Author: Thor Hartvigsen Translation: Shan Oppa, Golden Finance

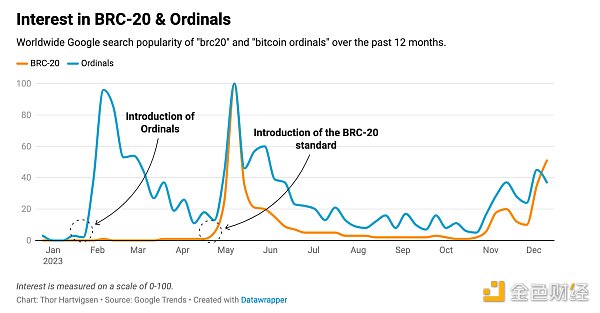

Another week, another new narrative to focus on. Ordinals has been making a big comeback in the cryptocurrency space recently, and if you’ve been active on Twitter in the past two weeks, you’ve probably heard about it.

p>

In this article, we’ll dissect these emerging trends and discuss their broader implications.

Introduction

As the approval date of a potential Bitcoin ETF approaches, concerns about the Bitcoin ecosystem Interest in the system has increased significantly, and many expect the asset will appreciate in value.

p>

Ordinals and the BRC-20 token based on its underlying technology, which attracted attention earlier this year, are once again bringing more practicality and disruptive functions this time. Become the center of attention.

p>

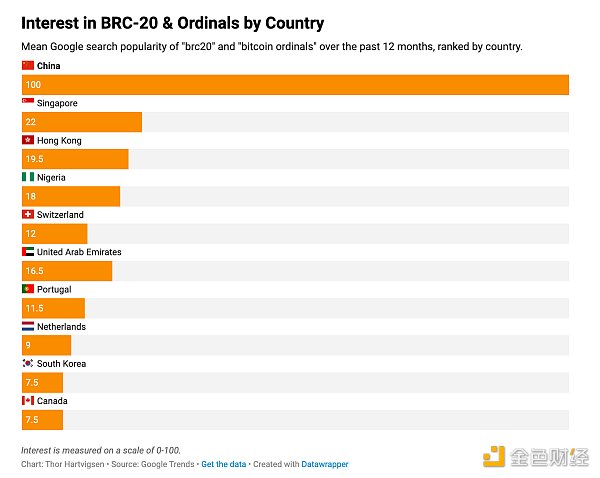

Anecdotal evidence from various online communities and data from search engines suggest that breakthroughs in these trends are occurring primarily in China. Middle-aged people and even grandmas are starting to join in and learn how to buy and trade BRC-20 tokens.

As usual, these were trending topics on Twitter and many others followed suit. Big exchanges took notice and started listing BRC-20 tokens left and right.

Ordinals & Inscriptions

ordinals was born in early 2023. It is a tracking and A means of transferring the smallest unit of Bitcoin (SAT). Satoshi (sats) is taken from the abbreviation of Satoshi Nakamoto, the founder of Bitcoin, and is equivalent to 1 Satoshi (one hundred millionth of 1 Bitcoin). Serial numbers enable tracking and transfer by assigning sats serial numbers and recording the order in which they were mined.

sat can be engraved with any content (such as text, images) without the need for smart contracts. It is essentially an unsigned NFT that is completely on-chain. The engraving process requires only two transactions and can later be displayed via an off-chain indexer.

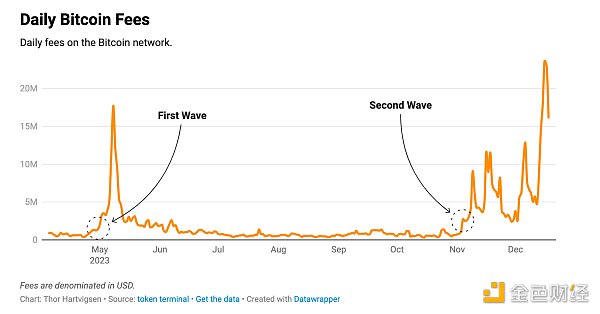

In fact, it is these engraving activities that have led to a significant increase in transaction fees and a decrease in processing speeds on the Bitcoin network.

p>

The link is blocked and the cost is skyrocketing. At that time, people were casting inscriptions and they were just burning money. Some collections sold out before transactions were even processed, and the front end simply couldn’t keep up with the explosion of pending transactions. Surely this marks the end of this crazy wave, right? Is it right?

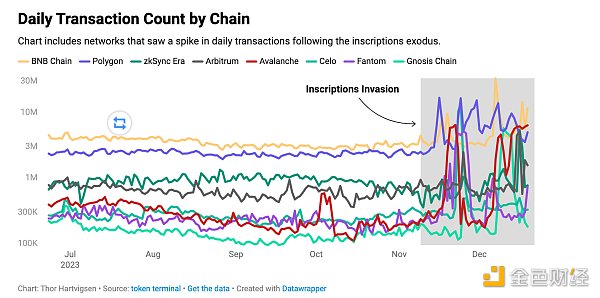

Of course not. What happened next was a massive exodus to other chains of biblical proportions. This in turn creates an involuntary stress testing scenario for many networks.

p>

As expected, except for a few networks (Arbitrum and TON) that were completely overwhelmed and needed to take a breather, other chains have withstood the baptism of the inscription storm.

Avalanche is even more exaggerated. Inscription activities once accounted for up to 90% of on-chain activities, and other platforms have reported similar figures. The situation is so serious that even the testnet has become a target.

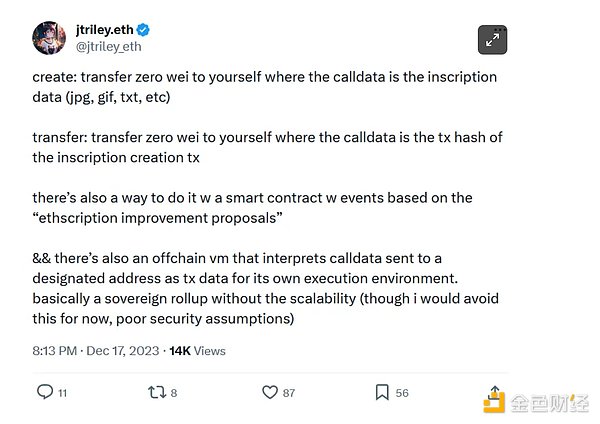

So, besides Bitcoin, what are the other application scenarios for inscriptions? jtriley.eth gave a concise and clear explanation on Twitter:

Essentially, the inscription can be passed Send yourself a transaction with a value of 0 and add the required media content in the transaction notes to create it. The transfer method is similar to this, except that the memo field is changed to the transaction hash of the previously created inscription transaction.

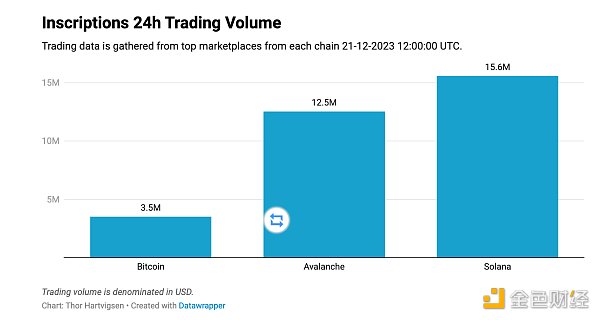

Beyond Bitcoin, the popularity of inscription applications is staggering. Chains like Solana and Avalanche have completely taken over the market in terms of transaction volume.

p>

Use Case

Now that we understand the technical aspects of inscription and how it works, let’s Let’s see what people actually do with it.

Please note that the iteration security and stability mentioned below have yet to be verified and have not been fully tested.

NFT

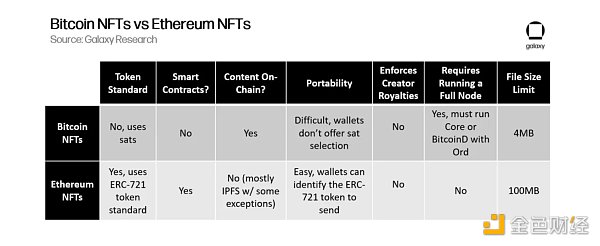

Although Bitcoin already has the infrastructure for NFTs, Inscription provides An alternative that was quickly accepted by the community.

Ordinal NFTs are completely different from the NFTs widely used on chains such as Ethereum.

p>

Compared with traditional NFTs, these digital artworks are not only extremely low-cost to produce, but also use completely different technical architectures and methods. By tracking individual sats, developers and artists can create unique digital art based on on-chain data, rather than a collection of cookie-cutter avatars. For collectors, this mechanism unlocks new possibilities, allowing them to determine the rarity of a collection based on on-chain data.

One such example comes from the Metaverse protocol BITMAP, which provides land parcels represented by Bitcoin block numbers.

BRC-20

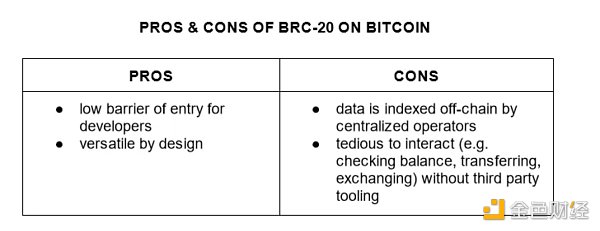

To create fungible tokens on Bitcoin, experimental The token standard-BRC-20 came into being. This is an important step in expanding the Bitcoin ecosystem.

p>

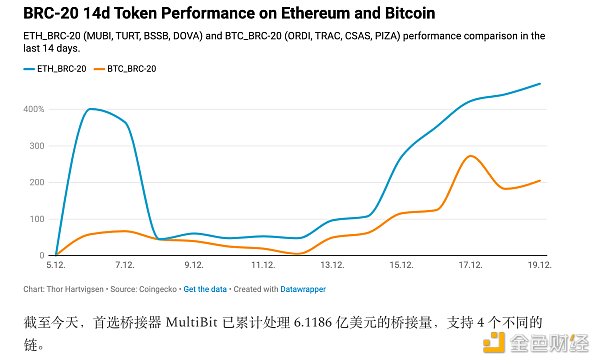

Many BRC-20 tokens have landed on Ethereum through bridge channels, attracting a large number of speculators. The daily gains of some popular tokens have even reached double digits, and in After a period of rising prices, Bitcoin trading activity is in a cooling phase.

p>

CBRC-20

CBRC-20 is also Bitcoin’s fungible token standard. In concept Similar to BRC-20, but with some significant improvements, which can be attributed to using a newer version of the Ordinals client:

Conclusion

Inscription It is very likely that their derivative applications will be around for a long time. They have had a profound impact on the market in a short period of time, providing alternative solutions to some existing concepts. There is a lot of room for improvement and innovation in the inscription space, which means there are plenty of attractive opportunities ahead. But please be careful not to blindly follow the trend. You must be familiar with this technology before deciding whether to participate.

Wilfred

Wilfred

Wilfred

Wilfred Huang Bo

Huang Bo JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Zoey

Zoey JinseFinance

JinseFinance JinseFinance

JinseFinance Davin

Davin Others

Others