This article explores the vibrant world of Real-World Asset (RWA) tokenization. Learn how blockchain technology is revolutionizing the financial industry by transforming physical assets like real estate and gold into digital tokens. Dive into conversations with key industry figures, stay on top of emerging trends, and learn how local innovations like KALP tokenization are making waves. The blog provides in-depth insights into key players and future trends, showing how tokenization is redefining investment and ownership.

Max and Ella are discussing a blog on the growing trend of Real-World Asset (RWA) tokenization, which explains how blockchain technology is changing the way people invest in high-value assets such as real estate and commodities. The blog highlights how tokenization is breaking down barriers, the latest trends, and the key players.

1. Big-name companies leading the trend

1. JPMorgan Chase

Pioneering blockchain through Onyx: JPMorgan Chase is at the forefront of blockchain innovation through its Onyx platform. Onyx aims to use blockchain technology to simplify financial transactions. The platform enables JPMorgan Chase to issue and manage digital tokens, including tokenized bonds and stocks.

Testing and implementation: JPMorgan Chase has successfully tested the tokenization of multiple assets, including bonds and stocks. For example, they conducted a pilot program involving the issuance and trading of tokenized bonds on their blockchain platform. This not only demonstrates its technological capabilities, but also highlights the potential of blockchain to improve market efficiency, shorten settlement time, and reduce transaction costs.

Wide impact: By integrating blockchain into its operations, JPMorgan Chase has demonstrated that this technology is not only suitable for technology startups, but can also be adopted by traditional financial institutions. Their participation shows that blockchain is expected to drive changes in traditional banking and finance, and establish their leading position in digital innovation.

2. Societe Generale

Issues Tokenized Bonds on Ethereum: As one of the major banks in France, Societe Generale has taken an important step in asset tokenization and issued tokenized bonds on the Ethereum blockchain. This move is noteworthy because it represents traditional financial institutions embracing blockchain technology to innovate core financial products.

Embracing new technologies: By using the Ethereum blockchain, Societe Generale is moving away from traditional financial methods and exploring the potential of blockchain in providing faster and more transparent financial transactions. The use of Ethereum smart contracts allows for automated processes, which improves efficiency and reduces operational risk.

Impact on the financial industry: Societe Generale's actions are a strong endorsement of the capabilities of blockchain, highlighting its potential to revolutionize the creation, management and trading of financial products. Their efforts have also contributed to the widespread acceptance and application of blockchain technology in the financial industry.

3.Securitize

Simplify digital token issuance: Securitize focuses on simplifying the issuance process of digital tokens while ensuring compliance with regulatory requirements. Their platform helps companies tokenize assets and provides an efficient process for creating and managing these digital securities.

Compliance: One of Securitize's core strengths is its focus on compliance with securities regulations. The services they provide ensure that tokenized assets meet legal standards, which is critical to maintaining investor confidence and ensuring market integrity.

Improve market liquidity: By providing a compliant digital token issuance and trading platform, Securitize enhances market liquidity and accessibility. Their technology supports secondary trading of tokenized assets, enabling investors to buy, sell and trade these digital securities securely.

4.Tokeny

Support blockchain integration: Luxembourg-based Tokeny assists institutions in moving their assets to the blockchain. They focus on ensuring that the tokenization process meets security standards and regulatory requirements, which is critical for institutional adoption.

Platform capabilities: Tokeny's platform provides solutions for creating and managing tokenized assets, with a focus on security and compliance. They provide tools for secure token issuance, investor onboarding, and asset management, helping organizations enter the tokenization field smoothly and efficiently.

Building trust and reliability: By prioritizing security and regulatory compliance, Tokeny helps to enhance trust in tokenized assets and encourages institutions to participate in the exploration of blockchain technology. Their efforts have promoted the widespread acceptance and normalization of asset tokenization in traditional financial markets.

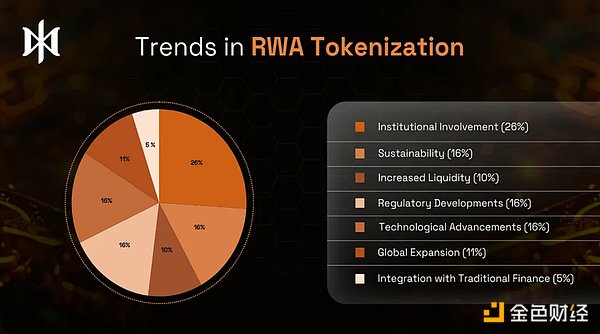

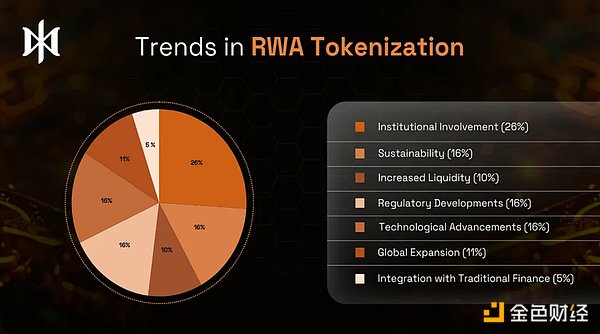

2. What are the latest trends in RWA tokenization?

Institutional participation: Major financial institutions including Blackstone, Goldman Sachs and Fidelity are increasingly entering the tokenization field, enhancing the credibility and influence of this market.

Sustainability: Tokenization of sustainable assets, such as carbon credits and renewable energy projects, is growing, driving investment into environmentally friendly projects while delivering financial returns.

Liquidity Enhancement: Tokenization improves liquidity for previously illiquid or difficult-to-access assets by allowing fractional ownership of assets and easier trading.

Regulatory Developments: Evolving regulations and frameworks are shaping the tokenization landscape, with governments and regulators working to address legal and compliance issues.

Technological Advances: Innovations in blockchain technology, such as smart contracts and decentralized finance (DeFi) protocols, are improving the efficiency and functionality of tokenized asset platforms.

Global Expansion: Tokenization is gaining traction in multiple regions around the world, with significant adoption trends particularly in financial centers such as the United States, Europe, and Asia.

Integration with traditional finance: The integration of tokenized assets with the traditional financial system is deepening, including partnerships between blockchain platforms and traditional financial institutions.

Intensified market segmentation: Tokenization is expanding beyond traditional asset classes to niche markets and industries including art, collectibles and intellectual property.

Improved transparency and security: The use of blockchain technology brings greater transparency, traceability and security to tokenization, solving common problems in asset management.

Innovative investment tools: Through tokenization, new investment products and tools are emerging, such as tokenized real estate funds and commodity-backed tokens, providing investors with diversified investment opportunities.

3. KALP Tokenization: The global potential of a local story

Back in India, an innovative project called KALP is making a splash. They launched BIMTECH CBDC, a digital currency that is traded in an academic setting. Students, suppliers, and managers have all become part of this tokenized ecosystem. More than 1,300 transactions have been completed, showing how tokenization can be applied in real-world scenarios. KALP’s GINIToken acts as transaction fees, making the entire system efficient, proving that even small ecosystems can benefit from tokenization. Tokenization of Commodities Tokenizing commodities such as gold and oil has become a major trend. Companies like Paxos and Tether Gold allow investors to hold tokens that are backed by physical gold reserves. This makes it easy to trade or invest in commodities without having to deal with the complexity of the actual asset. A Paradigm Shift in Real Estate Real estate is one of the most exciting areas for tokenization. Platforms like RealT and tZERO allow people to buy fractional ownership of a property. This means you don't have to buy the entire property to invest in real estate. This makes real estate investment open to everyone, not just the rich.

4. Dealing with the regulatory environment

Governments are beginning to recognize the potential of tokenization and are supporting this trend with regulatory measures. For example, the EU's Crypto Asset Market Regulation Act (MiCA) and the US Securities and Exchange Commission's (SEC) growing focus on tokenized securities are paving the way for widespread tokenization adoption. As these regulations become clearer, it will be easier for institutions and individuals to tokenize assets safely and legally.

In short, the pace of global RWA tokenization adoption is accelerating, and it will change our perception of asset ownership and trading. Whether it's giants like JPMorgan Chase or innovative local projects like KALP, tokenization is gradually being integrated into our daily financial lives. With the rise of trends such as sustainable development and fractional ownership, we are moving towards a more inclusive and efficient financial world.

5. FAQ

1. What is the trend of asset tokenization?

Asset tokenization is growing rapidly as it provides higher liquidity, fractional ownership, and more convenient investment opportunities. The trend is driven by advances in blockchain technology and growing interest from retail and institutional investors.

2. Which countries are leading in the adoption of RWA tokenization?

Countries such as the United States, Switzerland, and Singapore are leading in the field of RWA tokenization, thanks to their developed financial markets, supportive regulatory frameworks, and innovative technology ecosystems.

3. How can institutions participate in RWA tokenization?

Institutional players, including major banks, asset managers, and investment firms, are increasingly engaging in RWA tokenization to improve liquidity, simplify operations, and open up new investment avenues.

4. How big is the real-world asset tokenization market?

The RWA tokenization market is growing rapidly and is expected to reach approximately $2 trillion by the mid-2020s, driven by increasing popularity and technological advances.

5. What are the main challenges hindering the adoption of tokenized assets worldwide?

The main challenges include regulatory uncertainty, technical integration issues, and concerns about security and market fragmentation, which have hindered the widespread adoption of tokenized assets.

6. How big is the RWA tokenization market?

The RWA tokenization market is estimated to be approximately $10 billion by 2024, reflecting the early but expanding stage of this field within the broader financial landscape.

JinseFinance

JinseFinance