Source: Mankiw Blockchain Law

Introduction:

In September 2021, the National Development and Reform Commission and other departments jointly issued the "About Rectifying Virtual "Notice on Currency "Mining" Activities" (hereinafter referred to as the "Notice"), the state does not allow mining. After that, chain games became popular. Is there any correlation between the two? Some people say that virtual currency mining is machine mining, and blockchain games are human mining. There is essentially no difference. So, under the background of domestic ban on mining, are there any legal risks in developing a blockchain game platform?

01 Is playing blockchain games mining?

Before answering this question, you need to understand two concepts: virtual currency mining and liquidity mining.

1. What is virtual currency mining?

The concept of “mining” in the blockchain refers to a reward behavior for blockchain miners. In order to encourage everyone to maintain data, the blockchain has set up a reward rule. Those who process the data the fastest and best and are recognized by the system can obtain a corresponding amount of virtual currency such as Bitcoin as a reward. Through this rule, they can obtain virtual currency. The way of currency is "mining", and those involved in data processing are "miners", responsible for transaction confirmation and data packaging.

2. What is Yield Farming?

Yield farming is a method in DeFi (decentralized finance). Application refers to the mechanism through which users provide token assets to support the liquidity of DeFi projects and thereby obtain income. For example, users deposit or lend tokens on the Compound lending platform to make the liquidity of the capital pool better, thereby receiving COMP governance token rewards. Liquidity mining is essentially a token distribution mechanism that makes DeFi applications more usable and promotes users to participate in DeFi businesses.

To put it simply, it can be understood that you can get income by depositing tokens, which is called "mining". It follows the concept of virtual currency mining mentioned above. The income from liquidity mining includes governance tokens and handling fees.

For example, if a new bank is opened, depositors will receive interest income/handling fees provided by the bank. In order to improve the liquidity of funds, in addition to interest, the bank also provides bank-issued funds to depositors. of stocks. As a bank grows bigger, the stocks in the hands of depositors become more valuable. If the bank collapses, the stocks in the hands of depositors become worthless. As long as there is money in your bank card, it provides liquidity for the bank's deposit and withdrawal business. But in the currency circle, this concept is called liquidity mining.

3. What is the relationship between playing blockchain games and mining?

After clarifying the above two concepts, let’s take a look at what the relationship between blockchain games and mining is?

Most of the chain game projects on the market require players to earn gold to participate. There are also certain thresholds for earning gold. First, you need to register a virtual currency wallet (such as MetaMask). In the virtual currency Purchase virtual currencies such as USDT in the exchange, and then use the virtual currency to buy game tokens on the chain game platform. After entering the game, depending on the game type, you can obtain more game tokens by upgrading, killing monsters, breeding pets, etc. These game tokens or props can be traded on virtual currency exchanges and exchanged for other virtual currencies. This behavior of buying and selling game tokens/props on chain game platforms and trading with other virtual currencies is subjectively because players want to make money while playing games. Objectively, it is a reflection of the different virtual currencies on the exchange. The exchange of currencies provides liquidity.

