Investopedia states: “A prediction market is a market where people can trade based on A market for contracts on the outcome of unknown future events.” Essentially, it is a betting/gambling market. To better understand the betting market, let's break down the life cycle of a bet:

In the belief stage, a A prediction is just an opinion. When a person turns his opinion into a bet of money, he can reap rewards when the results support that belief.

Beliefs are formed through the interaction of complex cognitive, social, emotional, and environmental factors. Opinions can arise from immediate conviction or thoughtful reflection, and because there is no monetary loss to the person expressing the opinion, opinions are given more freely.

Want to profit from your beliefs

There is a belief-independent but very attractive result

The first type of bet may come from a calculated perspective, while the second type comes from a "small bet, big win" attitude.

In order for any contract to be successful, there needs to be a side and a counter-party:

To bet $50 on Chelsea to win a game, someone (or many people) needs to be willing to put in a total of $50 to bet on Chelsea to lose (assuming the odds are 50/50)

Margin trading on GMX, the trader opens a long position, and GLP is the opposite

Casino games such as roulette and blackjack require a "banker" as the opponent

Sometimes, in order to attract the opposition to participate, we need to adopt some incentives, because the outcome of an event is not always equally likely to happen. These incentives can include various forms, such as odds, bond curves in AMM (Automated Market Maker), and even funding rates in perpetual/margin trading platforms.

The structural design of market forecasts becomes more complex when focusing on specific types of outcomes. Sports betting, for example, requires unique odds setups because almost no two events will have nearly the same outcome. Furthermore, each major event (e.g. the outcome of a league championship) may involve many smaller events (the outcome of each league game), adding further complexity.

In predicting events, the contract also needs to be executed correctly. What if your opponent refuses to pay? This is why derivatives are essentially legally enforceable contracts. On the blockchain, contracts can be executed trustlessly based on the results.

So, to make a bet, you need:

The event occurs (or does not occur) and the event/game contract is released

Ensure that enough participants have an opinion on these events (maker demand: market participants provide market orders)

Ensure these participants have counterparties (taker demand: market participants execute existing orders in the market)

< /p>

Ensure settlement

Ensure there is no market manipulation

Results

"Gambling games promote the 'illusion of control': the belief that gamblers can exert skill over outcomes that are actually defined by chance." - Dr. Luke Clark

The result is the end of the event stakes. Once the outcome is determined, the bet is complete.

Does prediction market require Web3?

Let’s look at the necessity of Web3 based on the above-mentioned criteria for creating a gambling market:

Event/Game Creation

There is no explicit Blockchain use cases. Permissionless Posting is a bug, not a feature, as it creates a high degree of redundancy for the same event, thus worsening the punter experience. Bets can be created based on an event, or games like on-chain roulette or blackjack can be created. (Permissionless publishing refers to anyone being able to publish information or transactions without centralized review or permission)

Events can also be price discovery. We’ve seen prediction markets on Aevo for yet-to-be-released coins, which provide a good indicator of how the market feels about the coin’s price.

Parcl is also creating a prediction market for better price discovery in real estate. It provides homeowners with a ballpark figure for what their home is worth and also provides a budget range for buyers looking to purchase real estate in a certain city.

The use case for price discovery is also a function of liquidity in event contracts, which is why the next section is important.

Manufacturer demand

Blockchain cannot control manufacturing The needs of consumers are driven entirely by offline behaviors such as built-in marketing or games.

Those targeting price discovery must focus on generating as much maker volume as possible in order to obtain the most accurate price for a specific asset.

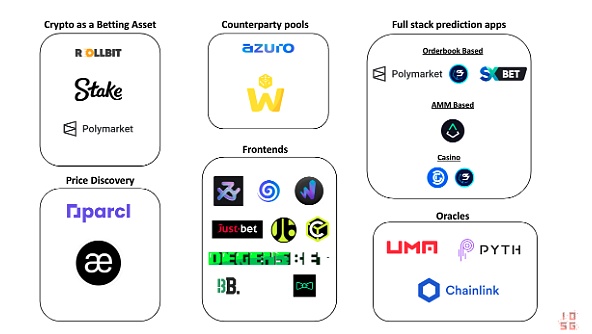

Counterparties

Now we enter an interesting topic. Counterparties can be incentivized to gamble through attractive odds, especially when the outcome of an event is almost certain. As you can see in the image below, it is possible to win $200 with a $0.50 bet due to the huge mismatch in the Polymarket order book.

One way is like Augur Turbo, where each market is an independent market running on Balancer AMMs. LPs (liquidity providers) here serve as counterparties in different markets. While this structure does a good job of avoiding overreliance on odds calculation (or fetching), it makes the experience of publishing predicted events worse.

For price discovery order books like Aevo, if there is no liquidity, the platform will sometimes have to act as the counterparty itself. This is not ideal, especially when the bottom of the market is unknown.

Another approach is to create a counterparty LP pool like "The House". Just like Azuro and WINR did. There is a liquidity pool that will serve as the counterparty to bettors. Parcl has a USDC liquidity pool that serves as the counterparty for traders to long-term or short real estate prices in different cities.

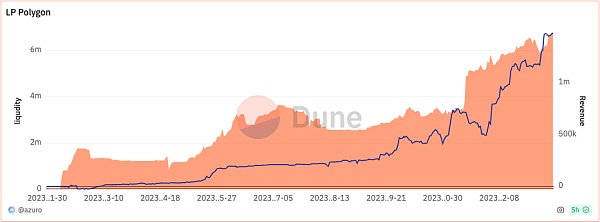

Both protocols have proven their effectiveness:

Azuro on Polygon Revenue generated by LPs (Source: Dune)

WINR’s LP token (WLP) value has grown from $1 to approximately $1.27 (if Starting LP around July 1, 2023, indicating a 27% return)

(Source: Dune)

These models demonstrate some good product-market fit, where the front-end only needs to focus on punters placing bets on the platform without having to manage order books or make the trade-offs that come with AMMs.

You can think of these models as Uniswap v4, with different front ends using the underlying liquidity (similar to hooks).

WINR protocol has a casino betting front-end and another margin trading protocol that offers up to 1000x leverage, which ensures high pool utilization but can be very detrimental to the pool. Danger.

Ensure settlement

Once the event is completed, the bet is Settlement is required. In the AMM structure, everything is on-chain and settled on the contract. For the Polymarket order book model, the order book is maintained off-chain. Polymarket can block withdrawals if needed. For Azuro frontends like Bookmaker.xyz, no deposit is required. Each bet is considered an independent transaction. The only off-chain components are the calculation of odds and the data source.

Ensure no manipulation

If there is a centralized Data providers, and this data source is manipulated by the provider, which may adversely affect the results of market makers (makers) and takers (takers). This is one of the main reasons why most Web3 prediction markets use oracle systems like Chainlink. There is a trade-off between latency and data integrity when using oracles. When choosing an oracle, platforms can choose between first-party and third-party oracles, which involves latency trade-offs. In fast-moving events, whether there is a delay is a very important factor.

In casino games, the integrity of randomness is crucial, and its fairness cannot be affected by its source.

Chainlink and other oracles such as Supra and Pyth minimize the possibility of manipulation through aggregation, but in the vast market, the authenticity and reliability of data sources Still a problem. These oracle systems strive to protect markets from inappropriate manipulation by aggregating multiple data sources to provide reliability and reduce the risk of a single point of failure. Still, ensuring the authenticity of data sources and preventing manipulation remains an ongoing challenge in prediction markets.

Successful and failed existing applications

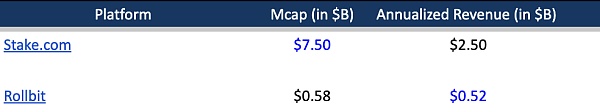

When we look at the crypto market and prediction markets, the more successful examples are crypto The currency is used as an asset for staking on sites such as Stake.com and Rollbit.

(The blue number is the predicted number)

Although like Polymarket The application has achieved some success, but it is not a platform that can maintain consistent transaction volumes because there is a huge gap between the event environment and the platform.

Source: Dune

Product-market fit of cryptocurrencies and prediction markets (PMF) has initially appeared in "House" pool systems like Azure and WINR. An obvious application scenario is that a new front end focused on a specific type of prediction market only needs to focus on the demand side. They can leverage systems like Azure and WINR, which in turn provide stablecoin holders with best-in-class yields (40-60% annualized at current rates).

In most countries, regulations on gambling apps and online casinos are very strict. Protocols like Azure and WINR may also face lower regulatory pressure than companies like Rollbit.

The crypto market will have as much engagement as the front-end provides. There are currently no fully permissionless and trustless crypto prediction markets.

