory, banks can create an unlimited amount of money out of thin air with just $1 in deposits. While this system is important to the global economy (because it stimulates demand), it poses a multi-faceted threat to the stablecoins we know and use.

USDT, USDC, BUSD, TUSD, and USDP - these are the top centralized stablecoins in the crypto space, with a combined market capitalization of about $123 billion, or about 10% of the global cryptocurrency market cap. Most of these stablecoins are backed by U.S. dollars that are stored in a bank account somewhere. The key word here? The key word is "bank account", which means that these deposits are also subject to the fractional reserve system that could collapse at any time. Recently (March 10, 2023), Silicon Valley Bank (SVB) collapsed, the second largest bank failure in the United States, causing a huge shock in the crypto market. Because the issuer of the USDC stablecoin Circle has about 8% of its reserves in SVB, USDC once fell to $0.88, 12% below the dollar parity.

Without the intervention of the FDIC (Federal Deposit Insurance Corporation), 8% of USDC's reserves will disappear out of thin air, causing the real price of USDC to drop to $0.92. You can imagine how serious the consequences will be for USDC holders (including DeFi funds, institutions and retail investors, etc.). Reading this, you may be thinking, "But aren't there many decentralized stablecoins that can replace USDC? For example, FRAX and DAI."The problem is: these so-called "decentralized" stablecoins are not so decentralized because most of their reserves come from centralized stablecoins. For example, MakerDAO’s DAI stablecoin is about 35% backed by USDC, and a significant portion of the FRAX stablecoin in circulation is also backed by USDC.

Ignas | DeFi Research noted on Twitter: “We found that $USDC is backed by cash held by banks, except... the banks don’t actually hold the cash.”/Twitter

When we mention DeFi, we usually think of it as a completely parallel financial system. But since the goal of the crypto industry is to completely get rid of the traditional financial system (TradFi), why is DeFi so dependent on the system it wants to break away from?

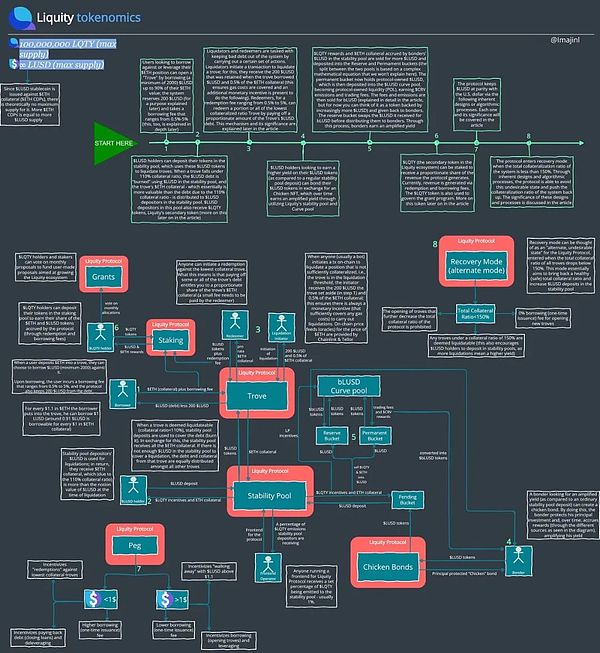

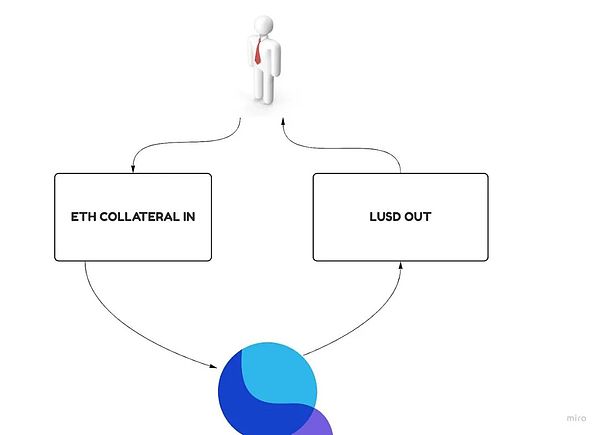

The Liquity Protocol was born as a truly decentralized stablecoin issuer that is not subject to any banking risk.The protocol leverages the security of Ethereum to mint a stablecoin $LUSD (pegged to the US dollar) on the Ethereum blockchain using $ETH as collateral. This means that $LUSD is fully backed by $ETH, which is arguably one of the highest quality collateral in cryptocurrencies.

In addition to providing decentralized stablecoins, the Liquity Protocol also provides completely interest-free loans, high capital efficiency, and generous returns on its stablecoins.

Liquity Protocol uses a dual token economic model: $LUSD is the native stablecoin issued by the protocol, and $LQTY is a token used to incentivize the adoption of certain features of the protocol and is also a value capture token in the ecosystem. We will introduce these two tokens in detail later.

Trove is a core component of the Liquity protocol. They facilitate the creation of collateralized debt positions (CDPs). In simple terms, users can deposit $ETH tokens as collateral and mint Liquity's stablecoin $LUSD. You can think of Trove as Liquity's version of MakerDAO's vault, but with some nuances.

First, Liquity's Trove only accepts $ETH as collateral. This is because the main goals of the protocol are to:

Maintain price stability

Maintain decentralization

Maintain censorship resistance

$ETH is an ideal collateral in these regards.

Other major stablecoin issuers, such as MakerDAO, Abracadabra Money, Inverse Finance, and QiDao offer multiple collateral options, which enables them to scale (issue more stablecoins), but also brings some corresponding problems:

Sacrificing price stability, because collateral can be highly volatile and on-chain liquidity is low, which increases the risk of bad debts. Liquidation may not be executed due to insufficient liquidity, or liquidation is no longer economically viable due to a sudden drop in price.

