Author: Eureka Partners, Foresight News

Prospects of Bitcoin Layer2

Bitcoin was originally conceived to be used in electronic payment systems. Therefore, for security and stability, the design of non-Turing-complete scripting languages limits Bitcoin's ability to perform complex calculations. Bitcoin exists more as digital gold for value storage. With the explosion of the ecology on public chains such as Ethereum and Solana, in order to activate the trillion-dollar assets dormant in the Bitcoin ecosystem, developers have also been exploring expansion solutions for the Bitcoin ecosystem, but the technical limitations of solutions such as side chains and lightning networks still exist, so they have been tepid.

The inscription wave spawned by Ordinals in 2023 has expanded the new asset form of the Bitcoin ecosystem, and further triggered the market's thinking and exploration of Bitcoin's scalability and programmability. A series of new Layer2 solutions such as Merlin and B² Network have also emerged, using programmability to create a series of DeFi applications such as Swap, lending, and liquidity mining to expand new application scenarios in the Bitcoin ecosystem.

Most Layer2s in the market currently participate in on-chain scenarios such as DeFi by bridging liquidity to the Ethereum ecosystem and coupling with the Ethereum ecosystem. However, many Layer2 withdrawal bridges are essentially multi-signature bridges. The bridge schemes that manage public assets through multi-signatures often have trust risks and cannot allow users to withdraw assets at any time in a trustless form. For many BTC holders, they have no motivation and are not confident in bridging BTC assets to the Ethereum ecosystem to gain unknown returns. After all, the security of funds is the cornerstone of all returns. Therefore, the ideal Bitcoin Layer 2 should inherit the security features of Bitcoin and be able to build an extensible and programmable on-chain financial infrastructure.

Bitlayer has high expectations as the core support in Layer2

As the leader of BTC Layer2, Bitlayer uses layered virtual machine technology (Layered Virtual Machine), combined with zero-knowledge proof (ZKP) and optimistic verification (OP) mechanisms to support a wide range of computing tasks. Additionally, Bitlayer has built a dual-channel, bi-directional locked asset bridge through its innovative OP-DLC and BitVM bridge technologies, inheriting the security of Bitcoin’s first layer.

Bitlayer’s main technical innovation lies in the adoption of the latest BitVM computing paradigm and OP-DLC bridge.

Compared to other Bitcoin second-layer solutions, Bitlayer aims to solve three core problems facing the second layer and proposes corresponding solutions:

Trustless 2-Way Peg — By combining OP-DLC with the BitVM bridge, a new model that goes beyond the traditional multi-signature model is proposed, enabling trustless bi-directional flow of assets between the Bitcoin main chain and Bitlayer.

Layer 1 Verification — Inheriting Bitcoin’s security through BitVM.

Turing-Completeness — Supports multiple virtual machines and achieves an environment that is 100% compatible with the Ethereum Virtual Machine (EVM).

Token Airdrop (Ready Player One)

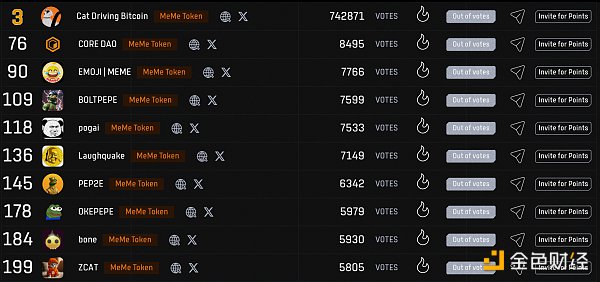

In addition to the underlying technology, the prosperity of the on-chain ecosystem is also crucial to the development of a chain. In order to encourage DEX, Wallet, NFT Marketplace, Lending, LSD, Bridge, Stablecoin and other types of projects to be built on Bitlayer, Bitlayer officially announced a series of ecological incentive plans on March 29. The first event, Ready Player One, will issue public chain tokens worth $50 million to ecological builders and project parties. According to official data, as of now, Ready Player One has attracted more than 800 project registrations. Before the voting ends on May 10, users can actively participate in the voting and earn "No. 1 Player" activity points. At the same time, the registered project teams can accumulate popularity points, which will help them occupy a favorable position in the Bitlayer official rankings to win more developer airdrop rewards and grants.

