Author: Marcel Pechman, CoinTelegraph; Compiled by Baishui, Golden Finance

ETH has been trading below $3,750 for the past three days, despite the upcoming launch of a spot exchange-traded fund (ETF) for ETH in the United States. Some believe that ETH's lack of bullish momentum is due to a lack of clarity from regulators on how long it will take for individual S-1 fund applications to be approved. In any case, According to derivatives indicators, bullish sentiment among Ethereum investors has fallen to a three-week low.

Regulatory uncertainty weighs on ETH prices

However, even if the U.S. Securities and Exchange Commission (SEC) approved each of the applications from BlackRock, Fidelity, VanEck and others this week, investors are still worried that current market conditions are not conducive to demand for an Ethereum ETF. The lack of enthusiasm for cryptocurrencies is partly due to regulatory uncertainty, but there are also some macroeconomic concerns as the real estate market shows further signs of stress.

Coinbase, Binance and Kraken face lawsuits for not registering as brokers when offering securities investments. The SEC and the U.S. Department of Justice have also charged cryptocurrency companies including privacy tools such as Samourai Wallet and Tornado Cash. In addition, regulators claim that Ethereum staking service intermediaries can be considered securities because there is a promise of returns in exchange for the work of others.

Even assuming there are no imminent events on the crypto regulatory front, investors are reluctant to hold assets that are considered riskier during a potential recession. Moody's Ratings said on June 6 that the debt ratings of at least six U.S. regional banks are at risk of downgrades due to "significant investments in commercial real estate," which has been hurt by rising interest rates.

Confidence in Ethereum derivatives market declines

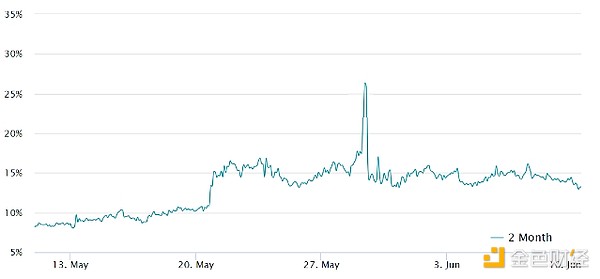

Professional traders prefer monthly contracts due to the absence of funding rates. In neutral markets, these instruments trade at a premium of 5% to 10% to compensate for their longer settlement period.

Premium of Ethereum 2-month futures relative to the spot market. Source: Laevitas.ch

Data shows that the ETH futures premium fell from 15% on June 6 to 13% on June 10. While far from a bearish structure, this is the lowest level in more than three weeks. This is certainly not what one would expect, as some analysts claim that an Ethereum ETF could capture up to 20% of Bitcoin inflows in similar instruments.

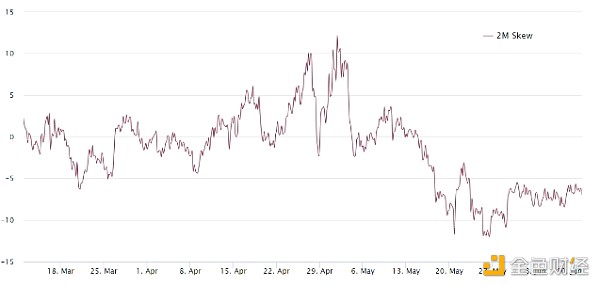

Traders should also analyze the options market to gauge if investors are becoming less optimistic. If investors expect Ethereum prices to fall, the 2-month delta deviation indicator will rise to over 8%, while periods of excitement tend to result in a negative 8% deviation.

Ethereum 2-month options Delta deviation. Source: Laevitas.ch

The ETH options 25% delta deviation was last at a bullish level on May 29, but the latest -6% level is fairly neutral and balanced, meaning that whales and market makers currently have similar odds for both positive and negative price moves on Ethereum prices.

Despite the potential launch of Ethereum ETF spot trading in the U.S., Given the weakening bullish signals on Ethereum futures and options, ETH prices are unlikely to break through $4,000 in the short term.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coindesk

Coindesk Coinlive

Coinlive  Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph