After experiencing a new round of market shocks, the panic in the entire market has eased a lot as the price of Bitcoin has rebounded.

With the repeated collapse of altcoins, from the question of "Are there any more altcoins?" to the voices of various professional investors leaving the market, the past one or two months have been gloomy for the crypto market other than Bitcoin.

But no matter how panicky the market sentiment is, when asked which track the market is most optimistic about in the future, "Bitcoin ecology" is still the most popular.

Especially recently, the large positions of institutions buying Bitcoin, the continuous increase in the number of Bitcoin held by ETFs, and the rapid development of Bitcoin ecology such as Stacks and Fractal Bitcoin have the momentum to drive a new round of market conditions.

Institutional holdings and ETFs

As a major Bitcoin holder on Wall Street, MicroStrategy has been buying again recently.

According to the latest SEC documents, MicroStrategy has purchased 18,300 bitcoins in the past month, with a total investment of about $1.11 billion, at an average price of about $60,655. Currently, MicroStrategy's total bitcoin holdings have reached 244,800, accounting for 1% of the total bitcoin issuance.

Three years later, MicroStrategy once again spent $1.1 billion to buy bitcoins, which is undoubtedly a shot in the arm for the crypto market that has just shown signs of recovery.

Although the market has looked shaky in the past few months, and the voices of "bull market is no longer" have been heard everywhere, the 13F documents disclosed by the SEC for the second quarter of 2024 show that, with the decline in Bitcoin prices, US institutions have been increasing their positions in Bitcoin ETFs against the market trend:

According to Matt, Chief Investment Officer of Bitwise, the number of institutions holding Bitcoin ETFs increased from 965 to 1,100 in the second quarter, and more than 130 institutions purchased Bitcoin ETFs for the first time in the second quarter, and the proportion of Bitcoin ETFs held by these institutions has also increased from 18.74% to 21.15%.

Therefore, despite the sharp fluctuations in the market, even when the trend is not clear, these institutions have not been scared away, but continue to increase their positions and buy. It is conceivable that if it is a bull market, the number of institutions entering the Bitcoin ETF and the amount of purchases will be more impressive.

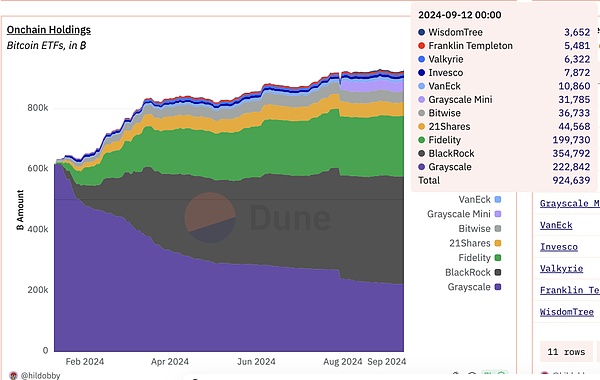

From the trend chart of the number of Bitcoins held by the Bitcoin ETF since its issuance, this data has generally maintained a continuous upward trend in the past 9 months. Even during the period of drastic fluctuations in the crypto market, the number of Bitcoin ETFs held has not changed much.

Therefore, despite market fluctuations, Bitcoin's fear and greed index once entered the extreme panic range, and large American institutional investors are still continuing to test the waters and buy.

Chart of changes in the number of bitcoins held by Bitcoin ETFs, source: Dune

Fractal Bitcoin

Fractal Bitcoin is one of the most eye-catching projects on the market recently. In addition to the generous Airdrop that attracted a lot of attention, Fractal Bitcoin has exceeded 241EH in just a few days since its launch, reaching 38.1% of Bitcoin's total computing power, which shows its popularity.

Fractal Bitcoin price and computing power, source: UniSat Explorer, September 16, 2024

Fractal Bitcoin was launched by the Unisat team. As a team that has been deeply involved in the Bitcoin ecosystem and has received investment from top institutions such as BN, it is expected that it will receive such popularity after its launch.

Fractal Bitcoin is also the Layer2 of Bitcoin, known as "the only native Bitcoin expansion solution at present", focusing on stronger compatibility with Bitcoin and shared security. Without changing the original Bitcoin code, it increases the transaction speed and increases the transaction confirmation time to 30 seconds. Compared with the at least 10 minutes of the Bitcoin main network, the TPS is increased by more than 20 times.

Regarding the difference between Fractal Bitcoin and other Layer2 and sidechains,the founder of Fractal Bitcoin said, "If other L2 and sidechains are like building another highway, then Fractal can build countless highways parallel to the Bitcoin mainnet. Each road can be to expand the Bitcoin mainnet or to expand another road."

Of course, there are many plans for Bitcoin expansion. The ultimate goal is to share the security of Bitcoin to the greatest extent and greatly improve TPS, just like what Fractal Bitcoin wants to achieve, but there are almost no real implementations at present.

Since the Bitcoin ecosystem exploded, the Layer2 track has been crowded with various players. In addition to the original old Layer2 such as Stacks and RSK, there are also RGB++ that has transformed, as well as a number of new Layer2 such as BEVM and Merlin, which is quite lively.

However, who can truly carry the banner of Bitcoin ecosystem Layer2, bring DeFi, GameFi, NFT, etc. into the Bitcoin ecosystem, and introduce massive dormant Bitcoin into the entire crypto liquidity pool, at present, it still needs further observation and verification.

Stacks Nakamoto Upgrade

As the most well-known Layer2 in the Bitcoin ecosystem, Stacks ushered in the Nakamoto upgrade on August 28.

For Stacks, this upgrade is of great significance, mainly for four points:

1. STX production is halved:After the Nakamoto upgrade, Stacks' output will change from 1,000 STX rewards per Bitcoin block to 500 STX, and the inflation pressure of STX will be greatly reduced.

2.60 times TPS improvement:Through this hard fork, the block production of Stacks is decoupled from the block time of Bitcoin, and the block confirmation time is reduced from more than 10 minutes to 10 seconds, and the TPS is increased by more than 60 times.

3. Better security:After the Nakamoto upgrade, the new consensus mechanism writes the historical data of the Stacks chain into the Bitcoin block. Without changing the Bitcoin block data, the Stacks block data cannot be tampered with, which further enhances the security of the Stacks chain.

4. Decentralized anchor coin sBTC is launched:sBTC will be launched about a month after the upgrade. This is the first fully decentralized Bitcoin anchor coin, which does not require permission and is open to participation, making it more attractive to Bitcoin whales.

With the official completion of the Stacks Nakamoto upgrade, the battle for Bitcoin's Layer2 will become more intense. After all, the security of the Stacks main chain has withstood the test of the market for quite a long time, and after the upgrade, the security has been greatly improved, and the TPS optimization has also been greatly improved.

In addition, Stacks itself has high recognition in Europe and the United States, and is the first SEC-compliant Token project. At present, the level of ecological development is also the best among all Layer2s. It has a certain first-mover advantage and is obviously a heavyweight player in the Bitcoin Layer2 hegemony.

Summary

Of course, in addition to these, the Bitcoin ecosystem has recently made many other new moves, such as the Babylon mainnet launch in late August to start staking, reaching the staking limit of 1,000 BTC in just three hours. The Airdrop expectation plus Babylon's luxurious financing background have attracted considerable market attention. And recently, several OP_CAT protocols in the Bitcoin ecosystem are also in full swing.

In any case, compared with the dullness or even extinguishment of other ecosystems, the wealth-creating effect and enthusiasm of the Bitcoin ecosystem are visible. After the extinguishment of inscriptions and runes, there is continuous innovation and vitality, and a large amount of resources and funds have entered, which is indeed worth looking forward to.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice Nell

Nell Cointelegraph

Cointelegraph