How Arweave works and why it exists

Arweave, Arweave's working principle and significance of existence Golden Finance, this article briefly introduces Arweave's working principle and value.

JinseFinance

JinseFinance

1. Crypto's business model

Recently, there have been many criticisms of the value accumulation of Ethereum and L2. The rapid exploratory development of Ethereum and L2 has brought difficulties to their value assessment. This article attempts to give some thinking directions. Before talking about how to look at the business model of Ethereum and L2 specifically, let's take a look at the entire business model of Crypto.

1.1 "Enterprise" category

Core: Control + monopoly (licensing), price discrimination brings profits

The focus of this type of model is to achieve the goal of increasing revenue through a high degree of control over services and protocols, which is no different from the operating principles of traditional companies. Decentralization here is highly disposable, and it only needs to be acceptable to users. As a profit-oriented company, it needs to ensure efficient operation, and there should be no control diplomacy.

For such projects, the competition is the business model, that is, the price discrimination ability, the speed of response to meet user needs, and the ability to bring user growth. Token is mainly a means of acquiring customers and assetization.

Take Solana Foundation as an example. Its high degree of control over the ecosystem can be said to even have the right to shut down. Solana calls itself Global Onchain Nasdaq, and has always emphasized fundamentals, especially business models and profits, which constitute the core value of this story. Solana's income comes mostly from MEV income, that is, the price discrimination generated after monopolizing the block space, and the SOL asset itself is a concentrated assetization tool.

Core: Permissionless participation (asset issuance, business), open and relatively fixed charging standards

The focus of this category is to create open and almost unchangeable protocol standards, with DAO and foundation governance behind them but with less intervention, and more autonomy for the protocol. The use of the protocol is permissionless, and the profit model is open and difficult to change. Anyone can use the protocol to create markets and assets to obtain their own business or profits. "Protocols" often have an assessment of the degree of autonomy, that is, there is a range of decentralization. The lowest is that the team has the right to update the protocol and is supervised by the market; the worst is to destroy their own update rights and hand over the product to the market. There are different degrees of hard or soft decentralized governance differences in the middle. Tokens here play more of a dividend and governance role.

For such projects, the test is the sustainability of product operation, the sustainability of demand, and the network effect brought by the entry time. The pioneers who find PMF often have significant competitive advantages.

1.3 "Asset" Category

Core: Focus on the value of the asset itself

Including BTC, Memecoin, decentralized algorithmic stablecoins, etc. The asset itself is based on its characteristics. Consensus is obtained, and the empowerment of assets is continuously completed based on this. The attributes of the asset itself include three aspects. The first is the consensus and network effect brought by "early adoption" in a specific scenario, such as BTC as a value storage, USDT as a payment medium, and ETH as an asset issuance; the second is the asset mechanism attributes, including rarity, deflation mechanism, price anchoring, etc.; the third is the wide acceptance and dissemination brought by its own symbolic meaning, such as the widely understood BTC as "digital gold", ETH "programmable credit currency", and the cultural effect of Memecoin.

For such projects, the test is the strength of consensus, the adoption and continuation of assets.

In the Crypto world, different projects and assets correspond to the above business models or combinations of models. We can also try to use this perspective to evaluate the current Ethereum and L2.

2.1 Current positioning of L2

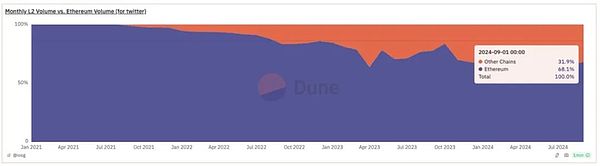

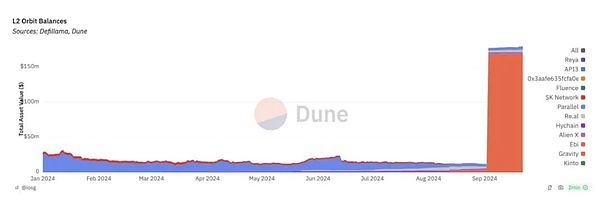

L2 was originally positioned as Ethereum's Scaling, carrying Ethereum transactions on a large scale. This goal has actually been achieved to a certain extent. From the perspective of diverting Ethereum transactions and bringing incremental growth, it is relatively successful. At present, L2 has become an important part of the Ethereum ecosystem, with the number of transactions accounting for 85% of the total and the transaction volume accounting for 31%, becoming an important part of Ethereum's fundamentals.

