Author: Stella L (stella@footprint.network)

Data source:Footprint Analytics public chain research page

In August, the cryptocurrency market fluctuated violently, and both Bitcoin and Ethereum suffered significant declines. Layer 1 blockchains generally suffered from the market downturn, however, Tron bucked the trend and grew strongly. In the field of Bitcoin Layer 2, the development momentum is impressive, and the TVL of various scaling solutions has increased significantly. At the same time, the Ethereum Layer 2 network is under great pressure, but it is also continuing to evolve, and the participation of heavyweight players such as Sony has become a highlight of the ecosystem. Despite the shrinking market value, innovation in Bitcoin and Ethereum Layer 2 remains the key to future growth.

The data in this report comes from the public chain research page of Footprint Analytics. This page provides an easy-to-use dashboard containing the most critical statistics and indicators for understanding the public blockchain space, updated in real time.

Market Overview

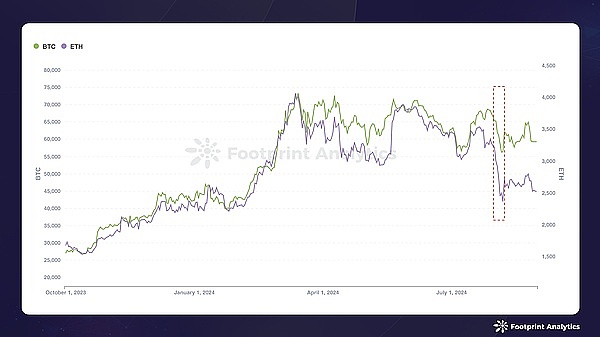

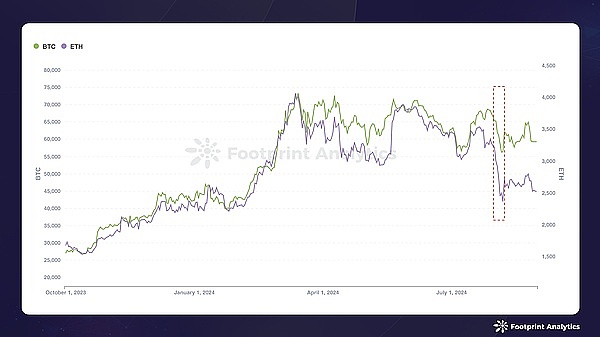

Both Bitcoin and Ethereum saw significant declines in August. The Bank of Japan unexpectedly announced an interest rate hike in late July, a move that triggered a chain reaction across markets. Strategies such as short-term volatility strategies and foreign exchange carry trades saw a significant decline in returns, leading to a sharp drop in the value of cryptocurrencies in the first week of August. Both Bitcoin and Ethereum hit their lowest point of the month on August 7.

Data source: Bitcoin and Ethereum price trends

The Bank of Japan unexpectedly announced a rate hike in late July, a move that triggered a chain reaction across markets. Strategies such as short-volatility strategies and foreign exchange carry trades saw a significant decline in returns, leading to a sharp drop in the value of cryptocurrencies in the first week of August. Both Bitcoin and Ethereum hit their lowest point of the month on August 7.

Continued selling pressure continued throughout the month, exacerbated by factors such as multiple government actions and the legacy of Mt. Gox, although the impact of these factors has gradually weakened.

Meanwhile, Ethereum is undergoing an important transition that has caused uncertainty among some investors. The blockchain plans to scale by moving more transactions to the Layer 2 network. This year, activity on the Ethereum Layer 2 network has increased significantly, with giants such as Sony launching projects such as Soneium in this ecosystem. However, the shift in activity to Layer 2 has led to a decrease in Ethereum's transaction fee income, which may affect the value of Ether.

At the end of the month, after Telegram founder Pavel Durov was arrested in France, the market's focus increasingly turned to the relationship between blockchain technology and digital privacy. Although Federal Reserve Chairman Powell clearly "hinted" at the possibility of a rate cut in late August, market sentiment remained generally negative throughout the month.

