Author: @Web3_Mario

Abstract: First of all, I apologize for the delay last week. After briefly studying Clanker and other AI agents, I found them very interesting and spent some time developing some frame gadgets. After evaluating the development and potential cold start costs, I think it may be the norm for most small and medium-sized entrepreneurs struggling in the Web3 industry to quickly chase market hotspots. I also hope that everyone will understand and continue to support. Getting back to the point, this week I hope to discuss with you a point of view that I have been thinking about recently. Of course, I think this can also explain the recent market volatility. That is, after the BTC price breaks through a new high, how to continue to capture incremental value. My point of view is that the focus should be on observing whether BTC can take over AI and become the core of driving economic growth in the new political and economic cycle ushered in by the United States under Trump's administration. The game here has already started with the wealth effect of MicroStrategy, but the whole process is bound to still face many challenges.

As MicroStrategy's wealth effect unfolds, the market has begun to speculate whether more listed companies will choose to allocate BTC to achieve growth

We know that the crypto market fluctuated violently last week, and the price of BTC fluctuated widely between $94,000 and $101,000. There are two core reasons, and I will briefly sort them out for you here.

First of all, it can be traced back to December 10, when Microsoft formally rejected the "Bitcoin Fiscal Proposal" proposed by the National Center for Public Policy Research at its annual shareholders' meeting. In the proposal, the think tank suggested that Microsoft diversify 1% of its total assets into Bitcoin as a potential means of hedging inflation. Prior to this, MicroStrategy founder Saylor also publicly announced through X that he was the FEP representative of NCPPR and gave a 3-minute public online speech, so the market had some hope for the proposal, although the board had already clearly recommended rejecting the proposal.

Here is a little more about the so-called National Center for Public Policy Research in the United States. We know that think tanks are composed of some industry experts and are generally funded by governments, political parties or commercial companies. Most think tanks are non-profit organizations, not official institutions. This type of operation is tax-free in countries such as the United States and Canada. Usually, the views output by think tanks need to serve the relevant interests of the sponsors behind them. The NCPPR, founded in 1982 and headquartered in Washington, DC, has a certain influence among conservative think tanks, especially in supporting the free market, opposing excessive government intervention, and promoting corporate responsibility, but its overall influence is relatively limited and is smaller than some larger think tanks (such as the Heritage Foundation or the Cato Institute).

The think tank has been criticized for its stance on climate change, corporate social responsibility and other issues, especially its suspected funding sources with interests in the fossil fuel industry, which has limited NCPPR's policy advocacy. Progressives often accuse it of being a "spokesperson for interest groups", which has weakened its influence in the broader political spectrum. In recent years, NCPPR has initiated the FEP (Free Enterprise Project) project and frequently proposed at the shareholders' meetings of various listed companies to question the policies of large companies on right-wing issues such as racial diversity, gender equality and social justice. For example, for companies such as JPMorgan Chase, they submitted proposals to oppose mandatory racial and gender quotas, believing that these policies will lead to "reverse discrimination" and harm corporate performance. For companies such as Disney and Amazon, they questioned that companies are too catering to progressive issues and advocated that companies should focus on profits rather than "pleasing minorities." With Trump's inauguration and his support for cryptocurrency policies, the organization immediately promoted Bitcoin adoption to major listed companies through FEP, including giants such as Amazon in addition to Microsoft.

With the formal rejection of the proposal, the price of BTC fell to $94,000, and then quickly pulled back. From the degree of price fluctuations caused by this incident, it is not difficult to observe that the current market is actually in a state of anxiety, and the point of anxiety is what is the new source of growth after the market value of BTC has broken through the historical high. And we have seen from some recent signs that some key leaders in the crypto world are choosing to use MicroStrategy's wealth effect to promote the financial strategy of allocating BTC in the balance sheet to more listed companies to achieve the effect of fighting inflation and performance growth, so as to make BTC more adopted. Then let's look forward to whether this strategy can succeed.

BTC, as a substitute for gold, still has a long way to go to become a global value storage target in a broad sense, and it is not easy to succeed in the short term

First, let's analyze the first attraction of this strategy, whether the effect of allocating BTC to fight inflation is valid in the short term. In fact, usually when it comes to fighting inflation, the first thing that comes to mind is gold, and Powell also mentioned the view that Bitcoin is a competitor to gold when answering reporters' questions at the beginning of the month. So can Bitcoin become a substitute for gold and a global value storage target in a broad sense?