What we look forward to seeing is the possible success of applications like Parcl, which bring transparency to a fairly illiquid asset class. From fundamental principles, it appears to have the right structure to achieve its price discovery objectives.

The main application scenarios of Web3 include counterparty pool structures that support the construction of various prediction markets, and the successful application of prediction markets for better price discovery.

As the market capitalization of cryptocurrencies grows and more and more people have disposable capital on the chain, the prediction market industry may be profitable, or at least Also very useful.

Part.2 Investment and FinancingEvents

Leveraged trading protocol Particle completed a seed round of financing, led by Polychain Capital

* DeFi

Particle, a leveraged trading protocol, completed a seed round of financing, led by Polychain Capital, with Nascent, Inflection, Neon DAO, Naveen Jain, Arthur Hayes, DCF God, Sam Williams, Kalos, Richard Ma, Palmer, vxCozy and others participated in the investment, and the specific financing amount was not disclosed.

AAA gaming platform SkyArk Chronicles completed US$15 million in financing, led by Binance Labs

* Game

AAA gaming platform SkyArk Chronicles completed US$15 million in financing, led by Binance Labs, VividThree, Bryan Pellegrino, CEO of GuildFi, Jambo, BreederDAO and LayerZero, Wangarian, co-founder of Tangent Ventures, and S.Y. Lee, CEO of Story Protocol, participated in the investment.

RWA commercial lending agreement Kasu completed a US$3 million seed round of financing, led by Woodstock and others

* RWA

RWA commercial lending agreement Kasu announced the completion of a US$3 million seed round of financing, Woodstock, Morningstar Ventures and Faculty Group led the investment, with participation from Cypher Capital, Matterblock, Andromeda Capital, NxGen, Rarestone Ventures, Asteroid Capital and Optic Capital. Funds raised will be used to advance the Kasu innovation platform, which is dedicated to redefining RWA lending standards and optimizing corporate cash flow to reduce credit risk, provide risk management and yield.

Decentralized hackathon platform BeWater completed a new round of financing, led by OKX Ventures

* Ecosystem

The decentralized hackathon platform and global open source developer organization BeWater completed a new Round of financing, the specific amount has not been disclosed, OKX Ventures led the investment.

Bitcoin Layer 2 network Bitfinity completes $7 million in token financing at a valuation of $130 million

* BTC Layer2

Bitcoin Layer 2 network Bitfinity is valued at $130 million Completed $7 million in token financing, including a seed round of approximately $1 million in 2021 and a $6 million growth round completed in June last year. Bitfinity is currently in the testnet phase and plans to launch mainnet later this month or early February. Bitfinity hopes to grow the team to approximately 25 people in the coming months after mainnet launch and establishing and growing its ecosystem.

Gamified NFTFi and SocialFi platform Eeesee completes US$2.85 million in financing

* Game

Gamified NFTFi and SocialFi platform Eeesee announced the completion of $2.85 million in financing, including a $1.1 million seed round Financing and US$1.75 million in private placement financing, investors include SevenX Ventures, Maven Capital, MetaBros, Contango Digital Assets, BasementDAO, etc. Eeesee’s native token ESE is scheduled to be launched in the first quarter.

Quora received a $75 million investment from a16z to accelerate the development of its AI chat platform Poe

* AI

Online Q&A website Quora CEO Adam D'Angelo issued a message announcing the completion of US$75 million Financing, led by Andreessen Horowitz (a16z). The funds from this round of financing will be mainly used to accelerate the development of its AI chat platform Poe, and it is expected that most of the funds will be paid to the creators of Bots on the platform through its creator monetization plan.

Umoja completes US$2 million in financing

* DeFi

Umoja, a decentralized risk hedging strategy management company founded by Robby Greenfield, former head of social impact at ConsenSys, completed US$2 million in financing, Quantstamp, Blockchain Founders Fund, Orange DAO, Hyperithm, Psalion, Blizzard (Avalanche) and others participated in the investment.

Solana ecological DeFi product Saros has completed a US$3.75 million private placement round of financing

* DeFi

Solana ecological DeFi product Saros has completed a US$3.75 million private placement round of financing, Solana Ventures, Hashed, Spartan , Arche Fund, GBV, Assym, IF, Genblock, K300, Cryptomind, Kyros and Evernew participated in the investment. The funding round, which was completed in late 2022, will be used to support its expansion plans and development of the Saros super app.

