Source: The Surplus of the Rich

This article is a sequel to the article "The King of Sichuan is here and doesn't pay taxes?"

In yesterday's article, we mentioned that from the founding of the country until 1913, the entire United States had no income tax as a whole.

Then, the question is:

Before 1913, what did the U.S. federal government rely on to survive?

The answer is:

Tariffs, consumption taxes and land sales revenue.

On October 31, 2024, Trump first proposed to consider replacing income tax with tariffs at a closed-door meeting with some Republican lawmakers on Capitol Hill.

Is this feasible?

Then, we have to talk about the issue of U.S. tariffs.

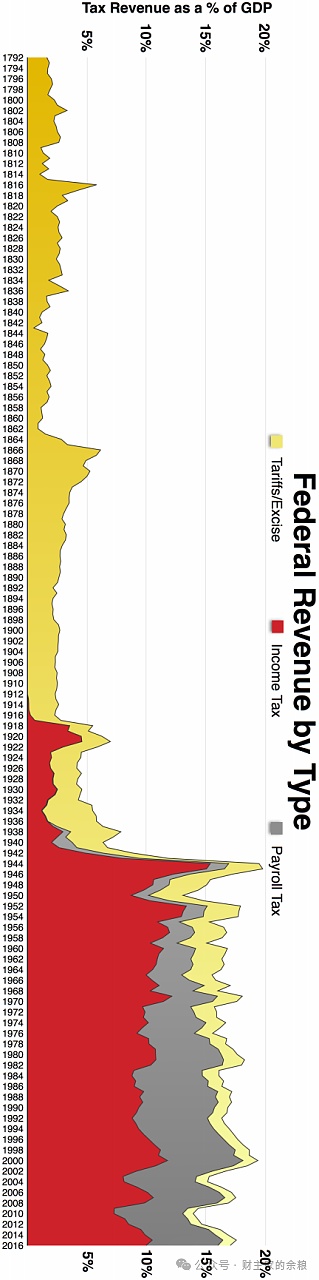

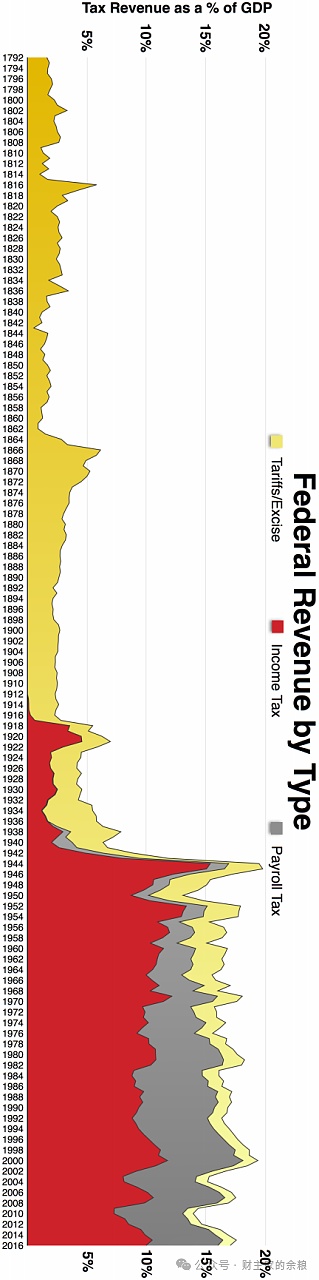

Let's take a look at the ratio of tariffs/consumption taxes, income taxes, and social security taxes to the US GDP since the establishment of the US federal government in 1792 (please view in horizontal mode).

(To put it simply, income tax refers to the tax on the income of enterprises and residents, while social security tax is the social security payment deducted from personal salary income after the establishment of the social security system. Tariffs are taxes imposed on imported goods, and consumption taxes are taxes on domestic consumption of goods).

From the chart, we can observe that from 1792 to 1912, during these 120 years, the US federal government's income tax and social security taxes were close to 0, with only tariffs and consumption taxes.

Income tax originated from the 16th Amendment to the Constitution in 1913, which stipulates that the federal government has the right to levy income tax on institutions and individuals; As for social security tax, it originated from the Social Security Act passed by the US Congress in 1935. The bill established a pension system for the working population in the United States, and later gradually expanded to other groups, eventually forming a social security system. Social security benefits are called wage tax or social security tax.