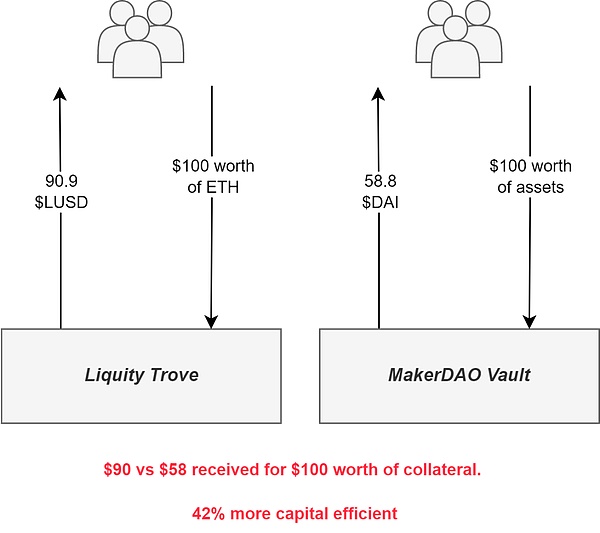

Sacrifices decentralization, because some of the underlying collateral may have centralized characteristics (for example, if the collateral is USDC or USDT). As a result, these protocols usually need to increase the minimum collateralization ratio (to keep the collateral level healthy to prevent a sudden drop in price from causing bad debts or to provide enough time for liquidation), which reduces their capital efficiency. In contrast, Liquity's Trove only accepts $ETH as collateral, which can reduce the collateralization ratio to 110% (because $ETH is less volatile than most other DeFi tokens and has sufficient on-chain liquidity).

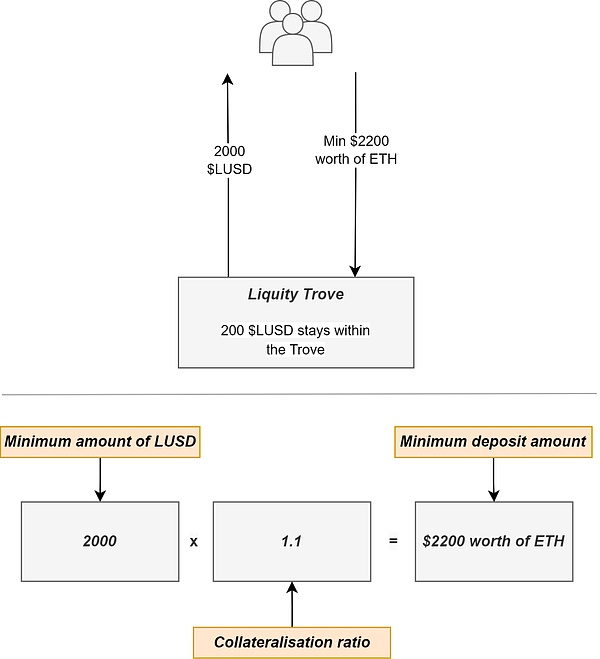

In short, this means that for every $1.1 worth of ETH tokens deposited as collateral, you can borrow 1 LUSD. This makes Trove extremely capital efficient because you can take on more debt with less collateral.

To better understand this, we can look at MakerDAO. Most MakerDAO vaults have a minimum collateralization ratio of about 170%, which means that for every $1.7 of collateral deposited, only 1 $DAI stablecoin can be minted (borrowed).

Second, and perhaps most importantly, Liquity Protocol’s Trove allows interest-free lending, i.e. you can get a loan using your $ETH tokens as collateral without paying any interest.

Most stablecoin issuers (such as those mentioned above) typically charge a floating interest rate on debt, ranging from a few percentage points to more, which reduces the attractiveness of opening a debt position. Not only is the interest rate itself a deterrent, but its variability makes it highly unpredictable.

This interest rate also compounds (accumulates rapidly over time), which also increases the risk of liquidation (usually resulting in a net loss of several percentage points on your collateral due to liquidation penalties paid to the liquidator) as the value of your debt relative to your collateral increases over time (assuming your collateral price is relatively stable or completely stable).

However, the Liquity protocol does charge a one-time borrowing fee, which varies between 0.5% and 5%. While the fee is typically 0.5%, we’ll explain why the fee varies later in the article.

This one-time borrowing fee is added to the debt when a Trove is opened and is paid when the user closes a Trove. It’s worth noting that major stablecoin issuers, including Abracadabra Money and QiDao, also use this fee structure. This is a better option for users looking to open a debt position, as it is a one-time fee that costs significantly less than a floating rate over the long term.

Third, and perhaps the only major drawback to Liquity’s lending mechanism, is that the minimum amount of $LUSD (i.e. debt) to borrow is 2000 $LUSD.

This means that at least $2200 worth of $ETH collateral needs to be deposited with the protocol. In addition, the protocol retains 200 $LUSD from the debt taken on (for reasons explained later in the article), which is only returned when the user closes Trove.

Finally, the Liquity protocol is not governed by a DAO and its smart contracts are completely immutable.

How does this relate to Trove?

In a system like MakerDAO, $MKR (Maker’s auxiliary token) is used to govern the protocol and can be used to vote on key matters, such as changing key parameters like interest rates, minimum collateralization ratios, and listing new collateral types.

What are the downsides of such a system?First, it is not always decentralized. Some “big whales” may accumulate a lot of governance power to influence decisions in their favor (rather than voting in the best interest of the protocol), and participation in governance votes is often low. Secondly, these systems can be manipulated by flash loans. Finally, these governance proposals often take a long time to develop, discuss, and ultimately execute. Furthermore, relying on a system that requires human governance may not be efficient because they may not have all the information they need to make informed decisions.

In contrast, in a system like Liquity, the protocol is governed entirely by algorithms — algorithms that are unmanipulatable, battle-tested, and use transparent blockchain data to make the most appropriate adjustments to the protocol. Specifically, the fees associated with Trove are adjusted by these algorithms based on market conditions (more on this later in the article);Second, the immutability of the protocol means that no interest rates or new collateral types can be introduced, and the minimum collateral ratio cannot be changed. While such a system may be optimal in terms of decentralization, it may come at a cost in terms of security and scalability. Because Liquity’s smart contracts are immutable, any vulnerabilities or flaws in the code cannot be changed. At the same time, users’ growing preferences for collateralized debt positions may not be met, hindering innovation that might otherwise occur. If the system is mutable, it may be better able to adapt to these changes.