Layer 1

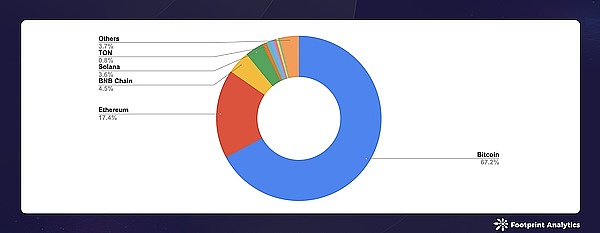

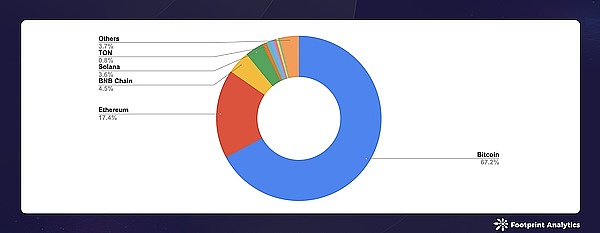

As of the end of August, the total market value of blockchain cryptocurrencies fell 12.1% from the end of July to $1.74 trillion. The market is still led by Bitcoin, Ethereum, BNB and Solana, with market shares of 67.2%, 17.4%, 4.5% and 3.6% respectively. It is particularly noteworthy that the absolute value of Bitcoin's market share increased by 2.4%, while Ethereum's market share decreased by 2.3%.

Data source: Market value share of public chain tokens in August 2024

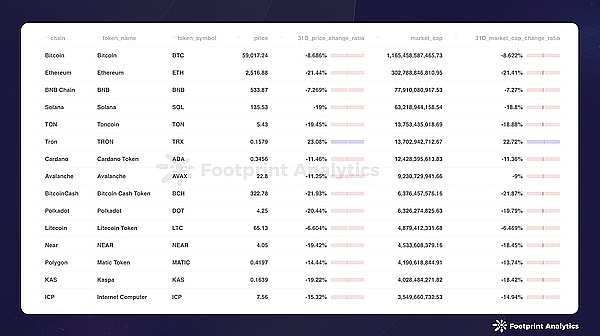

Bitcoin closed at $59,017, down 8.7%. Ethereum's downward trend was more obvious, and it eventually closed at $2,516, a drop of 21.4%.

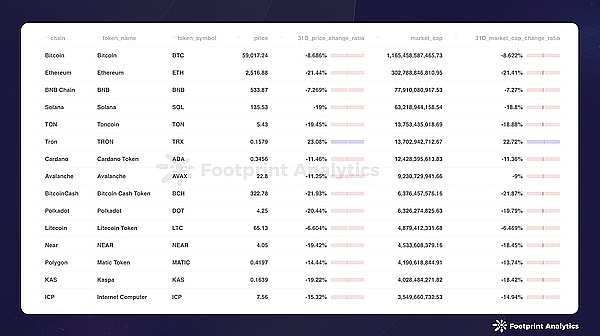

Among the top 15 chains by market value, Tron is the only chain that has achieved double growth in token price and market value this month. TRON's price rose by 23.1% and its market value increased by 22.7%. In contrast, other chains showed a downward trend.

Data source: Public chain token price and market value at the end of August 2024

Tron stood out in the market volatility, thanks to catching the Meme craze, which triggered a surge in on-chain activities. The launch of SunPump, the first meme fair launch platform on Tron, has significantly increased user engagement.

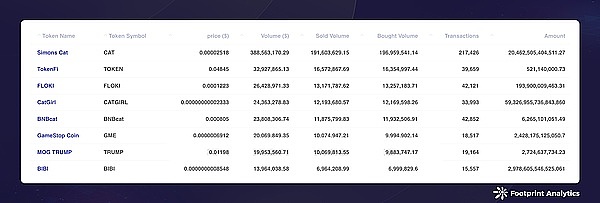

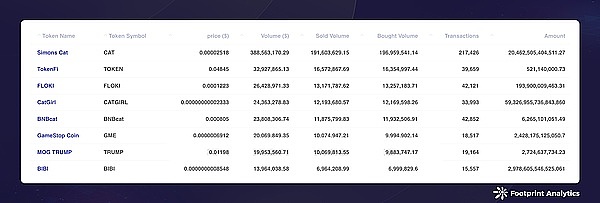

The BNB chain has also introduced new policies and incentives to promote on-chain meme-related activities, with Simon’s Cat, TOkenFi, and FLOKI leading in terms of trading volume over the past 30 days.