In fact, this issue has always been the focus of discussions about the value of Bitcoin. Many people have made many arguments based on the similarity of the original attributes of assets, which will not be introduced here. What I want to point out is how long it will take to realize this vision, or whether this vision supports the current valuation of BTC. My answer is that it is not easy to achieve in the foreseeable four years, or in the short and medium term, so it is not very attractive to use it as a promotion strategy in the short term.

We refer to how gold has developed to its current status as a value storage target. As a precious metal, gold has always been regarded as a precious item by various civilizations and has universality. The core reasons are as follows:

The obvious luster and excellent ductility make it valuable as an important ornament.

The low output value brings scarcity to gold, which gives it financial attributes and makes it easy to be chosen as a class symbol in a society after class division.

Gold's wide distribution around the world and low mining difficulty make civilizations not restricted by factors such as culture and productivity development. Therefore, the dissemination of value culture is from bottom to top and has a wider range.

With the universal value formed by these three attributes, gold has played the role of currency in human civilization, and the entire development process has made the intrinsic value of gold stable. Therefore, we can see that even if sovereign currencies abandon the gold standard and modern financial instruments give it more financial attributes, the price of gold basically follows the law of long-term growth and can better reflect the real purchasing power of currency.

However, it is unrealistic for Bitcoin to replace the status of gold in the short term. The core reason is that its value proposition, as a cultural viewpoint, must be contracted rather than expanded in the short and medium term. There are two reasons:

Bitcoin's value proposition is top-down: As a virtual electronic commodity, Bitcoin mining requires computing power competition. There are two determining factors here, electricity and computing efficiency. First of all, the cost of electricity actually reflects the degree of industrialization of a country, and the cleanliness of the energy behind the so-called electricity determines the future development potential. Computing efficiency needs to rely on chip technology. To put it bluntly, it is no longer possible to obtain BTC simply by relying on a personal PC. With the development of technology, its distribution is bound to be concentrated in a few regions, and undeveloped countries with a large global population distribution that do not have competitive advantages will not be easy to obtain. This has an adverse impact on the efficiency of the spread of this value proposition, because when you cannot control a certain resource, you can only become the object of its exploitation. This is why stablecoins compete with the sovereign currencies of some countries with unstable exchange rates. From the perspective of national interests, this naturally cannot be recognized, so it is difficult to see undeveloped countries encouraging this value proposition.

The decline of globalization and the challenge of the US dollar hegemony: We know that with the return of Trump, the isolationism he promotes will deal a relatively large blow to globalization, and the most direct impact will be the influence of the US dollar as the global trade settlement target. This has caused a certain challenge to the hegemony of the US dollar, and this trend is the so-called "de-dollarization". The whole process will hit the demand for the US dollar in the world in the short term, and Bitcoin, as a currency mainly denominated in US dollars, will inevitably increase its acquisition cost in the whole process, which will increase the difficulty of promoting its value proposition.

Of course, the above two points only discuss the development challenges of this trend in the short and medium term from a macro perspective, and will not affect the narrative of Bitcoin as a substitute for gold in the long term. The most direct impact of these two points in the short and medium term is reflected in the high volatility of its price, because the rapid increase in its value in the short term is mainly based on the improvement of speculative value, rather than the enhancement of the influence of its value proposition. Therefore, its price fluctuations are bound to be more in line with speculative products, with high volatility. Of course, due to its scarcity, if the over-issuance of the US dollar continues to be serious, as the purchasing power of the US dollar decreases, all US dollar-denominated commodities can be said to have a certain degree of anti-inflation, just like the luxury market in previous years. However, this anti-inflation is not enough to make Bitcoin more competitive than the value-added effect brought by gold.

Therefore, I think that taking anti-inflation as the focus of promotion and marketing in the short term is not enough to attract "professional" customers to choose to allocate Bitcoin instead of gold, because their balance sheets will face extremely high volatility, which cannot be changed in the short term. Therefore, it is highly likely that in the next period of time, large listed companies with stable business development will not aggressively choose to allocate Bitcoin to cope with inflation.

BTCtakes over AI and becomes the core of driving economic growth in the new political and economic cycle ushered in by Trump

Next, let's discuss the second point, that is, some listed companies with weak growth can achieve overall revenue growth by allocating BTC, thereby driving up market value. I think this financial strategy can be more widely recognized. This is the core of judging whether BTC can gain new value growth in the short and medium term in the future. I think this is easy to achieve in the short term. In this process, BTC will take over AI and become the core of driving economic growth in the new political and economic cycle ushered in by Trump.

