Author: Crypto_Painter Source: X, @CryptoPainter_X

This bull market:

1. Slow growth, no money-making effect like in previous bull markets;

2. Poor liquidity, most of the high-market-cap altcoins except BTC have not reached new highs;

3. Lack of traffic, social media attention is much lower than in previous bull markets;

Talk about these 3 points systematically:

1. Is this bull market rising slower than previous bull markets?

Judge whether this bull market is rising fast or slow? This is a technical issue. The momentum of price increases is not simply determined by the speed of change, but by its sustainability. For example, assuming that a bull market takes one year to complete, then if this bull market fluctuates at a low level in the first 11 months of the year, but rises by 300% in the last month, and then peaks and enters a bear market, would you call this a bull market?

Although the price rose very fast in the last month, this kind of market situation does not represent the continuous demand in the market, and can only be regarded as the main force operation, which is more common in the market of small-cap altcoins. This kind of bull market has only one purpose: to increase shipments;

So for BTC, the bull market we need to see is a long-term process with long-term sustainability, continuous buying and rising prices. This structure corresponds to the long-term strong demand, indicating that people are truly buying, holding and holding for a long time.

We can analyze the price growth rate of each round of bull market from three dimensions;

They are: the duration of the bull market, the increase brought by the bull market and the kinetic energy in the bull market process;

As shown in the figure:

In order to make a fair comparison with the current bull market, I will use the same structural interval to calculate the average daily price increase%;

The corresponding intervals are all the early brewing stage of a bull market, that is, the period from the lowest point to the time when the price just broke through the new high and fluctuated near the previous historical high;

Dividing the price increase during this period by the number of days it lasted, it can be concluded that the rate of increase in the early trend stage of the last three bull markets is indeed gradually declining, with an average daily increase of 1.10%, 0.71% and the current 0.65% respectively;

From this point of view, this bull market is indeed rising slowly.

Next, let's take a look at price momentum:

As shown in the figure, the following three charts correspond to the performance of BTC prices on the ASR-VC trend indicator after they first broke new highs in 2017, 2020, and 2024:

March 2017

December 2020

March 2024

At first glance, it seems that there are obvious differences;

After the previous two prices broke through the historical high, there were different degrees of deep corrections, but these corrections have one feature, that is, they did not destroy the trend strength of the original upward channel. The green middle track line in the figure always keeps going up, while in the current market, the middle track of the green channel at the daily level has almost flattened, which has never happened in history;

On the other hand, it is worth noting that after the previous two prices had deep corrections, they successfully broke through when they tested the previous historical high for the second or third time, thus creating a new strong bull market, while the current situation is that there have been multiple consecutive tests, and none of them have been able to create a strong bull market;

Although the overall liquidity level cannot absolutely reflect the rise and fall of prices, the liquidity level can determine the upper limit of price increases;

The overall liquidity level of the cryptocurrency market is mainly observed through two aspects: on-site liquidity and off-site liquidity;

On-site liquidity generally refers to assets that have been exchanged for stablecoins or cryptocurrencies through legal currency, which is reflected in the total market value of stablecoins on the chart;

While off-site liquidity generally refers to global liquidity, which can be more specifically expressed as net US dollar liquidity, which is reflected in the chart as the balance sheet of the Federal Reserve minus a series of deposit items in the US dollar fiscal account;

First, let's look at on-site liquidity, that is, the performance of the market value of stablecoins in the past two bull markets. Because USDC and DAI appeared later, we will start with USDT alone;

It can be seen that before the last bull market completely broke through the 20,000 mark, the market value of USDT was compared with the market value level when the bull market peaked in 2017, and it had increased by 18.7 billion US dollars. To put it bluntly, when the price returned to the same position, USDT had 18.7 billion more than before;

Then look at the current bull market, under the same conditions, USDT's market value has increased to $38.5 billion, but the increase is only 52.16%. Note that although the total market value is indeed higher than the previous bull market, the price of BTC is completely different;

That is to say, because BTC's previous historical highs are different, the liquidity required for a breakthrough must also be different;

We simply use the price ratio to convert:

$69000 / $20000 = 3.45

18.7 billion x 3.45 = 64.5 billion

That is to say, if the current bull market is to achieve the same breakthrough as the previous bull market, we currently need USDT's market value to be $64.5 billion higher than the peak level of the previous bull market;

left;">That is to say, the additional $38.5 billion added to the current market is not enough, and the overall liquidity of this bull market is insufficient compared to the previous bull market;

You will definitely say, "You don't count other stablecoins, isn't that rogue?"

Okay, let's calculate the performance of the three major stablecoins USDT+USDC+DAI and see:

As shown in the figure, I not only added USDC and DAI, but also added the net inflow of BTC's spot ETF. It can be seen that the on-site liquidity of this bull market has indeed increased a lot, reaching $50.9 billion;

and the on-site liquidity before the last bull market broke through completely increased by $22 billion;

But the question is, without these 250, will we be unable to break through?

I personally think that it is not necessarily the case. The key point is whether liquidity can continue to increase. That is to say, if there are three more months of fluctuations in the future, but during these three months, the incremental liquidity brought by "stablecoin + ETF + Hong Kong ETF" gradually reaches a level of more than 20 billion, then we can smoothly break through the previous historical high and stay away from this disgusting range;

However, the current situation is indeed not optimistic, because the increase in stablecoins has stagnated, and whether the net inflow of ETFs can continue to maintain a sustained inflow after a short week of explosive volume is still unknown;

The following figure shows the market value trend of stablecoins and the weekly net inflow level of ETFs in the past three months:

At the same time, since stablecoins have no new liquidity, but the net inflow of ETFs has begun to recover in the past month, the price of BTC has gradually rebounded without a significant change in the market value of stablecoins;

You may be curious why BTC has entered an extremely shrinking and sideways trend every weekend. The above chart explains the cause of this phenomenon. Because the stablecoin funds in the market have completed the game, the price of BTC is more susceptible to the influence of ETFs, so liquidity will only be restored during the opening of the US stock market;

Therefore, the most important thing to pay attention to at the moment is whether the market value of stablecoins can go in a new direction. If it goes up, it must be waiting for some long-term positive macro data, and BTC will be able to formally break through the current range when the additional liquidity is gradually sufficient;

Conclusion: This round of bull market is indeed different from the previous bull market. It went too fast in the early stage, resulting in the current time can only be exchanged for space. If it can maintain the current range for a long enough time and liquidity continues to increase, it will eventually break through. If it accidentally falls below the range and liquidity begins to shrink and outflow, the bull market is likely to end early;

Since we have mentioned the macro, let's talk about OTC liquidity, that is, net US dollar liquidity;

Because this part involves too much macro content, I can only make a simple comparison, as shown in the figure:

![Bull Market]()

In the early stage of this bull market, not only did the external net US dollar liquidity not increase, but it also shrank by US$857.1 billion, a decrease of 12.22%.

This seems to explain why the accumulation of liquidity in the current bull market is far less than that in the previous bull market. Obviously, the external environment is not a state of abundant liquidity;

But even so, if you look closely at the blue net liquidity curve of the US dollar, the overall performance in the past year is oscillating upward, that is to say, although the overall liquidity is insufficient, at least it has been in a state of slow growth in the past year;

In such a harsh external environment, BTC still has a short-term high. To be honest, if the proportion of liquidity diverted from the US dollar to BTC in the past bull market was only (220/14330) 1.5%, the diversion ratio in the current bull market may have reached (509/5692) 8.9%!

This represents that the trust and favor of traditional capital for BTC has reached a new level!

From this perspective, this round of bull market is indeed different from the previous bull market. The overall environment is very bad, and the whole class did not perform well, but BTC can at least rank in the top 5, especially when Nvidia ranked first in the class, BTC's performance is already very good!

The liquidity link ends here, and there is another point about the issue of media attention

3. Compared with the previous bull market, are there fewer people paying attention to this round of bull market?

First of all, the conclusion is yes!

For practitioners or traders in the cryptocurrency industry, it seems that BTC has been the focus of global attention in the past two years, but in fact, at least from a data perspective, the results are disappointing;

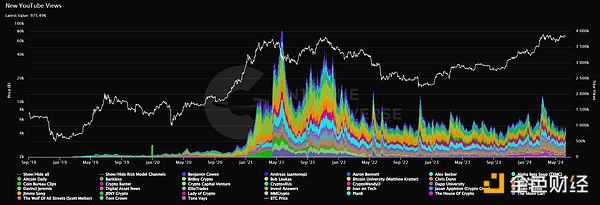

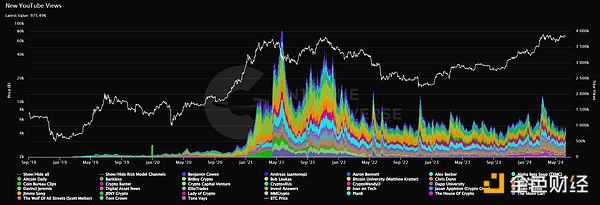

As shown in the figure, this is the video views of all BTC-related channels on YouTube in the past five years. You can clearly see that the highlight moment of BTC is the bull market in 2021, and in this round of bull market, both the attention and topic popularity are not as good as before!

A sad fact: when BTC broke through the historical high of 69,000, the popularity on YouTube was not as high as when FTX exploded. . .

However, if we still compare it with the previous price breakthrough of the historical high, the data is still much better than in the past. This shows that if the price of BTC can continue to be strong in the future and once break through the $100,000 mark, these long-silent leeks will still come back!

Conclusion: From the perspective of social media, this round of bull market is not much different from the past bull market. BTC has achieved social media normalization, especially in the current market that is gradually becoming US-based, the attention of the majority of leeks is far less important than in the past bull market.

Huang Bo

Huang Bo