Since the establishment of the United States, it has been a metal currency era for about 100 years. Only gold and silver are currencies. The government cannot print money casually. It can borrow money to spend money, but it must eventually be repaid with metal currency, which is equivalent to putting a tight ring on the government's head.

At this time, the US government mainly survived on tariffs, and the amount of tariffs itself was not large, accounting for only 2-3% of the total US GDP, so the federal government's income was just that little.

Under such circumstances, the government must be prudent and frugal in spending, and spend within its means - it is absolutely unlike today's federal government, which spends money like water and has no sense of fiscal responsibility. It borrows money when it has no money, and never thinks about paying it back. The US national debt has piled up to a terrifying level of 35 trillion US dollars, with each American owing an average of 100,000 US dollars.

Because the government has little income, it will not think about "spending money to do big things". The government rarely intervenes in people's lives, work and economic activities. Therefore, for more than 100 years after its founding, the United States has been a social model of "small government, big society". It was the most economically free country among the major countries in the world at that time. Those in Europe who wanted to pursue religious freedom, economic freedom and the American dream immigrated to the United States in droves.

Until the eve of the outbreak of the First World War, even with the consumption tax revenue and the land sales revenue, the total revenue of the US federal government accounted for less than 5% of the GDP at that time.

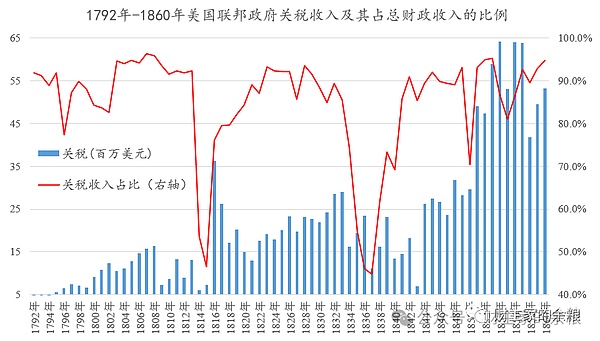

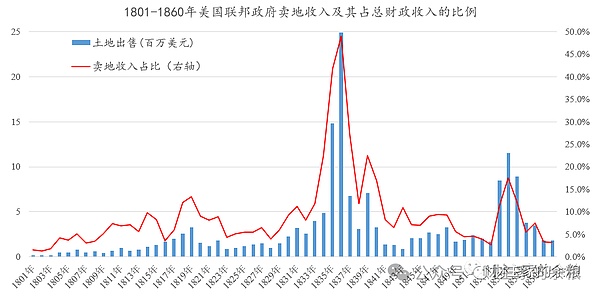

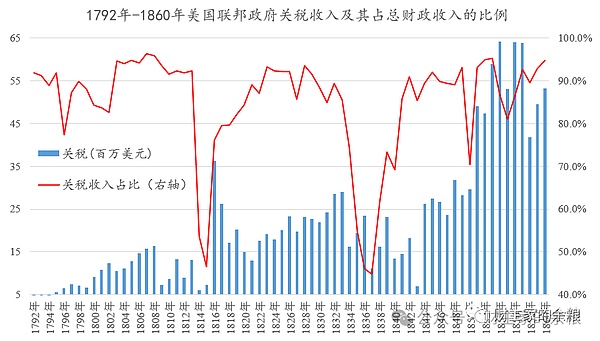

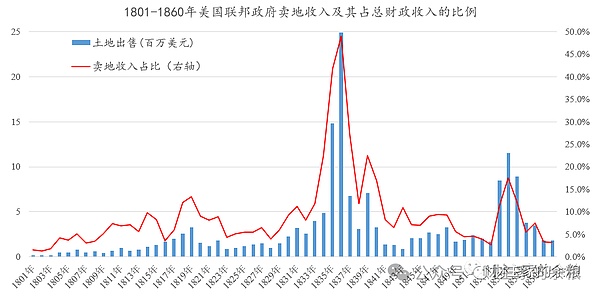

I wrote an article that listed the tariff revenue and land sales revenue of the U.S. federal government from its establishment in 1792 until the outbreak of the Civil War.

Trump said that replacing income tax with tariffs was not a whim, but a well-thought-out decision with a strong historical heritage. After all, the U.S. government has been supported by tariffs for hundreds of years.

In order to illustrate the difference between the previous US government and the current US government, and how shameless the current federal government is in spending money, I will give you some data:

From 1789 to 1849, over a period of 60 years, the total revenue of the US federal government was 1.16 billion US dollars, the total expenditure was 1.09 billion US dollars, and the surplus was 0.7 billion US dollars. In 1849, the annual GDP of the United States was 2.4 billion US dollars;

From 1850 to 1900, over a period of 50 years, the total revenue of the US federal government was 1.446 billion US dollars, and the total expenditure was 1.545 billion US dollars. The deficit is 0.99 trillion U.S. dollars, and the annual GDP of the United States in 1900 was 20.6 billion U.S. dollars;

From 2017 to 2020, in 4 years, during Trump's first presidency, the federal government's total revenue was 13.53 trillion U.S. dollars, total expenditure was 19.09 trillion U.S. dollars, and the deficit was 5.56 trillion U.S. dollars. In 2020, the U.S. GDP was 21.3 trillion U.S. dollars;

From 2021 to 2024, in 4 years, during Biden's presidency, the federal government's total revenue was 18.31 trillion U.S. dollars, total expenditure was 25.98 trillion U.S. dollars, the deficit was 7.67 trillion U.S. dollars, and the U.S. GDP was 29.35 trillion U.S. dollars in 2024.

From the perspective of their responsible attitude towards national finances, Biden and Trump are the most shameless, most extravagant, and most irresponsible presidents in the history of the United States. It is really magical for Trump, the most irresponsible spender in history, to say that the federal government should save money and replace income tax with tariffs!

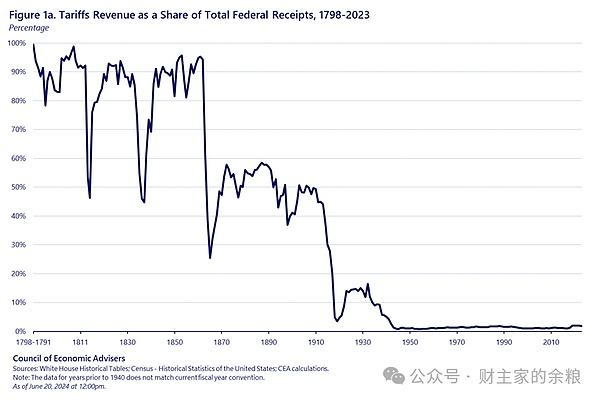

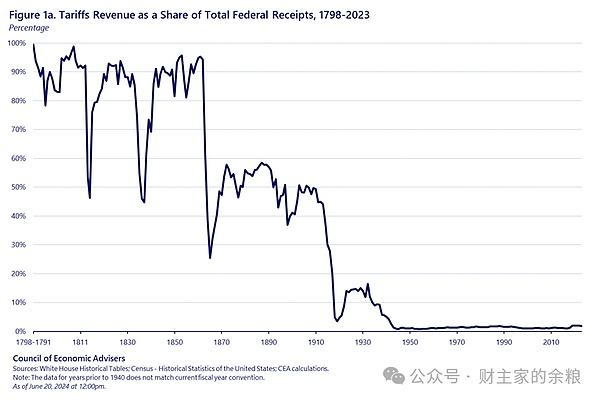

The following chart shows the proportion of tariffs in the total federal fiscal revenue of the United States from independence to 2023.

According to the above chart, except for a few years when the revenue was derived from selling land, before the outbreak of the Civil War, tariff revenue accounted for more than 90% of the federal fiscal revenue. After the outbreak of the Civil War, in order to raise war expenses, the federal government began to significantly increase various consumption taxes and temporarily increased income taxes, which reduced the proportion of tariffs in federal revenue to about 50%.

In 1913, after the obstacles to the federal government's income tax were removed at the constitutional level, the proportion of tariffs in government fiscal revenue was truly significantly reduced to less than 10%.

However, during the Great Depression, the US Congress came up with the infamous "Smoot-Hawley Tariff Act", which raised tariffs and caused the global economic depression to last for 10 years. During this period, the proportion of US tariff revenue to total federal fiscal revenue rose to about 15%.

After the end of World War II, the United States took the lead in establishing a global economic order with the US dollar as the global currency, the General Agreement on Tariffs and Trade (GATT, later changed to the World Trade Organization WTO) as the trade basis, and the IMF, the World Bank, and the World Bank for Settlements as the financial framework. The promotion of free trade around the world has led to a significant decline in US tariff revenue, and its share in US fiscal revenue has even dropped below 5%. In the latest 2023 and 2024, tariff revenue accounts for less than 2%.