In the previous analysis, we have clearly analyzed the successful strategy of Micro Strategy, which is to convert BTC appreciation into company performance revenue growth, thereby boosting the company's market value. This is indeed very attractive to some companies with weak growth. After all, lying flat and embracing a trend is more comfortable than burning yourself to fight for a career. You can see that many companies are dying, and their main business revenue is declining rapidly. In the end, they choose to use this strategy to allocate the remaining output value and reserve some opportunities for themselves.

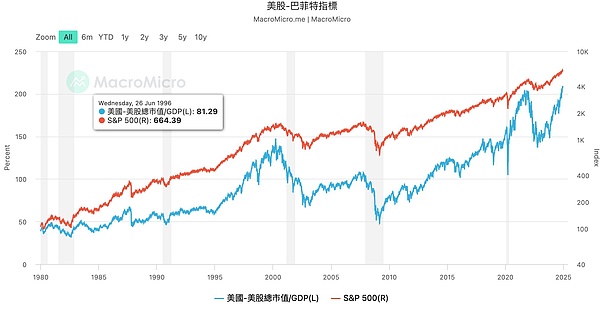

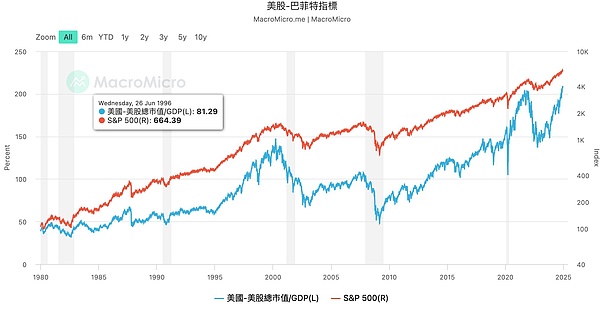

With the return of Trump, his internal government policy cuts will have a significant impact on the US economic structure. Let's take a look at a data, the Buffett indicator of US stocks. The so-called Buffett indicator, the stock god Buffett mentioned in a special article in Forbes magazine in December 2001: the ratio of the total market value of the stock market to GDP can be used to judge whether the overall stock market is too high or too low, so it is generally called the Buffett indicator. This indicator can measure whether the current financial market reasonably reflects the fundamentals. Buffett's theoretical index indicates that 75% to 90% is a reasonable range, and more than 120% indicates that the stock market is overvalued.

We can see that the current Buffett index of US stocks has exceeded 200%, which shows that the US stock market is extremely overvalued. In the past two years, the core driving force that has pushed the US stock market to avoid a correction due to monetary policy tightening is the AI sector represented by Nvidia. However, with the slowdown in revenue growth in Nvidia's third-quarter financial report, and according to its performance guidance, revenue in the next fiscal quarter will slow further. The slowdown in growth is obviously not enough to support such a high price-to-earnings ratio, so there is no doubt that US stocks will be under pressure for some time to come.

For Trump, the specific impact of his economic policies is undoubtedly full of uncertainty in the current environment. For example, whether the tariff war will trigger internal inflation, whether the reduction of government spending will affect the profits of domestic enterprises and cause the unemployment rate to rise, and whether the reduction of corporate income tax will further increase the already serious fiscal deficit problem. In addition, Trump seems to be more determined to rebuild the ethics and morality of the United States. The promotion of some culturally sensitive issues, such as strikes, demonstrations, and labor shortages caused by the reduction of illegal immigrants, will cast a shadow on economic development.

If economic problems are triggered, in the current extremely financialized United States, it means a stock market crash, which will have a serious impact on his support rate and thus affect the effect of his internal reforms. Therefore, it is very cost-effective to implant a core that has been mastered and drives economic growth into the US stock market, and I think Bitcoin is very suitable for this core.

We know that the "Trump deal" that has recently occurred in the crypto world has fully demonstrated its influence on the industry, and most of the companies supported by Trump are local traditional industrial companies, not technology companies, so their businesses did not directly benefit from the entire AI wave in the last cycle. If things develop as we described, the situation will be different. Imagine if local small and medium-sized enterprises in the United States choose to allocate a certain amount of Bitcoin reserves in their balance sheets. Even if their main business is affected by some external factors, Trump can achieve the effect of stabilizing the stock market to a certain extent by advocating some crypto-friendly policies to drive prices. Moreover, this targeted stimulus is extremely efficient and can even bypass the Federal Reserve's monetary policy. It is not easily constrained by the establishment. Therefore, in the next new US political and economic cycle, this strategy is a good choice for the Trump team and many American small and medium-sized enterprises, and its development process is worth paying attention to.

Weiliang

Weiliang