Author: Terry, Vernacular Blockchain

Last night Michael Saylor, the founder of Microstrategy, tweeted again, Microstrategy Between February 15 and February 25, approximately 3,000 Bitcoins were purchased again at a price of approximately US$155.4 million, with the average price of each Bitcoin being approximately US$51,813.

At the same time, Bitcoin has exceeded 53,000 USDT and 54,000 USDT, 55,000 USDT, even exceeded 56,000 USDT, setting a new high since December 2021. The market atmosphere seems to have gradually returned to the bull market.

Behind this, facing the end of a new halving cycle, for Bitcoin in 2024, what new catalysts are worth looking forward to in various dimensions such as market and technology? factor? Will it push Bitcoin to the next level?

01 The new “Pixiu” in the crypto world

As a Bitcoin veteran, MicroStrategy's buying of Bitcoin has long been a big-ticket strategy. The news of MicroStrategy's public purchase of Bitcoin can be traced back to August 11, 2020.

So far, Microstrategy has purchased 193,000 Bitcoins for about $6.09 billion, with an average price of $31,544 per Bitcoin.

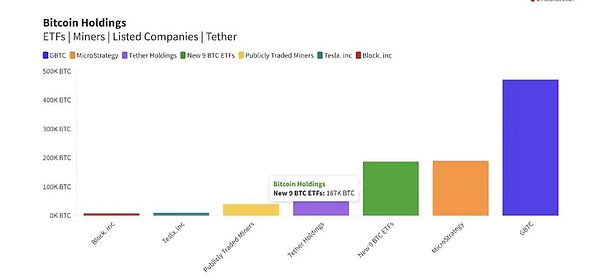

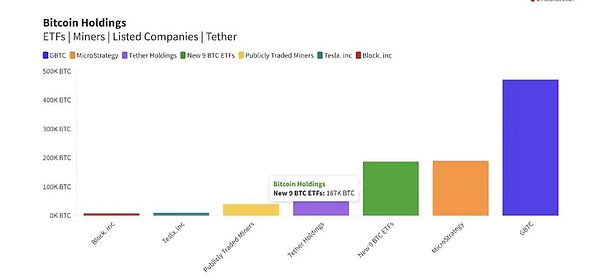

Leaving aside the trading platform as a custodian,among the corporate entities that currently hold more than 100,000 Bitcoins, in addition to Block.one and the long-defunct Mt.Gox, the company ranks third That's MicroStrategy.

To some extent, MicroStrategy has taken over the baton from Grayscale since 2020 and become the new cryptocurrency "Pixiu": Currently MicroStrategy's 190,000 BTC It firmly ranks first in the BTC holdings of listed companies, and its total value currently exceeds 10 billion US dollars.

Among the listed companies, in addition to MicroStrategy, it is followed by the leading listed mining company Marathon, which holds 13,286 BTC, accounting for 0.063% of Bitcoin issuance, with a current value of approximately US$700 million; Tesla still holds 9,720 Bitcoins, worth approximately US$275 million, and has not changed its Bitcoin holdings for the sixth consecutive quarter.

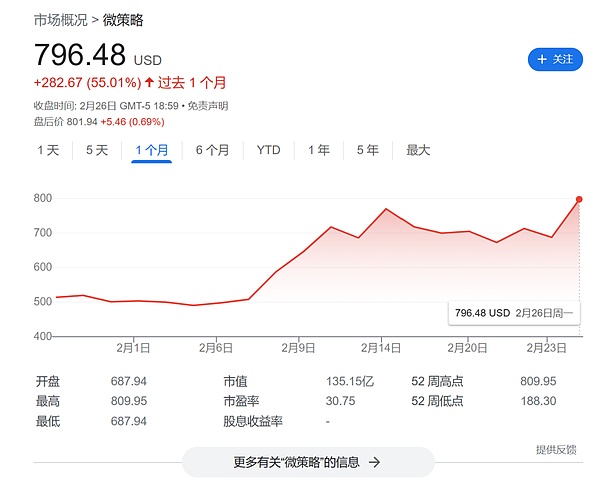

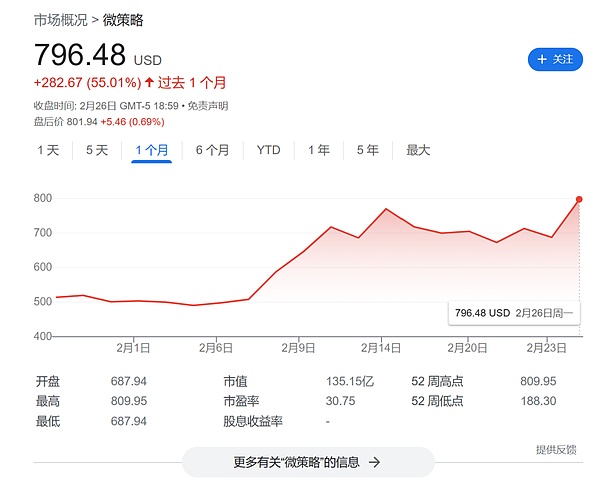

Interestingly, MicroStrategy's total market capitalization is currently $13.5 billion, so its The fair value of BTC held accounts for about 80% of the market value, which means that 80% of the net assets can be understood as the value of Bitcoin, which has led many investors to regard MicroStrategy as a "quasi-Bitcoin ETF" to configure.

Even pushing forward half a month, before this round of stock price surge, the total market value of MicroStrategy was only US$7 billion. At one time, the value of BTC held was higher than the total market value. phenomenon, it is appropriate to consider "high-quality assets" with a "price-to-book ratio" less than 1.

Of course, since the approval of the spot Bitcoin ETF on January 10, a new and more powerful cryptocurrency "Pixiu" has gradually surfaced - with just one In March, the BTC holdings of 9 new spot Bitcoin ETFs (except GBTC) completed the flip of MicroStrategy.

Bitcoin holding ranking

Bitcoin holding ranking

Currently The total net asset value of the Bitcoin spot ETF is US$37.67 billion, the ETF net asset ratio (market value as a proportion of the total market value of Bitcoin) reaches 3.76%, and the historical cumulative net inflow has reached US$5.63 billion.

In general, every market trend has its own crypto "pixiu". Looking back now, in the cycle from 2020 to 2022, it was Grayscale buying and Tether's additional issuance. As the "bull market engine" that drives incremental over-the-counter funds, since 2024, spot Bitcoin ETFs and MicroStrategy have successfully filled their positions and taken over the historical task of promoting the market.

02 The Bitcoin L2 trend is in the ascendant

Since the emergence of Ethereum and the public chain ecosystem, regardless of Is it the ICO craze in 2017, or the DeFi summer of 2020, and the subsequent NFT craze?Nearly every carnival in the industry over the years is no longer dominated by Bitcoin, and some are even gradually leaving Bitcoin behind to dance alone. trend, it was not until the Ordinals craze since 2023 that BTC was finally no longer absent.

With the explosive development of the Bitcoin ecosystem, the development of Bitcoin Layer 2 in 2024 has almost become a certain mainstream narrative.

After all, BTC is the highest quality asset in the industry. The new asset form created with the help of inscription diversion is destined to generate new demand. Although there are still underlying flaws in directly implementing smart contract scenarios such as DeFi, A series of pan-BTC L2s like Stacks, RSK, etc. may not be a breakthrough opportunity. Even coupling with Ethereum is one of the options (just like the renBTC and WBTC bridging Ethereum ecosystem).

Therefore, many people predict that in the next round of bull market, among the top 100 projects by market value, there will be at least 10-15 BTC L2 related targets, and some will enter the top 10. project.

From this perspective, Bitcoin, which has now reached a trillion-dollar market value, is already the largest “sleeping fund pool” to be mined in the crypto world. This also makes Bitcoin’s programmability, In particular, L2, which carries larger funds and richer use cases - such as creating Swap, borrowing, liquidity mining and a series of applications, is gradually no longer out of reach, and has gradually become a necessity.

Pantera partner Franklin Bi clearly pointed out:If DeFi reaches the same proportion on Bitcoin as on Ethereum, it is expected that the total value of DeFi applications on Bitcoin will reach 2250 billion US dollars (25% of Bitcoin’s market value), and over time, its size may fluctuate between US$72 billion and US$450 billion (8% ~ 50% of Bitcoin’s market value).

03 Potential variables in the evolution of Bitcoin technology

Colored coins in 2012, SegWit in 2017 , have given Bitcoin different limits of expansion and new possibilities, and promoted a wave of ecological prosperity by slowly becoming a reality.

However, since the Tarpoot upgrade in 2021 brought new combinations and possibilities in performance, privacy and even smart contracts to Bitcoin, Bitcoin has rarely received widespread attention in the past three years. wave of technological innovation.

Until 2023, the Ordinals protocol spawned a new wave of new asset issuance on Bitcoin, and attracted the market to focus on Bitcoin’s expansion track, especially the volume of discussions on Bitcoin’s technical aspects. Also started to increase again.

From the beginning of 2024 to the present, if there is any new trend worthy of attention at the technical level of Bitcoin recently, it is undoubtedly the development and innovation of RGB and the underlying Lightning Network dimension.

As an initial concept in 2018, the RGB exploration solution is expected to be officially launched in April this year. It is essentially a A scalable and private smart contract system for Bitcoin and the Lightning Network, designed to combine the security of the Bitcoin network with the efficiency of the Lightning Network and its own scalability, giving expand them to their maximum extent.

To put it simply, it is to carry forward the original intention of Bitcoin's "electronic currency" and allow two people to purely realize P2P encrypted private transfers like paper currency transactions.

Of course, its experience is average. Only two people with transaction intentions can transfer money (to ensure anonymity) - that is to say, transfer money to other people, even To obtain the consent and confirmation of the other party, both parties basically need to be online at the same time; secondly, because the contract status cannot be globally visible, RGB cannot carry use case scenarios involving multiple people.

Not long ago, Nervos launched the RGB++ solution based on the original RGB protocol. It tried to entrust RGB’s asset status, contract release and transaction verification to the CKB public chain. CKB Acting as a third-party data hosting and computing platform, users no longer need to run the RGB client themselves.

In general, the current Lightning Network ecosystem has gradually developed. OmniBOLT, Taproot and RGB have all flourished or are about to be launched. There are many worthy of attention in terms of new asset issuance and capacity expansion. New variables have emerged, and most of them have been settling for a long time. Therefore, 2024 is likely to be another "technological evolution year" for Bitcoin.

04 Summary

Currently, there are less than 2 months left before the fourth Bitcoin halving. It is expected that On April 21, 2024, the block reward will drop from 6.25 BTC to 3.125 BTC.

Source: https://history.btc123.fans/half/

Source: https://history.btc123.fans/half/

From this perspective, the current continuous inflow of funds into ETFs, MicroStrategy buy buy buy, RGB and other technologies The ecosystem continues to evolve, and halving events are superimposed. At least in the next two months, Bitcoin is likely to have multiple layers of "safety cushion" protection under multiple benefits. Even if there is a repeat of the possibility of a sharp correction before and after the halving, it can still start. to a certain hedging effect.

However, although the footsteps of this halving are getting closer and closer, the expansion of Bitcoin in all dimensions has obviously ushered in new variables, and even once exceeded the halving. attention, as to where these new variables will eventually lead Bitcoin, it is worth looking forward to.

JinseFinance

JinseFinance