Compiled by: Block unicorn

Ethena is the most successful protocol in DeFi history. About a year ago, its total volume locked (TVL) was less than $10 million, but today it has grown to $5.5 billion. It is integrated into multiple protocols in various ways, such as @aave, @SkyEcosystem (IE Maker/Sparklend), @MorphoLabs, @pendle_fi and @eigenlayer. There were so many deals with Ethena that I had to change the cover several times when recalling another collaboration. Of the top ten protocols in TVL, six work with or are Ethena itself (Ethena is ninth). If Ethena fails, this will have a profound impact on many protocols, especially AAVE, Morpho, and Maker, which will functionally fall into varying degrees of insolvency. At the same time, Ethena has significantly increased usage across DeFi through multi-billion dollar growth, similar to what stETH did for Ethereum DeFi. So, is Ethena destined to destroy DeFi as we know it, or will it usher DeFi into a new renaissance? Let’s delve deeper into this issue.

How exactly does Ethena work?

Despite being more than a year old, there are still widespread misunderstandings about how Ethena works. Many claimed it was the new Luna and then refused to elaborate further. As someone who has warned about Luna, I find this view to be very one-sided, but at the same time I also believe that most people lack adequate knowledge of the details of how Ethena works. If you think you fully understand how Ethena manages delta neutral positions, custody and redemptions, please skip this section, otherwise this is important reading to fully understand.

