Source: Kaiko Research; Compiled by: Deng Tong, Golden Finance

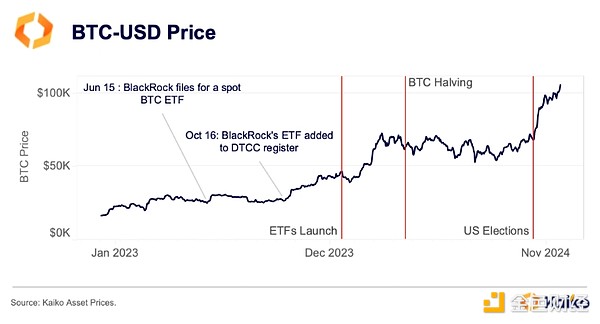

1. BTC's Road to the $100,000 Mark

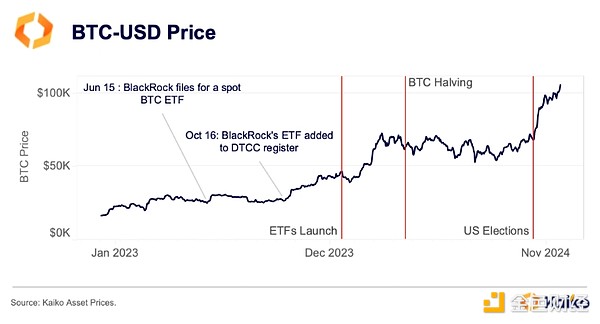

2024 is a successful year for Bitcoin. With the launch of the spot BTC exchange-traded fund in January, the market has gradually matured, and the fourth halving has gone smoothly.

Even several billion-dollar liquidations and sell-offs could not prevent BTC from succeeding this year. The price of BTC denominated in US dollars has risen by nearly 140% so far this year, and has risen even more relative to other fiat currencies (some of which experienced a sharp depreciation in 2019).

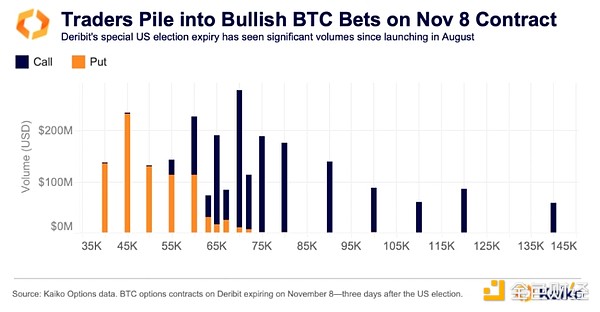

Second, the US election stimulates bullish bets

The 2024 US election is of great significance to cryptocurrencies. Bitcoin or digital assets have never received so much attention on the world stage - at least not so positive attention.

President Trump expressed support for progressive regulation and open dialogue with the industry in the summer. He even appeared at the Bitcoin Nashville conference shortly after an attempt was made on his life. Much of the cryptocurrency community rallied around Republican candidate and eventual Democratic nominee Kamala Harris and began to take some positive steps around cryptocurrencies.

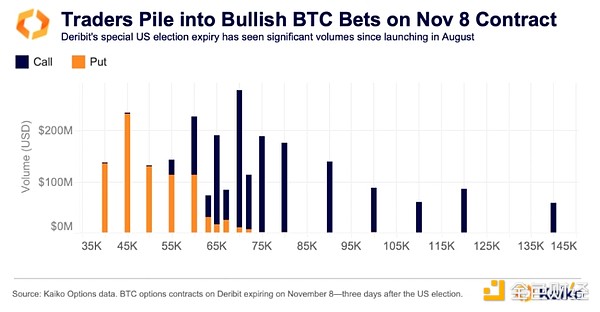

Ahead of the November 5th election, Bitcoin saw a “Trump trade” from market participants. A special election contract on Deribit attracted billions of dollars in volume and open interest ahead of the election, with a major bullish bias from traders betting on new all-time highs soon after the election. They were right, with BTC trading over $75,000 by November.

The overall Senate vote, as well as the final vote, were widely seen as bullish for the cryptocurrency. As a result, BTC led the post-election rally for crypto assets, topping $80,000 by November 11th.

As we’ve shown above, the increasingly bullish sentiment has continued through the rest of November and into December, with Bitcoin’s current all-time high at over $107,000.

