Author: insights4.vc Source: substack Translation: Shan Oppa, Golden Finance

The first stable It’s been ten years since the launch of BitUSD, marking a key evolution in the decentralized finance (DeFi) ecosystem. Today, stablecoins are an essential financial instrument in this space, with a current total supply of over $156 billion. Launched on the BitShares blockchain by cryptocurrency visionaries Dan Larimer and Charles Hoskinson on July 21, 2014, BitUSD aims to maintain a stable value 1:1 against the U.S. dollar. However, BitUSD eventually decoupled in 2018, highlighting the complexities of the early stability model.

In contrast, modern stablecoins such as Tether (USDT) and USD Coin (USDC) achieve significant stability, primarily through large fiat reserves and other powerful mechanisms that enhance their reliability. Stablecoins today play a key role in the cryptocurrency and DeFi ecosystem, providing liquidity to exchanges, facilitating collateralized lending, and allowing market participants to retain exposure to digital assets without the need to constantly convert to fiat currencies.

Overview of Stablecoins

Types of Stablecoins h3>

Based on the mechanism used to maintain price stability, stablecoins can be divided into:

Fiat-Collateralized Stablecoins: These stablecoins are backed by fiat currencies such as the U.S. dollar and are kept by a central custodian. Tether (USDT) and USD Coin (USDC) are examples. The fiat currency reserves held by the issuer are equal to the stablecoins issued, ensuring that each stablecoin can be redeemed at a 1:1 ratio, thereby stabilizing value and building user trust.

Cryptocurrency-collateralized stablecoins: These stablecoins are backed by other cryptocurrencies, such as MakerDAO’s DAI, and require users to lock up the cryptocurrency ( Such as Ether) as collateral. Due to the volatility of cryptocurrencies, they often require over-collateralization and automatic liquidation to protect the peg.

Algorithmic Stablecoins: These stablecoins rely on algorithms to control supply based on demand and require no collateral. For example, FRAX combines algorithms with fractional staking, while TerraUSD (UST) used a seigniorage model before its collapse. Their stability depends largely on market confidence and algorithmic robustness.

p>

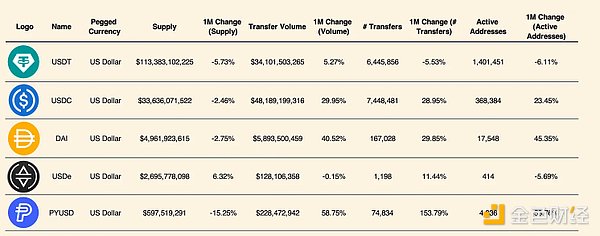

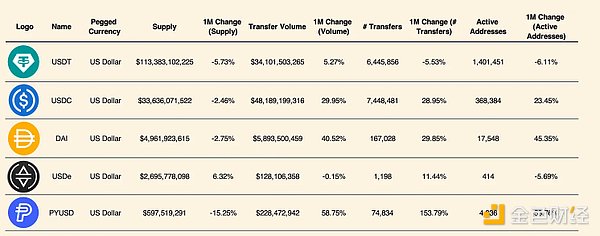

Top 5 stablecoins by supply

Tether (USDT)

Collateralization and Escrow: Tether is fully backed by fiat reserves (cash, cash equivalents, U.S. Treasuries) and is backed byCantor Fitzgerald Protect. As of October 26, Tether reported holding $100 billion in U.S. Treasuries, more than 82,000 Bitcoins (approximately $5.5 billion), and 48 tons of high-quality gold.

Supply and usage trends: USDT supply is $113.4 billion ,Supply dropped 5.73% over the past month. Transfer volume rose by 5.27%, but active addresses fell by 6.11%, indicating a decline in user activity despite steady growth in transaction volume.

United States Monetary Fund

Collateralization and Escrow: USDC is fully backed by fiat reserves and managed by BNY Mellon, Customer Bank and Cross River Bank.

Supply and Usage Trends: USDC supply is $33.6 billion, supply The volume decreased by2.46% , while the transfer volume surged by29.95% . Active addresses increased by23.45% , indicating strong demand for transactions.

DAI

< strong>Collateralization and Custody: This over-collateralized stablecoin uses ETH, BTC, private credit, and U.S. Treasuries, with Coinbase Custody, Sygnum Bank, and Wedbush Securities as custodians.

Supply and Usage Trends: DAI supply is $5 billion, The supply decreased by 2.75% , but thetransfer volume increased by 40.52% . Active addresses increased by 45.35% , reflecting increased adoption and transaction activity.