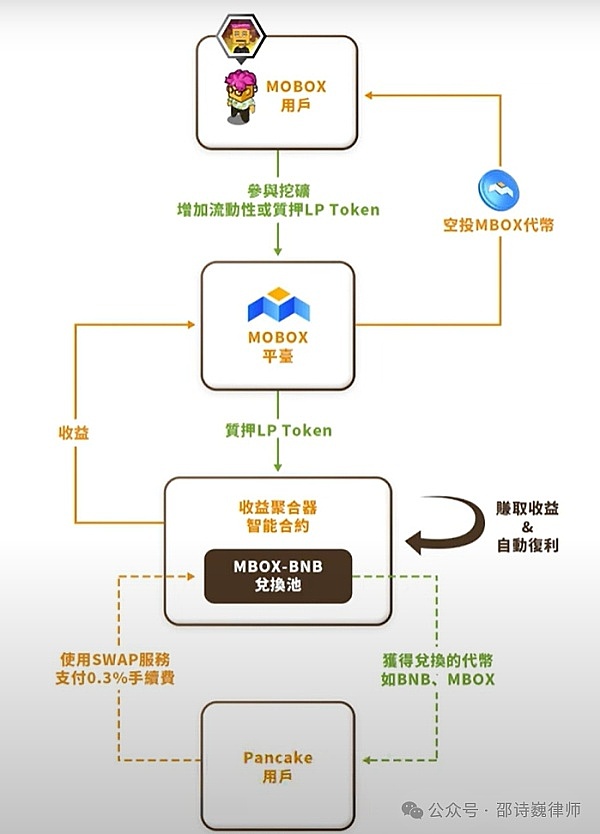

For example, Mobox, founded in 2020, is a chain game platform with DeFi liquidity mining as its core. A core gameplay of the Mobox platform is to use liquidity mining. Provide liquidity for Mobox token and BNB token transactions on a centralized cryptocurrency exchange), and pledge the collected LP tokens on Mobox to obtain airdropped Mbox tokens.

02 What are the legal risks involved in developing a chain game platform in China?

The common feature of virtual currency mining, liquidity mining, and the play to earn model in blockchain games is that it requires investing manpower and material resources to obtain proof of workload in exchange for benefits. . So does the 2021 "Notice" mentioned at the beginning of the article restrict "mining" in chain games? The answer is no limit.

Because the notice regulates virtual currency “mining” activities. Virtual currency mining requires the purchase of a large number of mining machines and computer graphics cards, which consumes a large amount of electricity. In practice, Bitcoin mining, for example, is more of a crime of theft (theft of electricity). Although liquidity mining and chain gaming are similar in principle to virtual currency mining, they do not actually consume a lot of electricity. , a waste of national energy.

If there are no restrictions on relevant policy risks in the "Notice", does that mean there are no legal risks? For chain game developers, there are two types of high-frequency legal risks that need to be paid attention to: the crime of opening a casino and the crime of illegal fund-raising.

For relevant legal analysis of the crime of opening a casino, please refer to Lawyer Shao’s previous article "Blockchain games that make money while playing, how to avoid becoming gambling?" ", today I will mainly talk about illegal fund-raising crimes.

Illegal fund-raising is not a specific crime. In the criminal law, it mainly refers to the crime of illegally absorbing public deposits and the crime of fund-raising fraud.

First, the crime of illegally absorbing public deposits. According to the "Interpretation of the Supreme People's Court on Several Issues Concerning the Specific Application of Laws in the Trial of Criminal Cases of Illegal Fund-raising", this crime can be summarized as having four characteristics: illegality, openness, inducement, and non-specificity.

Openness and non-specificity are characteristics of any chain game project, which mainly refers to public promotion to the society and attracting funds from non-specific users. Even if some projects use invitation codes and other methods with certain thresholds to participate in the game, there is no obstacle to being considered open in judicial practice.

Therefore, if the chain game platform wants to avoid the risk of being suspected of being illegal as much as possible, it needs to eliminate "illegality" and "incentiveness" in the platform gameplay. To expand, "illegality" refers to the fact that according to the "Announcement on Preventing Financing Risks of Token Issuance", domestic platforms are prohibited from engaging in the exchange business between legal currencies, tokens and "virtual currencies", and are not allowed to buy, sell or act as The central counterparty buys and sells tokens or "virtual currencies". "Incentive" means that during the game promotion process, it promises users to maintain principal and interest or pay income returns.

Second, The crime of fund-raising fraud. It refers to behaviors such as squandering the funds raised for the purpose of illegal possession, using them for illegal and criminal activities, concealing, and evading the return of funds. Although blockchain games are a type of application based on the decentralization and non-tampering characteristics of blockchain technology, it is undeniable that domestic blockchain games cannot be completely decentralized. Among public chains, private chains, and alliance chains, only the public chain is highly decentralized. Private chains have limited nodes, and it is theoretically possible for organizers to collude with multiple malicious players to harm other players.

03 Written at the end

Through the analysis of this article, It can be concluded that "mining" of chain games will not involve the policy risks of virtual currency mining. Chain game platform entrepreneurs need to pay more attention to the legal risks of illegal fund-raising. It is recommended that the "illegality" and "incentiveness" of the platform's gameplay be avoided through compliant publicity and gameplay design. In addition, relevant agreements need to be signed within the partners to prevent some shareholders from harming the interests of the platform and players, thereby causing disaster. and other shareholders.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Finbold

Finbold