Author: @Web3Mario

This article was first published on August 16, 2024

Summary: This week, I continued to study the relevant documents of Telegram API. I have to complain a little bit. I really can't praise the document style of Telegram. It feels a bit "Russian hardcore". I chatted with my friends in my spare time and talked about a very interesting stablecoin project, Usual Money, which seems to have been popular recently. Since the author has always maintained an interest in the stablecoin project, I immediately spent some time doing some research. I have some experience to share with you, hoping that you can look at or participate in this project more cautiously. In general, I think the core innovation of Usual Money lies in the design of tokenomics. By using the profits of interest-bearing collateral as the value support of its governance token $Usual, and by encapsulating a 4-year bond product USD0++, the liquidity of USD0 is reduced, ensuring the relative stability of the above profit flow. However, for retail investors with smaller funds, USD0++ is equivalent to a liquidity honeypot, and they need to be cautious when participating.

Analysis of the mechanism and core selling points of Usual Money

After the points activity started last month, some PR soft articles have appeared on the Chinese Internet to introduce Usual Money. Interested friends can learn about it by themselves. Here is a brief review and supplement of some more interesting information. When reading other introduction articles, it is mentioned that the founder of Usual Money is a former French politician. I once thought that it should be an image of a politician who is old and uses his influence to seek a generous pension for himself when his political career is coming to an end. But in fact, the founder is very young, Pierre Person, who was born on January 22, 1989 and served as a member of the National Assembly of the 6th constituency of Paris from 2017 to 2022. In his political career, he mainly served as an election staff and political ally of French President Macron. He belongs to the French Socialist Party and belongs to the left political spectrum. During his tenure, he was involved in bills such as LGBT medical care and marijuana legalization, so he basically fits the image of a typical "white left elite". Considering his political background, it is understandable that he chose to "abandon politics and do business" this year, because the Renaissance Party (centrist) led by Macron lost to the left-wing coalition "New People's Front" in the 2024 National Assembly elections, and was not far behind the far-right party National Union, which was in third place. This basically means that the political environment in France is becoming more extreme in line with most Western countries. As a representative of the establishment and an important political ally of Macron, Pierre Person's choice to change careers at this time is a wise choice.

The reason for adding this information is to help everyone see what the founder's sustenance is for the project, which determines how much resources he is willing to invest in it. Back to Usual Money, this is a stablecoin protocol. Its core mechanism includes three tokens. One is USD0, which is a stablecoin issued at a 1:1 ratio with RWA assets as reserves. The second is USD0++, which is a tradable certificate of a 4-year USD0 bond designed by it. The third is Usual, its governance token.

We know that the current stablecoin track is divided into three categories according to the direction of evolution. Mainly include:

Highly efficient transaction medium: This type of project mainly refers to fiat-backed stablecoins such as USDT and USDC. Their main use value is to open up the link between real-world assets and on-chain assets. Therefore, the construction focus of these projects is on how to create more liquidity for issued assets, thereby bringing users a better trading experience and increasing adoption;

Anti-censorship: This type of project mainly refers to crypto-asset-collateralized decentralized stablecoins such as DAI and FRAX. Their main use value is to provide storage and hedging capabilities for some funds with high requirements for privacy under the premise of anti-censorship. Therefore, the construction focus of these projects is how to increase the stability of the protocol as much as possible on the basis of ensuring the degree of decentralization of the protocol, and have a stronger fault tolerance in dealing with risks such as bank runs;

Income-based low-volatility wealth management product certificates: This type of project mainly refers to USDe, etc., which packages a certificate of a low-risk wealth management product with Delta risk neutrality into a stable currency. Their main use value is to capture more income for users and to ensure the low volatility of the principal as much as possible. Therefore, the construction focus of these projects is how to find more low-risk and high-return investment portfolios.

In the actual evolution of the project, these attributes are intertwined with each other, but usually the core innovation point of a project is one of the above three. Usual Money belongs to the third category. Therefore, its main core selling point is to bring income to users through USD0. So let's take a look at how Usual Money is designed. For the judgment of a stable currency project, it is usually analyzed from two dimensions, one is stability and the other is growth. Products like USD0 usually have relatively strong growth potential, but are slightly weaker in stability.