Part.3 IOSG post-investment Project Progress

Starknet: The main network will be upgraded to v0.13.0, all nodes need to be upgraded after completion

* ZK Layer2

Starknet tweeted that it plans to upgrade the Starknet mainnet to v0.13.0 around 19:00 on January 10th, Beijing time (pending governance voting approval). After completion, all nodes will need to be upgraded. To ensure that full nodes remain consistent with the reduced fees, users should upgrade the full node version to avoid incorrect responses. Among them, Pathfinder full nodes should be upgraded to v0.10.3 after the mainnet upgrade, and Juno full nodes should be upgraded to v0.9.1.

zksync launches Boojum update

* ZK Rollup

Upgrade: The zkSync Era is transitioning to a new Boojum proof system without starting over.

Performance: Boojum demonstrates world-class attestation performance, perfectly integrated with zkSync Era's sequencer, which can already handle over 100 TPS.

Decentralization: The Boojum prover only requires 16 GB of RAM, which provides the possibility for the decentralization of large-scale provers in the future. Ready: Shadow Proof is now live on Mainnet!

The cross-chain bridge Stargate community has passed the proposal vote on integrating NEAR

* Crosschain

According to the Snapshot voting page, the cross-chain bridge Stargate community’s comment on “Integrating Stargate with NEAR through Aurora "The proposal has been passed to support cross-chain native USDC between NEAR and ETH, Arbitrum, Optimism, Polygon and BNB Chain. NEAR becomes the first non-EVM chain to be integrated by Stargate Finance.

Chain game Illuvium updates its 2024 roadmap: striving to launch a public beta version in Q1, which may also be postponed to early Q2

< p style="text-align: left;">* GameChain game Illuvium updates 2024 roadmap, including launch of testing The net is the primary target. The team is integrating blockchain technology, finalizing the IMX passport, and completing the Fuel exchange. The goal is to launch an Open Beta version in the first quarter of 2024, but due to the commitment to quality and thorough testing, it may be extended to the beginning of the second quarter. Regarding parallel progress, the Overworld, Arena and Zero teams will continue to develop new features in parallel with the testnet rollout, ensuring there are no delays.

EigenLayer will introduce three new LSTs, sfrxETH, mETH and LsETH, on January 30

* LSD

Ethereum re-pledge protocol EigenLayer will be introduced at 04:00 on January 30 Three new Liquid Staked Tokens (LST) are Frax Ether (sfrxETH), Mantle Staked Ether (mETH) and Liquid Collective Staked Ether (LsETH). At that time, EigenLayer will reopen, allowing re-staking at the existing cap of 200,000 ETH per LST.

Part.4 Industry Pulse

The 125th Ethereum Core Developer Consensus Meeting: Discuss the inclusion of part of EIP in the Electra upgrade

* Developer

The 125th Ethereum core development The Developer Consensus Conference (ACDC) has ended. The main discussions include the Cancun upgrade test network, and EIP-7002, EIP-6110, EIP-7251, SSZ--ification, EIP-6404, EIP-6465, EIP-6466, Should EIP-6914, EIP-7549, etc. be included in the Electra upgrade?

Layer1 public chain Berachain open test network Artio, the main network is expected to be launched in the second quarter

* Layer1

Layer1 public chain Berachain opens the test network "Artio" to the public. Berachain is an established Meme-driven projects in the Cosmos ecosystem adopt the PoL (proof of liquidity) mechanism, and the mainnet is expected to be launched in the second quarter. In Berachain's three-token system: users earn pledge tokens BGT by providing liquidity to on-chain protocols (such as native DEX or stablecoin lending platforms). BGT cannot be purchased by the market and can only be earned. BGT can be destroyed by the exchange network. BERA, the native Gas token. Validators channel staking rewards back into the Berachain ecosystem via a variety of supported protocols to maintain liquidity on the network. Users who delegate BGT tokens to validators can earn HONEY, Berachain’s native stablecoin, from the network protocol.

Orbiter Finance: Tokens will be launched this year and the token economy and distribution plan will be gradually announced

* Layer2

Layer2 across Rollup bridge Orbiter Finance tweeted that it will launch its native token this year And gradually announce the token economics and distribution plan to ensure a fair process. And the O-Points program will play an important role in shaping the rules for airdrops.

The game L3 solution XAI mainnet has been launched on Arbitrum

* Game

Arbitrum ecological game Layer3 solution XAI tweeted that the mainnet has been launched on Arbitrum online.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance YouQuan

YouQuan Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist