Author: Yogita Khatri, The Block; Compiler: Deng Tong, Golden Finance

Despite significant inflows into the recently launched spot Bitcoin exchange-traded fund in the United States, expectations are that Bitcoin will remain relevant in investor portfolios, according to a recent analyst report Matching the amount of gold in it is unrealistic.

The report released on Thursday by a team of JPMorgan analysts led by Nikolaos Panigirtzoglou stated thatin Bitcoin Risk is a key factor that is often overlooked in the debate over which gold should be matched in investors' portfolios. The argument goes that Bitcoin’s market cap needs to climb to $3.3 trillion (i.e. for investment the value of gold), thus meaning that the price of Bitcoin will more than double.

Analysts say most investors consider risk and volatility when allocating across asset classes. Given that Bitcoin is approximately 3.7 times more volatile than gold, they concluded that they expect Bitcoin to be in investors’ portfolios The amount is unrealistic to match gold.

Analysts believe that if Bitcoin is assumed to be comparable to gold in terms of risk capital (money earmarked for speculative activities), the implied allocation will shrink to 0.9 million billion, a number calculated by dividing $3.3 trillion by 3.7.

“This would mean a Bitcoin price of $45,000, well below current levels. In other words, At the current price of $66,000, the implied allocation to Bitcoin in investors’ portfolios on a volatility-adjusted basis has exceeded that of gold,” the analysts said.

Sponsored Business Content

Analysts said, Of the $3.3 trillion in total gold used for investment purposes, only 7%, or $230 billion, is held in funds, with the remainder held in gold bars and coins.

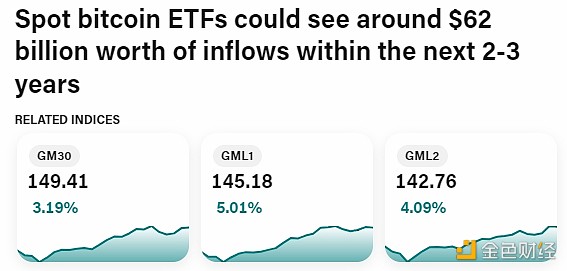

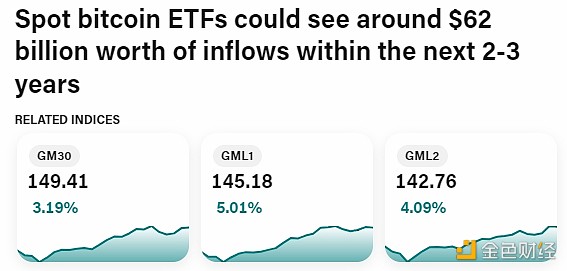

Analysts noted that benchmarking gold and using the same volatility of 3.7 indicates the potential for a Bitcoin ETF The size is about $62 billion (i.e. $230 billion divided by 3.7). They added that this represents a “realistic target” for the potential size of a spot Bitcoin ETF over time, possibly within two to three years. However, they noted thatmuch of the implied net inflows are likely due to continued rotation of existing instruments into ETFs.

Since its launch, the spot Bitcoin ETF outside of the Grayscale Bitcoin Trust has seen cumulative inflows of $19 billion, almost as much as JPMorgan Chase’s previous forecast of $36 billion in 2024 rotation half of the funds.

Considering that GBTC has seen total outflows of $10 billion to date, and spot Bitcoin ETFs have seen total net inflows of $9 billion, analysts still consider this to be a "huge" number.

However, they are skeptical that the $9 billion represents new money entering the cryptocurrency space, as retail investors may be moving away from existing investments into new spot Bitcoin ETFs.

JinseFinance

JinseFinance