Of all you’ve just read, one thing may stand out: the extremely low minimum collateralization ratio.You may be thinking, “A 110% collateralization ratio must be unsafe and will greatly increase the risk of bad debts” (and thus cause price instability in the $LUSD stablecoin).

This concern may apply to other stablecoin issuers that use traditional clearing systems.

But Liquity has implemented a state-of-the-art clearing system by adopting an innovative concept - the stable pool.

Here’s how it works:

Holders of the $LUSD stablecoin can choose to deposit their $LUSD tokens into the pool.

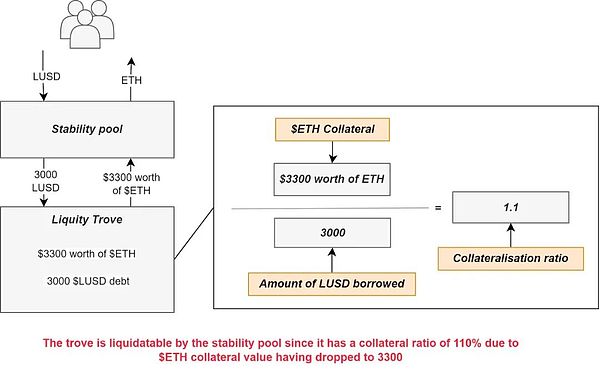

When the collateralization ratio of any Trove drops below 110%, anyone can initiate a transaction to liquidate that Trove and receive 0.5% of the $ETH collateral of that Trove and the 200 $LUSD set when the user opened the Trove.

This ensures that there is always an economic incentive for the liquidation process. This is important because if the value of the collateral is less than the debt, the user has no incentive to repay the debt, obtain an equal amount of collateral, and liquidation rewards.

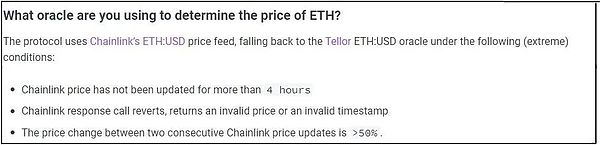

How does the liquidator know when a Trove is undercollateralized? Liquity uses on-chain price oracles to determine the price of $ETH and therefore which Troves can be liquidated. These oracles are primarily provided by Chainlink, with backup oracles provided by Tellor. The image below (taken from Liquity's documentation) describes the circumstances under which the backup (Tellor) oracle is used to provide $ETH price information.

Now you understand how liquidation is initiated. But what happens to the debt?After liquidation is initiated, the outstanding debt of Trove is actually offset (destroyed) by $LUSD deposits in the stability pool. The collateral is then seized by the protocol and returned to the Stability Pool. In this way, Stability Pool depositors receive a pro rata portion of the $ETH collateral of the liquidated Trove, which is worth approximately 9% more in nominal terms (at the time of liquidation) than the $LUSD used to burn Trove debt (mathematically, this works out to 9.45% if you factor in the 0.5% $ETH collateral given to liquidators, but due to $ETH volatility, it averages out to 9%). This means that it is always profitable to deposit $LUSD into the Stability Pool, as Trove will always remain overcollateralized.

It is worth noting that the Stability Pool is further incentivized by Liquity’s auxiliary token $LQTY, making deposits into the Stability Pool even more attractive.

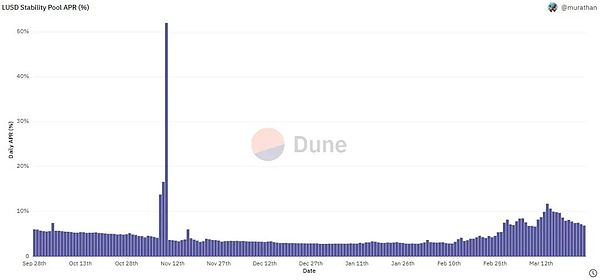

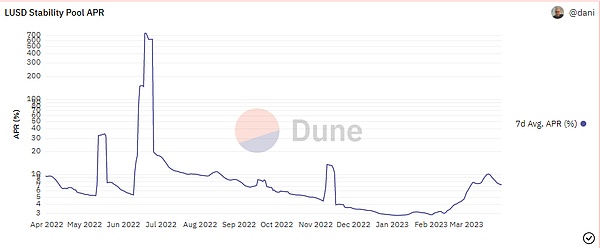

Overall, the incentive for depositing LUSD in the stable pool is primarily a very competitive stablecoin yield (annualized interest rate, APR), which is composed of ETH collateral received during the liquidation process and the issuance of additional $LQTY.

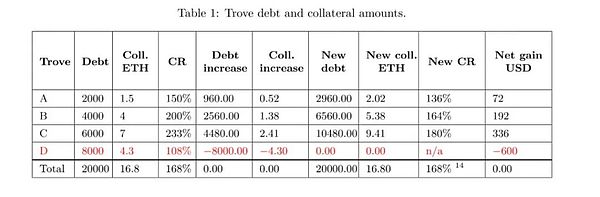

But what if there is not enough $LUSD in the stable pool to pay off the debt of a lending position? Don't worry, the developers have considered this scenario. In this case, the debt and collateral are evenly distributed among all other open lending positions. While at first glance this may seem disadvantageous to users holding open positions, in fact, at the time of liquidation, all other positions receive a net gain (of course, over time, the price of $ETH may fall, and this may no longer be the case).

The figure below, taken from Liquity's documentation, shows an example of the redistribution of debt and collateral among all other Troves.

However, due to sufficient deposits in the stable pool, the protocol has never used this secondary liquidation mode, and I don't think it will happen often in the future. It is just a backup mechanism set up to deal with the worst case scenario.

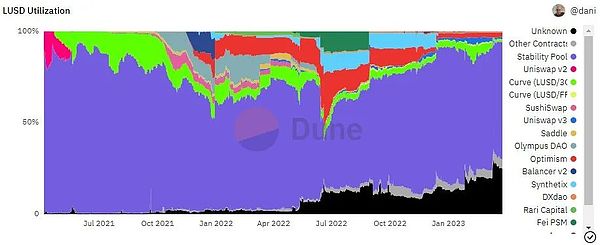

As shown in the above figure, most (about 65% at the time of writing) of the $LUSD stablecoins are deposited in the stable pool because this is currently the most important use case of $LUSD. This can be attributed to the very high APR for stable pool deposits (see the chart below), which averages about 7.9% per month and about 22% per year. Such stablecoin yields are very rare.