Data source: BNB chain popular memecoins

In addition, several major financial institutions have expanded their blockchain portfolios this month. Top asset manager Franklin Templeton expanded its blockchain fund to include Avalanche. Meanwhile, Grayscale Investments launched Avalanche Trust and a new Sui fund.

As of the end of August, the total TVL in the DeFi space was $64 billion, down 16.8% from the end of July.

Data source: Public chain TVL at the end of August 2024

Among the top 15 chains in terms of TVL, Sui is the only one to achieve growth, with a monthly growth rate of 41.8%. NAVI Protocol, the largest DeFi project on Sui, provides lending and liquid staking products. Its TVL surged 72.0%, from $140 million on August 1 to $230 million at the end of August.

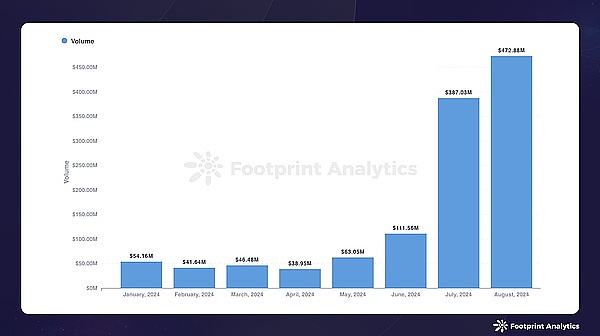

Although Polygon's TVL fell 1.3% from July, the prediction market Polymarket attracted great attention. Affected by the US election cycle, Polymarket's monthly trading volume increased by 22.2% month-on-month to $470 million, and the number of traders soared 46.1% to 83,000. Polymarket's TVL increased by 19.6% in August to $110 million, ranking third on the Polygon chain, behind AAVE and Uniswap. However, 78.0% of Polymarket's total trading volume is election-related, raising questions about whether it can maintain this growth after the US election.

Data source: Polymarket data dashboard

At the same time, Telegram founder Pavel Durov was arrested in France, which had a direct impact on TON's performance. In August, TON's TVL plummeted by 53.1%, and institutional investors withdrew to avoid potential risks.

Bitcoin Layer 2

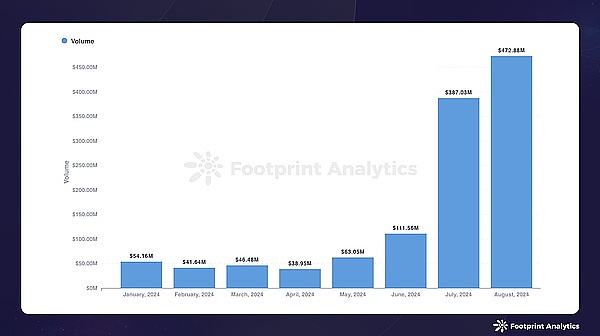

As of August 31, Bitcoin Layer 2 (including sidechains) has a TVL of $1.09 billion, a 5.8x increase since January 1, 2024, and a staggering 18.7x increase since January 1, 2023.

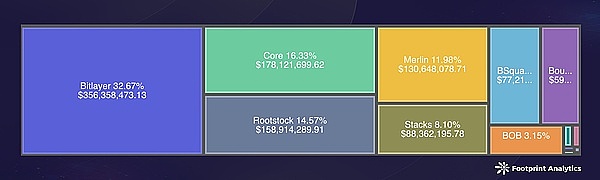

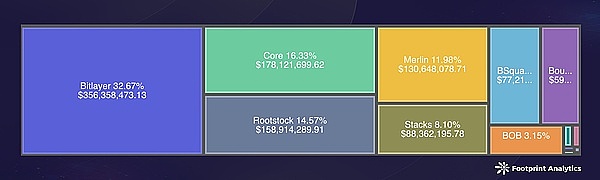

Bitlayer leads the field, accounting for 32.7% of the total TVL, followed by Core at 16.3%, Rootstock at 14.6%, and Merlin at 12.0%.