In fiscal year 2023, the U.S. federal fiscal revenue was 4.47 trillion U.S. dollars, of which tariff revenue was 80.3 billion U.S. dollars, accounting for 1.8%;

In fiscal year 2024, the U.S. federal fiscal revenue was 4.92 trillion U.S. dollars, of which tariff revenue was 77 billion U.S. dollars, accounting for 1.6%;

In contrast, the total U.S. income tax revenue was 2.6 trillion U.S. dollars and 2.96 trillion U.S. dollars in fiscal years 2023 and 2024 respectively.

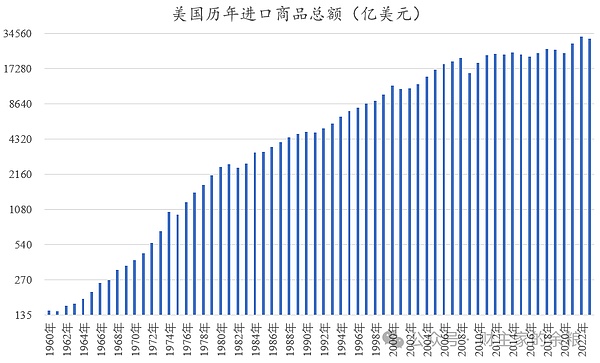

Trump said that he wanted to completely replace income tax with tariffs, so first we need to see how much the total amount of goods "imported" by the United States each year is, and whether we can increase taxes by 10, 20, or 50 times from this?

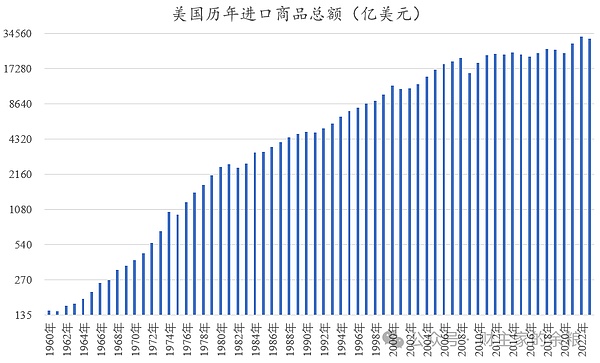

From 1960 to now, the annual import value of goods in the United States has soared from 14.7 billion US dollars to about 3.2 trillion US dollars now, and has basically stabilized at about 3.1 trillion US dollars in the past three years.

Many people use calculators to calculate that the average customs tariff rate in the United States is only 2%. It imports 3 trillion US dollars of goods each year and receives about 80 billion US dollars in tariffs. If it is increased to 70% or even 100%, wouldn’t it be possible to receive 2 trillion or even 3 trillion US dollars in tariffs?

Alternative income tax is completely feasible!

This kind of linear thinking reminds me of what someone said -

You are so stupid, and you are nothing!

Let’s take a look at the history of the average tariff rate on US imports…

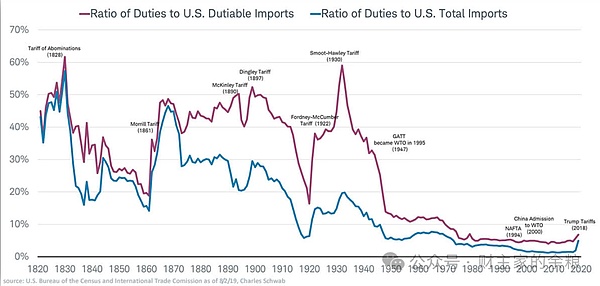

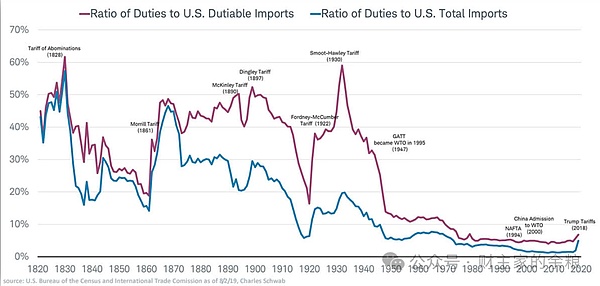

The chart below shows the average tariff rate on all US imports and taxable goods from 1820 to the present…

As you can see, even after the disastrous Smoot-Hawley Tariff Act was signed in 1930, the average tariff rate on US taxable goods soared to 59.1%, but the average tariff on all imported goods was only 20%.