USD

< strong>Collateralization and Custody: As a synthetic stablecoin, USDe uses ETH, ETH LST, BTC and USDT to remain delta neutral, with Copper, Ceffu and Cobo as custodians .

Supply and usage trends: USDe's supply is $2.7 billion, transfer volume decreased slightly, while active addresses increased slightly, indicating stable usage patterns.

PYUSD (PayPal USD)

Collateralization and Escrow: PYUSD is issued by PayPal, is fully backed by fiat assets (U.S. Treasury securities, cash and equivalents), and is backed by State Street Bank & Trust Company and < em>Customer bank custody.

Supply and Usage Trends: PYUSD is the smallest currency with asupply of 598 million USD, itstransfer volume increased by 58.75% , andthe number of active addresses increased by 153.79% , reflecting people’s strong interest and usage expand.

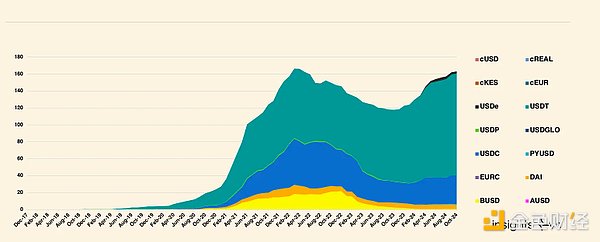

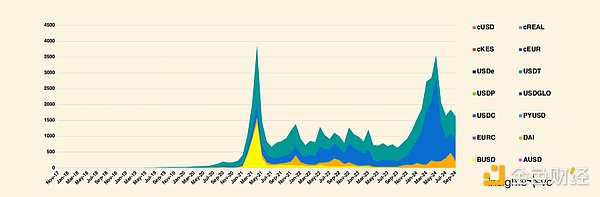

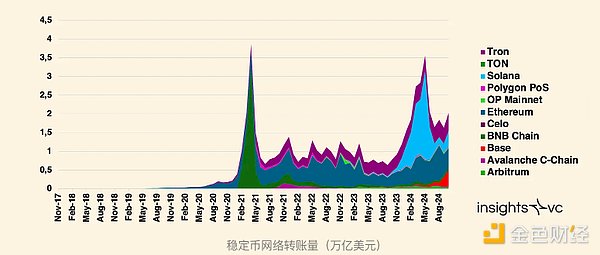

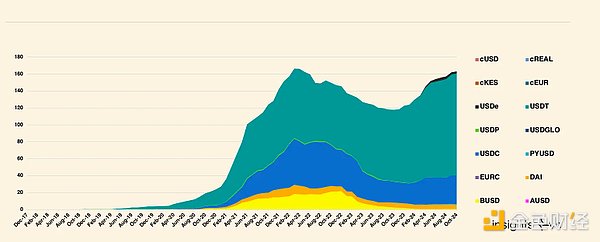

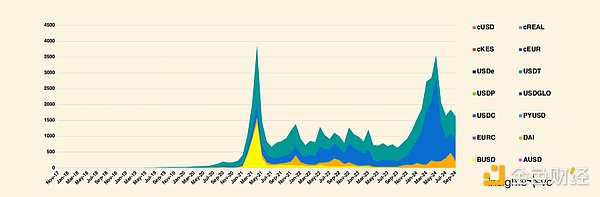

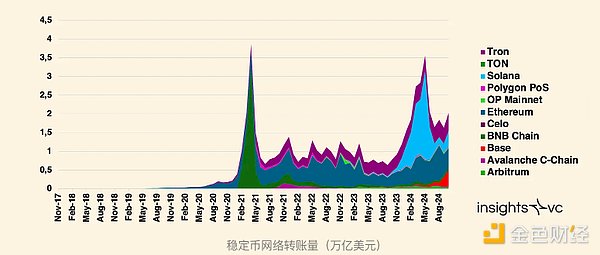

The data in the chart above clearly shows the growth and fluctuation trends in stablecoin usage and transfer volume over time. Stablecoin supply and transfer volumes both increased significantly starting in early 2018 and peaked in mid-2021, likely due to increased interest in DeFi and the broader cryptocurrency market. After 2021, while supply remained stable at a high level, there were cyclical surges in transfer volume, especially around early 2024. This could indicate a resurgence of market activity or volatility during this period.

p>

USDT and USDC dominate the stablecoin market, holding the largest share in terms of both supply and trading volume. Other stablecoins, such as new entrants such as DAI, BUSD, and PYUSD, have a smaller but growing share, highlighting the diversity within the market.

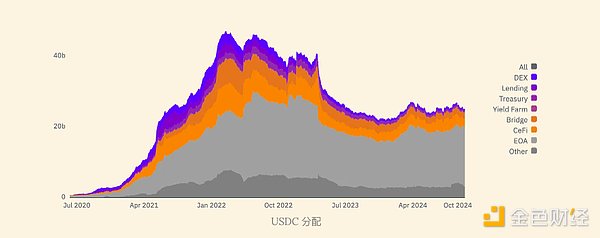

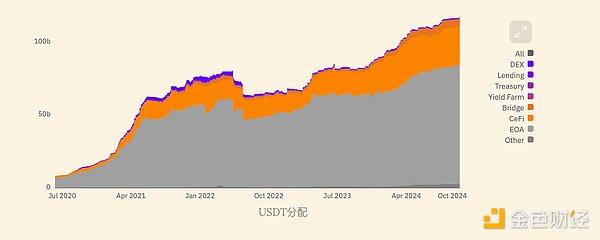

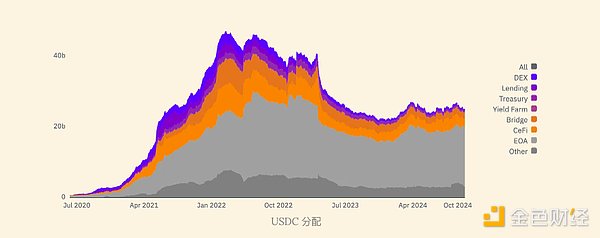

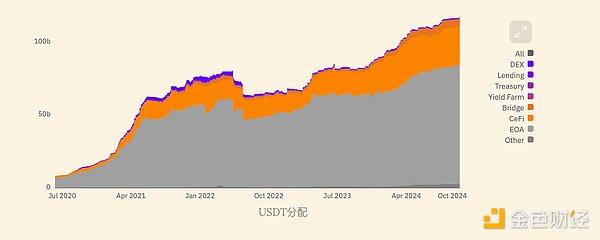

USDC and USDT distribution

USDC and USDT holdings in decentralized finance There are significant differences in distribution across (DeFi) and centralized finance (CeFi) platforms and various wallets. For USDC, the largest concentration is in External Owned Accounts (EOA), worth $16.8 billion, followed by CeFi, worth $2.3 billion, and Bridge holdings, worth $1.8 billion. Treasury accounts contain $438 million, while decentralized exchanges (DEXs) hold $388 million and lending protocols hold $195 million. Revenue farming had limited use at $3.0 million and other miscellaneous holdings at $3.2 billion.

p>

In contrast, the distribution of USDT is more concentrated, with US$81.5 billion in EOA and US$26.3 billion in CeFi. Bridge holdings are $5.1 billion, while DEX holdings are $473 million and lending protocol holdings are $439 million. Treasury accounts were lower at $54 million, with revenue farming at $1 million. Other holdings totaled $2.5 billion.

As of October 2024, Base for Ethereum, Tron, Arbitrum, Coinbase and Solana< /strong> Is the leading blockchain using stablecoins to settle value. While Ethereum leads in overall settlement value, higher transaction fees on its network result in fewer sending addresses each month compared to lower-fee networks like Tron and Binance Smart Chain. Metrics such as sending addresses are favored over raw transaction counts because they are less easily manipulated, underscoring this delicate pattern, with Tron, Polygon, Solana and Ethereum< /strong> Leading the field in stablecoin activity.

p>

Market trends in 2024

Stripe acquires Bridge Network

On October 20, 2024, Stripe acquired Bridge Network for US$1.1 billion, marking significant progress in the stablecoin and cryptocurrency payment market. Bridge, often referred to as the “Stripe of cryptocurrency,” specializes in providing stablecoin payments to businesses without requiring them to handle digital tokens directly. Major investors including Index Ventures and Haun Ventures have seen Bridge's valuation grow 200% since it reached a $350 million valuation in August in a funding round that included participation from top firms like Sequoia. Stripe's annual revenue is estimated to be between $10 million and $15 million, and the acquisition reflects its commitment to stablecoin infrastructure, which CEO Patrick Collison likened to "the room-temperature superconductor of financial services."