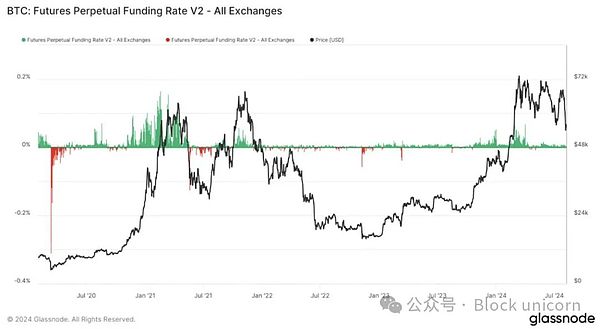

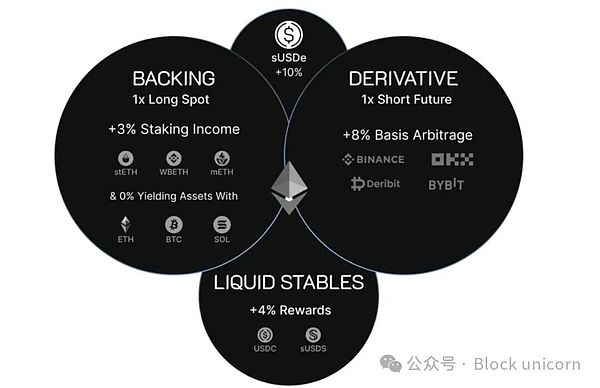

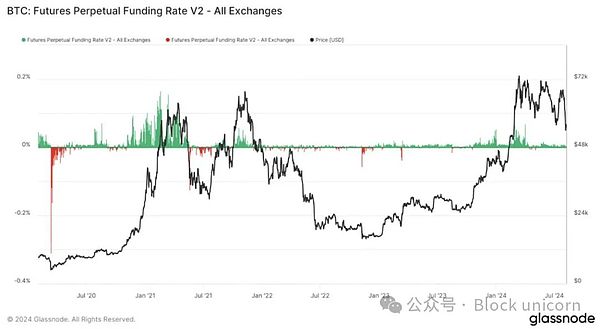

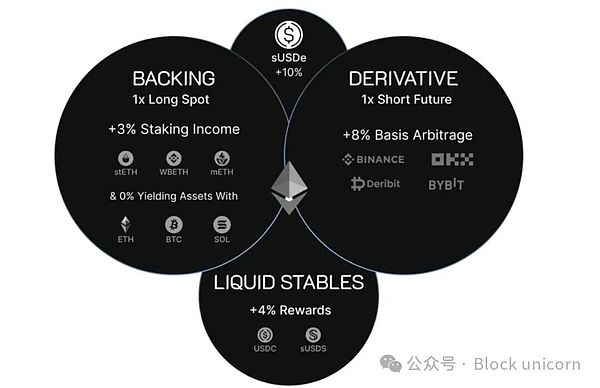

Overall, Ethena benefits from financial speculation and the cryptocurrency bull market just like BTC doesbut in a more stable way. As cryptocurrency prices rise, more traders want to go long BTC and ETH, while fewer traders are willing to go short. Due to supply and demand, traders who go short are paid by traders who go long. This means that traders can hold BTC while shorting the same amount of BTC, thereby achieving a neutral position where when the price of BTC rises, the profits and losses of the long and short positions cancel each other out, while the trader still earns interest rate income. Ethena operates entirely on this mechanism;it takes advantage of the lack of sophisticated investors in the crypto market who would rather profit by earning a yield than by simply going long BTC or ETH.

However, a significant risk to this strategy is the custody risk of the exchange, as demonstrated by the collapse of FTX and its impact on the first generation of Delta neutral managers reflect. Once an exchange goes down, all funds may be lost. This is why mainstream managers, despite managing capital efficiently and safely, were hugely negatively impacted by the collapse of FTX, most notably @galoiscapital, through no fault of their own. Exchange risk is one of the important reasons why Ethena chose to use @CopperHQ and @CeffuGlobal. These custody service providers serve as trusted intermediaries, responsible for holding assets and facilitating Ethena's interactions with exchanges, while avoiding exposing Ethena to the exchange's custody risks. Exchanges in turn can rely on Copper and Ceffu because they have legal agreements with custodians. Total P&L (i.e. the amount Ethena needs to pay long traders, or the amount long traders owe Ethena) is settled periodically by Copper and Ceffu, and Ethena systematically rebalances its positions based on these settlements. This custody arrangement effectively reduces exchange-related risks while ensuring system stability and sustainability.

Minting and redeeming USDe/sUSDe is relatively simple. USDe can be purchased or minted using USDC or other major assets. USDe can be staked to generate sUSDe, which earns yield. sUSDe can then be sold to the market, or redeemed USDe, by paying the corresponding swap fees. The redemption process usually takes seven days. USDe can then be redeemed for the backing asset (corresponding to a value of $1) at a 1:1 ratio. These backing assets come from asset reserves as well as the collateral used by Ethena (primarily BTC and ETH/ETH derivatives). Given that some USDe is not staked (many of which is used for Pendle or AAVE), the yield generated by the assets backing this uncollateralized USDe helps to enhance the yield of sUSDe.

So far, Ethena has been able to handle large volumes of withdrawals and deposits with relative ease, Although sometimes USDe-USDC slippage is as high as 0.30%, which is relatively high for a stablecoin, it is far from a significant degree of decoupling and far from a danger to lending protocols, so why are people so Worried?

Well, if there is a large withdrawal demand, say 50%

How do you make Ethena "fail"?

Given that we now understand that Ethena's earnings are not "fake" and how it works on a more granular level, what are Ethena's main real concerns? Basically there are the following situations. First, funding rates could become negative, in which case Ethena's insurance fund (currently around $50 million, enough to withstand slippage/funding losses of 1% at the current TVL) is insufficient to cover losses, Ethena will end up losing money instead of making a profit. This scenario seems relatively unlikely as most users are likely to stop using USDe when benefits decrease, which has happened in the past.

Another risk is custody risk, the risk of Copper or Ceffu trying to operate with Ethena's money. This risk is mitigated by the fact that the custodian does not have full control of the assets. The exchange has no signing authority and no control over any wallets holding the underlying assets. Both Copper and Ceffu are "integrated" wallets, meaning that all institutional users' funds are mixed in hot/warm/cold wallets, and there are multiple risk protections in place such as governance (i.e. controls) and insurance. From a legal perspective, this is the structure of a bankruptcy remote trust, so even if the custodian becomes bankrupt, the assets held by the custodian are not the property of the custodian and the custodian has no claim to these assets. In practice, there is still a risk of simple dereliction of duty and centralization, but there are indeed many precautions to avoid this problem, and I think the likelihood of this happening is equivalent to a black swan event.

The third and most commonly discussed risk is liquidity risk. To manage redemptions, Ethena must sell both its derivatives position and its spot position. This can be a difficult, expensive, and potentially very time-consuming process if the price of ETH/BTC moves wildly. Currently, Ethena has hundreds of millions of dollars ready to be able to exchange USDe for U.S. dollars at a 1:1 ratio, as it holds a large stable position. However, if Ethena accounts for an increasing proportion of total open interest (i.e., all open derivatives), this risk is relatively serious and could cause Ethena's net asset value (NAV) to decline by a few percentage points. However, in this case, the insurance pool is likely to fill the gap, which alone is not enough to cause a catastrophic failure of the protocol using it, which naturally leads to the next topic.

What are the risks of using Ethena as a protocol?

Broadly speaking, Ethena’s risks can be divided into two core risks: USDe liquidity and USDe solvency. USDe liquidity refers to the actual cash available willing to purchase USDe at a base value of $1 or 1% below that base value. USDe solvency means that even though Ethena may be out of cash at one point (such as after a longer period of withdrawals), it can obtain that cash if there is enough time to liquidate the assets. For example, if you lend $100,000 to a friend and he owns a house worth $1 million. It is true that your friend may not have ready money, and he may not be able to come up with it tomorrow, but if you give him enough time, he will probably be able to raise enough money to pay you back. In this case, your loan is healthy, your friend is just illiquid, that is, his assets may take a long time to sell. Bankruptcy essentially means that liquidity should be non-existent, but limited liquidity does not mean that the asset is bankrupt.

When Ethena works with some protocols (such as EtherFi and EigenLayer), it only faces significant risks if Ethena becomes insolvent. Other protocols, such as AAVE and Morpho, may face significant risks if Ethena's offerings become illiquid for an extended period of time. Currently, on-chain USDe/sUSDe liquidity is approximately $70 million. While there are quotes available through the use of aggregators stating that up to $1 billion in USDe can be exchanged for USDC at a 1:1 ratio, this is likely due to the huge demand for USDe at the moment, as this is intent-based demand, in This liquidity may dry up when Ethena experiences massive redemptions. When liquidity dries up, Ethena will be under pressure to manage redemptions to restore liquidity, but this may take time, and AAVE and Morpho may not have enough time.

To understand why this is the case, it is important to understand how AAVE and Morpho manage liquidations. Liquidations occur when debt positions on AAVE and Morpho are unhealthy, i.e. exceed the required loan-to-value ratio (ratio between loan amount and collateral). Once this happens, the collateral is sold to repay the debt, a fee is collected and any remaining funds are returned to the user. Simply put, if the value of the debt (principal + interest) approaches a predetermined ratio compared to the value of the collateral, the position will be liquidated. When this happens, the collateral will be sold/converted into debt assets.

Currently, many people use these lending protocols to deposit sUSDe as collateral to borrow USDC as debt. This means that if a liquidation occurs, large amounts of sUSDe/USDe will be sold for USDC/USDT/DAI. If this all happens at the same time, and is accompanied by other severe market moves, USDe will likely lose its peg to the US dollar (if the liquidation is very large, certainly in the case of around $1 billion). In this case, a large amount of bad debt could theoretically be incurred, which for Morpho would be acceptable since the vaults are used to isolate risks, although some revenue vaults would be negatively affected. For AAVE, the entire core pool will be negatively affected. However, in this potential scenario where it is purely a liquidity issue, there may be adjustments to how liquidations are managed.

If a liquidation could result in bad debt, rather than immediately selling the underlying assets into an illiquid market and letting AAVE holders bear the difference, AAVE DAO can assume liability for the tokens and positions, but not Sell the collateral immediately. This would allow AAVE to wait until the price and Ethena liquidity return to stability, allowing AAVE to make more money during the liquidation process (rather than a net loss) and for users to receive their funds (rather than receive nothing due to bad debt). Of course, this system only works if USDe returns to its previous value, if not, the bad debt situation will be even worse. However, if there is an as-yet-undiscovered high-probability event that could cause the token value to go to zero, then liquidation is unlikely to gain more value than waiting, which could be a 10-20% difference as individual holders realize and start selling positions faster than the parameters change. This design choice is important for an asset that may have liquidity issues in frothy markets, and may also be a good design choice for stETH before withdrawals are enabled on Beacon Chain, and if successful, it may also be a way to increase the AAVE vault/ An excellent way to insure your system.

The risk of bankruptcy is relatively reduced, but it is not zero. For example, let’s say one of the exchanges Ethena uses goes bankrupt. Of course, Ethena's collateral was safe with the custodian, but it suddenly lost its hedge and now must hedge in a potentially volatile market. Custodians can also go bankrupt, as @CryptoHayes pointed out when I spoke with him in South Korea. No matter what protections are in place around the custodian, there may be serious hacks or other issues, cryptocurrencies are still cryptocurrencies and there are still potential risks, even if those risks are extremely unlikely and may be covered by insurance, But the risk is still non-zero.

What are the risks of not using Ethena?

Now that we have discussed the risks of Ethena, what are the risks of protocols that do not use Ethena? Let's look at some statistics. Half of Pendle's TVL (at the time of writing) is attributed to Ethena. For Sky/Maker, 20% of revenue is attributable to Ethena in some way. About 30% of Morpho TVL comes from Ethena. Ethena is now one of the main drivers of AAVE's revenue and new stablecoin. The big-name platforms that don't use Ethena or interact with its products in some way have essentially been left behind.

There are some interesting similarities between Ethena's adoption and Lido's adoption in the protocol. Around 2020 and 2021, competition for the largest lending protocols intensified. Compound, however, is more focused on minimizing risk, perhaps to ridiculous extremes. AAVE integrated stETH back in March 2022. Compound began discussing adding stETH in 2021, but did not do so until a formal proposal was made in July 2024. This point in time happened to be when AAVE began to surpass Compound . While Compound is still relatively large, with $2 billion in total value locked, it's now just over a tenth the size of AAVE, which it once dominated.

To some extent this can also be seen in @MorphoLabs vs. @AAVELabs’ relative approaches to Ethena. Morpho started integrating Ethena in March 2024, while AAVE didn’t integrate sUSDe until November. There was an 8-month gap in which Morpho grew significantly and AAVE lost relative control of the lending space. Since AAVE integrated Ethena, TVL has increased by $8 billion and revenue for product users has increased significantly. This leads to the “AAVETHENA” relationship, where Ethena’s products create higher yields, which incentivizes more deposits, which in turn creates more borrowing demand, etc.

Ethena’s “risk-free” rate, or at least its “normal” rate, is about 10%. That’s well over twice the value of the FFR (risk-free rate), which is currently around 4.25%. The introduction of Ethena into AAVE, and specifically sUSDe, functionally increases the equilibrium interest rate for borrowing, as AAVE's "base" rate now inherits Ethena's base rate, which is close, if not exactly 1:1. This point has happened before after AAVE introduced stETH. The borrowing interest rate of ETH was roughly the same as the return rate of stETH.

In short, protocols that do not use Ethena may run the risk of lower yields and lower demand, but avoid the risk of severe USDe price decoupling or collapse, which is likely to be minimal. Some systems, like Morpho's, may be better able to adapt and avoid potential collapse because of their independent structure. So it's understandable that systems like AAVE, which are based on larger pools, will take longer to adopt Ethena. Now, while most of this is looking back to the past, I want to make some more future-focused points. Recently, Ethena has been working hard to integrate DEX. Most DEXs lack short selling demand, i.e. users who want to short a contract. Generally speaking, the only user types that can consistently do this at scale are delta neutral traders, of which Ethena is the largest. I believe that a perpetual contract platform that can successfully integrate Ethena while maintaining a good product can break away from the competition in a very similar way to how Morpho has broken away from its smaller competitors by working closely with Ethena.

Catherine

Catherine