Hong Kong is once again in the spotlight.

The last time the spotlight was on was the virtual asset spot ETF that caused a media sensation in April. If we look back more than a year ago, the excitement of Hong Kong's first official announcement of the virtual policy declaration and the subsequent carnival of activities are still ringing in our ears. But unfortunately, every time the attention starts with a high opening that everyone expects, it ends with an unsatisfactory low.

On June 1, the new Hong Kong virtual asset regulations have been implemented for a year, and the Hong Kong Securities and Futures Commission has updated the licensing list of virtual asset platforms. With the end of the transition period, platforms that have not obtained licenses will set sail again and leave this Chinese Web3 holy land that was once highly expected.

Another surprise is that on the eve of the announcement of the license, native platforms such as OKX and Huobi, which entered the market in groups, left in large numbers despite the high sunk costs of the application. The strong native background of cryptocurrencies does not seem to have any bonus in Hong Kong.

Amid the endless discussions, the question once again arises: Can Hong Kong Web3 work?

01

The list of the Securities and Futures Commission is released, local institutions get the first chance, and native platforms leave

On June 1, the Hong Kong Securities and Futures Commission officially announced the licensing results. The two original licensed platforms No. 1 and No. 7, HashKey Exchange and OSL Exchange, successfully obtained VATP official licenses. 11 platforms including HKbitEX, PantherTrade, Accumulus, DFX Labs, Bixin.com, xWhale, YAX, Bullish, Crypto.com, WhaleFin, Matrixport HK were "deemed as applicants for licenses", while 6 platforms including BGE, HKVAX, VDX, bitV, HKX, and bitcoinworld were not deemed as applicants for licenses.

It is worth noting that being deemed as a license does not mean that a license will definitely be issued, but it is indeed one step closer to a license. Platforms deemed as licensed will still need to undergo a series of tests on the SFC's policies, procedures, systems and monitoring measures before they can be officially licensed. If problems arise in the middle, the SFC also has the right to withdraw or cancel its compliance license.

As for why it is specifically named as deemed licensing, the core reason is that according to the previously issued "Anti-Money Laundering and Terrorist Financing Ordinance", May 31 is the last day of the transition period for applying for platforms. After that, platforms that have not obtained a license must stop operating in Hong Kong and complete the liquidation of Hong Kong customer assets before August 31, otherwise they will be held criminally liable. Platforms deemed to be licensed can continue to operate after the end of the transition period, and the Hong Kong Securities and Futures Commission will conduct a simultaneous review.

The facts are exactly the same. On June 3, in order to avoid the public's misunderstanding of being deemed as a license applicant, the Hong Kong Securities and Futures Commission adjusted the list, merging 11 platforms with platforms that are applying for licenses, collectively known as the "List of Virtual Asset Trading Platform Applicants", and once again emphasized that there are only two platforms that have been licensed, and urged investors to only buy and sell virtual assets on virtual asset trading platforms licensed by the Securities and Futures Commission. It is worth mentioning that the 6 platforms that were not deemed to have obtained a license have not withdrawn their applications, but they are currently unable to operate in Hong Kong.

Overall, Hong Kong has considered a wide range of virtual asset platform license applications, retaining both inclusiveness and emphasizing boundaries. While trying not to hinder the normal operation of the platform, the license issuance was strictly reviewed, reflecting the professionalism of Hong Kong's financial center.

From the perspective of the platforms approved this time, scale and professionalism were undoubtedly considered during the approval process, and financial institutions with local advantages have gained the upper hand in complying with supervision. Among the approved platforms, there are two traditional Hong Kong brokerages, three platforms whose parent companies or executives are from local Hong Kong companies, three relatively native crypto platforms, and xWhale and Accumulus with mainland resource advantages.

After the license was issued, the market was full of discussions. In the year of the license application, many well-known crypto-native offshore exchanges such as OKX, Gate and Bybit announced their applications for Hong Kong licenses, but at the end of the license issuance, they announced their withdrawals one after another, which also made the market hesitant.

