Author: @Web3Mario

Abstract:

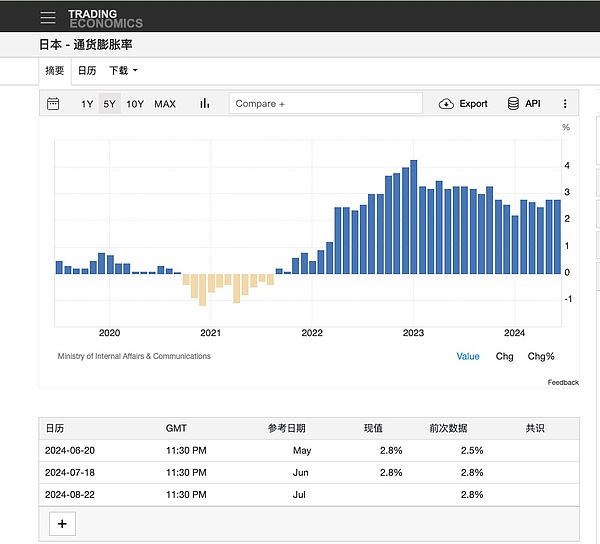

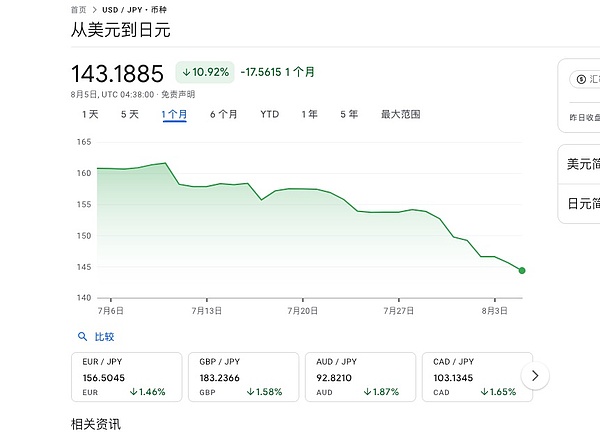

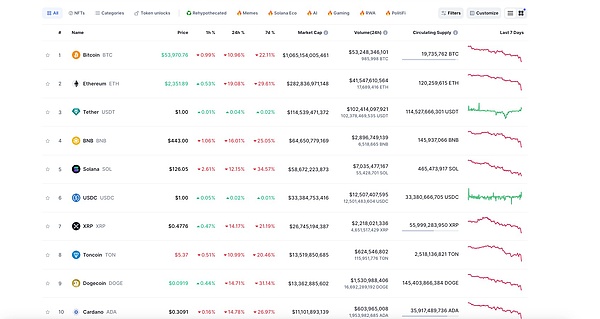

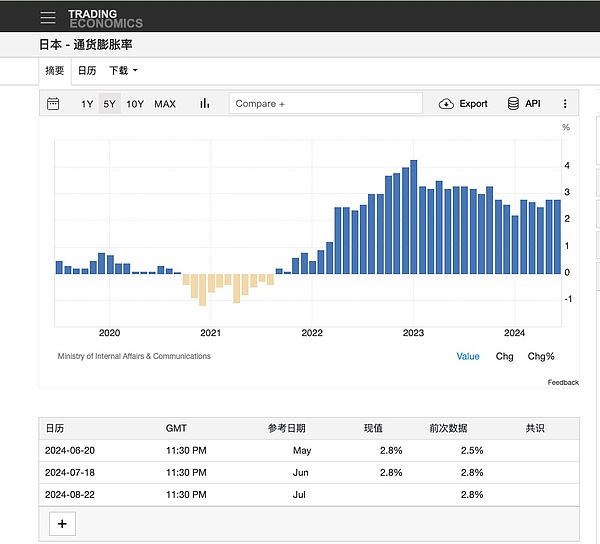

This week, I was learning some APIs related to Telegram Bot. The framework of the TON contract has been basically completed. I was a little happy, but the plunge of the entire crypto market on Monday really cast a shadow on my mood. I had certain expectations for this result. But I didn't expect it to come so quickly and so violently. Therefore, I sorted out some of my views and shared them with you. I hope you can stabilize your mentality and don't let panic affect your investment decisions. In general, the core reason for the sharp pullback of risky assets led by US technology stocks in this round is that the Bank of Japan's aggressive interest rate hike has made many JPY carry trades invalid or face greater risks, especially in three aspects: exchange rate fluctuations, interest rate reversals and liquidity risks. In the face of these risks, "Mrs. Watanabe" is closing positions to repay yen debts and reduce risks. However, considering the relationship in the US-Japan alliance, the real factor that dominates the long-term trend of the market in the future is still the monetary policy of the Federal Reserve. Therefore, before the US interest rate cut, everyone should remain patient. Of course, it is still necessary to adjust the leverage appropriately.

Abenomics and Japan's long-term negative interest rate environment make the yen an important global financing and carry asset

I believe that those who have a little basic knowledge of economics are familiar with the so-called "Lost Twenty Years of Japan". Since the bursting of the Japanese bubble economy in the early 1990s, the economy has fallen into a long-term stagnation and entered the so-called "Lost Twenty Years". During this period, economic growth was slow, and the investment willingness of enterprises and individuals was sluggish, leading to continued deflation. In response to the economic downturn, the Bank of Japan began to implement a low-interest rate policy in the late 1990s, lowering the benchmark interest rate to a level close to zero, hoping to stimulate economic activity by reducing borrowing costs.

