An in-depth but balanced analysis of Ethereum's current status, potential catalysts, supply and demand changes, etc., gives a conservative but systematically optimistic thinking on the question of "Is Ethereum's price about to take off?"

Since the beginning of this bull run, Ethereum's price performance has been quite disappointing. While Bitcoin has successfully broken through its all-time high, rising more than 350% from its cycle low, Ethereum has lagged behind. Its price action has been slow, lacking clear catalysts, and its reaction to Bitcoin's price surge has been relatively weak.

Recently, however, it seems that we have witnessed a shift in market sentiment. Now, the question on everyone's mind is: Is it time for Ethereum to finally shine?

In today's discussion, we will delve into this crucial question.

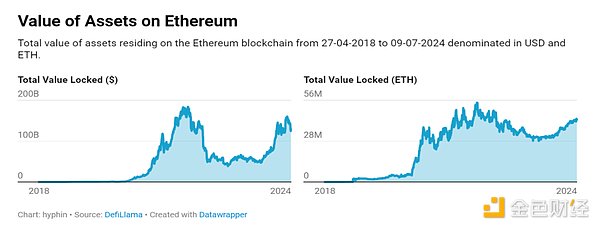

But remember, no one can predict the future. Therefore, what follows are just some thoughts, and thoughts are particularly prone to change in the field of cryptocurrency. As trading expert Peter Brandt perfectly expressed, “Have a firm opinion, but be humble.” With that in mind, let’s dive in. 1. The current state of the network has great potential To thoroughly analyze the potential of Ethereum (ETH), we first need to analyze the current state of the Ethereum blockchain. From a macro perspective, these factors make ETH valuable and attractive to investors. 1) Total Value Locked (TVL) After a significant drop in Total Value Locked (TVL) during the last bear market, there has been a clear restart in activity on the Ethereum blockchain. Over the past year, TVL has risen by about 200%. While there is still some room to reach all-time highs, the upward trend is clear.

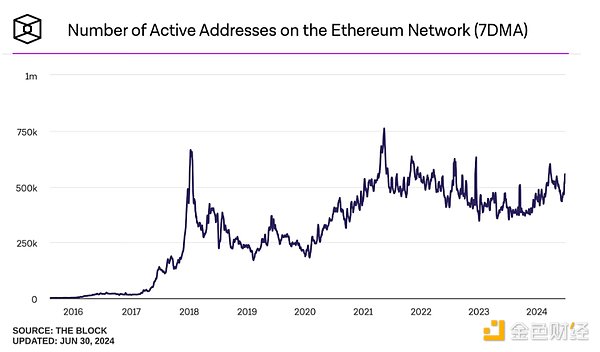

Over the past two years, active addresses have shown strong resilience, never falling below 300,000 even at the lowest point of the bear market. This shows that Ethereum has surpassed the initial hype stage and become a mature blockchain that has stood the test of time.

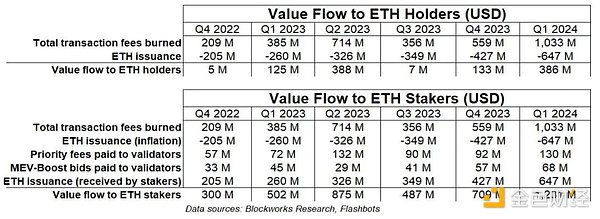

2) Value Flow

Value flow, a measure of income for holders and stakers, has also grown over the past rolling year.

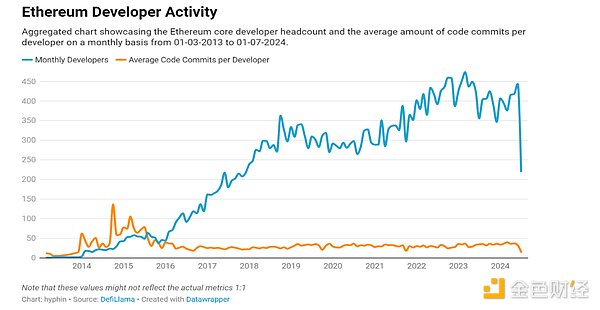

3) Core developers

Core developers are an important indicator because it is developers who ultimately build the future of blockchain. With more than 440 full-time developers, Ethereum is at the forefront of development activity, and this number is still on an upward trend, which means that Ethereum is still very attractive to developers.

2. Some catalysts

In addition to the healthy growth of on-chain indicators, Ethereum has many upcoming catalysts. Here is a list of some of the important catalysts:

1) Future launch of a spot ETF

This is without a doubt one of the most important catalysts for Ethereum. The unexpected approval of an Ethereum ETF reinforces the value proposition of cryptocurrency as an established asset class and will create a new wave of demand for Ethereum. Given the success of the spot Bitcoin ETF, there is every reason to be excited.

