Author: Nancy Lubale, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

The altcoin market has been trending downward since the 2024 bull run hit a roadblock in March, but some key indicators suggest that the recent recovery could be a signal of a "massive move" in the future, according to cryptocurrency analysts.

Are altcoins ready to take off?

From a technical perspective, the altcoin market is showing strength as it remains above an ascending trendline supporting TOTAL2 - the cumulative market capitalization of all cryptocurrencies other than Bitcoin since the 2017 bull cycle.

"Altcoin market capitalization is currently testing long-term trendline support that has remained strong for the past eight years," independent cryptocurrency analyst Mags said in an X post on October 26.

A retest of this multi-year support line is a bullish indicator that the downtrend is easing, while increased buying from current levels could push altcoin prices higher.

“With BTC also breaking out, the market appears ready for a massive move,” the analyst added.

“It’s time to push it higher.”

If BTC price decisively closes above this level and TOTAL2 holds above long-term trendline support, it could indicate that the market is ready for a massive rally.

Altcoin market cap. Source: Mags

Meanwhile, analyst Moustache noted that a breakout of the expanding wedge is to be closely watched.

“I think it’s inevitable that TOTAL2 will break out of the 7.5-month descending expanding wedge over the next 1-2 weeks,” Moustache explained in an Oct. 26 X post.

TOTAL2’s 11% drop from $981 billion to $873 billion between Oct. 21 and Oct. 25 may just be a “bias,” according to Moustache, as prices struggle to recapture a trendline that has been acting as support since Sept. 26.

“Altcoins are long overdue for a big rally.”

TOTAL2 daily chart. Source: Moustache

It’s Still the Season for Bitcoin

Bitcoin dominance — a measure of Bitcoin’s market share relative to the entire cryptocurrency market — is one of the indicators commonly used to indicate whether altcoin season has begun. It can provide traders with an overall picture of investor sentiment and risk appetite in the market.

The indicator has been trending upward since the beginning of 2023, reaching a three-and-a-half-year high of 59.75 on October 25.

As of the time of publishing, BTC dominance is 59.56%, maintaining an upward trend, indicating thatit’s still “Bitcoin season.”

Bitcoin market dominance. Source: TradingView

Popular cryptocurrency YouTuber Crypto Banter said that once Bitcoin’s dominance drops significantly, a “parabolic” altcoin season phase will occur.

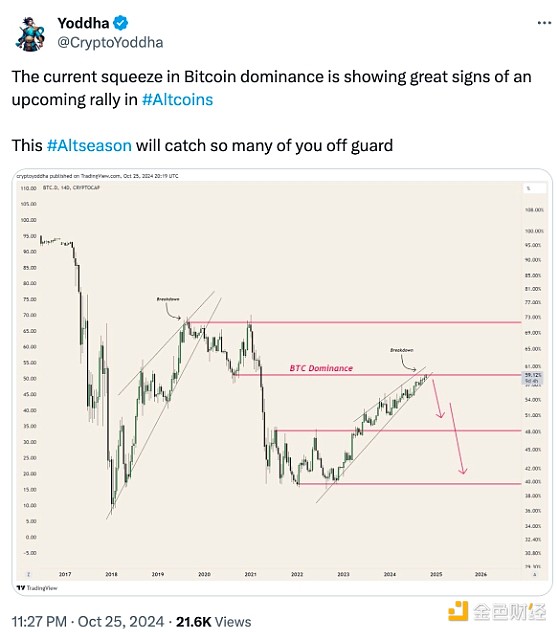

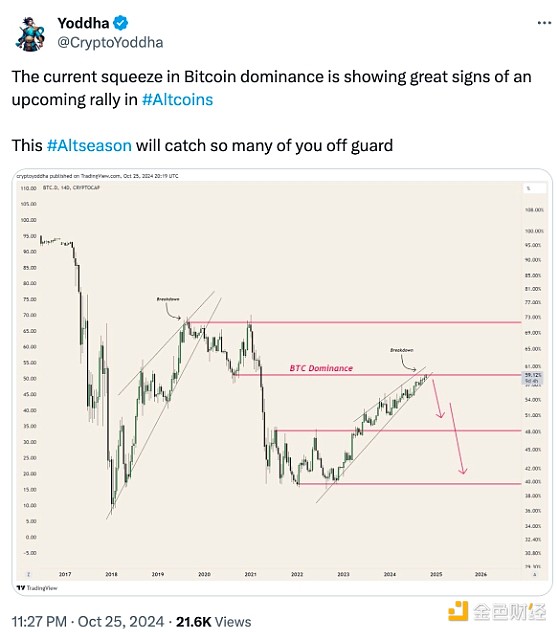

Yoddha, an anonymous cryptocurrency analyst, believes that Bitcoin’s dominance may “squeeze into” an ascending wedge, foreshadowing an imminent rebound in altcoins.

Source: Yoddha

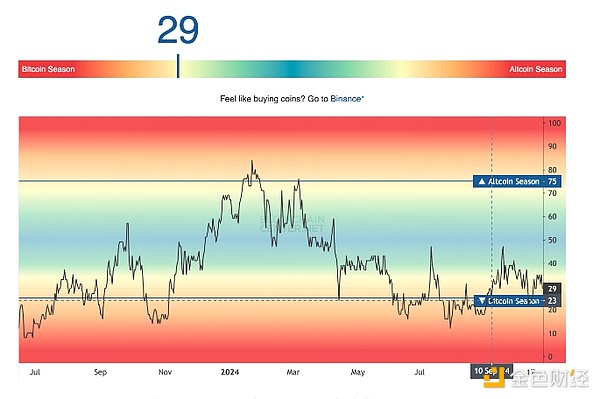

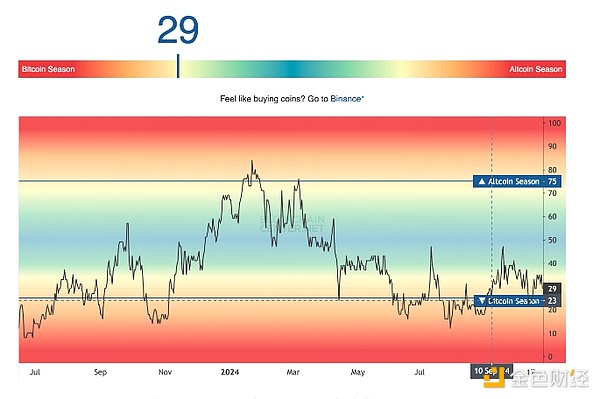

At the same time, Bitcoin’s current dominance means that altcoins are still underperforming BTC.

According to data from the Blockchain Center, only 29% of the top 50 altcoins have outperformed BTC in the past three months, far from the 75% level required for official "altcoins".

Altcoin Seasonal Index. Source: Blockchain Center

Aaron

Aaron