It was in this context that the general term for a series of economic policies launched by former Japanese Prime Minister Shinzo Abe after he took office for the second time in 2012. The core goal of these policies is to stimulate economic growth, end long-term deflation and solve the structural problems of the Japanese economy. The core framework of Abenomics consists of the "three arrows". Here I will only briefly introduce its bold monetary policy, which mainly includes two aspects: First, the Bank of Japan has implemented a large-scale quantitative easing policy. This means that the Bank of Japan injects a large amount of funds into the market by purchasing government bonds and other assets to lower interest rates and increase liquidity. Second, the Bank of Japan officially introduced a negative interest rate policy in 2016. This policy intends to further reduce the cost of interbank borrowing and encourage more funds to flow into the real economy, thereby promoting consumption and investment and raising inflation expectations. The so-called "negative interest rate" is briefly mentioned here. It does not mean that the lender of funds needs to pay interest to the borrower, but that the real interest rate is negative, that is, the interest rate is lower than the domestic inflation rate. Against this background, a carry trade has gradually become popular, namely the yen carry trade (JPY Carry Trade). The market has given a very interesting name to traders who do this carry trade, called "Mrs. Watanabe". The so-called yen carry trade refers to an investment strategy based on interest rate differences. The basic principle is to borrow money in a low-interest currency (such as the Japanese yen) and then invest the money in a high-interest currency or high-yield asset to earn the interest rate difference. The operation principle is as follows:

Borrowing Japanese yen: Since interest rates in Japan are very low (sometimes even close to zero), investors can borrow Japanese yen at a very low cost.

Converting to a high-yield currency: Convert the borrowed Japanese yen into another currency with a higher interest rate, such as the Australian dollar or the New Zealand dollar.

Investing in high-yield assets: Then invest the money in bonds, deposits or other assets in the country of the high-yield currency to earn higher interest income.

Carry income: Investors' profits come from the difference between the borrowing cost (low-interest Japanese yen loan) and the investment income (high-interest asset).