Data source: Bitcoin ecological public chain TVL

Sponsored Business Content

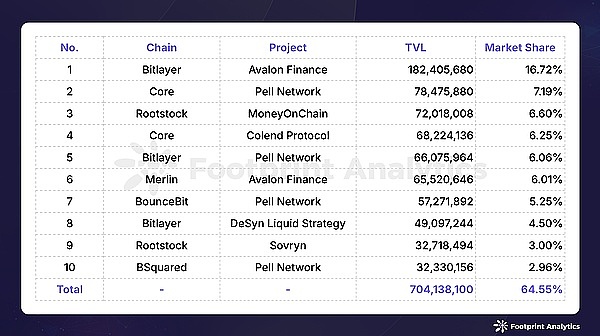

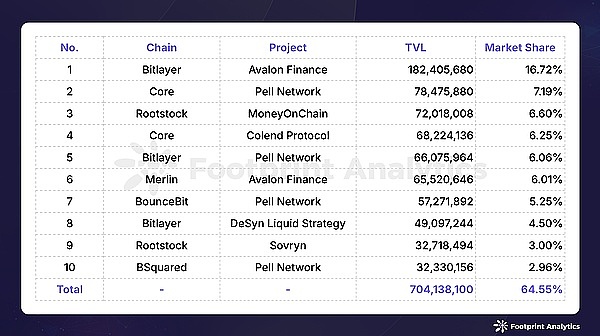

From the perspective of individual DeFi projects on a single chain, the top 10 projects account for 64.6% of the total TVL, among which Avalon Finance (Bitlayer), Pell Network (Core) and MoneyOnChain (Rootstock) rank at the top, accounting for 16.7%, 7.2% and 6.6% respectively.

Data source: Bitcoin Ecosystem Public Chain TVL

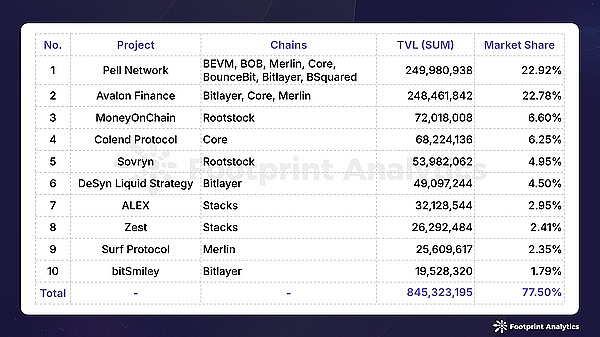

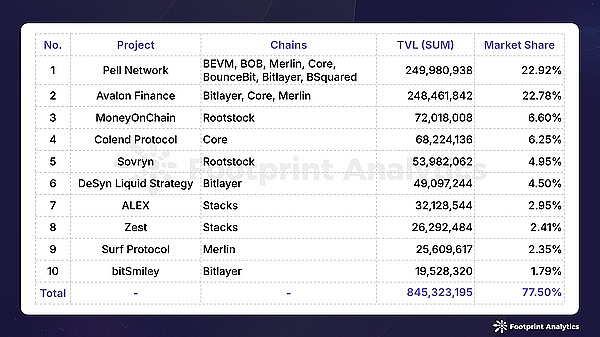

When considering the multi-chain TVL of the project, Pell Network operates on seven chains and leads with a market share of 22.9%, while Avalon Finance operates on three chains and follows closely with a market share of 22.8%. The top 10 projects account for 77.5% of the total market share.

