Source: Jinshi Data

In the two years since the Federal Reserve began actively fighting inflation, stock traders have been glued to their screens every time the Consumer Price Index (CPI) is released. But things should be different when the latest CPI data comes out on Wednesday.

Why? Because as inflation falls toward the Fed's target and the Fed prepares to cut interest rates, the data is less important to the stock market. Instead, it's all about the weakness in the employment situation and whether the Fed can avoid a hard landing.

"The key question for stock market investors is whether the Fed waited too long to cut rates because recession risks are higher now than they were two months ago," said Eric Diton, president and managing director of Wealth Alliance. "Suddenly, inflation is no longer a big problem."

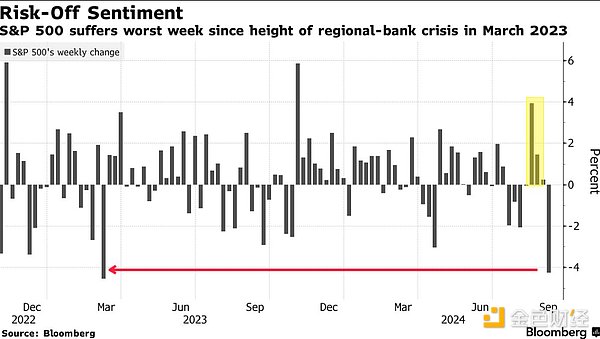

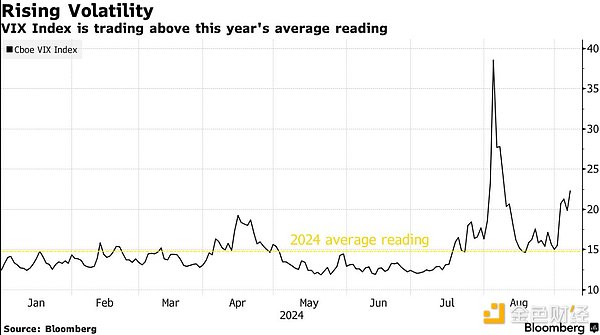

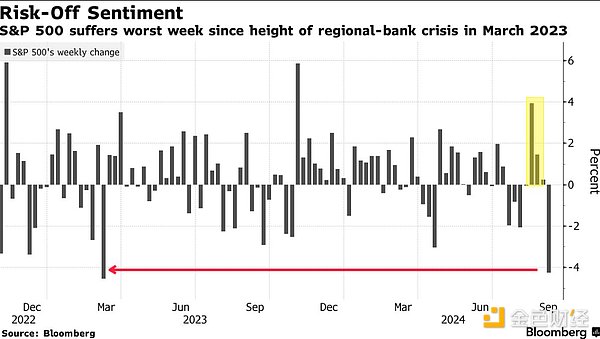

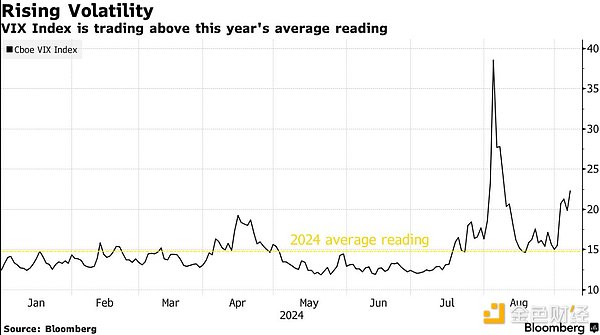

The S&P 500 just ended its worst week since Silicon Valley Bank's collapse in March 2023, with large technology stocks falling and Nvidia falling 14%. Volatility has also picked up, with the CBOE Volatility Index (VIX) rising from 15 on August 30 to nearly 24 on September 6. Options traders are betting on more volatility, but less than the market had previously expected for the CPI day. As of Friday morning, they expected the S&P 500 to move 0.85% this Wednesday. If achieved, it would be the smallest CPI day swing so far this year, according to data compiled by Piper Sandler. On the other hand, before Friday's weak nonfarm payrolls report, traders were pricing in an implied volatility of 1.1% for the S&P 500. That's one of the highest absolute values so far this year and 83% higher than the average implied daily move through 2024, according to data compiled by Susquehanna International Group. The index fell 1.7% on the day, even more than expected.

"The stock market has had a strong run this year," Diton said. "So why not take some profits?"

Basically, the market's thinking has now shifted, with rate cuts seen as inevitable but the strength of the economy looking less solid. On August 23, Fed Chairman Jerome Powell all but declared victory in the fight against inflation when he spoke at the Fed's Jackson Hole symposium in Jackson Hole, Wyoming. Since then, more policymakers, such as New York Fed President John Williams, Chicago Fed President Anthony Goolsbee and Fed Governor Anthony Waller have said rate cuts are necessary -- the question is how much.

Now, the Fed is turning to the other side of its dual mandate, which is to maintain maximum employment. Friday’s jobs report showed nonfarm payrolls increased by 142,000 jobs last month, bringing the three-month average down to its lowest level since mid-2020, according to the Bureau of Labor Statistics.

Looking ahead to the Fed’s Sept. 18 rate decision, swaps fully reflect expectations of at least a 25 basis point rate cut. Meanwhile, data compiled by UBS Group AG show that implied volatility is accelerating ahead of major macro events related to employment, and equity market volatility measures such as skew remain elevated as traders hedge against further downside risks to stocks. “The skew suggests there is additional value in providing downside protection to hedges,” said Rocky Fishman, founder of derivatives analytics firm Asym 500. “If the results do disappoint from a macro perspective, then the potential decline in stocks this time could be larger than previously thought.”

For now, investors have good reason to be more wary of the jobs data than they are of the inflation data. The S&P 500 had its worst jobs data day since 2022 last month, falling 1.8% on Friday, Aug. 2, and then falling another 3% on Aug. 5 on a weak jobs report. Two weeks later, inflation data was roughly in line with expectations, and the S&P 500 rose just 0.4%, the smallest one-day gain in CPI since January.

Traders expect volatility in the S&P 500 to rise as demand for out-of-the-money put options is higher than demand for out-of-the-money call options, according to UBS data. Commodity trading advisors (CTAs), which take a ride on asset prices through long and short bets in the futures market, see little room to add positions now, UBS said. The VIX, a measure of implied volatility in benchmark U.S. stock index futures through over-the-counter options, is in the low 20s, a level that is not necessarily dangerous in itself, but the index is 52% above its average this year, and the volatility curve suggests that risks will rise in the coming months.

Fed officials have entered a pre-meeting blackout period and will not make any comments before September 18. However, the latest Beige Book shows that business contacts are more worried about slowing economic growth than inflation. The Beige Book compiles information from business contacts in 12 regions. However, there was no mention of "recession" in the report, and only 10 references to "inflation" - the lowest level until 2024, according to DataTrek Research.

While the U.S. economy is generally expected to remain strong, the Atlanta Fed's GDPNow model shows some slowdown, predicting real GDP growth will be 2.1% annualized in the third quarter, down from about 3% a few weeks ago. It’s just one more sign that the Fed needs to cut rates before it’s too late to prevent a recession. If they don’t, investors who have bid up stocks on expectations that policymakers will soon lower borrowing costs may have to consider the old adage: “Be careful what you wish for.” Diton said that’s especially true if stocks rally on concerns that the Fed isn’t adequately addressing a slowing economy that would eventually hit corporate earnings. “Right now everyone is looking at every data point on the economy and jobs,” he said. “If the data continues to weaken, there will be more selling.”

Edmund

Edmund