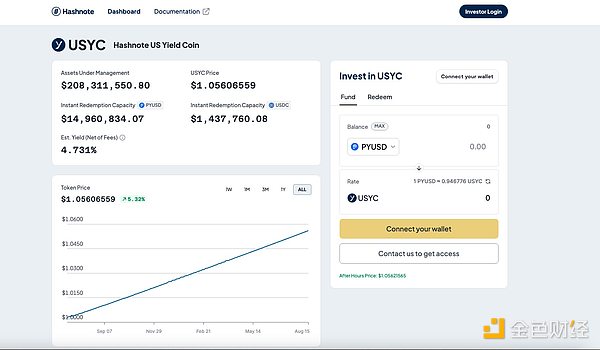

First of all, in terms of stability, USD0 adopts the current mainstream 100% reserve design, rather than the over-collateralization mechanism. Similar ones include Fei, the current version of FRAX, Grypscope, etc. Simply put, you pay a sum of money to mint an equivalent stablecoin from the protocol, and at the same time, this part of your funds will be 100% reserved as the reserve of the newly issued stablecoin, which serves as the value support of the stablecoin. The mechanism selected by USD0 is to make some choices on the type of reserves accepted. It chooses to use a basket of RWA assets as the reserve of USD0, among which RWA assets specifically refer to short-term US Treasury bonds and US overnight reverse repo bonds. At the current early stage, there is only one kind of reserve for USD0, which is USYC issued by Hashnote, which is an RWA on-chain asset that meets the above requirements. Users can choose to use USYC to mint USD0 from Usual Money at the same value. Of course, they can also use USDC, but the agent will be responsible for exchanging it into USYC.

This has two advantages:

While ensuring that the risk is extremely low, it brings a real source of income to the protocol;

Through aggregation, it brings liquidity to the early RWA assets.

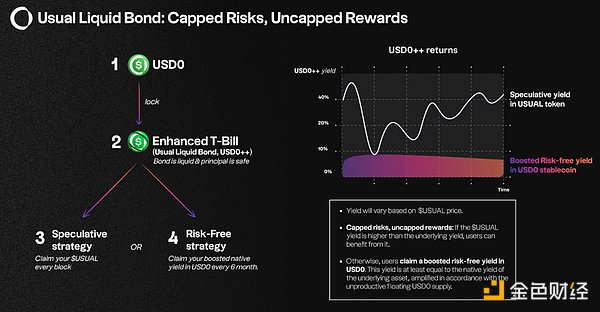

In fact, most similar projects are similar in the first point. Even projects like USDT and USDC actually operate in this way. Therefore, the core innovation of Usual Money lies in how the income is distributed. This is the core of its mechanism. USD0++, in simple terms, is a tradable bond of USD0 with a term of 4 years. It should be noted that holding USD0 does not actually generate any income. Only after exchanging USD0 for USD0++ that needs to be locked for 4 years before it can be redeemed can the income be captured. This is similar to the design of Ethena. Of course, during the duration, users can sell USD0++ in the secondary market and discount it in advance in exchange for liquidity.

It is worth noting here that the source of income of USD0++ and the way of income distribution. First of all, it should be emphasized that the source of income of USD0++ only corresponds to the RWA income corresponding to the assets you paid. Rather than dividing the total income generated by all reserves according to the proportion. Secondly, in terms of profit distribution, Usual Money provides two options. First, you can hold USD0++, then the reward will be distributed in the form of Usual tokens, which is the same as the current average yield of RWA. Second, you can choose to lock it for 6 months. After the lock-up period expires, you can choose to get all tokens in the form of USD0 or Usual tokens. However, if you unlock during the lock-up process, you will not be able to obtain the income generated during the lock-up period.

To give a specific example, assuming that the current average APY of Usual Money's reserves is 4.5%, you purchased 100 USD of USD0 and converted it into USD0++. At this time, you have two choices:

If you hold it, you can get a Usual token reward worth 0.0123 USD (100 * 4.5% / 365) every day. Of course, if you add Usual value-added, your income may be magnified, otherwise it may be reduced. This is the so-called USD0++ Alpha Yield.

You can choose to lock it for 6 months. Assuming that the average APY remains unchanged at 4.5% during these 6 months. After the 6-month period, you can choose to get USD0 worth 2.214 US dollars, or Usual tokens worth 2.214 US dollars. This avoids the risk of reduced returns due to Usual price fluctuations during the duration. This is called Base Interest Guarantee (BIG).