Even when the $LQTY incentives issued to the stable pool begin to decrease and eventually run out, there will still be additional $ETH collateral available when Trove is liquidated (when the collateralization rate < 110%) to incentivize users to deposit in the stable pool.

If this is not enough to incentivize users to deposit $LUSD (for example, the APR for depositing in the stable pool may be lower than other opportunities to earn $LUSD), bots that utilize flash loans (deposit $LUSD within a block to cancel the debt, and withdraw $ETH) can always provide $LUSD liquidity to liquidate Trove. In this way, the system does not need to rely on users depositing $LUSD into the stability pool, nor does it need to rely on a secondary liquidation mechanism (i.e., allocating debt and collateral between all other open lending positions) to complete liquidations. As you can see here, not only has there never been a bad debt in the protocol, but all liquidations have been seamless and occurred exactly when they should have occurred (when Trove's collateralization ratio dropped below 110%). In contrast, MakerDAO, Abracadabra, and many other stablecoin issuers have experienced liquidation issues in the past, often resulting in bad debts and insolvency situations. Some protocols like MakerDAO mint and sell their $MKR tokens to cover these bad debts, but you can see that this is a far inferior system to Liquity.

However, this liquidation model used by Liquity also has a potential risk: Chainlink’s price feeds (which, as you remember, the Liquity protocol uses for liquidations) are controlled by a 4/9 multisig and could be manipulated. However, as mentioned before, Tellor is used as a fallback if Chainlink’s price feeds look suspicious. While this mitigates some of the risks that come with using Chainlink, it does leave a potential attack vector (if both Chainlink and Tellor are manipulated at the same time, perhaps due to regulatory pressure). Due to the immutable nature of the Liquity contracts, this risk cannot be completely eliminated.

Recovery mode can be seen as an "alternative and non-ideal state" of the Liquity protocol, which is entered when the total collateralization ratio of all lending positions is less than 150%. The main goal of recovery mode is to restore the total collateralization ratio of the protocol to a healthy (safe) level and increase $LUSD deposits in the stable pool by repaying debts or replenishing collateral.

How does the protocol achieve this?First, the protocol prohibits any user who cannot increase the total collateralization ratio of the system from opening new lending positions.Second, in order to encourage users to open new lending positions to increase the total collateralization ratio of the system, the protocol will waive borrowing fees.Third, any lending position with a collateralization ratio below 150% will be considered liquidable, which will also incentivize $LUSD holders to deposit funds in the stable pool, because more liquidations mean higher returns. By doing this, the protocol is able to simultaneously increase the total collateralization ratio and increase the amount of deposits in the stable pool.

While this mechanism is important during periods of market or protocol turmoil, it is a short-lived mode that, once triggered, typically only lasts for a short time (in fact, this mode has only been triggered once, and for only a few minutes). Furthermore, the very possibility of the protocol triggering this mode is an effective way to prevent the system from actually entering this state.

It is worth mentioning that the liquidation mechanism in recovery mode is different from normal mode, but you don’t need to go into these details. If you are interested, you can read the detailed introduction to recovery mode in the official Liquity documentation.

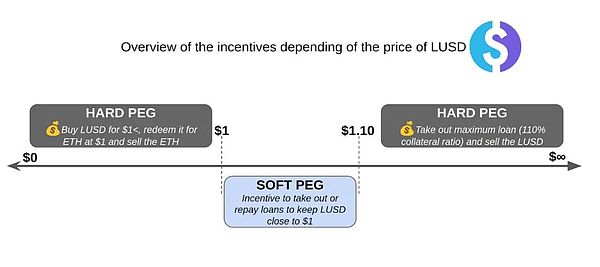

So far, we have mainly discussed the Liquity protocol. Now, let’s put this newfound knowledge together and understand how Liquity’s underlying protocol design and algorithms keep $LUSD stable at its ideal $1 peg (equivalence).

Before we go any further, let’s first introduce a simple mechanism in the protocol called “redemption.” This is a process where anyone (usually a bot) can redeem $LUSD from the least collateralized loan position for $ETH. This means that redemption is essentially another way to repay some or all of the $LUSD debt, and the redeemer is entitled to receive a corresponding proportion of the $ETH collateral in that loan position, minus a small fee (fees range from 0.5% to 5%, adjusted based on the peg of $LUSD; more information can be found in the related content), which is paid to the protocol.

For example, let’s assume that the least collateralized loan position has 400 $LUSD debt, and the current price of $ETH (for simplicity) is $1. In this case, we set the redemption fee to 1%. Now, anyone can redeem 400 $LUSD for $396 worth of $ETH tokens. So where did the $4 worth of $ETH go? This is the 1% redemption fee paid to the protocol. Why would anyone be willing to redeem from the borrow position with the lowest collateralization ratio? We will explain this question in the next few paragraphs.

Now, let's talk about the anchoring problem.

1) Reduce the one-time borrowing fee

2) Incentivize users to borrow (open a lending position) and increase $ETH for leverage

3) When the $LUSD price is above $1.1, users are incentivized to open a lending position and "cash out", that is, after borrowing $LUSD, profit by selling or exchanging other assets, and then exit the operation.

Let's analyze these strategies one by one.

1) The protocol uses an algorithm to determine the one-time borrowing fee. If the anchor price of $LUSD is above $1, the borrowing fee is usually reduced, encouraging users to open a lending position because it is cheaper for them (this is why the borrowing fee range is between 0.5% and 5% mentioned earlier). More lending positions being opened will increase the supply of $LUSD, thus driving down the price; while increasing the supply of $LUSD will not directly lower the price, it will encourage more people to sell their newly minted $LUSD, thus bringing the price down.