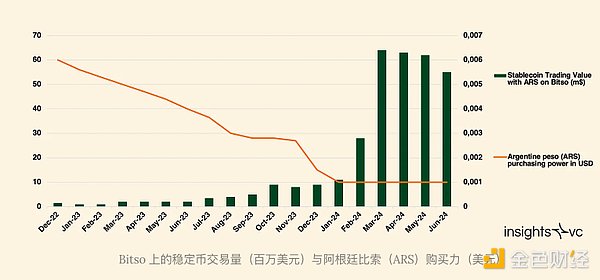

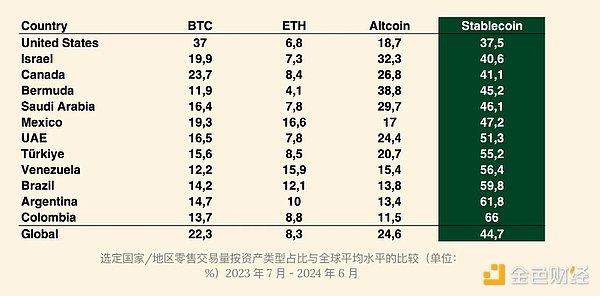

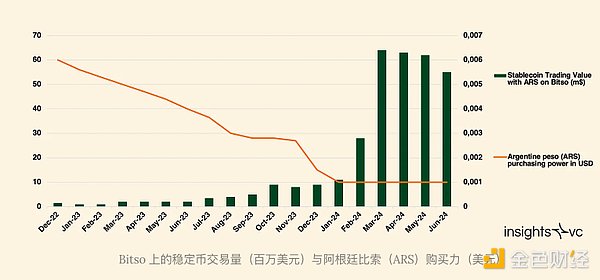

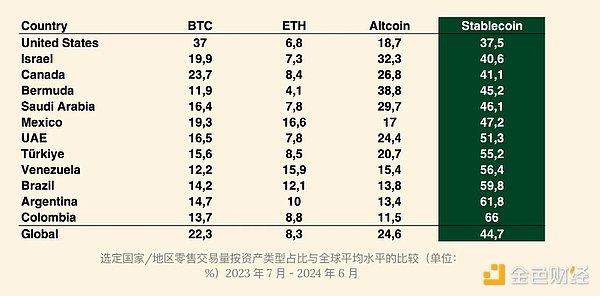

Emerging markets and currency stability

In the presence of serious currency In depreciating emerging markets, stablecoins can serve as a hedge against local currency instability. Countries such as Argentina, Türkiye and Venezuela have shown significant adoption of stablecoins as residents seek alternatives to depreciating local currencies. For example, Argentina’s stablecoin trading volume is significantly higher than the global average at 61.8%, driven primarily by inflation and demand for U.S. dollar proxies.

p>

Cross-border transactions and remittances

Stablecoins are revolutionizing cross-border payments , especially in Africa and Latin America. In sub-Saharan Africa, stablecoins are critical for businesses facing foreign currency shortages and high remittance costs. For example, stablecoins have reduced remittance fees by approximately 60% compared to traditional methods in Nigeria. Likewise, stablecoins make cross-border transactions in Latin America cost-effective and fast, and Circle recently expanded in Brazil to meet this demand.

Regulatory Development and Challenges

Regulatory environments in different regions The differences are huge and affect the development of stablecoins. The European Union’s Markets in Crypto-Assets (MiCA) regulation, which will come into effect in June 2024, provides a comprehensive regulatory framework and creates an enabling environment for stablecoin projects in Europe. Conversely, U.S. regulatory uncertainty has pushed some stablecoin activity to markets outside the U.S., with issuers such as Circle emphasizing the importance of regulatory transparency to maintaining the U.S.’s competitive advantage in the stablecoin space.

Institutional and retail demand

Stablecoins are gaining ground among retail and retail investors Usage is increasing across organizations. In Nigeria, stablecoins are popular for daily transactions and cross-border payments, while in the EU, stablecoins are used more in B2B transactions such as invoice settlement and remittances. Additionally, in countries with high inflation rates, such as Turkey, retail adoption of stablecoins as a means of hedging against inflation is also high.

p>

Global Stablecoin Regulation

Due to financial stability and investor protection , anti-money laundering compliance and innovation are the main driving factors, and stablecoin regulations vary widely between countries. Here is a breakdown of how stablecoin regulation is handled in each major jurisdiction:

European Union

MiCA Regulation: Markets in Crypto-Assets (MiCA) regulations will come into effect in mid-2024 to enforce reserve requirements for stablecoins and ensure market integrity Sexuality and consumer protection.

Innovation Initiatives: The EU supports innovation through the blockchain regulatory sandbox and DLT pilot system to help The company conducts testing within a compliance framework.

Notable Exclusions: MiCA does not currently cover DeFi or NFT, limiting its wider use The scope of the encryption field.

United States

Multiple Agencies: Regulatory agencies are led by the U.S. Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the Financial Crimes Enforcement Agency (FinCEN), forming Complex situation.

Ongoing Federal Bills: The proposed Lummis-Gillibrand Act and FIT21 aim to establish Unified regulatory framework for stablecoins.

State Leadership: States like New York and Wyoming are leading the way with innovative Laws, including the state of Wyoming, recognize DAOs as legal entities.

UK

Stablecoins in the existing framework: Stablecoins are included in existing financial regulations, and the FCA sets anti-money laundering, KYC and promotion standards.

Digital Securities Sandbox: This sandbox allows companies to trial digital asset solutions in a controlled environment program to support safe experiments.

Singapore

Comprehensive guidance from the Monetary Authority of Singapore: The Monetary Authority of Singapore imposes strict anti-money laundering, consumer protection and licensing standards on stablecoins.

Regulatory Sandbox: Provides a safe testing environment for innovation, with strict KYC, security and reserve management requirements.

Japan

FSA-led regulation: The Financial Services Agency enforces KYC/AML requirements and requires a stablecoin license.

International Standards First: Japan allows internationally regulated stablecoins to operate domestically to promote global interoperability. Operability.

Updated Payment Services Act: This update ensures security while adapting to New digital asset trends.

United Arab Emirates (UAE)

VARA’s Licensing Requirements: The UAE Virtual Asset Regulatory Authority requires licensing for stablecoin-related activities.

Focus on security: Strict KYC and AML frameworks protect consumers and promote liability in the stablecoin space Responsibility grows.

Switzerland

FINMA Supervision: The Swiss Financial Market Supervisory Authority (FINMA) takes a principles-based approach to the enforcement of anti-money laundering and data protection laws.

Support for DeFi: A regulatory framework that encourages innovation while maintaining security and transparency.

Key regulatory topics and requirements

AML and KYC Compliance

Global AML/KYC compliance is consistent with FATF standards and requires stablecoin issuers to verify identities and monitor transactions , and recommends using innovative tools such as zero-knowledge proofs for privacy-focused KYC.

Regulatory Sandbox

The sandbox is a digital asset product Provides a safe testing environment that balances innovation and compliance. Major jurisdictions such as the UAE, UK and Japan have adopted sandbox frameworks and often engage in international collaboration to harmonize regulatory practices.

Privacy and Security Agreement

Stablecoin providers must Implementing strong cybersecurity measures, data privacy and asset custody regulations are increasingly valued; in regions such as Hong Kong, secure asset storage is a mandatory requirement.

Integration and Exclusion of DeFi

DeFi is playing a big role in Stablecoins remain largely unregulated, but jurisdictions such as the UK and Japan are exploring frameworks to connect decentralized finance and traditional finance, while the EU’s MiCA currently excludes DeFi from regulation, pending possible future revisions.

Outcomes and Unintended Consequences

Positive Outcomes

Enhanced consumer protection and market integrity enhance confidence in stablecoins and promote economic growth in regions with clear regulatory frameworks.

Regulatory clarity in centers such as Singapore and Switzerland has attracted digital asset companies, boosting economic growth and establishing these places as digital A global hub for assets.

Challenges and Unintended Consequences

Regulatory arbitrage: Companies may choose jurisdictions with less stringent regulations, thereby exposing themselves to the risk of regulatory arbitrage. Regions such as Gibraltar and the UAE face the challenge of balancing innovation with comprehensive regulation.

Privacy Concerns: MiCA’s transparency requirements may be inconsistent with privacy-focused blockchain technology conflict, thereby potentially compromising user privacy.

Innovation and Regulation: A strict regulatory framework may hinder new market entrants; e.g. The decentralized approach in the United States has led some companies to move abroad due to regulatory uncertainty.

Conclusion

In the past decade, stability The coin has rapidly matured from the initial concept of BitUSD to a cornerstone of decentralized finance, with a current total supply exceeding $156 billion. Modern stablecoins such as Tether (USDT ) and USD Coin (USDC ) have gained widespread adoption by ensuring their value through large fiat reserves, with USDT best known as $113.4 billion supply leads. Emerging markets are increasingly adopting stablecoins to hedge against currency devaluation – for example, Argentina’s stablecoin trading accounts for61.8% of its retail trading volume. Regulatory responses have varied globally: the EU's MiCA regulations aim to promote innovation through clear guidelines, while regulatory uncertainty in the US has prompted some issuers to look elsewhere. Institutional interest is surging, such as Stripe's $1.1 billion acquisition of Bridge Network. As stablecoins continue to bridge traditional finance and cryptocurrencies, their future depends on striking a balance between innovation and effective regulation.

Anais

Anais