In fact, this kind of interest rate arbitrage transaction is also widely distributed in the DeFi field. The most typical one is LSD-ETH interest rate arbitrage, that is, using stETH as collateral in lending platforms such as Compound, lending ETH, and then exchanging it for stETH again. If the borrowing rate of ETH is lower than the yield of stETH during the whole process, there is room for interest rate arbitrage. The same is true in the yen arbitrage market. Usually there are two operation paths: the first is to use US dollar assets as collateral, lend yen, and directly purchase high-dividend stocks of the five major Japanese trading companies. This is actually one of Buffett's core investment portfolios in recent years. The second is to borrow yen and sell it again for US dollars, and then purchase some high-interest financial instruments, such as US stocks and US bonds. This is similar to the revolving loan gameplay in DeFi just introduced.

This kind of transaction has become extremely popular as the United States officially entered the interest rate hike cycle in 2022. Therefore, with the Fed's interest rate hike, major economies around the world have entered the interest rate hike cycle in order to stabilize exchange rates and avoid capital outflows. Among them, only Japan still adheres to its low interest rate policy, which makes the yen the main source of low-cost financing in the tightening cycle. Of course, some friends will say that the RMB interest rate is also very low, but considering the background of the entire international politics and the dividends of China's financial sovereignty, the RMB is not suitable as an interest-carrying asset. Therefore, it can be said that in this round of tightening cycle, the reason why the "Seven Sisters of Technology" market in the United States is still "the horse is still running and the dance is still dancing" is inseparable from the support of the yen.

This has a good and bad impact on Japan. On the positive side, due to the existence of the "Buffett carry path", Japanese stocks have experienced a long-term growth. This has brought a rare "wealth effect" in Japan. We know that the vitality of an economy is mainly built on the wealth effect. Only when people can obtain wealth relatively easily and remain optimistic about future returns can they dare to leverage investment or consumption. Only in this way can economic vitality be created. Driven by foreign investment, Japan has set off a surge in the "Japanese Special Estimates". The wealth effect brought about by this has officially turned Japan from long-term deflation to moderate inflation, which can be said to have realized the original idea of Abe's economics. But on the other hand, the existence of another carry trade path means that a large amount of yen has been converted into US dollars to purchase US dollar assets, which has caused the yen to enter a long-term depreciation trend against the US dollar. From 2021 to 2024, the price of the US dollar against the yen has risen from a minimum of 103 to 160, and the yen has depreciated by more than 60%. However, considering that the fluctuation of the currency exchange rate does not have such a strong impact on the sense of gain of the country's citizens, even under such a depreciation, Japan's domestic inflation is also growing in an orderly manner.

The Bank of Japan's forward-looking guidance and the confrontation with the speculative market have officially come to an end recently, and the yen has ushered in a V-shaped reversal

After the entire trend lasted for more than two years, it has recently ushered in a reversal, which naturally stems from the end of the US dollar interest rate hike cycle. At the beginning of 2024, the newly appointed Bank of Japan Governor Kazuo Ueda reversed the negative interest rate policy of the previous governor Haruhiko Kuroda and began to give the market forward-looking guidance on interest rate hikes. However, the market does not seem to believe it, but chooses to confront the Bank of Japan. The impact brought about by this is that the yen has depreciated all the way below 160 in the first half of this year. One interpretation of the reason behind this is that the speculative market does not recognize the sustainability of Japan's inflation, and believes that after the United States enters a cycle of interest rate cuts, Japan will return to the old deflation. Another interpretation is that it comes from the hedging demand in a complex yen interest rate arbitrage path. The core of this interest rate arbitrage path is Nvidia. Simply put, Japanese electronics and other chip stocks have a strong correlation with Taiwan Semiconductor and Nvidia in stock prices, which is related to the political and industrial transfer background. Therefore, for a long time, buying Japanese chip stocks has been an important channel to capture the alpha returns of the AI track. However, entering 2024, the US stock market has a clear "shrinking circle" trend. Capital gathers at the head for risk aversion, especially Nvidia, which makes Japanese chip stocks gradually decoupled from Nvidia. In order to avoid selling Japanese electronic stocks and losing future alpha returns, many funds have a hedging demand, so selling yen and buying Nvidia has become a good choice. This view is excerpted from Fu Peng, an economist I like very much. If you are interested, you can go to his official account to read this part of the logic.

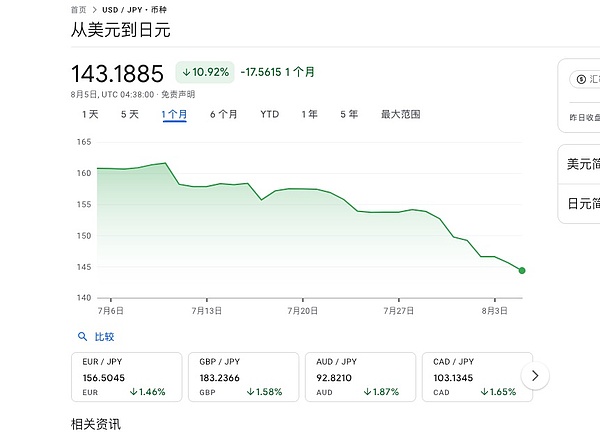

But no matter what the reason, this confrontation ended last Wednesday when the Bank of Japan officially raised interest rates by 15 BP, far exceeding market expectations. At this point, the market has officially ushered in a reversal. First of all, it can be seen that the exchange rate between the US dollar and the Japanese yen has quickly risen from 160 to 143 as of the time of writing. At this point, the Japanese yen carry trade has officially come to an end, and a large number of traders have begun to close their positions. This has led to a large number of risky assets denominated in US dollars being sold, and then exchanged for Japanese yen to repay debts.

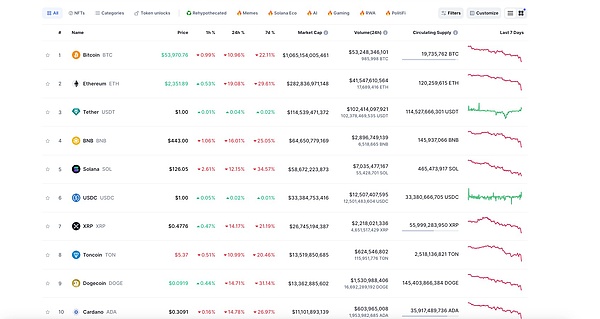

So we can see that after the weekend, the market fully digested the news of Japan's interest rate hike, and the entire unwinding officially entered a climax. This is the source of the plunge in crypto assets on August 5. There is also evidence that can explain this problem. In this round of decline, the decline in income assets is much higher than that of zero-interest assets such as Bitcoin, especially ETH. Because they are the core subject of interest rate arbitrage.

The Bank of Japan is a cooperating party in the US-Japan Alliance, and the dollar is the real factor in the future trend

Here I hope to briefly look forward to the future trend. I still hope that everyone will not be scared by this pullback, because although the yen carries The scale of trade is not small, but I think that in the US-Japan alliance, Japan is actually still a cooperative party. The reason why it recently announced an interest rate hike is just to match the US monetary policy. We know that the reason why the United States did not enter a recession early and the reason why the Federal Reserve has been slow to cut interest rates is the active US stock market. Even though small and medium-sized enterprises have been wailing everywhere, due to the wealth effect brought by the seven sisters of technology, especially Nvidia, the US GDP driven by the financial sector has not shown a significant decline. If the United States rashly cuts interest rates, it will greatly stimulate the risk market, which is very likely to cause inflation to reignite, which is obviously unacceptable. However, referring to the current economic situation in the United States, the United States has to cut interest rates again, so it is necessary to find a reason for the Federal Reserve to cut interest rates, and this reason is actually the retracement of US stocks. In order to cooperate with this policy, it is not difficult to understand the Bank of Japan's move. So when the United States officially enters the interest rate cut cycle, with the easing of liquidity again, crypto assets will surely usher in a recovery again. Therefore, everyone should remain patient and optimistic about the future. Of course, for high-leverage partners, appropriately reducing the leverage ratio is also an option that must be faced.

Joy

Joy