Bitlayer Ecosystem Native Projects at a Glance

Native Definition: Only for Bitlayer, cross-chain and multi-chain projects are not included; Top 30 in the list

Pumpad

Pumpad is a native Launchpad project of Bitlayer. According to the official statement, Pumpad is a one-stop Launchpad for the BTC ecosystem to issue VGA assets according to the IPOS standard. After the asset is issued, Pumpad can help the issuer automatically add liquidity to the DEX and deploy the automatic market maker protocol. It can be said that Pumpad is an issuance platform that provides full-cycle services to project parties, not just IDO services.

In terms of positioning, Pumpad proposed two concepts:

IPOS:Initial Pump Offering Standard refers to a set of IDO full-cycle service packages, including IDO mechanisms, market value management, etc., in order to allow project parties to operate matters before and after the issuance of coins with minimal operation and maintenance costs.

VGA:Value-Growing Asset Building means that all assets issued on Pumpad will follow IPOS to ensure that the project party cannot run away or withdraw funds, and earn a certain commission income through this model.

At present, there are no specific details for the above two concepts. In addition, the Pump Point proposed by Pumpad is used to incentivize loyal and active users, and may be used for airdrops or priority launches of Pumpad's own platform tokens in the future.

Specifically, Pumpad has two main businesses:

Launchpad:Pumpad's Launchpad will support various issuance methods, including oversubscription lottery, weighted allocation, and first-come-first-served IDO methods.

Airdrop:Pumpad's Airdrop module is a platform for users to receive airdrop incentives, and project parties can customize airdrop activities to incentivize different types of users.

As of May 10, Bitlayer ranked 19th on the Dapp Leaderboard and ranked first in the track. Other Launchpads have not seen Bitlayer follow or retweet, which means that Pumpad's "orthodoxy" is relatively strong. At present, the first project to cooperate with the platform is $CBD, which is also the MEME mentioned below. The "No.1 MEME+No.1 Launchpad" has joined forces, and the traffic of both parties may be able to achieve "left foot stepping on the right foot to go to the sky".

Official Twitter: https://twitter.com/pumpad_io

Macaron

Macaron is the first native DEX on Bitlayer. Macaron provides users with a range of tools, including liquidity farming, staking incentives, trade-to-earn, airdrops, etc. to increase user benefits.

With the technical and ecological support of Bitlayer, the Macaron team has been committed to creating excellent products to make Macaron DEX safer, cheaper and faster. As Bitlayer's native DEX, Macaron will serve as a trading platform for Bitlayer ecosystem assets and mainstream BTC assets, and has the following advantages:

Industry-leading security:Using technologies such as multi-signature protocols to ensure the security of funds, Macaron can provide users with 24/7 protection.

Advanced AMM Algorithm:Macaron's original AMM algorithm ensures that asset transactions are carried out efficiently at lightning speed, while providing high liquidity, minimizing slippage and optimizing yields.

Liquidity Provider Rewards:Macaron will provide rewards to users when they provide liquidity. Rewards will be calculated and distributed based on the fees collected. Macaron rewards liquidity providers who can help the team continuously improve the trading experience.

Trading Income:Macaron's Trade-to-earn rewards program introduces a revolutionary trading incentive method. A certain percentage of Macaron's governance tokens will be distributed to users as rewards.

Low Gas Fees:Thanks to Bitlayer's excellent underlying functions, Macaron, as a native DEX, can achieve high performance such as low fees, lightning-fast confirmations, and seamless transactions.

Seamless user experience: Macaron DEX's advanced AMM algorithm and superior functionality ensure that users can enjoy seamless trading, liquidity staking and other user experiences, just like experiencing a real top CEX.