Source: Dune Analytic

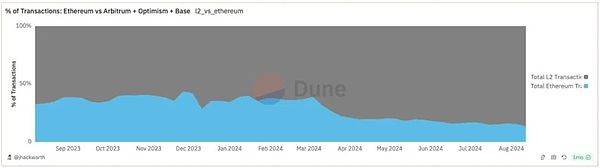

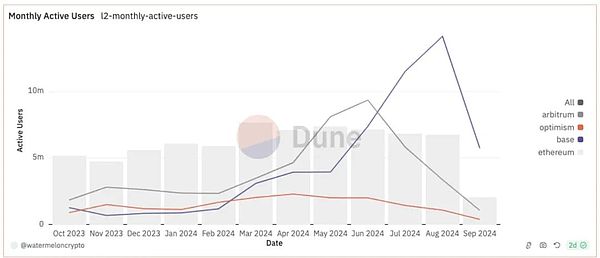

The number of active addresses is 3-4 times that of Ethereum

Source: Dune Analytic

Because the transaction cost of L2 is cheap, the actual improvement in Ethereum's overall transaction data will be slightly higher, but the impact of L2 adoption can still be seen.

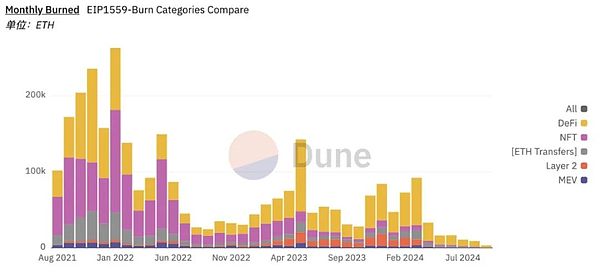

However, L2 did not bring the same proportion of revenue to Ethereum under such a transaction. The revenue brought by L2 is mainly divided into two aspects. The first is DA fees, which were transaction data fees before EIP4844 and Blob fees after EIP4844. The second is MEV. In addition to the current Based Rollup, L2 has completely swallowed this revenue into its own pocket, and in the short term, the expectation of giving back to Ethereum is low. This actually makes Ethereum enter inflation at present, and the concept of ultrasonic currency is gradually declining.

Source: Dune Analytic

Here is an explanation of why DA fees cannot be L2's revenue contribution to L1.

DA will only generate priority fees when it reaches saturation, that is, monopoly pricing power

DA is a commodity in an unsaturated state. In the long run, users can hedge and find substitutes

The growth rate of DA demand is disproportionate to the growth rate of supply. There are a large proportion of robot transactions in L2, and these transactions are not as necessary as real user transactions. If the C-end cost brought by DA fees is too high, this part of the transaction will naturally slow down. Therefore, it is not a reasonable conclusion that the so-called Blob will be saturated if the number of transactions is increased several times.

In essence, expansion itself is contrary to DA charges. In the pursuit of continuous expansion, making money should not be designed from the congestion of transactions. The architecture of Ethereum L2 also naturally refers to this point. Previously regarded as the Beta asset of ETH, L2 still calls itself "Ethereum L2" in terms of narrative. It has gone further and further in terms of fundamentals. In the future, L2's income will no longer mean Ethereum's income. The two should have their own valuation systems.

2.2 What kind of business model do different L2s have?

2.2.1 Universal L2

Universal L2 refers to the general-purpose L2, which pursues to become an application ecosystem. Many of the early Universal Rollups have moved towards the alliance form. Currently, most of the better-performing Universal Rollups have innovated in the mechanism of profit distribution to better encourage developers to innovate and retain, and users to actively participate. The trend of L2 is to gradually no longer rely too much on Ethereum, and maximize its customizability through some modular solutions.

Universal L2's management method is to expand outward with each team as the core. The competition faced by Universal L2 comes directly from the competition of external L1. The income of Universal L2 is almost 100% in its profit distribution mechanism.

Such a positioning is more in line with the "enterprise" model we described, and is suitable for valuation in a similar way to Alt L1, which means that its value is an assessment of its ecology, fundamentals, and especially income. Compared with Alt L1, its advantage is that it can fully utilize the community and ecology of Ethereum, as well as the liquidity of ETH. The disadvantage is that the ability to assetize Tokens is relatively lacking, and the ability to acquire customers is slightly insufficient compared to Alt L1.

2.2.2 Alliance L2

Alliance L2 is similar to Ethereum, both have their own first and second layers (L2/L3). The difference between Alliance and Ethereum is that the issuance of L2/L3 within the Alliance requires permission, which guarantees the business model of Alliance L2.

Early Universal L2 all went to Alliance L2, which also means that after gaining a certain amount of market attention, Alliance L2 is often a better business. Arbitrum and Optimism before the transformation, and zkSync and Initia recently are all working in this direction. For Alliance-type L2, in essence, it is already developing its own L1 ecosystem, but it still relies on the security of Ethereum and uses ETH as the settlement currency. The characteristic of Alliance L2 is that it changes the business model and participants within the ecosystem through its own management capabilities. Therefore, it is more appropriate to regard Alliance L2 as a "protocol" with a high degree of centralization.

Source: Dune Analytic

Alliance L2 is more regarded as a controlled Ethereum. Ecosystems like Optimism still delegate the task of application development. The difference from Ethereum is that such decentralization is more strategic. Through the licensing model and centralized management model, resources can be concentrated, synergy effects can be expanded, excellent resources can be brought in to share liquidity and ecology, and the original ecology can be fed back through the revenue gate after the new ecology is launched. This is why Coinbase and Sony both choose Optimism. With the help of L2's "enterprise" capabilities, it is expected that more breakthrough applications will be born.

As we mentioned earlier, "protocol" models have different decentralization ranges. In the process of exploring protocol decentralization, chains or applications often flee, such as the earlier DyDx and later TreasureDAO in the Arbitrum ecosystem. How to develop and consolidate one's own ecosystem while balancing the degree of protocol decentralization is the core value of measuring the alliance L2.

2.2.3 Appchain L2

Appchain L2 is more of an App with a new business model and value capture. Its valuation should return to the application itself plus the new value brought to the application by the L2 business model, regardless of whether the application itself is more suitable for the "enterprise" or "protocol" model. Most App Rollups will choose to rely on the alliance L2, with lower startup costs and stronger ecological radiation effects to rely on.

Appchain is currently more dependent on the alliance L2 and RaaS, and the cost of building a chain is very low. However, in the design of chain adaptability, supporting infrastructure (such as data browsers, etc.) still needs to be invested. For Appchain, the visible benefits are more efficient use of Tokens and the capture of MEV, while what is given up is the Lego effect and stronger liquidity on a chain. In terms of input-output, not all applications are suitable for Appchain. Suitable applications have strong endogenous cycles, such as Perp DEX, Gamefi, etc. In the long run, without the narrative heat of transformation to L2, how to reasonably evaluate ROI is more important.

