Web3 prediction markets are revolutionizing the way reality is predicted by leveraging blockchain to capture and aggregate information from different participants. These platforms embody the principle of "crowd wisdom" and create efficient markets where participants express their beliefs in the form of bets and truly participate.

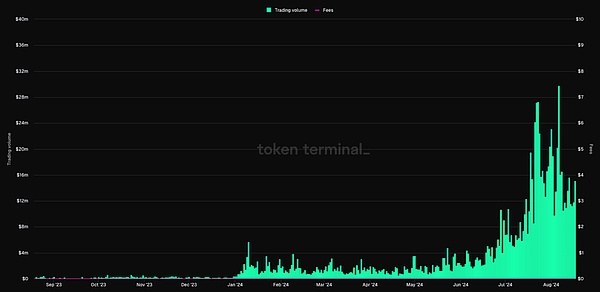

The growth of these platforms has been amazing. Leading the way, Polymarket's trading volume soared to $360 million in July 2024, a fifty-fold increase from its 2023 average. This surge is directly related to the event of the US presidential election, with more than 99% of bets focused on predicting the election results. However, outside of the political heat, you will also find markets predicting the first cat memecoin to reach a market value of $1 billion or the next viral TikTok theme.

Source: Token Terminal

As these markets mature, more innovations emerge and huge growth potential arises, which also raises a question: what will the next generation of prediction markets look like? Whether through technological advancements, improved user experience, or expansion into new scenarios, the future of Web3 prediction markets is expected to optimize and change the way we collectively predict and face emerging trends.

1. Challenges faced by prediction markets

1.1 Liquidity and market-making challenges

1.1.1 The dilemma of long-tail events

Pricing for rare events such as a prediction market on when habitable exoplanets will be discovered is a typical long-tail problem. The uncertainty and speculation of the results lead to low liquidity. In prediction markets, highly segmented events often have difficulty attracting participants, resulting in thin order books and limited trading activity. This lack of liquidity makes it difficult for traders to place orders, ultimately weakening market efficiency and causing these potentially hot but slow-moving prediction markets to be ignored.

1.1.2 Impermanent Loss of Liquidity Providers

Liquidity providers (LPs) - participants who provide assets to the market's liquidity pool to facilitate trading - face significant risks due to impermanent loss. For example, a prediction market such as whether a candidate will win an election will see the price of the relevant token move closer to zero or one as the outcome of the event becomes more certain. LPs who provide liquidity early may hold too many tokens for "failed" predictions, which will eventually return to zero, resulting in huge impermanent losses.

1.2 User Engagement and Market Attraction

1.2.1 Insufficient Cap

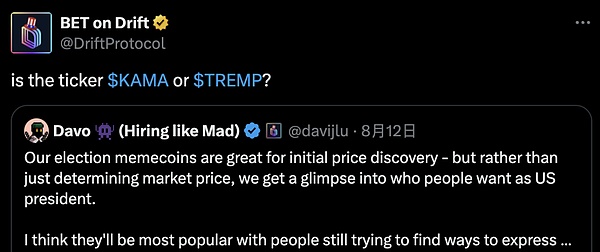

In the crypto world, everyone is chasing the next 100x opportunity, which makes prediction markets seem relatively ordinary. For example, instead of betting on Trump vs. Kamala Harris on a prediction market, many people may prefer to invest in memecoins like $TREMP or $KAMA, which offer unlimited potential and more adrenaline. For competition, prediction markets can introduce gamification elements such as dynamic event-specific markets or reward systems, as well as loyalty programs or tiered rewards to enhance user engagement and make the process of seeking the truth as exciting as speculating on memecoins.

1.2.2 Market Diversity and Longevity

Prediction markets need to diversify beyond political events to maintain long-term user engagement. While there are already established niches in sports and entertainment, the opportunity lies in creating specialized markets that cater to specific interests, such as predicting when ChatGPT-5 will be released. However, a common criticism of this is that even within a broader range of topics, users may only focus on specific topics, making these markets highly seasonal.

In addition, markets need to run for a long time and the results are uncertain, which may discourage user participation. Many topics take a long time to end and there is no clear criteria for winning or losing, which may make it difficult to attract sustained user interest. To address these challenges, prediction platforms should focus on quickly creating and closing market segments that match user interests, balancing the need for user participation with the feasibility of prediction markets.