Macaron provides users with a package of incentive plans, mainly including a points system, Macaron NFT, and income based on Macaron's native DeFi, namely trading income, LP incentives, staking rewards, etc. The points system is mainly composed of two parts: social points and DeFi points. The two points are obtained in different ways and the proportion of future exchange for mainnet tokens is different. Macaron NFT is a PFP NFT launched by the platform. Its rights include a series of empowering rights such as future airdrops and governance rights. DeFi native income includes stable asset interest earned through trading, staking, adding liquidity, etc. on Macaron. For more information about Macaron activities, please visit Macaron's official social media.

As of May 10, Bitlayer Dapp Leaderboard ranks 2nd, second only to the stablecoin bitSmiley. It has 49.2k followers on Twitter, which is quite popular.

Official Twitter: https://twitter.com/macarondex

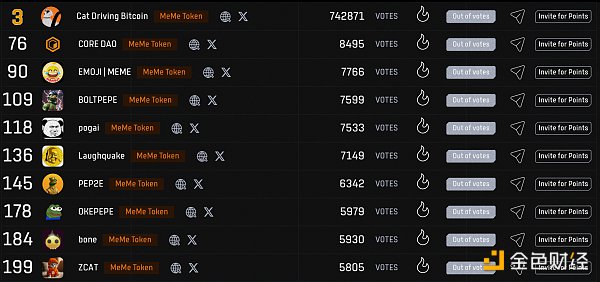

Cat Driving Bitcoin ($CBD)

Cat Driving Bitcoin ($CBD) is a native MEME token on the Bitlayer chain. The project's visual elements are mainly cats + driving, which also fits the overall elements of Bitlayer. According to the official statement, $CBD aims to subvert the meme economy by building MEME CBD - a prosperous, modern, high-rise Bitcoin world. $CBD is committed to becoming the largest community asset on Bitlayer and promoting Bitcoin to become the best human asset on the planet. It has been followed by Bitlayer and Marcaron official Twitter accounts.

As of May 10, Bitlayer Dapp Leaderboard ranked 3rd, which is the first in the MEME track. Combined with the previous data of $BONE, it ranked 9th in the MEME track, and $BONE official Twitter accounts have bitSmiley and Bitlayer following it. It has accumulated 12.2k fans and has increased 10 times within 24 hours after listing. In contrast, the potential of $CBD cannot be underestimated.

In the token model, unlike $BONE, which airdrops most of its tokens to bitSmiley testnet users, $CBD prefers a universal airdrop model: 70% for airdrops, 20% for liquidity, and 10% for the treasury.

According to the current information, $CBD will be airdropped to 4 types of users:

Bitlayer helmet NFT holders who have completed some cross-chain interactions

Hold BTC-related assets and have recently executed BTC transactions

Participate in the community ecology, such as voting, co-construction, etc.

Hold other assets in the Bitlayer ecology

It is worth noting that the $CBD airdrop channel is not airdropped by the project party itself, but on Pumpad. In addition, according to the above rules, Bitlayer helmet NFT holders are currently the ones with the clearest participation rules. For more airdrop rules, please continue to pay attention to the updates of official social media.

Official Twitter: https://twitter.com/catdrivebitcoin

TrustIn Finance

TrustIn Finance is a native permissionless lending protocol on Bitlayer, driven by a Bitcoin-safe equivalent Layer2 solution built on BitVM.

TrustIn Finance adopts the following design:

Floating interest rate:In TrustIn Finance, the interest rates for lenders and borrowers are determined based on the use of funds in the market. This maximizes the guarantee that participants can obtain the most ideal interest rate while also ensuring the safety of funds in the liquidity pool.

Risk isolation:To simplify the protocol and improve security, TrustIn Finance isolates asset pools based on different underlying assets to prevent a large number of defaults from overwhelming the protocol and mitigate potential uncontrollable consequences.

Reserve:Reserve is another important security measure introduced by TrustIn Finance, which aims to solve the problem of potential debt losses in the protocol. TrustIn Finance allocates part of the loan interest as a reserve according to the reserve coefficient to further ensure the safety of assets in the protocol.