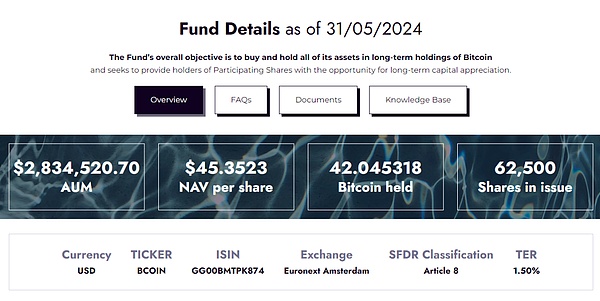

According to Wu, the reason is that the Hong Kong SFC requires all applicants for virtual asset trading platform licenses to sign a letter of commitment, promising that any of its entities cannot have mainland Chinese users in any region. Obviously, offshore exchanges cannot meet this condition. OKX tried to form an industry alliance to oppose this requirement but ultimately failed.

This rumor seems to have been confirmed. A Hong Kong regulatory practitioner who did not want to be named mentioned that "it is important for the SFC's application to have no historical baggage, and we cannot deny the gray behaviors that existed in offshore exchanges before or even still exist now." Hashkey Exchange CEO Weng Xiaoqi also responded in an interview, "The reason for the platform to withdraw its application may be related to customer service in sensitive areas, or it may be because the Hong Kong SFC has limited regulatory staff, so it chose to cooperate with a more familiar platform in the traditional financial field." Of course, there is actually nothing wrong with this move. In any financial center with regulatory transparency in the world, not violating the regulatory regulations of other regions is a natural boundary. In the context of the mainland's clear prohibition of virtual currency regulation, obtaining a compliance license in Hong Kong must also follow regional requirements, otherwise there is a suspicion of contempt for order. In contrast, on the official website of Coinbase, inaccessible areas are mentioned.

From a regulatory perspective, with the end of the first batch of licenses, Hong Kong's regulation has entered a new stage. The transitional period of rent-seeking without a license has ended, and the compliant platform has officially stood up. The withdrawal of non-licensed institutions will also bring more customer traffic and dividends to the compliant platform. According to Weng Xiaoqi, driven by the new regulations, the number of new APP activations increased by 267% month-on-month last week. According to the latest data, the cumulative transaction volume of HashKey Exchange has exceeded HK$440 billion, and the user's custodial assets have exceeded the US$500 million mark.

Back to the crypto community, the departure of native platforms has severely hit the confidence of native crypto personnel. Most platform applicants have shown obvious disappointment. This disappointment comes from ineffective consumption. It is disclosed that the application cost of the entire compliance process is as high as tens of millions of Hong Kong dollars. On the other hand, it is also a reflection of reality. As it moves further and further away from the mainland, Hong Kong seems to be moving away from the utopia of encryption.

02

Limited market is difficult to bypass, liquidity becomes a hidden concern, but the difference advantage still exists

Whenever Hong Kong Web3 is mentioned, the limited market that everyone criticizes is always unavoidable.

This point has aroused strong attention when the Hong Kong virtual asset spot ETF was listed. Due to the explicit prohibition of mainland customers, the trading volume of Hong Kong virtual asset ETF has been questioned. Before the listing, Eric Balchunas, senior analyst of Bloomberg ETF, predicted that it would take two years for the Hong Kong virtual asset ETF market to reach the $1 billion level. However, on the first day of the launch, although the trading volume was still an order of magnitude different from that of the United States, the total assets on that day reached $292 million.

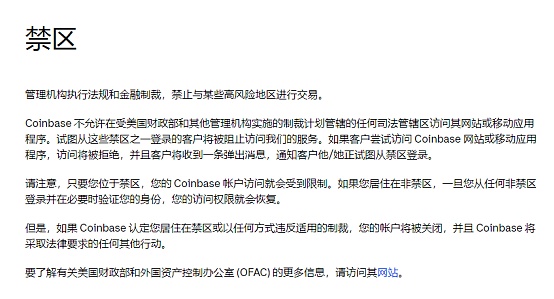

Hong Kong Bitcoin Spot ETF Trading Volume, Source: SOSO Value

As of May 31, the total market value of Hong Kong virtual asset spot ETFs reached US$301 million, and the average daily trading volume since its listing has reached US$5.8 million. In fact, this performance is not bad. In terms of market scale, the proportion of virtual asset category transactions in Hong Kong ETFs is almost the same as that in the United States, both at around 0.5-0.6%.

Although many data are crushed by the United States, compared with spot ETFs in other regions, Hong Kong has performed quite well.

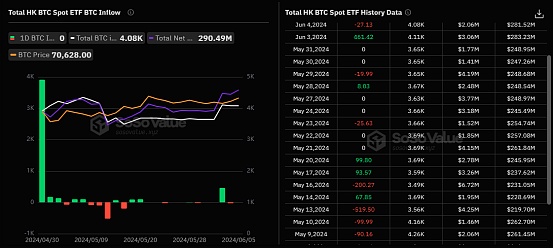

On June 4, the Australian Bitcoin spot ETF announced its official listing. According to HODL15Capital monitoring, Only 1 Bitcoin flowed into Australia's Monochrome Bitcoin ETF on the first day of trading. In fact, this is not the first Bitcoin ETF in Australia as rumored in the market. It launched a batch of ETFs in 2022, one of which was even closed due to insufficient demand. From the perspective of Europe, since the beginning of this year, Bitcoin ETPs registered in Europe have had a net outflow of US$506 million. Jacobi FTWilshire, the first European Bitcoin spot ETF announced to be listed in Amsterdam last year, had an asset management scale of only US$2.83 million as of May 31.

Performance of the first Bitcoin spot ETF in Europe, source: Jacobi official website

This seems to confirm what people familiar with the matter mentioned before the ETF was listed, "Hong Kong's market is not in the mainland." In the applicant's statement, Hong Kong's scale market restrictions have long been known, but the reason for the huge cost of entering the market is undoubtedly also driven by future expectations. "The competition landscape of crypto-native market trading platforms has stabilized, but the combined share of traditional capital in this market is even less than 5%. Traditional capital still has foreseeable prospects. Foreign capital and traditional capital are our main customers." A small platform applicant mentioned.

But on the other hand, away from the mainland, the shrinkage of the market is indeed obvious, and Hong Kong's criticized liquidity market has also become the main bottleneck for the development of virtual assets. Judging from the trading volume alone, Hong Kong ETFs only have millions, which is in sharp contrast to the US daily average of over US$100 million. This huge difference in liquidity is difficult or even impossible to be eliminated, because it is not only a problem of capital, but also a problem of the entire Hong Kong market.

In 2023, the number of companies with a daily turnover of 0 yuan on the Hong Kong Stock Exchange will expand from more than 400 to more than 700. According to data from the Hong Kong Stock Exchange, the average daily turnover of the Hong Kong securities market in 2023 will be HK$105 billion, a year-on-year decrease of 16%. This year, with the recovery of the market, coupled with policy stimulus such as stamp duty reduction and exemption and the lifting of restrictions on Hong Kong Stock Connect, it has eased. The 60-day daily average turnover of the Hong Kong stock market has rebounded from the low of HK$87 billion in the fourth quarter of last year to HK$120 billion. But on June 3, the turnover of Nvidia alone was US$49.326 billion, equivalent to HK$385.211 billion. One stock has crushed the entire Hong Kong stock market, which is still the lowest in the past five days.

NVIDIA 5-day trading volume, source: Tonghuashun

Under the limited liquidity, how to increase the attractiveness of local products to foreign capital under the competition of similar products in the United States is imminent. Although Hong Kong ETFs have also made many innovations and changes, such as considering allowing pledges and physical subscriptions, it is difficult to solve this fundamental challenge. What is more subtle is that due to high compliance costs, the current Hong Kong ETF rates are generally higher than those in the United States.

On the other hand, some industry insiders believe that the main problem in Hong Kong at present is the lack of innovation on the application side. This is indeed an objective fact and a common challenge in the Chinese crypto community, but it is difficult to evaluate whether this problem is caused by a lack of soil or for some profit-seeking reasons. It is worth noting that Chinese people are not without excellent innovation. In fact, there are excellent Chinese projects in the fields of public chain, Defi, ZK, data middleware, etc. To give an inappropriate example, before StepN, there was also a similar concept in my country, Fun Step, but what was the final result? Looking at the Western world, after Defi, many fields including public chains have not produced paradigm innovations for a long time, and entrepreneurs can only devote themselves to the market of unlimited volume traffic and volume growth. It is difficult to gain legitimacy when talking about Chinese innovation in the current Western-dominated context.

03

Hong Kong is on the road to traditional dimensional upgrading with stable policies, compliance and security

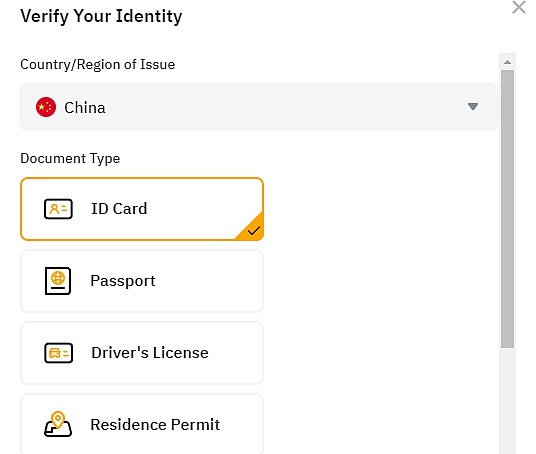

Hong Kong has its own drawbacks that are difficult to abandon, but naturally it also has its own unique advantages. As a gathering place for Chinese people of the same lineage, it is not easy to open a hole in virtual assets. Interestingly, recently, Bybit, the world's third largest offshore exchange, changed its previous cautious attitude and suddenly opened registration and certification for users in mainland China. Although Bybit issued a statement saying that it would expand its service scope to overseas Chinese communities, that is, overseas Chinese living outside China and restricted jurisdictions, some insiders said that it was a move to expand customers due to market obstruction. It is really difficult to comment on this act of pulling teeth out of the tiger's mouth, which may also be the reason why Bybit withdrew from Hong Kong.

Bybit registration interface adds China, source: X platform

Back to Hong Kong, despite the lack of liquidity, Hong Kong has adhered to the consistency of policy very well. The US has politicized encryption, changing its orders every day has become a daily routine, and the supervision is tight and sometimes delivered, making the entire industry like riding a speeding roller coaster. However, Hong Kong operates in accordance with rules and regulations, relaxes supervision before the gray area, and after establishing regulatory goals, continuously improves the path, forming a regulatory framework with licensing and permitting as the core, and gradually establishing boundaries towards the service support and product ends. If compliance is taken into account, it can be considered that Hong Kong is also among the best in the world. For big capital, safety is always more important than efficiency. In terms of safety, Hong Kong has a natural advantage.

Perhaps it is because of this that Hong Kong chooses to start from the traditional capital end rather than the native application of encryption, linking the content of Web3 in the context of Web2 to fill this asset gap. Even from the beginning, perhaps Hong Kong did not want to seize the encryption market in the past, but explored the transformation of Web3 asset categories in the traditional field from another dimension. From Hong Kong's recent actions, RWA, digital Hong Kong dollar, digital RMB, stable currency supervision, etc., all provide relatively realistic theoretical basis.

Hong Kong Securities and Futures Commission CEO Leung Fung-yee mentioned in her speech that "the SFC's support for Hong Kong's Web3 ecosystem does not mean an endorsement of virtual assets as an asset class. Will the provision of traditional financial services on traditional infrastructure be replaced by smart contracts and distributed ledger technology one day? It remains to be seen."

From the current perspective, Hong Kong's Web3 answer sheet is not satisfactory, but the future may not always be unsatisfactory. After all, the collision between the decentralized market and the traditional institution's dimensional upgrade still has a long way to go.

And the spectators may need to give Hong Kong more time.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance nftnow

nftnow Coinlive

Coinlive  Coinlive

Coinlive  Cointelegraph

Cointelegraph