1.3 Regulatory Barriers

Regulation remains a significant barrier to the development of prediction markets. The U.S. Commodity Futures Trading Commission (CFTC) fined Polymarket $1.4 million in 2022, demonstrating the risks of operating an unregistered platform. This regulatory action resulted in Polymarket banning U.S. users from using its platform in order to comply with the settlement agreement. However, the challenges are far from over, and recent developments have brought election-related prediction markets under greater scrutiny. As recently as 2024, the CFTC proposed a rule that would ban derivatives trading on U.S. elections, arguing that such markets could potentially influence election results.

Source: CoinDesk

This proposed ban has serious implications for platforms that rely on political betting markets, such as Polymarket, PredictIt, and Kalshi. Senator Elizabeth Warren has also publicly urged the CFTC to shut down election prediction markets entirely, citing concerns that these markets could disrupt the democratic process. These platforms are currently involved in legal proceedings to fight these regulatory measures.

This situation highlights the delicate balance that prediction markets must maintain between innovation and compliance. As the regulatory environment becomes more complex, these platforms will need to adapt or face significant operational restrictions that could inhibit the growth and diversification of this emerging industry.

2. Next Generation Prediction Markets

While today’s prediction markets face numerous challenges, a new wave of prediction market innovation is on the horizon. The next generation of prediction markets are being specifically designed to address these obstacles, incorporating advanced technology, enhanced market mechanisms, and user-centric features. Designed to overcome challenges with liquidity, user engagement, and regulatory restrictions, these upcoming platforms could change the landscape of prediction markets, paving the way for a stronger and more dynamic future.

2.1 Advanced Market Mechanisms

2.1.1 Specialized Liquidity Solutions

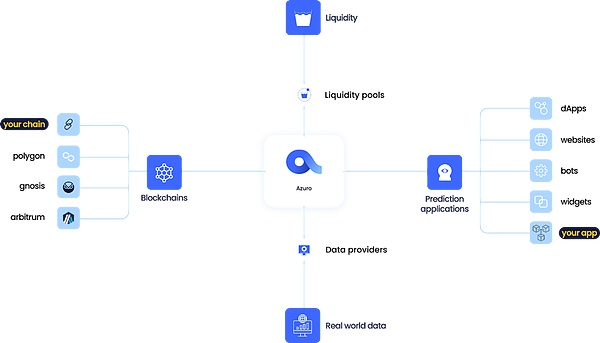

Specialized market makers can unlock a vast amount of collective knowledge by providing liquidity for complex outcomes. An example of innovation in this area is the peer-to-peer liquidity model employed by projects such as Azuro. This model pools capital into a single counterparty to respond to the needs of platform traders, ensuring that even niche markets have enough liquidity to operate effectively. Such systems support a wider range of prediction markets, making it easier to maintain liquidity for long-tail events.

This approach is particularly useful for markets that predict rare or highly specific events, such as the impact of a technological breakthrough. By pooling liquidity from different participants, this model spreads risk across multiple markets, reduces the likelihood of liquidity shortages, and enhances the overall robustness of the platform.

Source: Azuro

2.1.2 Leverage and Combination Betting

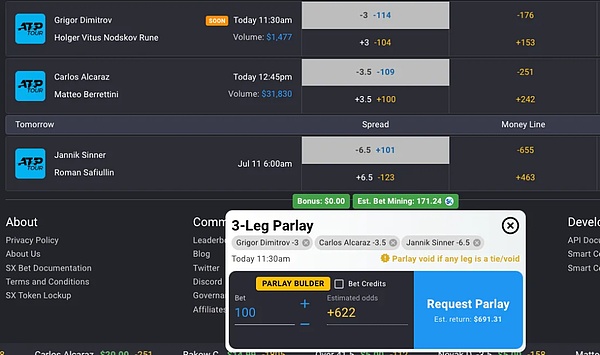

The ability to win in more diverse ways is particularly attractive to prediction market participants, which is where advanced betting strategies such as leveraged betting and combination betting come into play. Leveraged betting allows participants to increase their potential returns by increasing the amount they bet, which is particularly attractive in high-risk markets such as political predictions.

Source: CT

Combination betting combines multiple predictions into one bet, offering the chance of higher returns. For example, users can combine bets on multiple related economic events, such as interest rate changes and inflation data within a quarter. The interconnectedness of these events increases potential returns, but also comes with higher risks.