Early Contributor Incentive Mechanism:TrustIn Finance aims to grow with every participant and is committed to incentivizing all contributors. The specific incentive mechanism is subject to further official notification.

TrustIn Finance is expected to announce a points incentive plan in the near future, and users can earn points by depositing or touching assets. Points will serve as an important reference for the airdrop of TrustIn Finance governance tokens, which will be airdropped and distributed to users with points in a certain proportion. More information can be obtained through the official social media of TrustIn Finance.

As of May 10, TrustIn Finance ranked 6th on the Bitlayer Dapp Leaderboard, with a vote count close to Nekoswap. There are 38.1k followers on Twitter.

Official Twitter: https://twitter.com/TrustIn_Finance

Nekoswap

Nekoswap is the first native decentralized cross-chain exchange for runes and tokens on Bitlayer.

NekoRunes will be the first rune asset token on Neko swap. NekoSats promises a fair launch. In addition to the 2% $RNeko held by the project party, all other tokens will be airdropped and added to the liquidity pool. Secondly, Neko will try to solve the circulation problem of Layer 1 and Layer 2 rune assets by mapping. If the technical and time costs are high, other methods will be used to realize equity realization. In terms of token holder rights, Nekoswap has made a series of promises, including that Nekosats holders will permanently share the transaction fee dividend income of Nekoswap.

Nekoswap is working closely, and there is no official website or official website documentation. Nekoswap is committed to becoming a completely community-driven, fair, transparent and decentralized exchange, including Swap, liquidity pool, Farm, Launchpad, rune trading and other functions. In the future, for the access, deployment and development of the public chain, the project party stated that it will refer to the opinions of the community and decide the development direction through voting, AMA and other methods. More information can be obtained through Nekoswap's official social media.

As of May 10, Nekoswap ranked 4th on the Bitlayer Dapp Leaderboard and has 23k followers on Twitter.

Official Twitter: https://twitter.com/NekoSwap

BitMagic

BitMagic is the native NFT Marketplace on Bitlayer. Committed to promoting innovation in the Bitcoin NFT ecosystem, as an early and deeply involved native NFT platform project in the BitLayer public chain ecosystem, BitMagic aims to solve the challenges faced by NFTs in the Bitcoin network, such as reducing transaction costs and improving asset liquidity. Through a comprehensive platform, combined with NFT issuance and trading markets, BitMagic optimizes the full life cycle management of NFTs, significantly improving user experience and ecological value creation.

In the future, BitMagic will introduce NFT cross-chain bridges and points systems, which can not only promote the circulation of assets from the first layer to the second layer, but also stimulate users' trading enthusiasm through incentive mechanisms. In addition, BitMagic provides rewards for cross-chain behaviors of high-quality projects and native assets on the first layer to ensure that more assets are fully utilized on the second layer, accelerating the development of the Bitcoin second-layer NFT ecosystem.

BitMagic is closely integrated with BitLayer BitVM technology, focusing on process optimization, cost reduction and innovative trading incentive schemes, bringing users an unprecedented Bitcoin NFT trading experience and laying the foundation for the explosive growth of the BTC NFT ecosystem on the second-layer chain.

BitMagic is expected to launch its OG NFT in the near future, and holders can enjoy special rights such as future airdrops and Launchpad project priority, and plan to issue platform tokens in the future. Through this series of multiple rewards, active traders and NFT holders on the platform are encouraged. For more information, please visit BitMagic’s official social media.

As of May 10, BitMagic ranked 106th on the Bitlayer Dapp Leaderboard and has 21.4k followers on Twitter.