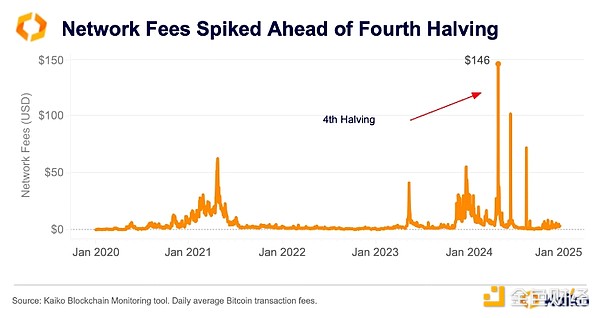

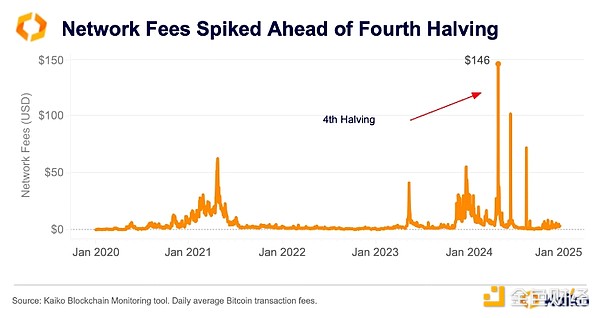

3. Bitcoin Fees Soared Before the Fourth Halving

Bitcoin’s fourth halving took place on April 19 of this year. On Saturday, Bitcoin’s average transaction fee soared to a record high of $146. This was significantly higher than Ethereum’s average fee of $3 that day.

The historic surge in Bitcoin network fees is perhaps the most important development in its fourth quarter.Despite warning signs, it caught many market participants by surprise.

Ordinals founder Casey Rodamor announced plans to launch Runes, a protocol that makes it easier to issue fungible tokens on Bitcoin. However, based on the impact of Ordinals on transaction fees, users may have expected the increase in transaction fees, but the historic increase still surprised many.

Ordinals allows node operators to burn data and images onto newly created Bitcoin blocks. These so-called "registrations" are similar to NFTs, increasing the demand for Bitcoin block space and boosting the fees earned by BTC miners.

The launch of Runes is also carried out in a similar way. The launch of the protocol has led to an increase in demand for block space, which in turn has affected fees.

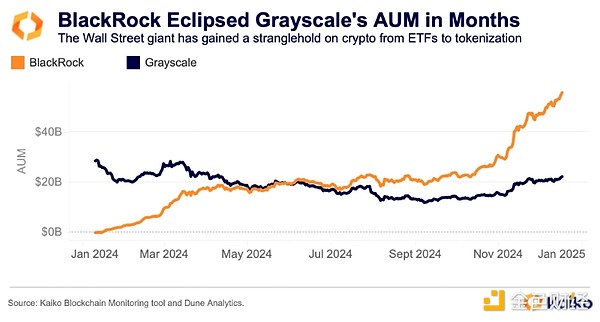

Fourth, BlackRock surpasses Grayscale

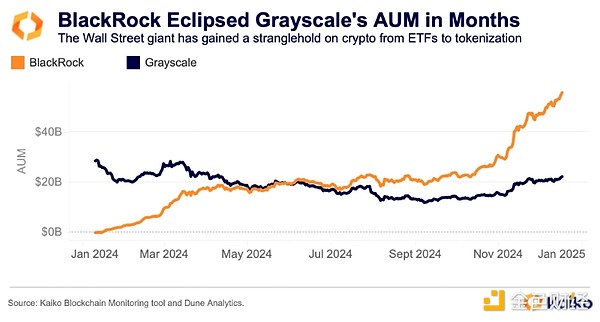

BTC ETFs have broken various records this year, with total assets under management of 11 funds rising to more than $100 billion.

BlackRock is the big winner, showing that major institutions are interested in Bitcoin and digital assets. Its spot BTC ETF has assets under management of more than $55 billion, surpassing Grayscale's GBTC in a matter of months. Launched in 2013 by digital asset manager Grayscale, GBTC is largely a cryptocurrency-first product, and its huge premium/discount to net asset value means that institutional buying is limited. As a result, after the ETF was launched this year, it was quickly surpassed by BlackRock.

GBTC has been losing assets for most of this year after the company decided to keep fees at 1.5%. In the US ETF space, companies are accustomed to low fees, so most of Wall Street prefers BlackRock and Fidelity to GBTC.

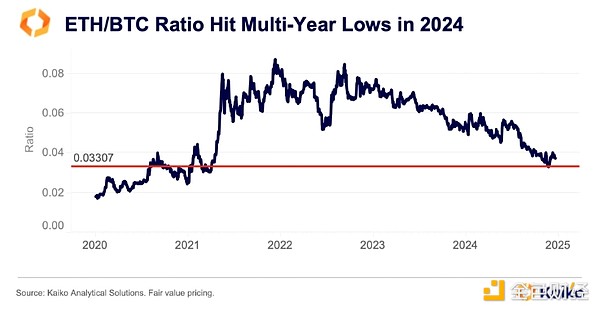

Five, ETH/BTC ratio declines

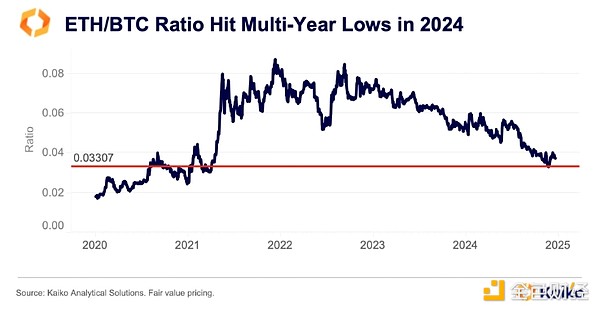

The ETH/BTC ratio has continued to decline since the merger and shows no signs of slowing down in 2024. The ratio compares the performance of the two assets and falls when Ethereum underperforms Bitcoin.

Other factors contributing to the decline include the rise of Solana as users migrated to cheaper networks during a period of heightened speculation in March and the fourth quarter of this year. Meme tokens (which we’ll discuss later) were behind much of the speculation and pushed Solana DEX volume to surpass Ethereum at times this year.

It fell to 0.033 in November, its lowest level since March 2021. What’s behind the underperformance? ETH has faced significant regulatory pressure since the merger as staking has come under scrutiny in the U.S., drawing the ire of the SEC.

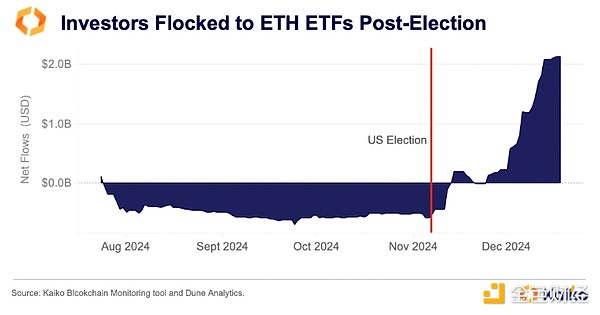

Six, slow start: ETH ETF launch

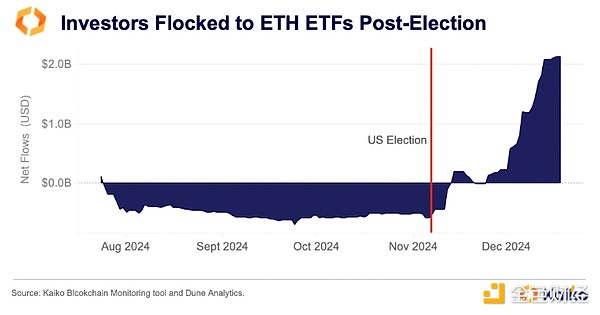

The ETH ETF has had a slow start since its launch in July. Similar to the launch of the BTC ETF, Grayscale's fund has once again put pressure on the market as the digital asset management company maintains its fees at 2%.

However, after Grayscale's ETHE outflows decreased, the newly launched fund began to see inflows at the end of 2024. Since the US election in November, inflows have increased significantly, and traders have also flocked to CME's ETH futures. This mirrors similar activity seen on BTC futures in May and June as traders executed carry trades.

Rising open interest in ETH futures and a changing regulatory outlook have reversed the trend for the ETH ETF, with net flows turning positive in late November and December. Net flows since launch now exceed $2 billion. This includes more than $3 billion in outflows from ETHE.

ETH will be one of the biggest winners of a regime change in Washington, D.C. While it has lagged behind Bitcoin this year, the regulatory shifts brought about by a change in the U.S. government will benefit the second-largest asset by market cap. ETH classification, commodity or security, and clarity of pledge could be two key drivers of growth next year.

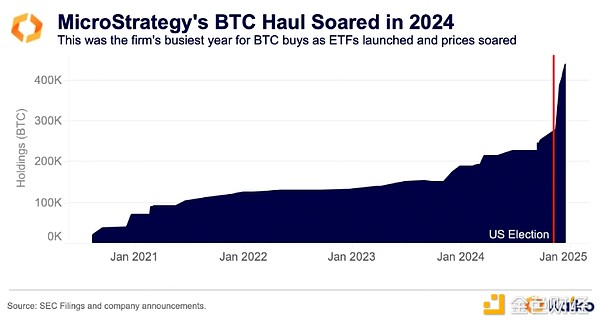

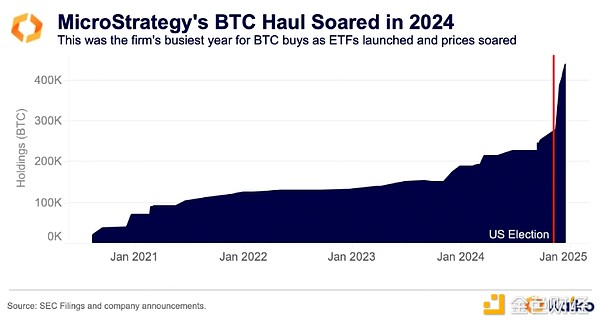

Seventh, trend-setting MicroStrategy buys more BTC than ever

MicroStrategy has had its busiest year yet in terms of buying BTC. The business software company has transformed itself from its core business in many ways this year. Chairman and former CEO Michael Saylor even called his company the world's first "Bitcoin finance company" in its third-quarter earnings report in November.

Since January, MicroStrategy has purchased more than 249,850 bitcoins, with purchases accelerating since the U.S. election and holdings nearly doubling in the past month. The company has issued multiple convertible bonds to finance its acquisitions, sparking concerns among some market participants that a price crash could have an adverse impact on the company and could even lead to forced selling.

For now, the strategy is working. The rapid rise in BTC prices and the market's bullish sentiment have caused the value of MSTR to surge to an all-time high. MSTR hit a new high for the first time in 24 years, since the dot-com bubble burst in March 2000.

While MicroStrategy is a pioneer in corporate bitcoin purchases, some Republican lawmakers want the U.S. government to follow suit. Senator Cynthia Loomis pledged to establish a strategic bitcoin reserve after Donald Trump wins the U.S. presidential election.

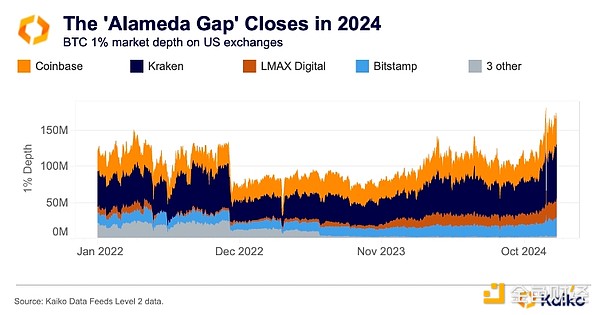

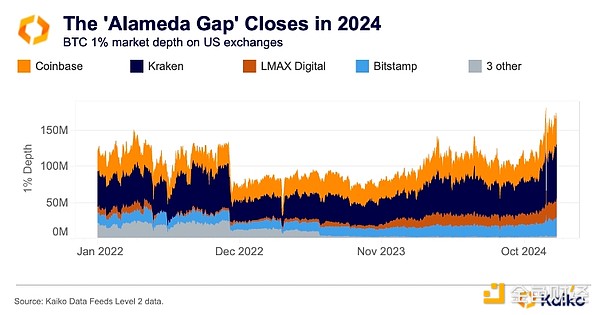

Eight, the Alameda gap has narrowed after the ETF listing

This year, the crypto market finally put the FTX crash behind it. The liquidity gap, or Alameda Gap, left after the collapse of FTX and its sister company Alameda Research has narrowed this year.

Driven by rising prices and growing market share, the market depth of 1% of Bitcoin this year has risen above FTX's previous level of about $120 million. Kraken, Coinbase and LMAX Digital have recovered the most. Notably, the Bitcoin market depth of the institution-focused LMAX reached a record high of $27 million this week, briefly surpassing Bitstamp to become the third-largest liquid Bitcoin market.

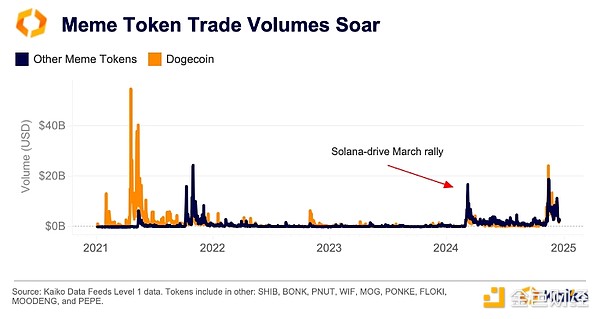

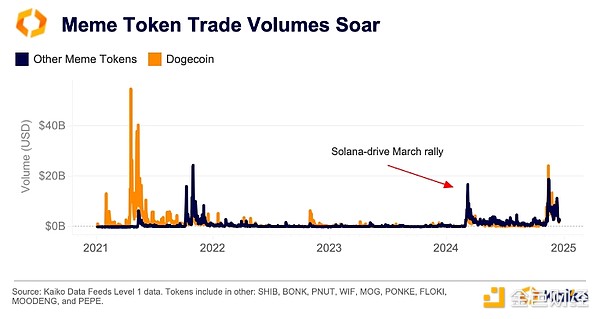

Ninth, Meme Token Frenzy

As mentioned above, meme tokens have soared exponentially at various times this year. In particular, tokens on Solana have experienced significant growth due to the launch of Pump dot fun, a protocol for launching meme tokens that enables anyone to issue tokens and build liquidity from scratch through word of mouth and participation.

However, familiar assets largely dominated the trading volume on centralized exchanges. Similar to its previous rallies in 2021, Dogecoin has once again found favor among traders - again due to post-election bullish sentiment. Dogecoin rose after President-elect Donald Trump revealed plans to set up a "Department of Government Efficiency" (D.O.G.E.) led by Elon Musk and Vivek Ramaswamy.

One of the new tokens launched on Solana this year is PNUT, which has captured people’s imagination and is inspired by Peanut the Squirrel (a New York pet influencer) whose untimely death led to a large outpouring of support (and token issuance) online.

One trader even turned a $16 investment in PNUT into $3 million in realized profits. PNUT is currently traded on several large centralized exchanges, including Binance, Crypto.com, and OKX.

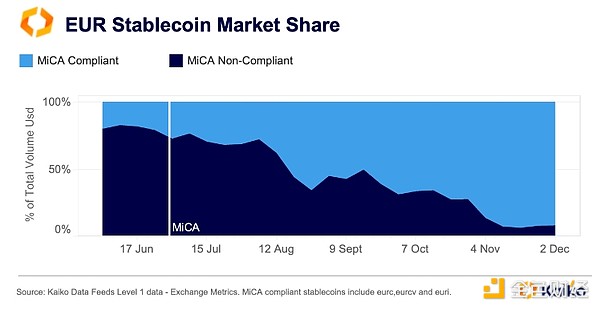

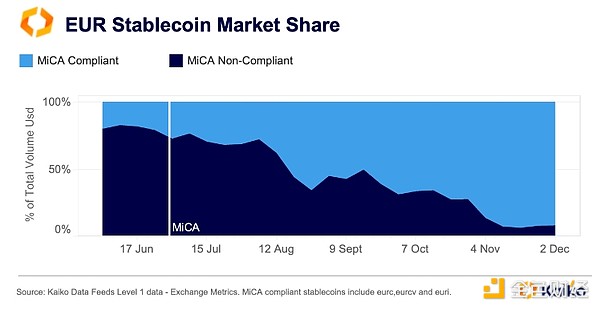

10. Regulation triggers changes in the stablecoin market

Since June, European regulation has been reshaping the stablecoin market. The landmark European Market for Crypto-Assets regulation (MiCA) has triggered a wave of stablecoin delistings and product offering adjustments on major exchanges.

Throughout 2024, euro-to-cryptocurrency trading volumes remained above last year’s average, indicating growing demand. Three months after MiCA was enacted, the euro-backed stablecoin market experienced a significant transformation, driven by the rise of MiCA-compliant alternatives. By November 2024, MiCA-compliant euro stablecoins, including Circle’s EURC, Societe Generale’s EURCV, and Banking Circle’s EURI, had captured a record 91% market share.

Binance has become a major player in the euro stablecoin market, on par with Coinbase, after listing EURI in late August. Still, Coinbase remains the largest market with a 47% share, driven by Circle’s EURC.

Conclusion

This year has been a big one for establishing digital assets as viable assets for Wall Street investors. Time will tell if the industry can continue to grow in the coming months and years, but this rally feels different.

The 2024 rally is built on the arrival of established companies with risk frameworks that currently include BTC and ETH. As regulation shifts and market structure changes, the rally is expected to extend beyond Bitcoin and into other assets next year.

Anais

Anais