2) When the price of $LUSD is above $1, users are automatically incentivized to open lending positions and sell their newly minted $LUSD. This way, they can exchange $LUSD for more other stablecoins, and then wait until the price of $LUSD recovers to $1 before closing their positions and earning the difference they previously earned by selling $LUSD. In addition, users who are bullish on $ETH (and therefore want to increase leverage) can take action when $LUSD is above $1: they can open a lending position, generate $LUSD, sell these $LUSD (thus lowering its price) in exchange for more $ETH (since the price of $LUSD is higher than expected, they can get more $ETH), then deposit these $ETH into the position again (increasing the maximum amount that can be borrowed because the collateral has increased), and repeat the process.

3) When the price of $LUSD is above $1.1, economically speaking, users will tend to generate $LUSD with $ETH at the lowest collateral ratio (110%) and make a profit by selling these $LUSD (thus driving down the price).

Scenario 2: The price of $LUSD is below $1. How to increase the price?

1) Increase the one-time borrowing fee

2) Incentivize users to repay debts (close borrowing positions) and reduce $ETH leverage

3) Incentivize users to redeem borrowing positions with the lowest collateral ratio

Let's analyze these strategies one by one.

1) If the $LUSD price is below $1, borrowing fees will typically increase (remember, borrowing fees are dynamic and can go up to 5%), which can disincentivize users from opening new borrowing positions because they are more expensive. Reducing the opening of new borrowing positions ensures that fewer $LUSD are minted and sold, preventing the price of $LUSD from deviating further from the peg.

2) When the price of $LUSD is below $1, users are automatically incentivized to close borrowing positions. Users who have opened borrowing positions but are keeping their debt in other stablecoins or other investments are incentivized to buy back $LUSD (driving the $LUSD price back up) and repay their debt because it is cheaper for them to do so. Additionally, users who are taking leverage can unleverage by buying back $LUSD (driving the $LUSD price back up) and repaying their debt because it is cheaper to do so.

3) When the price of $LUSD is below $1, it makes economic sense for anyone to redeem $ETH from the lowest collateralized borrow position. Anyone can buy $LUSD (driving the price back up) and redeem the lowest collateralized position, pocketing the difference, since the redeemed $ETH is worth more than the $LUSD they bought below the peg.

Below is a concise diagram showing two scenarios where the price of $LUSD is below and above the peg. If you want to understand $LUSD's peg in more depth, I recommend reading "How to Leverage Credit to Make Money with AAVE and Tesseract?" and "The premium of resiliency? Analysing LUSD's peg and liquidity strategy".

Now, there is one more key variable to discuss, which is crucial for $LUSD to maintain its peg: liquidity.

For stablecoins like $LUSD, deep liquidity (strong market depth) is crucial to improving user experience. Sufficient liquidity ensures that users enjoy low price slippage and market impact when trading stablecoins, while helping to keep the price of stablecoins close to the ideal $1 peg. As shown above, the $LUSD pool on Curve (a leading stablecoin AMM) has about $25 million in liquidity, and the ratio in the pool is very healthy (the pool is not mainly composed of $LUSD tokens). In addition, there are also many $LUSD liquidity pools on Uniswap v3 (another leading stablecoin AMM).

In addition to the Ethereum chain, $LUSD also has millions of dollars of liquidity on other chains (through cross-chain bridges like Celer, which can cross-chain $LUSD to Ethereum's L2 solutions), such as Arbitrum and Optimism. You can view all $LUSD markets here.

Now you have an understanding of the powerful algorithms, protocol design, and other relevant factors that keep $LUSD close to the $1 anchor.

Finally, we conclude this section by looking at the performance of $LUSD this year (2023).

As you can see, the trading price of $LUSD has remained in a narrow range close to the anchor value. Although there were some fluctuations during the $USDC depegment event, it is worth noting that it did not depeg severely, only falling by about 100 basis points (about 1%).

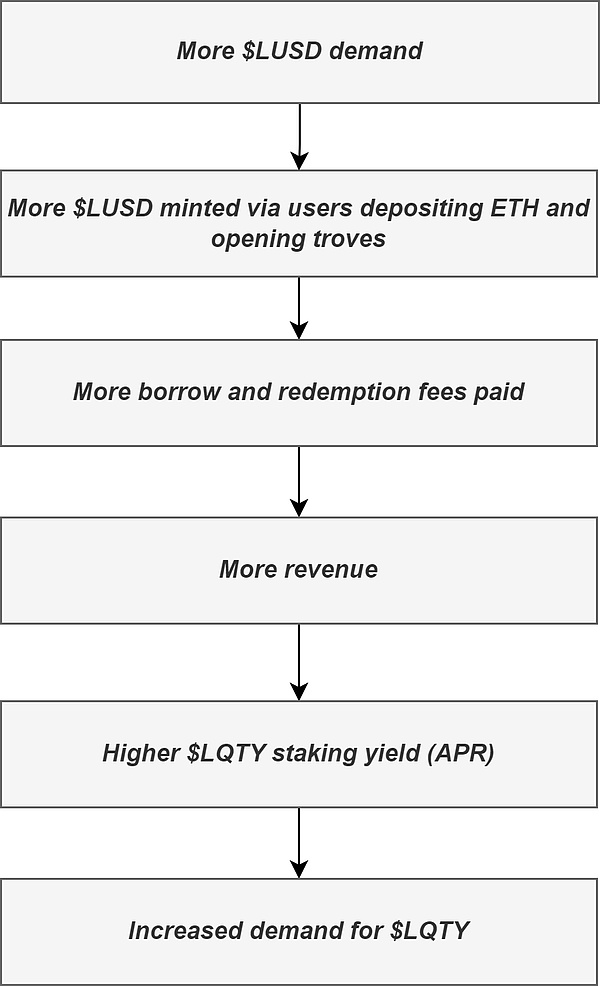

As you now know, the protocol will charge all borrowing and redemption fees incurred (borrowing fees are denominated in $LUSD, while redemption fees are denominated in $ETH). The protocol then distributes these fees in their raw form to holders of $LQTY tokens that stake, so stakers are rewarded in $LUSD and $ETH in proportion to their stake in the staking pool.

If you want to learn how to stake $LQTY tokens, you can watch the step-by-step tutorial “How To Stake LQTY” on Youtube.

In addition, the protocol has set up a Grant program called LiquiFrens, which aims to promote the development of the Liquity ecosystem. $LQTY holders govern the program and actually decide which proposals can be funded.

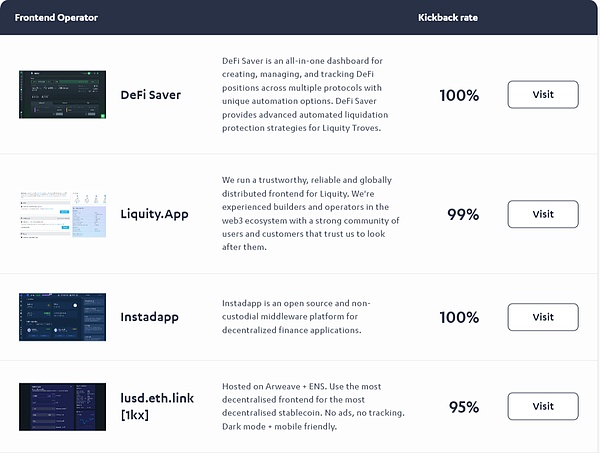

Another key difference between Liquity and other decentralized applications (dApps) is that Liquity does not run the frontend itself. Instead, Liquity outsources this work to any interested party.

Remember that users who deposit into the stable pool receive additional $LQTY incentives (token issuance)? Anyone who runs a frontend interface for Liquity can receive a certain percentage of the rewards from it; this ratio is determined by the "rebate rate". For example, if a frontend operator has a rebate rate of 99%, then for every 100 $LQTY tokens earned by stable pool users through their frontend, the operator will receive 1 $LQTY token.

The image above shows some popular frontend operators. Currently, there are a total of 64 frontends running for the Liquity protocol. What if the servers in one country are down? No problem. Government regulations prohibit operating these frontends in another country? No problem. This is the benefit of distributing the system across multiple frontends.

The best part? Some frontend operators are so altruistic that they charge no fees (with a 100% rebate), which means that as a depositor in the stable pool, you can get the most $LQTY benefits.

$LUSD tokens have no maximum supply limit, as these tokens are issued based on $ETH collateral and the protocol does not set a “cap” on accepting $ETH collateral to mint $LUSD.

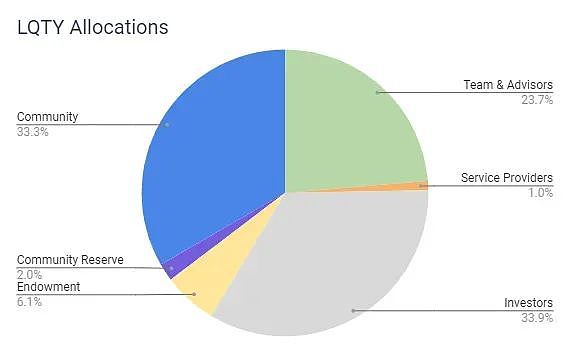

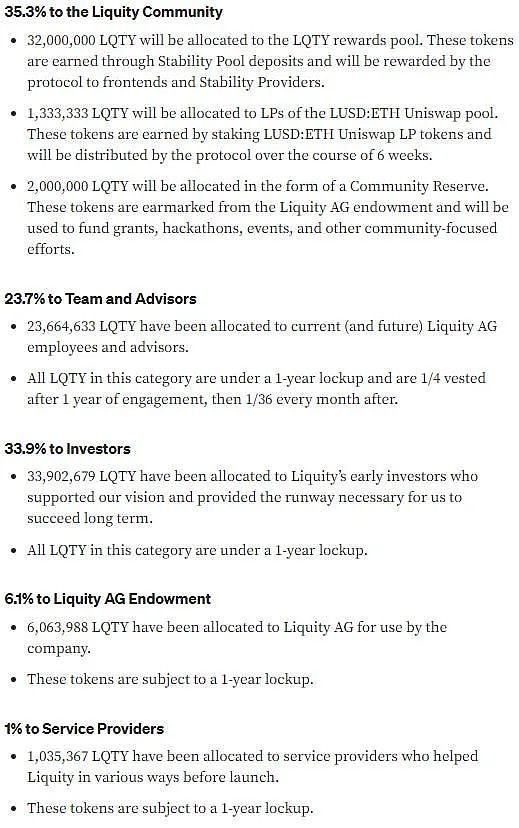

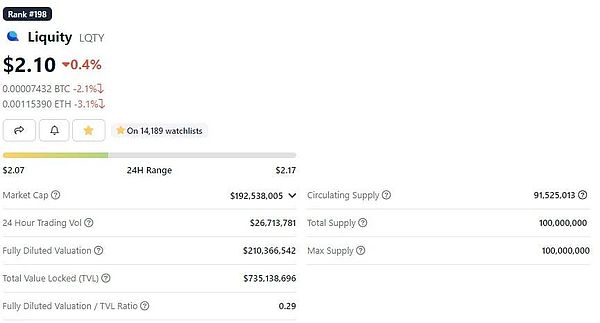

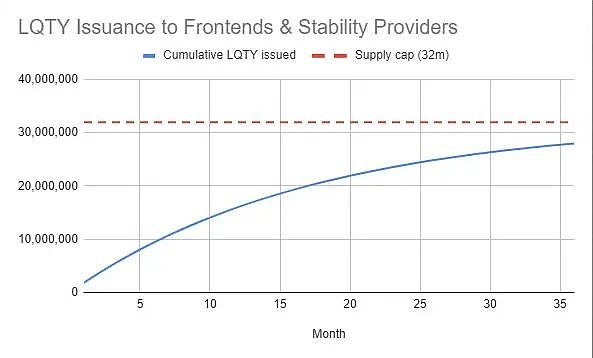

However, the auxiliary token $LQTY has a fixed maximum supply set at 100 million (100,000,000) tokens. This means that token holders will not face the risk of dilution after the issuance of $LQTY tokens ends.

The issuance of $LQTY tokens begins on the protocol launch date (April 5, 2021).

