Foreword

The three main directions that Uniswap has been promoting recently are Uniswap X, Uniswap V4 and Unichain.

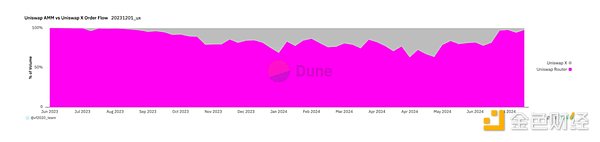

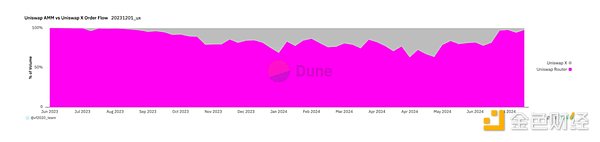

Last year, Uniswap introduced the intent trading network Uniswap X, which currently accounts for up to 10%-20% of the trading volume. At the same time, 1Inch, 0x, and Cowswap also introduced similar intent trading experiences.

In the past few months, the DEX landscape has shifted to intent-based protocols, unifying on-chain and off-chain liquidity, allowing traders to get better user experience and lower prices. These protocols introduce market makers, searchers, solvers, and other roles that obtain quotes from the front end of the DEX and access any liquidity source including CEX. After Uniswap launched UniswapX and enabled the frontend by default, Uniswap became an important player in the impact of the intention protocol on AMM liquidity.

Uniswap completed the contract audit in September and is about to launch V4. V4 includes Hooks, single contract design, gas fee optimization, lightning contracts, etc. Uniswap V4's single contract design integrates all liquidity pools into one smart contract, instead of creating a separate contract for each trading pair like V3. This design can significantly reduce transaction costs, especially in the case of multi-pool swaps and complex transaction paths. In addition, this integration can make liquidity more centralized and improve transaction efficiency. In V4, due to the single contract design and the new Hook system, Uniswap V4 has lower Gas fees when executing complex transactions.

Hooks builds a variety of Defi services based on AMM through a plug-in model. It allows developers to insert custom logic during the transaction process, such as setting dynamic fees, liquidity management strategies, independent control of specific trading pairs, etc. Hooks provides AMM with unprecedented flexibility. Developers can build more complex liquidity strategies and even dynamically adjust transaction parameters under different market conditions.

Unichain itself focuses more on the role of liquidity hub in OP Superchain, and can also solve the problems related to traders and LP experience. This article will not discuss Unichain in depth for the time being, and will update the research related to Unichain later

In addition to Uniswap, we also see many protocols making similar innovations. There are many studies in the direction of Hook, including Balancer, including Ekubo on Starknet; some use modular DEX to achieve similar effects to Hook, such as Valantis. And around the model like Hook, more protocols that originally specialized in the problems of AMM, such as liquidity management protocols, have a better way to enter. In terms of intention, Cowswap, 1inch Fusion and even more long-tail DEX are building their own transaction intention networks, behind which is the competition between PMM and AMM - PMM's continuous erosion of the on-chain liquidity market and the continuous improvement of on-chain protocols to retain more on-chain liquidity.

In response to the current changes in DEX, this article will focus on three viewpoints to explore the development trends of DEX that we will pay attention to in the future:

1. AMM will solve the problems in the current links and expand its links. Through plug-in/modular capabilities, it will solve liquidity management, asset issuance, personalized financial services, trading strategies and other DeFi scenarios.

2. Under the intent-centric DEX design, the importance of the front end is weakened, and LP faces vertical competition in the trading supply chain

3. AMM will focus on the long-tail market in the future, but at the same time we need to continuously optimize the pattern in which PMM gradually dominates

1. AMM solves the problems in the current links and expands

The links expanded by AMM are aimed at solving several core pain points and the market share that the previous AMM could not capture.

The changes are mainly brought about by Hooks. Hooks are the core innovation in Uniswap V4, allowing developers to insert custom logic in the transaction process, such as setting dynamic fees, liquidity management strategies, independent control of specific trading pairs, etc. Hooks provide AMM with extremely high flexibility, allowing AMM to expand its business scope. Developers can build more complex liquidity strategies and adapt to different market conditions.

1.1 Solving the problem of LP management based on AMM

Impermanent loss is the biggest problem currently facing LPs. When LPs deposit assets into the liquidity pool, the AMM algorithm automatically adjusts their positions to maintain a balance between assets. When prices fluctuate, LPs may lose money disproportionately on assets they hold, causing their holdings to be worth less than if they simply held the asset.