The social nature of combination betting brings another layer of excitement. Participants can share combination betting slips on social media, potentially creating virality when someone wins a jackpot. This can drive more participation, especially in the crypto community. However, the management of large returns, the risks associated with payment and how to set accurate odds remain a challenge.

The peer-to-peer combination betting system implemented on the Web3 sports betting platform SX Bet allows users to create customized bets, with liquidity provided by automated market makers. This innovation brings more dynamic and attractive prospects to prediction markets in various fields.

Source:SX Bet

2.1.3 Permissionless Market Creation

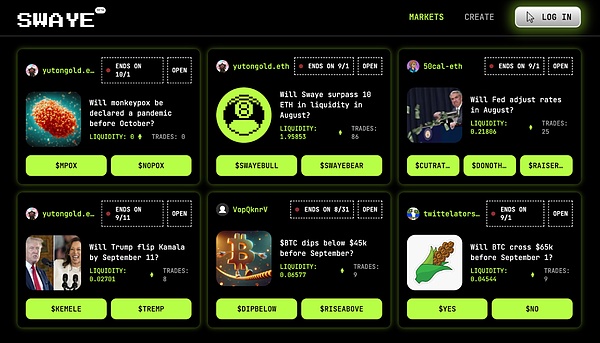

Permissionless markets created by users have the potential to significantly expand the range of predictable events. By allowing anyone to create markets, the platform can tap into predictive power in unexpected areas. For example, niche audiences might create markets predicting the success of a particular meme or the outcome of a specific event, which would typically be ignored by larger platforms.

Swaye is innovating in this space by allowing users to create markets tied to event outcomes, and participants can even create or trade memecoins tied to those outcomes. Users frustrated by the high opportunity costs and inability to create markets on traditional platforms can turn to Swaye, where they can generate markets and earn fees. For example, a user might create a market predicting whether the monkeypox virus will be declared a pandemic by a certain date. Outcome tokens, such as $MPOX and $NOPOX, would represent possible outcomes, with failed tokens going to zero and successful tokens potentially becoming perpetual memecoins.

Source:Swaye App

2.2 Enhanced User Experience and Engagement

2.2.1 Mobile First and Real-time Predictions

Optimizing for mobile is critical to capturing real-time insights. Imagine a mobile prediction market experience where users can interact and place bets during real-time events, such as sports games or political debates. Notifications and real-time updates can keep users continuously engaged, allowing them to make predictions and see results immediately anytime, anywhere.

2.2.2 Integration with Social Networks

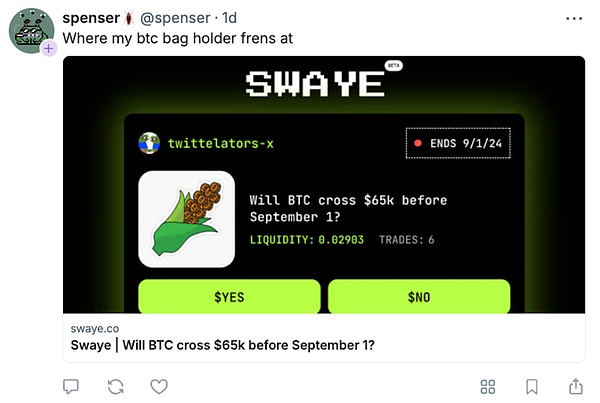

Leveraging existing social media channels is an effective way to attract more users and boost participation in prediction markets. By integrating with platforms like Farcaster and Solana’s Blink, prediction markets can leverage established networks for distribution and user interaction. Projects like Swaye and Bookie are already moving in this direction, enabling users to share their predictions directly in social feeds, creating viral moments and driving engagement.

Source: /swaye on Farcaster

Such integration can make prediction markets more accessible and appeal to a wider audience, as users can seamlessly participate in predictions shared in their social circles.

2.2.3 Gamification and Social Dynamics

Gamified prediction markets can further enhance their appeal, transforming them from a boring activity into an engaging competition. Features such as leaderboards, achievement systems, and competitive leagues can significantly drive user engagement. Imagine users participating in a social prediction league, earning badges and climbing the rankings based on accuracy. KOL-led predictions can add another layer of social attributes, with KOLs sharing their bets and encouraging their fans to join and compete, thereby deepening community participation and interaction.

2.3 AI Integration

AI is expected to revolutionize the prediction market landscape, solving long-standing challenges and unlocking new possibilities. As Ethereum co-founder Vitalik Buterin suggested, the intersection of AI and cryptocurrency, especially in prediction markets, may be the "holy grail of cognitive technologies."