Below is the distribution (supply) of $LQTY tokens.

As can be seen from the above chart, a whopping 57.6% of the $LQTY supply is allocated to investors, teams, and advisors (essentially insiders), which is much higher than the industry standard.

6.1% of the supply is reserved for the Liquity AG Foundation (legal entity). This portion of the $LQTY allocation currently generates income in the stability pool. This allocation and its income provide funding for the previously mentioned LiquiFrens grant program.

As shown in the Bubblemaps above (you can learn more about the platform and what these bubbles represent here), many externally owned accounts (EOAs, basically wallets) hold a large number of $LQTY tokens (whales), which increases the possibility of market dumps and price manipulation. One of the whales even holds 10% of the circulating $LQTY supply.

Currently, the vesting and lockup of $LQTY distribution is not too important, because as shown above, the circulation of $LQTY is already very high, close to 92%. Currently, only a small amount of team unlocking and stable pool token issuance has not yet entered the market; these issuances will gradually end around March 2024, as shown in the figure below.

This is good news for $LQTY holders and stakers as they will not be further diluted, and it is also positive for price action as there is little $LQTY supply remaining that has not entered the market.

For the entire DeFi space, Liquity creates value through its decentralized, censorship-resistant, and resilient stablecoin while avoiding bank risks. At the time of writing, Liquity is the closest stablecoin project to being truly decentralized and censorship-resistant.

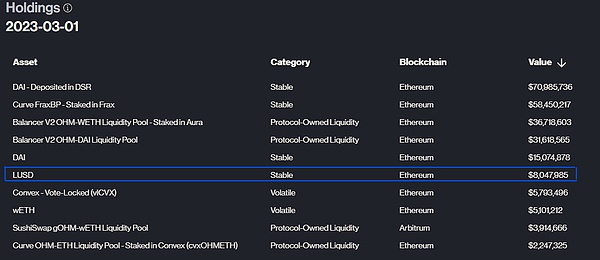

This feature has attracted the attention of some decentralized autonomous organizations (DAOs), such as OlympusDAO, which holds a large amount of reserve assets, leading DAOs like Olympus to start using $LUSD as a trusted asset backing, as shown in the figure below.

In addition, Liquity creates value through a fully decentralized protocol, allowing DeFi users to open highly capital-efficient, interest-free loans that are guaranteed by stable pools - currently, this may be the best liquidation system in DeFi.

These loans are seamless, instant, and permissionless, and users can borrow with $ETH collateral, thereby increasing leverage or gaining exposure to other crypto assets, participating in yield farming, enjoying tax benefits (compared to selling $ETH), and other opportunities.

Liquity also creates value for DeFi users who want to earn stablecoin yields through stable pools - this creates a symbiotic relationship between the protocol and users, where users can earn passive income, while the protocol ensures the safety of all funds (collateral) in the system.

Liquity's $LUSD stablecoin further creates value for users through its role in the DeFi ecosystem of Ethereum, Optimism, and Arbitrum. Currently, users can deposit $LUSD in Yearn vaults to earn automatically compounded interest, use it as collateral on Angle, borrow on Aave and Silo, or amplify yield on GearBox, in addition to many other applications. As $LUSD is integrated into more DeFi platforms, more functions are emerging.

Next, let’s talk about the value capture of the protocol.

As mentioned before, the protocol charges a one-time borrow and redemption fee, denominated in $LUSD and $ETH respectively, ranging from 0.5% to 5% (usually closer to the lower range). 100% of these fees belong to the Liquity protocol and are distributed entirely to $LQTY stakers, making the $LQTY token the value capture token of the protocol.

Liquity's Revenue vs Token Incentives

As shown in the above figure, even during the severe crypto bear market in 2022, Liquity continued to generate revenue and distribute it to $LQTY stakers. In addition, as 2023 began, the protocol's revenue increased, which may be attributed to the crypto market recovery we are currently experiencing.

However, the operation of the protocol has not been smooth sailing. As can be seen from the above figure, over the past year, the $LQTY token incentives issued by the protocol each month mostly far exceeded the protocol revenue, and in some months the issuance volume even reached 10 times the revenue.

Compared to some other stablecoin issuers, Liquity performs poorly in terms of efficiency, relying on more token issuance (incentives) to generate less revenue.

This also suggests that there may be potential issues with the sustainability of the protocol in the long term, as Liquity cannot generate revenue without affecting token holders, and issuing tokens will lead to dilution and potential price declines. Moreover, without continued token incentives, the protocol may not be able to generate significant revenue at all (this will be further discussed at the end of the article).

MakerDAO Revenue vs Token Incentives

As shown in the above figure, MakerDAO has generated almost all of its revenue over the past year without issuing any $MKR token incentives.

Abracadabra Money Revenue vs Token Incentives

Although Abracadabra is far less efficient than MakerDAO, its revenue is still higher than its token issuance (incentives) in most months.

Data source: Tokenterminal

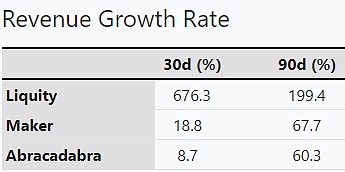

However, as shown in the above figure, Liquity has the highest revenue growth rate in the past 30 days and 90 days, reaching 676.3% and 199.4% respectively, compared with Maker's growth rate of 18.8% (30 days) and 67.7% (90 days), and Abracadabra's growth rate of 8.7% (30 days) and 60.3% (90 days).

Finally, it is important to understand that Liquity's revenue generation is not instant, because borrowing fees are only paid to the protocol when users close their borrowing positions, which takes time. Only redemption fees are received instantly by the protocol. Both fees (as mentioned above) are distributed in their original form ($ETH and $LUSD) rather than being used to repurchase and distribute $LQTY to stakers, which may result in $LQTY holders or stakers not fully capturing value.

The demand for $LQTY is highly correlated with the demand for minting $LUSD.