Impermanent loss is primarily due to the “negative gamma” nature of AMMs. In financial terms, gamma represents the rate of change of Delta, or the sensitivity of a portfolio’s value to the price of the underlying asset. In the context of AMMs, price volatility affects asset ratios, making it more likely that LPs will hold underperforming assets.

For example, when the price of one asset in a pool rises, the AMM rebalances by selling the rising asset and buying the depreciating asset. This results in LPs not being able to profit from the rising asset, but instead holding more of the depreciating asset. This negative gamma effect is particularly evident in AMMs such as Uniswap v2, as LP positions grow in square root proportion to price changes. Uniswap v3’s liquidity concentration mechanism further exacerbates this nonlinearity, making impermanent loss a risk that LPs need to pay special attention to.

To combat impermanent loss, LPs have adopted various hedging strategies to reduce volatility risk and obtain more stable returns. Some of the effective methods include:

Gamma Hedging with Perpetual Contracts: LPs can hedge their impermanent loss risk by trading perpetual futures or options contracts. For example, adopting a straddle strategy (buying both call and put options at the same time) can reduce the risk of price fluctuations in both directions. In addition, perpetual contracts provide continuous price hedging without an expiration date, which is very suitable for a volatile environment.

Option Selling (LP as Option Seller): Since the income model of LPs is similar to that of option sellers, protocols such as Panoptic allow LPs to sell their positions as options, selling volatility, which is particularly suitable for low volatility markets. Panoptic’s model essentially converts LP positions into tradable financial instruments, and LPs earn fees through option premiums.

In addition to hedging strategies, LPs can also reduce impermanent loss and increase profitability by actively managing their liquidity positions.

Rebalancing based on market indicators: LPs can use technical indicators such as MACD, TWAP, and Bollinger Bands to trigger rebalancing strategies. By monitoring these indicators, LPs can adjust liquidity ranges and risk exposure to reduce downside risk in highly volatile markets.

Inventory Management Strategies: LPs can adopt inventory management techniques to adjust their holdings based on market conditions. Protocols such as Charm Finance and ICHI help LPs dynamically manage liquidity, ensuring that their positions are adjusted according to volatility or price changes to avoid excessive losses.

In addition, there are some liquidity management protocols, such as Bunniswap, which builds liquidity management tools based on Uniswap V4 Hook to help its users directly optimize liquidity management methods and obtain more layers of incentives.

AMM runs on the chain. Due to the lag in block update time and the submission of transactions at the same time, price updates are usually lagging behind CEX, which allows arbitrageurs to take advantage of price differences, causing LPs to sell assets at less favorable prices and suffer losses.

According to a16z researcher Tim Roughgarden, LVR causes LPs of ETH-USDC to lose 11% of their principal each year. If the LVR risk is reduced by 50%, it can actually translate into a 5.5% annual return growth for LPs.

To mitigate this delay risk, multiple innovative solutions have been proposed:

Pre-confirmation protocol: Protocols such as MEV-boost and PBS allow block builders to pre-confirm transaction execution prices, thereby reducing the price manipulation space for arbitrageurs. This solution is particularly prominent in Unichain.

Price data based on oracle machines: By using real-time price data from CEX, protocols such as Ajna Finance ensure that AMMs maintain accurate market prices and reduce the risk of losses due to price lags.

Intention-based AMM: Intention AMM allows LP to set trading conditions and execute trades only at the most favorable price, using the RFQ (Request for Quote) mechanism to reduce latency-driven arbitrage.

Many liquidity management protocols can maximize LP returns, which is essentially to better measure implied volatility and make appropriate asset adjustments, that is, to extract implied volatility data from trading volume and liquidity patterns, assess potential risks and adjust positions accordingly. By comparing the potential return of LP fees with the cost of options, LPs can better decide when to hedge and when to continue holding positions. For example, Gamma strategy adopts a MACD-based hedging strategy, which instantly hedges LP risks as financial products to obtain more returns for LPs.

The MEV capture mechanism redistributes revenue by auctioning the right to extract MEV, ensuring that LPs not only get fees from regular transactions, but also benefit from arbitrage opportunities.

The pioneer in protecting traders and LPs by capturing MEV is CoW swap. Through transaction packaging and solver bidding under its CoW AMM batch auction, it ensures that transactions are completed at a unified price at the same time, eliminating MEV created by LVR. Angstrom from Sorella labs built an off-chain auction system through Uniswap V4 hook to prevent arbitrage.

App chains like Unichain reduce the MEV that traders and LPs will be subject to by providing a block construction environment and pre-confirmation under the protection of TEE.

Through Hooks, Uniswap V4 can implement a dynamic fee structure. Unlike traditional fixed fees, dynamic fees can be adjusted according to market conditions and the needs of liquidity providers. For example, during periods of high volatility, fees may rise to compensate for the risks of liquidity providers, while fees may fall during stable periods. This flexible charging mechanism can not only increase the returns of LPs (liquidity providers), but also allow traders to obtain better prices.

For example, Arrakis's HOT AMM introduces a dynamic fee model to help LPs capture more value from high-frequency and arbitrage transactions by identifying arbitrage transactions and applying higher fees to mitigate latency risks.

1.2 Personalized business logic

Different users will also have different subjective preferences for the weight of risk and return. The lack of differentiated practices cannot explain user behavior, and misses the opportunity to enhance user stickiness, incentivize positive behavior, and optimize capital utilization.

The liquidity pool in V4 supports more flexible configurations, and developers can use hooks and custom logic to create different pool types. For example, you can create a dedicated pool for hedging market risks, or a pool for specific arbitrage strategies, such as Cork protocol is building LRT ETH's de-anchored risk token trading AMM through Hook. This brings more innovation to DeFi applications and aggregates them into direct application opportunities of AMM, making Uniswap no longer just a trading platform, but an open platform for liquidity and trading strategies. How verifiable off-chain computing will become increasingly important, such as ZK coprocessors such as Brevis, combined with the development of verifiable computing, introducing external data to optimize AMM's personalized services for users. At the same time, in the intent network, solver trust assumptions are better reduced.

1.3 Asset Issuance

The most interesting part that AMM can expand and capture will be the capabilities related to asset issuance. Liquidity guidance capabilities such as LBP that Uniswap could not do before can also be solved by building Hooks, such as the Hook that Doppler is building. There can be further innovations on top of this, which essentially allows Uniswap to derive countless or even more asset issuance capabilities than pump.fun, directly capturing the value of asset issuance.

2.Under the intention-centered DEX design, the importance of strongly bound front-ends is weakened, and LPs face vertical competition in the trading supply chain

2.1Front-end importance weakens, vertical competition strengthensThe overall relevance of the front-end will decline, because the efficient solver market eliminates the advantages of using protocol-specific front-ends for transaction execution. The diversification of pools brought about by V4 and the potential existence of toxic traffic in Hooks have led to the inability of pools dominated by various Hooks to be directly routed by Uniswap. This is also the situation of future modularized AMMs - most pools will be behind the scenes, directly routed by middlemen-solvers, rather than directly acquiring users from front-end interactions.

The intent-centric future will have a significant impact on our understanding of value capture in the trading supply chain, the design of LPs, bridges, etc., the overall user experience, and more. In such a scenario, the role of the front end will gradually decline. Protocols will compete on efficiency rather than focusing on user acquisition on the front end. In fact, this trend started with DEX aggregators, as some DEXs gained a lot of trading volume through aggregators, but had few users for their protocol-specific front ends.

We are even starting to see DEXs like Ekubo on StarkNet that do not provide an exchange front end at all, but rely entirely on DEX aggregators and, in future solutions, route exchanges through their liquidity, accounting for about 75% of all trading volume on StarkNet.

2.2 Current limitations of RFQ

Most intent protocols on Ethereum are isolated primitive intent systems in which users express protocol-specific intents, mainly around transactions. The main protocols include CoW Swap, 1inch Fusion, and UniswapX.

One of the biggest problems with the current RFQ system is the lack of composability of intents, so a potential general intent network and architecture are also needed to solve this limitation. Teams such as Essential are establishing open and general intent standards through the general intent standard ERC-7521, so as to help various participants, including users, solvers, etc., to obtain a better user experience.

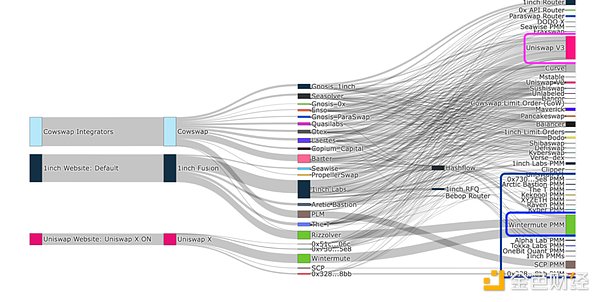

Especially for Solvers, serving various protocols across the stack, including building efficient on-chain routing, maintaining off-chain liquidity sources and private order flows, and delays between the same and different protocols. In addition to the unification between protocols, it is also particularly important to vertically integrate the roles in the transaction supply chain. Similarly, for pools and liquidity providers, the best way to obtain traffic in the intent network is to become a solver themselves. In order to better protect the interests of all parties in the various potential losses mentioned above, collaboration with block builders is particularly important. This has led to the current situation of vertical integration of participants under the RFQ, that is, solver service providers provide their own liquidity through off-chain/AMM pools and cooperate directly with builders. This also brings potential centralization issues. Due to the reduction in competition in the solver auction, the price effectiveness that everyone envisioned at the beginning may be more difficult to achieve.

3.AMM will focus on the long-tail market in the future, and needs to continuously optimize the pattern in which PMM gradually dominates

The long-tail effect of crypto assets is very obvious, and the blue chip pool will be captured by off-chain liquidity-the head assets with higher liquidity, that is, large-cap tokens, will eventually be filled by off-chain resources, especially PMM, while long-tail liquidity small-cap tokens will be routed to AMM. In fact, this has become a reality to a certain extent.

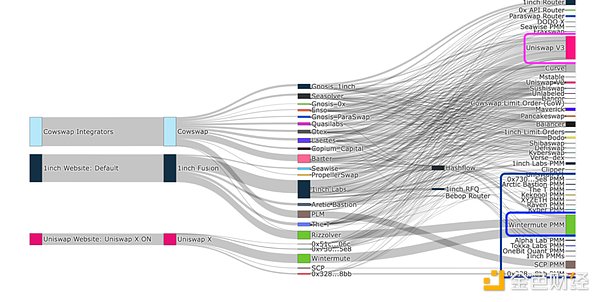

About 60-80% of the total weekly trading volume of Uniswap Labs front-end is filled by AMM. From a single transaction point of view, intent-based systems currently account for about 30% of all DeFi transactions. Since the beginning of 2022, it currently accounts for about 30% of DeFi transactions. PMMs account for the vast majority of intent-driven order flow, with Wintermute dominating, accounting for at least 50% of intent-driven flow facilitated by PMMs since September 2023.

As intent adoption continues to rise, PMMs are starting to receive more and more non-toxic traffic. But AMMs are filling more than just long-tail liquidity: only 30% of ETH/USDC trading through UniswapX and the Uniswap frontend is routed to AMMs. The advantage of PMMs, or private market makers, is to provide liquidity to capture non-toxic traffic.

3.1 Disadvantages of AMM

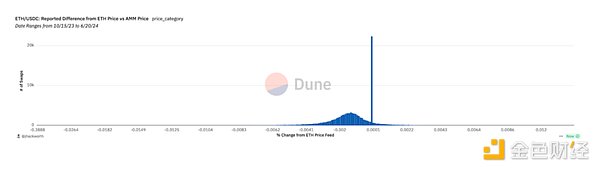

Due to the lag in LP price updates, AMM may quote an expiration price that is better than the market, and the market price is usually set by CEX. This can explain why some of the traffic flows to AMM.

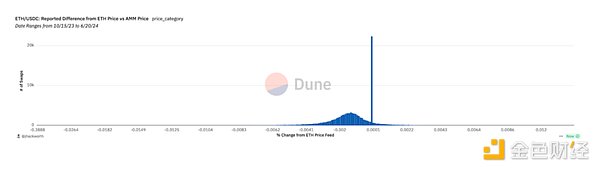

This can be seen in Variant's observation of Uniswap X. The figure below shows the difference between DEX quotes and market prices estimated using CEX API in transactions routed from the Uniswap front end to AMM. The liquidity routed to AMM is on average lower than the market price. This means that the reason why traffic flows to AMM is that LP offers a better expiration price.

For long-tail assets, the percentage of off-chain liquidity filler costs as a percentage of transaction volume decreases as the transaction size increases, while the cost of AMM decreases more slowly than off-chain filling, which means that AMM has weaker economies of scale. As the transaction size increases, it is cheaper to use off-chain liquidity to fill orders. The only fees for the filler come from lower filling gas efficiency and hedging costs.

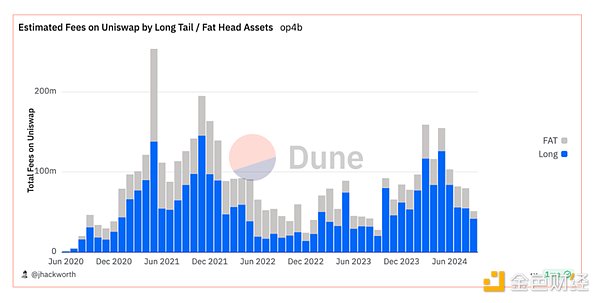

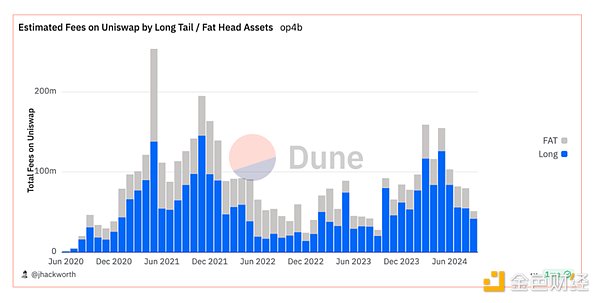

Uniswap's trading volume is increasingly concentrated in the top assets, while the fee trend is completely the opposite. In most months, most of the fees come from long-tail asset trading pairs. This is because Uniswap V3 introduced lower fee tiers, which compressed the top liquidity with more intense competition. Long-tail liquidity is more valuable than top liquidity because it is insensitive to fees, more scarce, and for these assets, price discovery is often more important than price efficiency.

3.2 Advantages and potential problems of PMM

As PMM attracts more traffic through intent-based systems, LPs on AMMs will face a larger proportion of arbitrage toxic traffic. LPs will suffer more losses in this environment because LPs rely on the fees of non-toxic traffic to offset the losses caused by toxic traffic. New AMM designs need to compete with PMMs if they want to capture non-toxic traffic.

The actual entities behind these PMMs are actually traditional market makers including Jump, Jane Street, GSR, Alameda and Wintermute.

These MMs bring higher profit margins by verticalizing each level of the MEV supply chain. In the current environment, it is better than in the previous pure on-chain liquidity provider environment, and cooperates with various MEV participants such as Builder to execute MEV strategies and produce blocks.

However, in the long-tail asset segment, on-chain AMM LP still has an advantage. This is mainly because CVMM will have its own inventory risk when making markets, so it is necessary to provide corresponding hedging strategies, which is still difficult to implement on long-tail assets.

This is ultimately a war between on-chain liquidity and off-chain market makers. As market makers erode on-chain liquidity, if price discovery is gradually dominated by off-chain liquidity in the future, it will lead to a shrinking of on-chain DEX liquidity. Our ultimate goal should be to transfer liquidity to the chain, not just to make it easier to obtain off-chain liquidity.

Arrakis is vertically integrating into the MEV supply chain through a next-generation AMM called HOT. The solution recaptures MEV for LPs with the goal of building a healthier and fairer on-chain market. With HOT AMM at its core, Arrakis is taking the first step to solve DeFi's CVMM problem by protecting on-chain LPs. HOT is a liquidity module that provides modular capabilities through Valantis.

4. Conclusion

With the development of DEX RFQ networks such as Uniswap X and Arrakis, and modular DEX architectures such as Uniswap V4 and Valantis, the DEX landscape will enter a new stage.

First, many problems in the business links of AMM itself will be solved, and the business scope will be greatly expanded. The most urgent of these is the LP problem. The LP problem can be divided into two types of losses: IL and LVR. Through various current liquidity management protocols, derivatives (which can be integrated into AMM as modular capabilities) and RFQ systems, the upper limit of on-chain liquidity can be increased. In addition, there are personalized business logic, cross-chain transactions, asset issuance capabilities, etc. It will capture more financial upper limits and business scenarios for AMM, and we are also optimistic about any protocol innovation that can effectively broaden the business scenarios of AMM.

Secondly, under the current intent pattern, there are still many RFQ-related issues that need to be resolved. The entire trading supply chain has changed significantly, similar to what happened in block production, and vertically integrated service providers have greater advantages.

Finally, AMM will focus on the long-tail market in the future, optimizing the pattern in which PMM gradually dominates. With the development of the intent network, centralized market makers that have vertically integrated the transaction chain will have an absolute advantage in the liquidity of most blue-chip assets, which has led to an increase in toxic traffic and a decrease in returns for native liquidity providers on the chain. For the purpose of enhancing the decentralized trading pattern on the chain, exploring how to increase the competitive advantage of AMM on the asset side, especially long-tail assets, is also a direction we continue to focus on.

YouQuan

YouQuan