Data source: Bitcoin DeFi project TVL (multi-chain aggregation)

For a deeper analysis of Bitcoin Layer 2, please refer to our latest research report jointly released with CoinMarketCap: "BTCFi: Analysis of the Bitcoin DeFi Ecosystem Based on On-Chain Data".

Ethereum Layer 2

As mentioned earlier, Ethereum faced many challenges in August, and its Layer 2 network was no exception.

Arbitrum One, Optimism, and Base continue to dominate in terms of TVL market share, holding 50.2%, 20.0%, and 8.2% respectively, with little change in TVL compared to last month.

DeGate's TVL increased significantly by 20.6%, Scroll increased by 7.4%, and Taiko increased by 7.1%. However, Blast decreased by 18.8% and zkSync decreased by 8.8%.

Data source: Ethereum Layer 2 Overview in August 2024 - Rollups (Bridge-related indicators)

Overall, user activity in Ethereum Layer 2 remains sluggish, suggesting that a new round of innovation and more attractive applications are needed to re-attract users. Against the backdrop of Bitcoin Layer 2's strong performance this year, the Ethereum Layer 2 ecosystem may need new narratives and stronger user participation to regain momentum.

This month, Soneium has become a hot topic. On August 23, Sony Blockchain Solutions Labs, jointly initiated by Sony Group and Startale Labs, announced the launch of Soneium, a new Layer 2 network based on Ethereum. The network will use Optimism's OP Stack technology, spanning the fields of games, entertainment and finance, combining Web3 innovation with consumer applications.

Soneium

In the week after the announcement, Soneium made rapid progress, including the launch of the "Minato" testnet, the launch of the "Soneium Spark" program for developers, and the cooperation with Transak to provide global fiat currency deposit services. As industry giants like Sony continue to enter the blockchain space, there is growing optimism about bringing more users into the Web3 ecosystem.

Blockchain Games

In August, a total of 1,492 games were active on various blockchain networks, down 5.45% from July. BNB Chain, Polygon, and Ethereum led the market with 20.2%, 17.4%, and 17.0% market share, respectively.

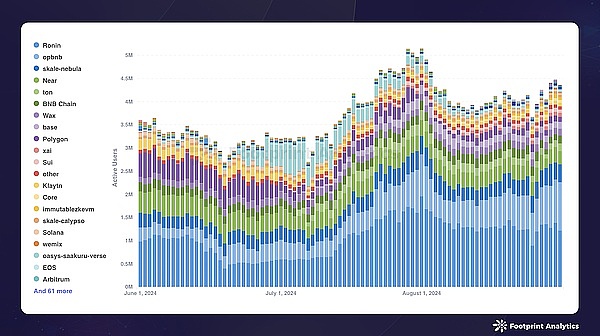

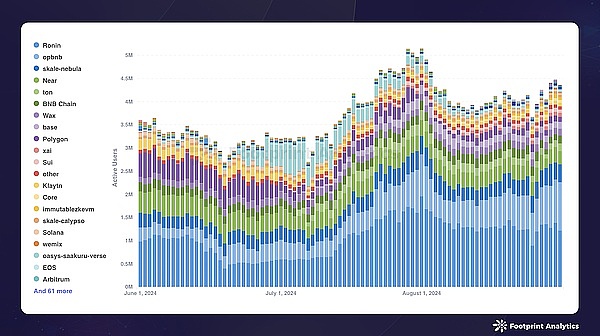

Ronin, opBNB, Nebula (SKALE subnet), and NEAR performed well in terms of DAUs, averaging 1.34 million, 691,000, 349,000, and 321,000, respectively, during the month. As of the end of August, these chains accounted for 28.0%, 23.8%, 8.8% and 6.6% of the DAU market share respectively.

Data source: Daily active users of blockchain games on various public chains

Ronin's DAU market share continued to decline during August, from 38.1% on August 1 to 28.0% on August 31. Despite this, Ronin's average DAU in August was still nearly twice that of opBNB, which followed closely behind. This downward trend was mainly caused by the performance of the game Lumiterra, whose DAUs dropped from 600,000 at the beginning of the month to 150,000 at the end of the month.