2.3.1 Content Creation and Event Selection

AI can significantly enhance the process of creating events in prediction markets. By analyzing trends in news, social media, and financial data, AI can obtain relevant topics in a timely manner and capture the public's current interests. For example, AI can identify emerging global issues, such as sudden geopolitical conflicts or technological breakthroughs, and use these as themes in prediction markets, ensuring that the market is dynamic and consistent with current prediction market themes.

2.3.2 Market Making and Liquidity

AI-driven liquidity management is gaining traction in prediction markets. Although specific implementations are still evolving, AI may eventually play a key role in dynamically adjusting liquidity depth and pricing in real time. By monitoring market activity and sentiment, AI can optimize liquidity provision, reduce slippage, and enhance market stability. This approach is particularly valuable in markets where liquidity demand fluctuates rapidly.

2.3.3 Information Aggregation and Analysis

AI systems may quickly process large amounts of data and provide comprehensive forecasts, turning prediction markets into the preferred source for making informed decisions. By aggregating data from a variety of sources, such as economic indicators, public sentiment, and historical trends, AI can provide highly accurate forecasts, making prediction markets more reliable and insightful.

For example, Polymarket’s recent integration with Perplexity will allow for the aggregation of search engines and social media sentiment, creating news summaries for users and providing visual data to help users make more informed decisions.

2.3.4 AI as a Market Participant

The role of AI as an active participant in prediction markets is expected to expand significantly. Platforms like OmenETH have demonstrated how AI bots can trade alongside humans, increasing market depth and improving forecast accuracy. These AI bots are particularly good at identifying and exploiting price discrepancies, helping to keep markets consistent and efficient.

Source: Gate.io

AI’s potential extends beyond trading. By engaging in niche and long-tail markets — such as predicting the outcome of a specific scientific breakthrough or the impact of new regulation on a niche industry — AI can make these previously illiquid markets more viable. AI systems’ ability to process large amounts of data and respond quickly to new information can ensure that these specialized markets remain active and attract participants. One project working to allow the construction of these AI agents is Autonolas.

AI also has the potential to revolutionize dispute resolution in prediction markets. AI-driven systems can provide fair and efficient adjudication in disputed outcomes, such as close elections, reducing the time and costs involved in traditional human arbitration.

2.4 ZK Keeps Predictions Private

In prediction markets, privacy is more than just about keeping bets secret; it is essential to ensuring that the market functions properly. If everyone can see each other’s predictions, there is a risk of copying the most successful predictors, which could weaken the diversity of opinion in these markets.

To address this issue, platforms can use privacy-preserving techniques that keep predictions confidential until the outcome of an event is revealed. For example, a method called commit-reveal allows participants to submit predictions in a way that remains hidden until the outcome is revealed. This process is similar to sealing your prediction in an envelope that can only be opened by the blockchain at the right time.

Platforms can also implement advanced cryptographic techniques, such as zero-knowledge proofs (ZKPs), to provide stronger privacy guarantees. These methods ensure that predictions remain anonymous without sacrificing market transparency and security. Although these techniques are very powerful, they also have some trade-offs, such as increased computational costs, which platforms must carefully weigh.

3. Conclusion

With the end of the 2024 election cycle, the future of prediction markets is at a critical crossroads. The optimistic view is that these platforms will expand into diverse fields such as finance, technology, and science, thanks to innovations such as artificial intelligence integration and advanced market mechanisms. This evolution may transform prediction markets into an important tool for decision-making, allowing collective wisdom to shape the future.

However, the pessimistic view is that prediction markets face significant challenges. Prediction markets often face limited demand, insufficient passive inflows from savers, and insufficient participation from key players, such as more savvy traders. This, combined with competition from traditional financial instruments and regulatory pressures, could limit their growth.

During major political events, trading volumes are concentrated in a few key markets, raising questions about sustainability. User participation is likely to drop sharply after the 2024 elections. This could make it difficult for prediction markets to maintain growth momentum and expand their usefulness beyond speculation.

Despite these challenges, the potential of prediction markets to redefine how we predict and shape the future is undeniable. The road ahead is full of uncertainty, but if these platforms can rise to the challenge, they could become the cornerstone of a new era - one in which collective wisdom is not just a tool for speculation, but a force that drives the course of history.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Alex

Alex Catherine

Catherine Others

Others Beincrypto

Beincrypto Beincrypto

Beincrypto Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph