Author: Stephen Katte, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Cryptocurrency executives say memecoins play an important role in attracting people to the cryptocurrency space, but the lucrative returns that have attracted new investors may not last.

During an August 13 panel discussion at the Canadian Futurists Conference, Appchain Noble CEO Jelena Djuric said that while the memecoin season is still moving forward, she is skeptical about its longevity in the market.

“Similar to ICOs and NFTs, it won’t last forever and it will be interesting to see what happens next because it will inevitably end.”

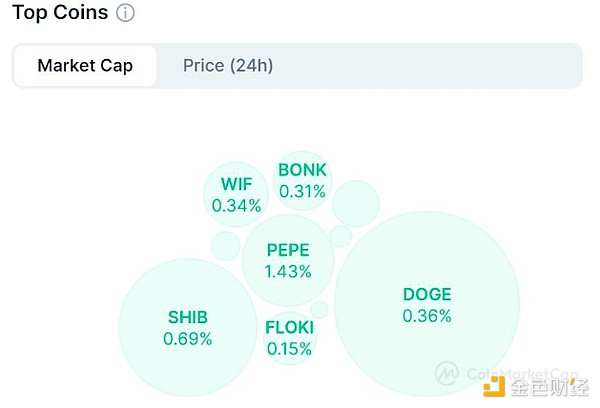

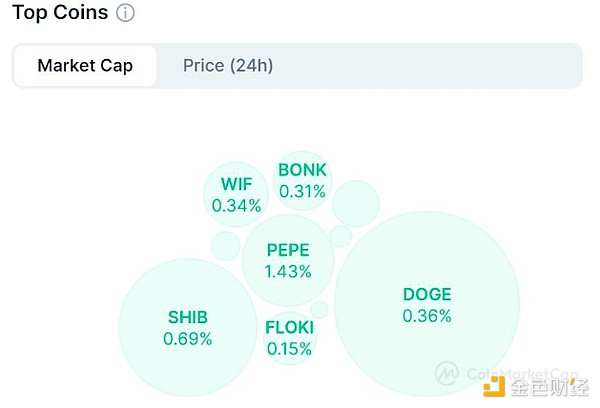

As of August 14, Coingecko listed 1,673 memecoins with a total market value of approximately $41 billion.

However, Djuric believes that memecoins are just the latest stage of “retail mania” in cryptocurrency. WonderFi’s Dean Skurka, Blossom’s Maxwell Nicholson and Noble’s Jelena Djuric at the Canadian Futurists Conference. Source: Cointelegraph “The initial phase, the first phase was obviously the ICOs in 2017, which was the first opportunity for retail investors to get decent returns,” she said.

“You don’t really have that opportunity anymore, even though we still have token launches, layer 2s, and Cosmos chain launches. You don’t really have the same opportunity for returns.”

The initial coin offering (ICO) boom began in 2017, raising an estimated $4.9 billion. By 2018, that number jumped to $33.4 billion. By 2019, however, that number had fallen to just over $370 million.

Non-fungible tokens (NFTs) are another example, Djuric said. NFTs have surged in popularity in 2020, and so have their prices.

On February 21, 2021, digital artist Mike Winkelmann, aka Beeple, made history when his NFT artwork “Everydays: The First 5000 Days” sold for more than $69 million. The current price on Coingecko is 6.99 Ethereum, or about $19,009.

NFT market cap peaked at $320 billion. As of August 14, its market cap was about $74 billion. Source: CoinMarketCap

“I think the emergence of Memecoins was a great opportunity when Solana’s gas fees were clearly very low and the Solana chain had demonstrated its ability to facilitate this high-volatility trading,” said Djuric.

“Secondly, you have the appetite. You have that latent demand. We’ve had a couple of years since the DeFi summer and the NFT craze, and I think it just happened to be born out of a perfect opportunity.”

Crypto platforms should embrace memecoin

It’s unclear whether memecoin will go the way of ICOs and NFTs. Dean Skurka, president of asset manager WonderFi, said platforms should embrace them while they’re still popular.

“I think there’s a clear trend here that there’s a real social element, a community element to retail trading in general, and certainly with memecoin. I think it’s important for platforms like ours to embrace it,” he said.

Although they started out as jokes, Pepe, Dogecoin, and Shiba Inu have all gained significant market capitalizations. Source: CoinMarketCap

Skurka believes that embracing trends as they emerge and promoting relevant conversations is a good opportunity to attract more people to the ecosystem and retain them.

“Not every memecoin, investment or speculative investment will end in success, but it does bring people into the ecosystem,” he said.

“From there, it’s a matter of education and persistence, and finding a balance between speculative investments and more stable investments like Bitcoin and Ethereum.”

Maxwell Nicholson, co-founder and CEO of digital investment platform Blossom, agrees that speculative assets like memecoins attract people to the space and may cause them to stay and diversify their holdings.

Nicholson said the 2022 bear market was a first for many people. They entered the space during the previous bull market and experienced the market’s volatility for the first time.

“They really got ripped off. It really teaches people maturity. We’re seeing a lot of people starting to diversify their portfolios,” he said.

“A lot of people are really starting to buy more large-cap blue chip stocks, both in crypto and in the stock market.”

Nicholson said this could be “good for the market” because if too many people get ripped off, it turns people off from crypto.

“It turns people off from the stock market and some people may never go back to the stock market.”

“A lot of people don’t go all-in on these speculative assets at the beginning, but rather put a small portion of their portfolio, say 5% to 20%, in the more speculative assets and put the bulk of their portfolio into longer-term investments,” he added.

Joy

Joy