Separately, on August 6, the Ronin cross-chain bridge was suspended due to a white hat hacker attack that revealed a critical misconfiguration in the cross-chain bridge upgrade proposal. Approximately $12 million worth of cryptocurrency was transferred. Although the issue was quickly resolved and all funds were recovered, the incident had a certain impact on the activity of the Ronin ecosystem.

Conversely, opBNB's DAU share increased from 17.5% to 23.8% in August. As of August 31, its market share almost doubled from 13.1% on July 1. SERAPH: In The Darkness, a game launched on opBNB in mid-July, has gained significant attention, with DAUs increasing from 187,000 on August 1 to 515,000 by the end of the month. Nebula’s market share also increased, from 7.6% to 8.8%. As a SKALE subnet with a “zero gas fee” model, Nebula’s growth was driven by games such as Yomi Block Puzzle, moteDEX, and Haven’s Compass. For more blockchain game industry trends, read “Blockchain Game Research Report in August 2024: User Growth and Cryptocurrency Market Volatility Coexist”.

Financing

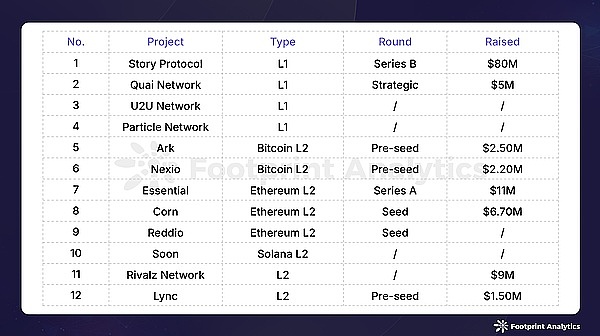

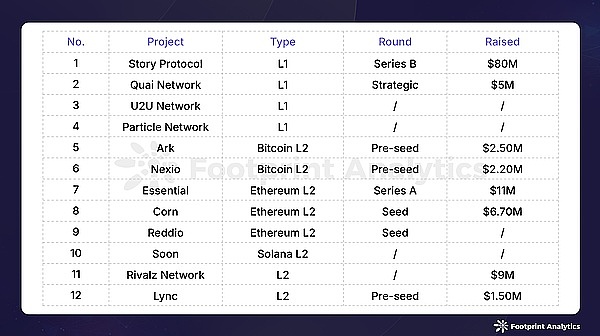

In August, there were 12 financing events in the public chain field, with a total amount of US$118 million, an increase of 20.1% from July. It is worth noting that four of the financing events did not disclose the specific amount.

Public chain financing events in August 2024 (data source: crypto-fundraising.info)

The increase in total financing this month was mainly due to a major financing event. July’s largest funding round was Caldera’s $15 million Series A, while August was significantly boosted by Story Protocol’s $80 million Series B.

Story Protocol’s core contributor PIP Labs received the funding, which is backed by venture capital giant Andreessen Horowitz (a16z). Story Protocol aims to revolutionize intellectual property management by transforming intellectual property (IP) into modular, programmable “IP Lego.” These assets can be licensed, managed, and monetized through smart contracts on the blockchain. Story Protocol gives creators the ability to embed licensing and royalty terms directly into their intellectual property, allowing for greater control over their data. The project’s mainnet is expected to go live later this year, sparking great anticipation.

Story Protocol

In addition to Story Protocol, three other Layer 1 blockchains, including Quai Network, U2U Network, and Particle Network, received new financing in August. On the Layer 2 side, multiple projects also successfully raised funds, including Bitcoin Layer 2’s Ark and Nexio, Ethereum Layer 2’s Essential, Corn, and Reddio, Solana Layer 2’s Soon, and other Layer 2 projects such as Rivalz Network and Lync.

An emerging trend worth noting is the increasing attention paid to Move Stack. Two Layer 2 blockchains, Nexio and Lync, which are powered by Move Stack, completed a new round of financing this month.

JinseFinance

JinseFinance