3. How does L2 affect Ethereum's business model?

After the Merge, especially after EIP1559, before obtaining a large amount of L2 expansion and EIP4844, Ethereum still relied on the transaction volume in the limited block space to capture higher priority fees and MEV. After the L2 expansion, it actually gave up the MEV of the expansion transactions and reduced the priority fees brought by L1 native transactions. After EIP4844, it gave up this part of the income as a DA. The active abandonment of such income is not a typical corporate practice. In fact, Ethereum has never developed into the "enterprise" model as we define it. The concession of this part of the profit is actually to give the maximum space to the DA and the settlement layer under the premise of adhering to a high degree of decentralization and autonomy, so that L2 can sacrifice a certain degree of decentralization under the minimum economic burden, and develop as large an ecosystem and as many applications as possible.

3.1 Ethereum as an L2 Issuance Protocol

Since establishing the path of Rollup Centric, Ethereum has been moving in the direction of being more of a "protocol" rather than an "enterprise". Although some requirements for Rollup have been put forward, such as L2beat Rollup stages, there has been no actual interference. At present, Vitalik has put forward some requirements for Ethereum Alignment, which will make the governance model of the Ethereum "protocol" move closer to a more cohesive direction. But as a whole, it is still a "protocol" with a very high degree of autonomy, and its long-term role is to issue Ethereum L2.

Currently, Ethereum L1 still carries more than half of the transaction volume of the entire ecosystem. In the long run, Ethereum is more like providing a platform (settlement layer) for issuing L2 without permission that is highly decentralized, autonomous, censorship-resistant, and the most secure.

Generally speaking, the model of permissionless issuance platforms is to extract a certain proportion from the issuance and trading of new assets, such as Uniswap extracting user fees, Pumpdotfun charging users for issuing coins in the early stage, and prediction markets extracting user transaction fees, etc.

Therefore, although Ethereum is an L2 issuance protocol, it did not set a profit gate through L2 in the early stage. This has led to the birth of a large number of L2 ecosystems that rely on Ethereum liquidity and community but do not contribute income to Ethereum, which means that Ethereum is the most decentralized and autonomous type in the "protocol" model. Looking at the relatively successful permissionless protocols, such as Uniswap, they have turned on the fee switch on some pools with absolute monopoly and network effects. After the protocol has achieved network effects, it has tried to obtain fees at a scale acceptable to users. This is the advantage brought by centralized management. At present, for Ethereum, on the one hand, it is trying to make some attempts to open fee gates through Based Rollup, and on the other hand, it does not force the pursuit of profits, and allows the L2 ecosystem, which originally had no profit gates, to continue to develop at a high speed.

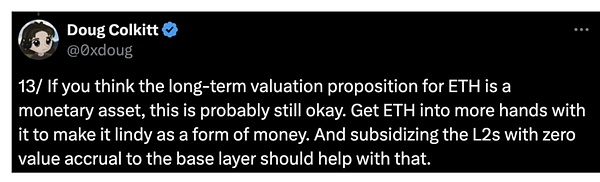

ETH has long been difficult to value through the "enterprise" and "protocol" models, because the early L1 business model is no longer valid after expansion. After all, a company that is willing to give up its own profits and a protocol that is willing to permanently turn off the fee switch should no longer be valued from the traditional perspective of enterprise & protocol fundamentals.

The original intention of Ethereum to abandon the fundamentals is to give more room for the development of the overall ecosystem. With the prosperity of the ecosystem, the value of Ethereum will eventually fall on the monetary value of ETH. So, what value can the potential prosperity of the Ethereum ecosystem bring to ETH?

Some people think that it is the security attribute brought by ETH. But at the same time, some technical factions who believe in the value of distributed networks and are anti-crypto believe that P2P networks should not be bound to specific and speculative currencies to provide incentives for nodes. Some people believe that incentives should be provided in a more non-speculative model, such as stablecoins or early PoW mining. The decentralization pursued by distributed networks and the continuous reduction of costs and the pursuit of capital-intensive PoS mining are not naturally adapted, and many governance methods need to be improved. At the same time, the security value of ETH itself is affected by its own price and has considerable reflexivity. We mentioned these two points in previous articles discussing economic security. At present, ETH is doing well in both incentives and security models, but in the long run, it is not its best.

So what is the most important value of ETH relative to the Ethereum network that will be recognized by the market?

Source: @0xdoug

We may be able to find some clues from the development history of Ethereum. There are five highlights in the history of Ethereum so far:

Direct Token Issuance

DeFi Summer Liquidity Mining

Liquidity Staking

L2 Mining

Re-staking AVS Mining

In the DeFi Summer era, the asset issuance model evolved into liquidity mining, which not only made ETH an asset supporting asset issuance, but also made it a liquidity target with pricing ability. So ETH found its second PMF - liquidity pricing asset. From then on, asset issuance in the Ethereum ecosystem will be accompanied by thoughts on liquidity improvement.

Liquidity pledge, while solving the pledge demand, leads to the enhancement of liquidity pricing value. Since then, asset issuance has gradually introduced the attributes of ETH time opportunity cost mining, that is, pledge, which is the third PMF of Ethereum.

L2 mining is a manifestation of such asset issuance + liquidity pricing + time cost mining. By bridging ETH to L2, staking and mining native Tokens/DeFi protocol tokens, and providing liquidity at the same time, this liquidity flows to various protocols through the liquidity engine on L2. ETH's three PMFs are integrated.

Re-staking and AVS mining are another realization of the integration of the three. The liquidity re-staking protocol releases liquidity, similar to the EigenLayer re-staking protocol to provide staking, and indefinitely mines AVS native tokens through time costs.

Ethereum continues to repeat and improve this model, constantly creating demand and value for ETH itself in asset issuance and Defi use cases. It also continuously strengthens ETH's first choice in interest-bearing assets, asset issuance, liquidity provision, or asset exposure and demand as gas, all of which allow ETH to be distributed to protocols and users, becoming the primary target of infrastructure and protocols in the Ethereum ecosystem and the first choice of value currency in the minds of users.

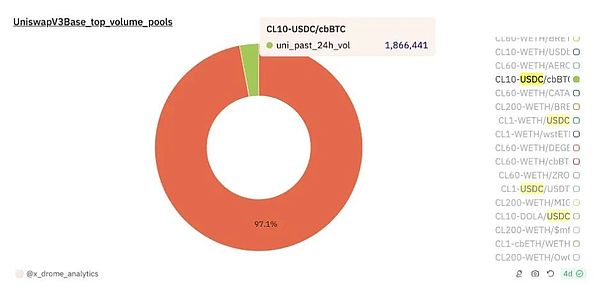

At present, the competition for this value is not fierce. For example, in the mainstream pool of Uniswap, currency pairs with ETH as the settlement unit account for more than 80%. But ETH still faces some potential competition. Including competition in value storage between L2 native assets and derivative assets, such as $cbBTC on Base, and competition for off-chain liquidity brought by the intention network.

USDC/WETH vs USDC/cbBTC, Source: Dune Analytic

But in the long run, the network effect brought about by the construction of ETH and the demand growth brought about by the incremental market of economic activities will, as Myles said, make all values more valuable.

4. Summary

Crypto has three valuable business models: enterprises, protocols, and currencies themselves. The difference between the first two lies mainly in the centralized control, monopoly, adjustment and price discrimination capabilities of the protocols. The protocols themselves also pursue different degrees of autonomy. The currency itself lies in the network effect generated by the early use of a certain scenario with Traction.

Due to the early positioning of Ethereum and its L2 strategy, the value of Ethereum was pushed to the level of permissionless "protocol" and ETH "currency". Due to Ethereum's vision, leadership structure and early L2 strategy, Ethereum semi-actively and semi-passively gave up the revenue from L2, reducing the burden of L2 and opening up growth space for L2. Although the standards of Ethereum Alignment from the Ethereum Foundation are becoming clearer and clearer, the overall open and autonomous positioning also makes Ethereum no longer positioned as a simple "enterprise".

The strong early L2 ecosystem has evolved into Alliance L2, which is essentially a more centralized leadership and a licensed L2 issuance "protocol", continuing the mission of Ethereum in a more centralized mode. Universal L2 returns to the competition of "enterprises" at the L1 level. Compared with L1 outside the Ethereum ecosystem, it has advantages at the startup level and disadvantages at the token level. The value of Appchain should return to the improved "application" itself (more "enterprise" or a more centralized "protocol") of the business model, and it is more necessary to consider the ROI of the chain. The more centralized and vigorous development of L2 is based on the support and space brought by giving up income under the highly decentralized model of Ethereum.

Ethereum, under the premise that DA has been proven to be not a suitable business model, has gradually positioned itself as a permissionless L2 issuance protocol that has abandoned the profit gate. It has actively abandoned its monopoly in the stock market, hoping to gain the ability to generate revenue in the incremental market. How the L2 Alliance and some L2s with strong corporate nature can bring new increments without the burden of paying taxes to Ethereum is the biggest bet of Ethereum.

The value of Ethereum as a currency comes from the continuous asset issuance and liquidity games on Ethereum. Five PMF Moments continue to bring value and usage inertia to the ETH asset itself. With the expansion of the overall Ethereum ecosystem, ETH, as the most valuable asset in the ecosystem, plays a vital role in every link from the start-up to the operation of the new ecosystem, which relies on the strong network effect of ETH. As the ecosystem stabilizes, some native assets/Wrap assets will certainly play a supplementary role, but it is difficult to affect the absolute share of ETH.

If there is a day when the L2 ecosystem prospers in the future, ETH, as a network effect, can still obtain huge returns on adoption brought by increments, even if it does not necessarily have a monopoly effect. At that time, Ethereum will gradually establish a value form dominated by ETH assets.

After understanding the trade-offs of Ethereum for the ecosystem and the value positioning of ETH and L2, we are more convinced that L2, as the new force of the Ethereum ecosystem, will move forward lightly in a commercial interest-driven mode, and quickly open up the ceiling of use cases with rich technical architecture options, multi-directional development, and internal vertical integration advantages. ETH, as an asset with the most network effects, will be discovered in value as the entire ecosystem flourishes.

Arweave, Arweave's working principle and significance of existence Golden Finance, this article briefly introduces Arweave's working principle and value.

JinseFinance

JinseFinanceThe U.S. economy declined more than expected, global liquidity tightened more than expected, domestic industrial policies were not implemented as expected, the "black swan" event before the U.S. election had an impact, and expectations of global geopolitical turmoil rose more than expected.

JinseFinance

JinseFinanceThe S&P 500 (an index of the top 500 US companies) is still below its mid-July peak and the level at the end of July when the “crash” began. What is causing this downward trend? Does it portend more serious problems for the US economy?

JinseFinance

JinseFinanceOn August 8, the U.S. Federal Reserve took a major enforcement action against Pennsylvania-based Customers Bank, marking the U.S. government’s gradual increase in regulatory oversight of cryptocurrency-related businesses.

JinseFinance

JinseFinanceEthereum’s 2025 Pectra upgrade poses significant risks, including concerns about client, operator, and cloud diversity, according to a new report from Liquid Collective and Obol.

JinseFinance

JinseFinanceGolden Finance launches the 2190th issue of the cryptocurrency and blockchain industry morning report "Golden Morning 8:00" to provide you with the latest and fastest digital currency and blockchain industry news.

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinanceThe Ethereum Foundation's Danny Ryan discusses how the Merge will increase security and explains how proof of stake impacts developers.

Future

FutureNigel Dobson, head of portfolio banking services at ANZ, said: "When we looked at this in depth, we came to the conclusion that this is a significant protocol shift in financial market infrastructure."

Cointelegraph

Cointelegraph

Please enter the verification code sent to