Even if Trump launched a trade war against China in 2018, the average tariff rate on all US imports was only 4-5%, and it returned to around 2.5% in 2023 and 2024.

Can anyone imagine what it would be like to impose a 100% tariff on all US imports?

It is impossible for Trump to raise the tariffs on all imported goods to 100%!

First, because there is such a low tariff rate of 2%, the import volume of the United States can reach such a high level. If you add a 50% tariff, it means that imported goods become extremely expensive, and Americans can't buy so many things. Moreover, this thing is nonlinear, that is to say, if your import tariff rate increases a little, your import amount may drop significantly. Don't say that you raise the tariff rate to more than 50%. Even if you raise the average tariff rate to more than 20%, the import amount may be halved, halved, or even halved again. You simply can't receive so much money.

Second, other countries will not be stupid enough to bear the tariffs of the Trump administration. They will take retaliatory measures and add their own tariffs. In this way, the exports of the United States will also be greatly affected. As the world's largest importer, if the United States opens an era of high tariffs and other countries follow suit, the largest globalization in human history since World War II will be completely over. Just as the world fell into a deep economic depression after the signing of the Smoot-Hawley Act in 1930, if Trump dares to increase tariffs to such a high level, it will definitely push the entire world economy into a catastrophic abyss. The Great Depression brought out Hitler, Mussolini, and Tojo Hideki. What kind of monsters will appear in the world this time? We can only pray for good luck... Third, even if Trump insists on imposing such high tariffs, most of the industrial products consumed by Americans on a daily basis are actually imported, including the goods they wear and use on a daily basis, and even most electronic products are produced abroad. If the Trump administration really imposes such high tariffs indiscriminately, the domestic inflation rate in the United States will immediately soar, and the American people will not be able to bear it and will rebel. You know, Trump also boasted during the campaign that he could reduce inflation when he came to power!

Fourth, a sharp increase in tariffs without market expectations will only lead to the collapse of the US import and export industries. The collapse of these two industries means an extreme credit crunch worldwide, which is extremely fatal in the contemporary financial system and is likely to lead to a depression in the US economy and the global economy;

Fifth, if global trade collapses due to Trump's high tariffs, then the US dollar, which has served as the world currency since World War II, will have no great significance.

It is precisely because the United States continues to import goods and has a large trade deficit for decades, exchanging the US dollars made of waste paper for goods produced by other countries with real gold and silver, that the US dollar has a circulating status in the world. If global trade collapses, what are people doing with such high US dollar reserves? Waiting for Trump to pay back $1 trillion with 1 Bitcoin?

And so on, and so on, there are many other reasons that are beyond Trump's control.

In order to illustrate the impact of the surge in tariffs, let us briefly introduce the Smoot-Hawley Tariff Act and its subsequent impact.

In the 1928 presidential campaign, Republican candidate Hoover proposed to raise tariffs on agricultural products and protect American agriculture. This was his campaign promise. After Hoover really came to power, the more radical Republicans Smoot and Hawley proposed the Smoot-Hawley proposal in April 1929 to impose tariffs on more than 20,000 imported goods at the time.

These two guys.

At that time, the United States had been the world's largest economy for more than 30 years, and its foreign trade volume had always been the world's largest. In April 1929, the proposal was submitted to the U.S. House of Representatives and passed by the House of Representatives on May 28, but most economists believed that the bill would be difficult to pass in the Senate, and even if it was passed in the Senate, it would be vetoed by President Hoover.

In 1929, the United States, although economic growth seemed to be still strong, was also facing the risk of recession. The labor market had begun to decline, and politicians began to point the finger at foreign countries. As time went on, there were more and more signs that the bill might be passed in the Senate. By October 1929, when people learned that the bill was likely to be passed by the Senate, the U.S. stock market immediately reacted and began to plummet on October 24.

So, the U.S. stock market crash in 1929 did not break out without warning or inexplicably!

Not only that, when the governments of other major economies in the world learned that the bill had been passed by the House of Representatives, boycotts broke out immediately, and foreign governments began to increase tariffs on American products. By September 1929, the Hoover administration had received protest notes from 23 trading partners, but the threats of retaliatory actions were ignored by the US President - I am the president elected by the Americans, not by you, so who cares! On March 24, 1930, the court draft was passed by the Senate; on June 13-14, 1930, the revised bill was passed by both the Senate and the House. Although Hoover himself opposed the bill with economists, calling it "vicious, blackmailing and disgusting", he was influenced by his party, his cabinet and business leaders and finally signed the bill on June 17, 1930, making it a formal law.

The global trade system and economic order that was established with great difficulty after the First World War began to collapse in 1930.

In May 1930, Canada, the most loyal trading partner of the United States, retaliated by imposing new tariffs on 16 products. Germany established a trade system through liquidation. Subsequently, Cuba, Mexico, France, Italy, Spain, Argentina, Australia, New Zealand, Switzerland and all Commonwealth countries retaliated against the United States with tariffs.

At first, the tariff policy seemed to benefit the US manufacturing industry. Factories, construction contracts and industrial production that originally relied on foreign supplies increased dramatically. However, the global economy was already closely linked at this time. Because normal trade was forcibly interrupted, many industries began to face crises.

The export industry collapsed first, with exports of $5.4 billion in 1929 falling to $2.1 billion in 1933. Exports to Europe dropped from $2.3 billion to $800 million in 1932.

The import industry collapsed soon after, with exports of $44 billion in 1929.

The GDP of the United States increased from 1.6 billion U.S. dollars in 1929 to 1.5 billion U.S. dollars in 1933, of which imports from Europe dropped sharply from 1.3 billion U.S. dollars to 400 million U.S. dollars.

Affected by these two industries, other industries also began to gradually fall into a deep depression, and the import substitution industry, which had been prosperous for several months, also began to fall into a deep recession because the cost was too high for the whole society to afford.

The decline of many industries brought countless bad debts and non-performing loans, which caused the credit of the U.S. financial system to begin to tighten. At that time, it was still in the gold standard period. The Federal Reserve was not as bold as it is today and did not dare to print money casually. The federal government was also responsible, so it did not increase the national debt on a large scale, and this credit tightening fell into a self-spiral.

The credit tightening of the financial system brought about further deep recession and depression in all walks of life.

In this way, in just two years, the total US economy plummeted from 103.1 billion U.S. dollars in 1929 to 75.8 billion U.S. dollars in 1931, a drop of nearly 30%.

Smoot and Hawley boasted that the tariff bill would reduce unemployment, increase American wages, and make America great again. When the Smoot-Hawley Tariff Act was passed in 1930, the unemployment rate was 8%, but one year after the new bill was implemented, the unemployment rate doubled to 16% in 1931, and rose to 25% in 1932-1933.

This is the highest unemployment rate in the history of the United States.

That's not all.

Before the tariff bill, the United States was already the most important trading partner in the world. When the United States erected a high tariff wall, other economies that relied heavily on imports and exports began to collapse, and the economic collapse brought about a global credit crisis.

Under the global credit crunch, it became more difficult for countries to lower interest rates, postpone debt payments, or issue emergency loans, let alone international ones.

In 1931, when the Austrian Credit Bank collapsed, the global scourge of the Smoot-Hawley tariff began to emerge, and global credit began to tighten. From the United States to the United Kingdom, from Germany to Italy, from Japan to Spain, most economies in the world almost all fell into the Great Depression...

Moreover, this Great Depression lasted until the end of World War II.

Everyone is familiar with the following plot. In the face of the Great Depression, nationalism in various countries began to rise. German Nazis, Italian fascists, and Japanese militarism successively gained dominance in their own countries and used war as a means to solve the depression. Then, there was no more.

As for Smoot and Hawley, they soon lost their qualifications as members of parliament because of the tragic impact of the tariff bill. Then, the two tacitly died on the eve of the United States' participation in World War II.

So far, the bill has been identified as the "most disastrous act" in the history of Congress on the official website of the U.S. Senate, and Smoot and Hawley are also called the stupidest congressmen in American history. President Hoover, who signed the bill, was originally a free trade economic philosophy. Hoover passively became the "most protectionist" president in American history.

Next, let's see if Trump's tariffs instead of income tax are intended to challenge the title of the stupidest congressman in American history?

Or, at least challenge the "most protectionist" president?

Kikyo

Kikyo