This means that only the income of RWA assets corresponding to USD0++ in the 6-month lock-up period may be actually distributed, and the expected rate of return is only the average level of RWA. In addition, the income corresponding to the rest of the RWA assets will be reserved and managed by the protocol as the value support of Usual tokens. Of course, how this part of the assets is specifically connected with Usual tokens needs to wait for more mechanism details to be announced before we can know, but it is likely to be a repurchase or something like that.

Interests of all parties in Usual Money and why it is a liquidity honeypot designed for retail investors

After understanding the mechanism design of Usual Money, let's analyze the stakeholders involved in Usual Money and their respective interests. We can roughly divide it into six roles, VC or investors, RWA issuers, KOLs, whales, project parties and retail investors;

First of all, for VC or investors, their core interest point is the value of Usual tokens. We see that the investment institutions and fundraising scale of Usual Money are still relatively good. This also reflects the confidence of the entire mechanism design in ensuring the value support of Usual tokens. It can be estimated that the project has a strong ability to mobilize the enthusiasm of VC or Usual investors. Mobilizing more people to participate in the USD0 protocol through senior endorsements, or even directly locking it into USD++ will greatly help the price stability of Usual Money. Therefore, you will be more likely to see the support voices of relevant people on social media.

Secondly, for RWA issuers, we also know in the previous introduction that Usual Money is a good liquidity solution for RWA issuers. Frankly speaking, the adoption of RWA-type tokens in the current market is not high. The reason is that the yield of assets in the real world is often lower than that in the Web3 field, so it is not very attractive to the funds in the crypto world. After integrating Usual Money, since the focus of user participation has shifted from RWA to potential Alpha returns, the user funds attracted will be seamlessly converted into corresponding RWA without perception, which indirectly creates demand and liquidity for RWA, so they are also happy to support it.

Next is KOL. Here it depends on whether KOL is a buyer or seller, because in the current Usual Money points activity, the design of invitation commission sharing, if it is a KOL who hopes to gain this part of the benefits, of course, he will attach his invitation code after a like.

For whale users, usually due to their financial advantages, they will control a considerable portion of Usual token incentives, especially considering that the proportion of Usual's tokenomics design seems to be allocated to the community, accounting for 90%. After the above analysis, we know that since the term of USD0++ is 4 years, this means that participants will be more susceptible to greater discount rate fluctuations. However, for whales, an interesting design in Usual Money can be used to circumvent this problem, Parity Arbitrage Right (PAR). Simply put, when USD0++ has a large deviation in the secondary market, the DAO believes it is necessary to unlock a portion of USD0++ in advance to restore the liquidity of USD0++ in the secondary market. In this process, whales naturally have a heavier voice. When they think it is necessary to launch in advance, they can easily use this clause to reduce the discount rate, or reduce transaction slippage.

The above mechanism is also important for the project party, because in the process of restoring liquidity, it is actually equivalent to arbitrage transactions, and the interest generated by this part of the transaction will be managed by the project treasury. Therefore, maintaining a certain discount rate can bring benefits to the project party, which just corresponds to the exit cost of retail investors.

Finally, for retail investors, they are the only weak and passive party in this agreement. First of all, if you choose to participate in USD0++, you will mean a 4-year lock-up period. We know that in the bond market, the longer the duration, the greater the risk premium. However, the potential yield of USD0++ is only at the level of short-term US Treasury bonds. In other words, more risks are taken, but the lowest returns are obtained. When retail investors exit, they will not have the advantages of whale users in DAO governance, so it must mean that they need to bear a larger discount rate cost. Since these costs are an important source of income for the project party, it is unlikely that they will be taken care of by the project party.

Especially considering that the Federal Reserve has entered a rate cut cycle in the future, facing lower and lower yields, the capital efficiency of retail investors participating in USD0++ will be further compressed. At the same time, since rate cuts mean that bond prices will also rise, the gains from RWA appreciation will serve as nutrients for the appreciation of Usual, which retail investors will not get. Therefore, I think this is a beautiful liquidity honeypot woven by many elites for retail investors. Everyone must be cautious when participating. Perhaps for small capital users, it is more cost-effective to properly allocate some Usual than to earn USD0++.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin Alex

Alex JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Future

Future Cointelegraph

Cointelegraph