Author: Ciaran Lyons, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Ethereum’s price drop to $3,209 has now entered a “buy” range, traders say, but they warn that this may not last once the “huge” impact of exchange-traded funds (ETFs) takes effect.

“There are two major buy zones,” anonymous crypto trader Sheldon The Sniper told his 490,300 X followers in an X post on July 24. He noted that $3,300 and below is the current buy zone, adding that the $3,097 buy zone is past.

Sheldon further predicted that Ethereum could hit $4,000 “in the next week or two,” reiterating that the two entry points they suggest are “entry points where you ride them toward the next all-time high.”

Over the past 24 hours, Ethereum has fallen 7.68% from $3,469. Source: CoinMarketCap

Ethereum prices have fallen below the closely watched $3,500 mark, around which it has fluctuated since March 1, following the debut of spot Ethereum ETF trading, which saw net inflows of $107 million.

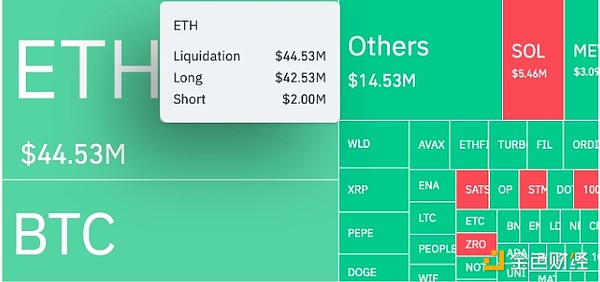

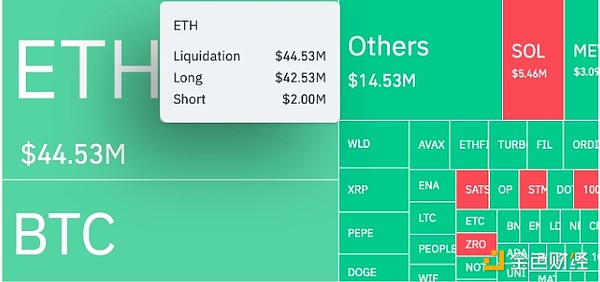

However, futures traders expect a sharp drop in prices following the Ethereum ETF trading debut. The 7.68% drop liquidated $42.53 million in short positions, and just $2 million in long positions, according to CoinGlass.

In the past 24 hours, Ethereum's liquidation amount was $9.89 million higher than Bitcoin. Source: CoinGlass Analysts Expect Massive Ethereum Price Increases Michael van de Pope explained in a July 24 analyst note that Ethereum will experience “huge” price swings as a result of ETF inflows, similar to the Bitcoin price jump from $40,000 to $70,000 following the launch of the Bitcoin ETF. Van de Pope also does not rule out the possibility of Ethereum doubling in price in the short term. “It is likely that one would speculate that the price of Ethereum would rise from $3,500 to $7,000-7,500,” he added, predicting that the consequences of the ETF launch could lead to short-term volatility.

“It’s going to take a week or two of downside momentum before Ethereum really surges to new all-time highs.”

Pav Hundal, chief market analyst at Swyftx, recently noted that he believes the “near-term target” is for Ethereum to reach its November 2021 all-time high of $4,890.

Huang Bo

Huang Bo