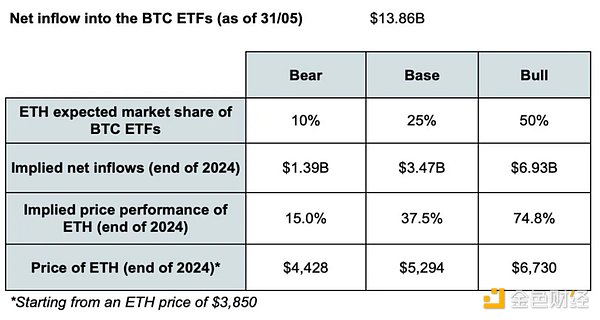

While it is difficult to accurately estimate the potential amount of funds that could flow into an Ethereum ETF, we can come up with a range of expected values based on the forecasts of various experts. This gives different potential scenarios for net inflows in the first year, ranging from $1.39 billion to $6.93 billion.

2) The next step is to estimate the price impact of these potential inflows on Ethereum

Again, there is no easy way to do this, but one option is to make some assumptions based on what has happened with recent spot Bitcoin ETFs and adjust them for Ethereum for the following reasons:

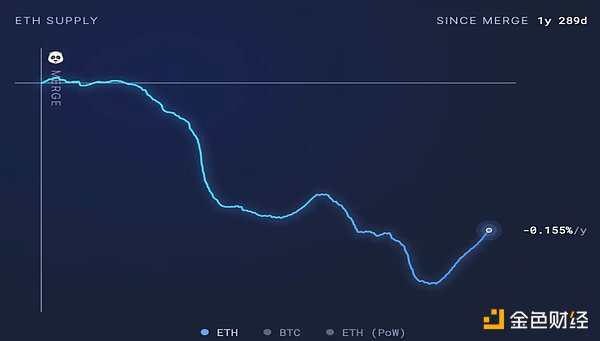

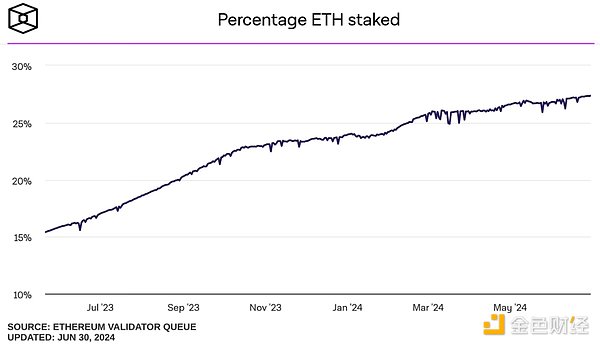

Bitcoin’s circulating market cap is currently about 3.15 times that of Ethereum. About 27% of Ethereum is staked, which means there is less circulating supply available to buy and sell, and more explosive price action is possible. Ethereum’s supply has generally been depreciating since the Merge (-0.184%).

Therefore, a reasonable assumption is that Ethereum is four times more reactive than Bitcoin, meaning that for the same inflows, the price of Ethereum will move four times more than Bitcoin.

Based on all of this, we can come up with different estimates of how Ethereum’s price will perform by the end of 2024.

3. Regulatory clarity

In addition to potential new sources of demand, the approval of spot ETFs also brings much-needed clarity to the status of Ethereum (a commodity). We all know that markets generally like clear rules, so the more regulatory issues around cryptocurrencies are resolved, the better.

1) Dencun Upgrade

This recent upgrade is very important for Ethereum. It brings several technical improvements that consolidate Ethereum's infrastructure, but one of the main features is that it significantly reduces transaction fees on the second-layer network by enhancing data availability. This is a key move to establish Ethereum as a scalable settlement layer.

2) US Presidential Election

Cryptocurrency has become an important topic in the upcoming election. On the one hand, the current presidential candidate, Donald Trump, has made a clear statement in support of cryptocurrencies. If elected, this could be a positive catalyst for cryptocurrency adoption and a boon to Ethereum. On the other hand, the Biden administration has been less clear on the issue but has shown some signs of loosening up. Overall, the outlook is bullish.

4. Ethereum Supply is Limited

At the end of the day, supply and demand are the only two variables that affect price. Now we are facing a situation where, in addition to the various potential incremental demand explained earlier, Ethereum's supply is also limited. This can be evidenced by the deflation in Ethereum's supply since the merger.

In addition, the proportion of staked Ethereum has reached an all-time high and continues to grow. This means that there is less supply available for purchase and trading on trading platforms, which also means that the market needs less demand to drive price changes, so there is more potential for explosive price action.

5. Price Action

In addition to the various catalysts mentioned above, the current situation of Ethereum is also very interesting. Looking back, we can observe that after bottoming out in June 2022, Ethereum traded sideways for nearly a year and a half before breaking out into the first wave of the bull market. Ethereum has now formed a consolidation pattern near the past highs for more than four months, and we are currently at some key resistance levels and the maximum level of fear sentiment on the timeline. This could provide potentially good buying opportunities from a medium- to long-term perspective. The current ETH/BTC chart is also approaching a key turning point. BTC has dominated the long-term downtrend, but ETH/BTC has recently rebounded from multi-year lows and is showing strong momentum. If this momentum holds and ETH/BTC breaks out of the descending channel, we can expect ETH to attract a lot of market attention.

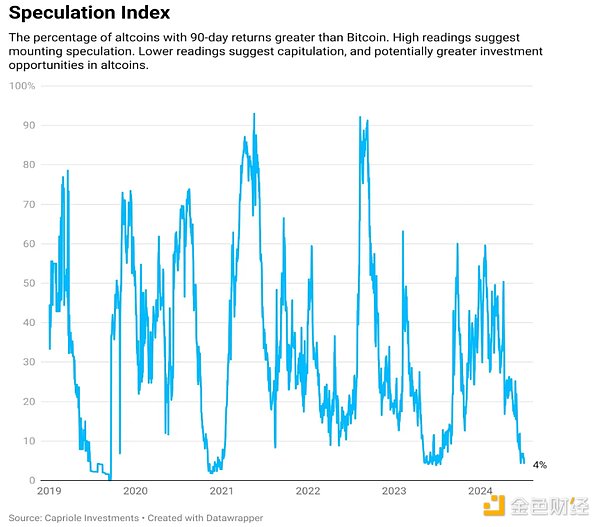

Last but not least, now seems to be the time to start the Memecoin season. So far, this bull run has been mainly driven by Bitcoin, with a few exceptions. Currently, Memecoin is performing near its all-time low compared to Bitcoin. However, we expect this trend to reverse at some point as investors shift their attention from Bitcoin to Memecoin. This potential market rotation fits in with our current bullish bias on ETH.

6. Negative Impacts

As with everything in life, it is important to keep a critical eye. Therefore, when analyzing Ethereum's global prospects, it is also important to pay attention to potential shortcomings that may have a negative impact on Ethereum:

Global Market Performance: Ethereum is very sensitive to overall market sentiment. If the overall trend of the entire cryptocurrency market is downward, Ethereum is unlikely to perform well. Although this is not the scenario we expect, it is still worth noting.

ETF Expectations: Negative surprises on the ETF side, such as poor net inflows and interest generated, may have a negative impact on Ethereum in the short term.

It is more difficult for the traditional financial community to understand Ethereum than Bitcoin: When the spot Bitcoin ETF was launched, Bitcoin was promoted as digital gold, and the traditional financial community easily understood this narrative. But for Ethereum, the situation is different, and there is no clear consensus on its value proposition. Some people see Ethereum as a global computer, some see it as a Web3 app store or a decentralized financial settlement layer, and so on. The confusion about what Ethereum really is may make it more difficult for the traditional financial community to allocate Ethereum in their portfolios.

Ethereum vs. Next Generation Blockchains: Ethereum has been widely criticized for its slow speed and high cost, especially compared to newer blockchains. There are two views in this regard. On one hand, some believe that this will lead to the slow decline of Ethereum, while others believe that this is not a problem because it uses Ethereum as a settlement layer for other layers to build and create scalable infrastructure. No matter which side of the debate you are on, it is important to keep an open mind.

7. Summary

Ethereum lagged behind at the beginning of this bull run, but it currently appears to be at an interesting moment.

The current state of its blockchain is promising and consolidates its development as a mature L1 blockchain that has stood the test of time. In addition, Ethereum has several bullish catalysts on both the demand and supply sides, and the current price action is consistent with these factors.

However, as has always been the case, things are rarely black and white, so it is important to remain aware of potential shortcomings that could negatively affect Ethereum.

Share to WeChat

Author: Vernacular Blockchain

This article is the opinion of the PANews columnist, does not represent the position of PANews, and does not assume legal responsibility. The article and opinions do not constitute investment advice.

Image source: Vernacular Blockchain If there is any infringement, please contact the author to delete it.

DepthCryptocurrencyBTCETFETH href="/zh/search/index.html?key=%E5%9F%BA%E7%A1%80%E8%AE%BE%E6%96%BD" data-v-35744de2="">InfrastructureDecentralization

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin Edmund

Edmund Joy

Joy Weiliang

Weiliang Joy

Joy Joy

Joy Beincrypto

Beincrypto Beincrypto

Beincrypto