Source: Mankiw Blockchain Law

01 Real cases

Recently, Lawyer Mankiw came across such a virtual currency lending case. The general facts of the case are as follows: B issued an IOU to A, which stated that he borrowed 500,000 yuan from A for a period of one year. Year. After the debt matured, B refused to repay for various reasons. In desperation, A filed a lawsuit with the court, requesting the return of the 500,000 yuan owed as indicated in the IOU.

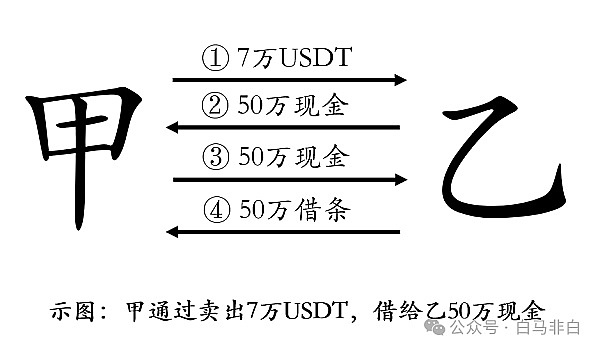

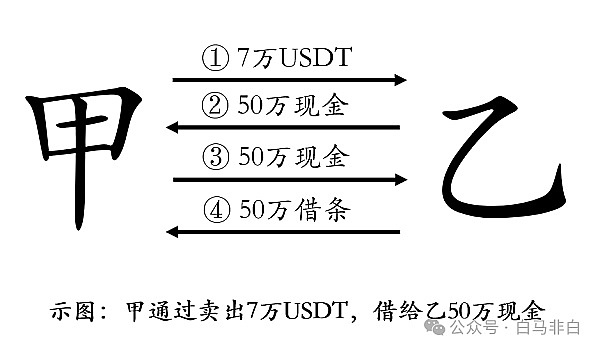

Lending and borrowing between A and B is not that simple. The court determined that the amount lent by A was a transfer of 70,000 USDT to B. Specifically, both parties A and B agreed verbally in advance that since B receives virtual currency, A will first transfer the virtual currency to B, and B will then give A the corresponding consideration in cash, and finally A will deliver the 500,000 cash received to B, thus Perform the contract and lend B 500,000 yuan (see the diagram for specific steps). During the trial, B raised no objection to the IOU issued by A, the USDT transfer record, etc. However, B denied receiving the 500,000 funds delivered by A, and therefore argued that A did not lend the money to B as agreed, so B did not need to repay it.

02 Court’s opinion: Rejection

After hearing the case, the court finally rejected all of A’s claims. The reasons for the ruling are roughly as follows: According to the notices and announcements issued by the People's Bank of China and other ministries and commissions,virtual currency does not have legal and compulsory monetary attributes, and is not a legal currency in the true sense issued by the central bank. Therefore, it cannot and cannot It should be circulated and usedin the market as currency. In addition, with reference to the Guiding Case No. 199 issued by the Supreme Court, "Gao Zheyu vs. Shenzhen Yunsi Road Innovation Development Fund Enterprise and Li Bin's Application to Revoke the Arbitration Award", disguised redemption transactions between virtual currency and legal currency should alsonot be supported . The court therefore determined that A’s behavior of transferring virtual currency in lieu of delivering money violated public order and good customs, and therefore ruled to reject all A’s claims.

From the above-mentioned lending operations of A and B, it can be seen that the two people are aware that virtual currencies cannot be circulated as legal tender, and have consciously taken prevention and control measures. To avoid legal risks, it is agreed to convert the virtual currency into legal currency first, and then complete the loan delivery. Unfortunately, A does not actually convert the virtual currency into cash (regardless of whether the virtual currency buyer is B or someone else) before handing the cash to B. In fact, A saves trouble and directly transfers 500,000 yuan worth of virtual currency to B as an alternative to A's fulfillment of the 500,000 yuan loan. In other words, A directly uses 70,000 USDT as 500,000 yuan, and accordingly believes that he has the right to require B to repay the money based on the IOU. However, in the court’s view, if X’s claim is supported, it is equivalent to admitting that using virtual currency as money is legal.

Generally, private lenders and borrowers agree to lend funds, and what the lender actually delivers is other easily realizable property, such as in-demand goods of equivalent value, Short-term bonds, bearer stocks, etc. can be considered as the lender has lent the money as agreed. However, as a special kind of virtual property, virtual currency has the exchange value of general equivalents. If the court recognizes that the act of transferring virtual currency in lieu of monetary payment is valid, then this judicial endorsement is contrary to the premise that my country currently denies that virtual currency can be circulated as legal tender.

It is becoming more and more common in practice to lend virtual currency with an IOU, or the IOU states that the borrowed money is actually delivered with virtual currency. In reality, it is difficult to file civil and criminal cases involving currency. Lenders often believe that as long as the IOU indicates that the loan is money and does not contain any words related to virtual currencies, then having an IOU will guarantee that they will be able to Thinking it's foolproof. But what they don’t know is that in private loan disputes, the court needs to comprehensively combine the facts of multiple parties to determine whether the loan has actually occurred. When a borrower requests repayment, in addition to producing an IOU, it must also provide evidence to prove actual performance of the contract.” "Lending funds" will have the right to demand repayment under legal or agreed circumstances.

03 How does the lender get his coins back?

As mentioned before, A takes the IOU, USDT transfer records and other evidence to sue the court to demand B to repay the money. Admitting that it is legal to substitute virtual currency for monetary payment will certainly not be supported by judicial decisions. Since virtual currency cannot be "used as money", A's transfer of USDT to B cannot be regarded as A's lending of funds as agreed, so B will argue that since A did not "borrow money", B does not need to "Pay back the money".

Although A did not "pay" and B did not "receive money", the court determined during the trial that A actually transferred the virtual currency , the fact that B has received the virtual currency. The reason why A transfers out 500,000 yuan worth of virtual currency is based on fulfilling the loan obligation of 500,000 yuan to B. Since the court believes that A’s act of withdrawing currency cannot replace the act of borrowing money, then B receives and possesses 70,000 yuan. A virtual currency has no legal basis. In view of the fact that virtual currency, as a virtual commodity that can be legally held, is also an object that should be protected by law,According to the unjust enrichment clause stipulated in Article 122 of the Civil Code, A has the right to require B to return Virtual currency.

There is a view in judicial practice that citizens invest and trade virtual currencies at their own risk and are not protected by law. For example, according to Article 1 (4) of the "Notice on Further Preventing and Dealing with Speculation Risks in Virtual Currency Transactions" issued by the People's Bank of China and other ministries and commissions, "...investing in virtual currencies and related derivatives violates public order and good customs." Civil legal acts are invalid, and the resulting losses shall be borne by the parties themselves..." However, this view is untenable - on the one hand, the scope of self-bearing losses in the above-mentioned notice is controversial, on the other hand, the above-mentioned ministries and commissions Regulations should not conflict with the principle of return of property after invalid behavior stipulated in superior laws. The specific analysis section refers to the previous article "If there is a dispute when investing in virtual currencies, can the investment be refunded?" 》. For the situation where virtual currency is obtained without legal basis, it should be the same as the situation where the virtual currency is mistakenly transferred or stolen. B should return the virtual currency to the original owner, and A has the right to request its return. Imagine that A requires B to return the virtual currency that he has no reasonable basis for possessing. If the court leaves it alone on the grounds of the so-called "own risk", it is equivalent to supporting B's behavior of "borrowing money to receive coins without paying them back".

04 Mankiw’s lawyer suggested

1. In currency-related private lending, try not to have a situation where "exiting currency instead of borrowing money" occurs. This kind of shrewd operation of selling sheep's meat to others will be counterproductive. When lending virtual currency, it is enough to directly state on the IOU that it is virtual currency.

2. Directly transferring virtual currency to the borrower can avoid receiving black money, reduce transaction costs and time costs such as T+1, But if you use virtual currency directly as money, the legal risks will be greater.

Joy

Joy