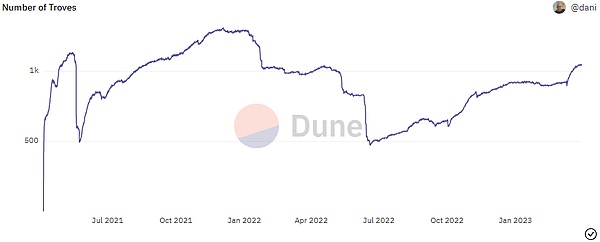

As shown in the figure below, the number of open lending positions has steadily increased since the middle of last year (2022).

However, this trend may be temporary as some of the design choices of the protocol (which make its anchoring solid and decentralized) may hinder the scalability of the protocol, thereby affecting the demand for $LQTY.

Main issues include:

Minimum $LUSD debt is 2000, which makes many small retail investors reluctant to invest

Secondary liquidation model and recovery model may make some users cautious about the protocol

Only $ETH is accepted as collateral (this may be the biggest problem with Liquity's scalability)

Given that we are in the midst of a crypto market recovery (“Crypto Spring”), a phase that is typically accompanied by extreme volatility, we can expect more liquidation events, leading to higher stablecoin pool yields, which will translate into more $LUSD demand, which in turn will restart the above cycle, leading to increased demand for $LQTY.

Currently, the average annualized rate of return (APR) for staking $LQTY is 7.33%, while the annualized rate of return (APR) for the most recent month is 8%, which is a considerable return (compared to the staking returns of other DeFi tokens), especially considering that all of these returns come from protocol-generated revenue.

At the time of writing, $LQTY’s market cap is also 3.19x lower than $MKR, showing huge room for future growth.

Finally, although less impactful, governance of the grant program is also a demand driver for $LQTY tokens.

Overall, while Liquity has built an impressive product and achieved a level of decentralization that other stablecoin protocols have not yet achieved, due to the immutable nature of its contracts, the protocol may gradually evolve into a single existing codebase, as innovation or the introduction of new products is impossible.

In my opinion, this is an existential risk to the Liquity protocol, as projects like Raft Finance are using Liquity’s code (hence the “codebase”) to build products that scale (perhaps without sacrificing the level of decentralization set by Liquity) beyond the capabilities of Liquity itself by expanding the types of collateral (such as LSDs and $stETH for $ETH) and continually innovating and expanding the product range. This is not the Liquity team’s intention to do.

In addition, stablecoins are still pegged to a depreciating dollar (due to inflation), and the use case for stablecoins like $LUSD may gradually disappear as products like Frax’s FPI (a stablecoin pegged to the CPI and resistant to inflation) emerge.

Insiders have also been allocated a large portion of $LQTY supply. While this does not lead to centralization (as $LQTY is not a governance token), it does concentrate a portion of $LQTY's circulating supply in a small number of whale wallets, increasing the risk of market sell-offs and price manipulation.

Finally, $LQTY's token issuance has sustainability issues, as the largest use of $LUSD is currently deposited into the stability pool, and when $LQTY's token issuance is exhausted, only the excess $ETH collateral from liquidation will be distributed to the stability pool depositors, and the reduction in returns may suppress deposit demand, thereby reducing the demand for $LUSD and $LQTY.

Personally, although I think the Liquity protocol is a model of stablecoin decentralization and anchor stability, I am concerned about its future as it may gradually become obsolete. On the other hand, Liquity's underlying technology will be improved and promoted in the future DeFi, and the prospects of DeFi seem very bright.

Original: Tokenomics 101: Understanding Liquity Protocol $LUSD & $LQTYCover: ChatGPT

比特币昨日触及 69,546 美元高点后回落,盘中最低跌至 66,500 美元,令部分投资者出局。以太坊跌幅更大,回到 2,640 美元的关键盘整区。市场在短期内面临健康调整或是深度回调,仍有待观察。

Alex

AlexMeta is using facial recognition technology to block scam ads that misuse celebrity images and help users recover their accounts faster. The system compares faces in ads with real profile pictures to detect and stop fraud in real time.

Weatherly

WeatherlyElon Musk's AI startup, xAI, has launched a Grok API for its chatbot, allowing users to access its features for a fee, but questions remain about the model's capabilities. Grok aims to provide less restricted responses than competitors and is integrated into the X platform, although it faces scrutiny over data privacy and environmental issues.

Anais

AnaisA phishing scam targeted users searching for "Soneium," a blockchain project by Sony, by leading them to a fake website that stole their crypto assets. The fraudulent ad appeared legitimate on Google, but redirected users to a site designed to drain their wallets.

Joy

Joy去中心化物理基础设施网络(DePIN)正在通过创新技术为 Web3 游戏带来深远变革,赋予玩家更多自主权,提升互动性与经济可持续性。DePIN 让玩家真正掌控游戏资产和治理权,创造沉浸式体验的同时促进社群合作与新的收入模式。

Miyuki

MiyukiIndonesia's regulatory agency, Bappebti, has extended the deadline for crypto exchanges to obtain a Physical Crypto Asset Trader (PFAK) license until the end of November 2024. This extension allows exchanges more time to comply with updated regulations and aims to strengthen the digital asset market in the country.

Anais

AnaisKomainu is making its first acquisition by purchasing Singapore-based Propine Holdings, gaining a Singapore Capital Markets Services License and positioning itself for a future Major Payment Institution license. Though financial details were not disclosed, this marks a key step in Komainu’s expansion in Asia.

Catherine

Catherine明尼阿波利斯联储发布报告称,禁止或对比特币征税有助于维持美国的永久预算赤字,引发华尔街强烈反对,相关人士引用1996年的论文为比特币辩护。币圈看好特朗普胜选,认为他上台后将推动设立比特币国家储备,目前其胜率已飙升至65%。

Alex

AlexScroll's SCR token launch, like the recent Hamster Kombat airdrop, has left some recipients dissatisfied, with criticism over fairness and transparency in the allocation. SCR's price has since dropped over 20%.

Kikyo

Kikyo普京宣布,金砖国家联盟成员,包括巴西、俄罗斯、印度、中国和南非,将采用加密货币推动投资与经济发展。这一举措被视为联盟的重大转折,可能加速全球“去美元化”进程。

Miyuki

Miyuki

Please enter the verification code sent to