Official Twitter: https://twitter.com/bitmagic_nft

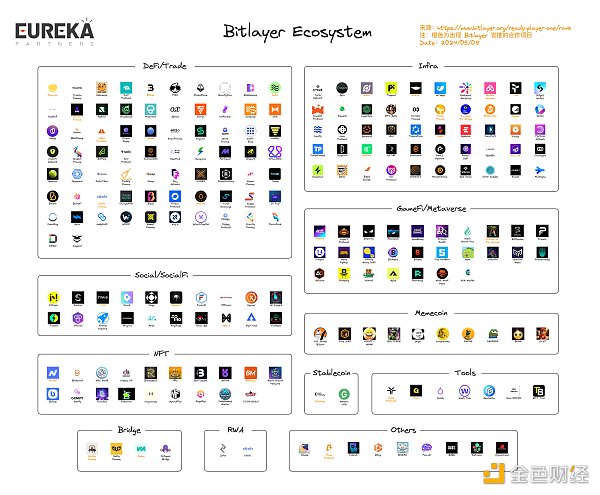

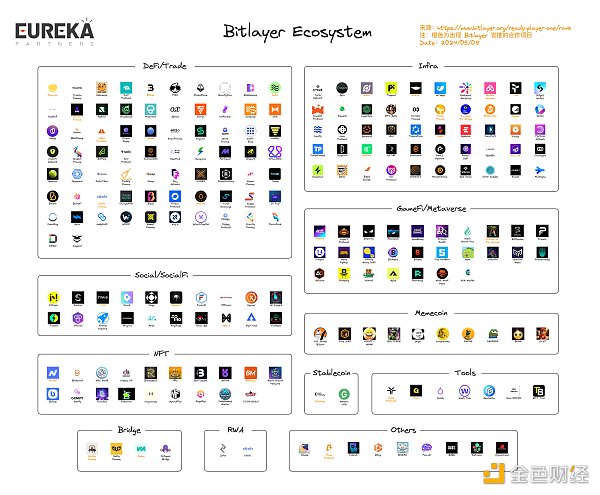

Eco-project puzzle

Bitlayer launched the Eco-incentive Program on March 29, announcing that it would spend 50 million US dollars to incentivize major early builders and contributors. As of the time of writing (May 10), a total of more than 280 projects were deployed on Bitlayer.

It can be seen that the Bitlayer ecosystem is expanding rapidly, and more and more projects are pouring into Bitlayer. This gives Bitlayer a great advantage in the current fierce BTC Layer2 competition.

Where is the Endgame of Bitcoin Layer 2

In the current fierce competition in the Bitcoin Layer2 track, we summarize three core solutions: rollup system (focusing on Layer1 verifiability), side chain system (focusing on solution maturity), and client verification (focusing on Layer1 native DA). There is no doubt that the market has not yet decided on a winner, but we believe that the greatest value of Bitcoin is the security of its Layer1. Therefore, whether Layer2 can inherit security is very critical. Although client verification can ensure that all ledger records occur in Layer1 to a large extent, the user's trust cost for the client is endogenous and therefore unavoidable. The rollup system tries to ensure the verifiability of Layer1 as much as possible, and ensures that the user's trust cost is controlled through a variety of modular solutions. Therefore, from this value system, we believe that the rollup system will eventually outperform the other two. Among the rollup systems, Bitlayer is the most thoughtful. Bitlayer emphasizes the verifiability of Bitcoin through the BitVM solution, and adds fraud proof to the original DLC bridge to ensure that the oracle is trusted. Although the current cross-chain bridge solution still requires external trust in the oracle, it is almost equivalent to the native bridge that "rollup" should have in terms of security. In addition, the prosperity of the Bitlayer ecosystem has reached its peak under the token expectations of Leadboard. At present, a large number of native projects have joined the ecological construction, including DEX, permissionless lending protocols, MEME, etc. So far, Bitlayer's ecosystem has attracted more than 280 projects to join.

In the early stages of the current bull market, Eureka Parnters still looks at the overall development of Bitcoin Layer2 with an optimistic and cautious attitude. Although the current market conditions are weak, we believe that when liquidity is sufficient, the market heat will still be reflected in the Bitcoin ecosystem, including Bitcoin-related assets and Layer2. At that time, Bitlayer will definitely be an ecosystem that cannot be missed.

JinseFinance

JinseFinance