Author: revelointel Source: substack Translation: Shan Ouba, Golden Finance

AI is one of the most powerful narratives in the cryptocurrency space right now, if not the most powerful; and it’s not going away anytime soon. Just yesterday, Apple announced a major integration with OpenAI to bring generative AI applications to users. NVDA continues to soar, sparking interest from crypto natives who want more exposure to the industry. While there is certainly demand for adjacent assets in crypto, there aren’t many projects that actually incorporate AI into their operations…

In this article, we’ll focus on Bumper. With its initial premise of protecting downside risk, Bumper is taking AI in a new direction. Bumper is a novel DeFi protocol that enhances traditional derivatives markets by providing a simple, fair, and decentralized way to hedge price risk. The protocol leverages a loss prevention tool that provides price protection against market crashes and downside volatility. Bumper’s philosophy revolves around establishing a fair profit and loss distribution procedure in risk markets. Unlike traditional adversarial markets, which typically have winners and losers, Bumper is motivated by creating a system that promotes fairness and the proper allocation of resources. Bumper aims to provide a mutual price risk facility that prioritizes minimizing individual losses over maximizing individual profits. By focusing on risk management and protection, Bumper aims to create a safer and more secure environment for participants in the DeFi ecosystem.

As you know, cryptocurrencies are inherently volatile; limiting downside risk while effectively preserving upside potential can be difficult. This is where Bumper's AI integration shines; the team uses AI to help predict price movements, thereby providing users with higher returns, lower premiums, increased efficiency, and solvency.

Bumper Background

Bumper is a typical project dedicated to improving its existing protocol through AI. As expected, Bumper’s AI integration strategy revolves around three key AI technology stacks, each designed to address specific challenges and enhance the capabilities of the protocol:

Price Prediction

Sentiment Analysis

Technical Analysis

To validate the accuracy and effectiveness of its predictive models, Bumper employs a proprietary agent-based modeling (ABM) approach. ABM is a computational technique that simulates the actions and interactions of autonomous agents (such as individuals, groups, or entities) to assess their impact on the overall system. These agents follow predefined rules and can learn, adapt, and evolve based on their experience and interactions.

Agencies are important because Bumper operates as a market maker and taker in a two-sided market: users on one side hedge their risk and pay a premium by locking in a floor price, and users on the other side deposit stablecoin liquidity to earn a yield. To meet the needs of both sides of the market, the pricing of premium costs needs to be optimized: if it is too expensive, takers will not participate; if it is too cheap, it is not attractive to market makers because they need to bear the risk. As price fluctuations and volatility change, finding a balance becomes more complicated. This is why Bumper's ABM tool is so important, as it can dynamically adjust premium prices based on real-time volatility, absorb signals from LLMs (large language models), foresee market trends and actively rebalance.

Through this ABM approach that supports AI integration strategies, Bumper predicts that its protocol efficiency will improve economics by 5-25%, effectively balancing the trilemma of lower premiums, higher returns and solvency strength.

Price Prediction

The first AI technology stack is related to price prediction, utilizing a large language model (LLM) with 70 billion parameters. Bumper trained this LLM with financial data, including price (open, high, low, close) and volume indicators from the Bitcoin price dataset. The LLM is fine-tuned using reinforcement learning with human feedback (RLHF), rewarding those prediction models that match the actual price data. The figure below shows a visualization of Bitcoin price prediction using Bumper's 70 billion parameter LLM. Initially trained based on daily opening/closing prices, it was later changed to hourly data, with the ultimate goal of incorporating tick data for higher accuracy. Since $BTC tick data contains hundreds of TB of data, it uses retrieval-augmented generation (RAG) to convert relational database information into data vectors. RAG technology not only improves LLM performance, but also facilitates the integration of multiple real-time asset price data streams, which is key for RLHF within the existing LLM context window.

Sentiment Analysis

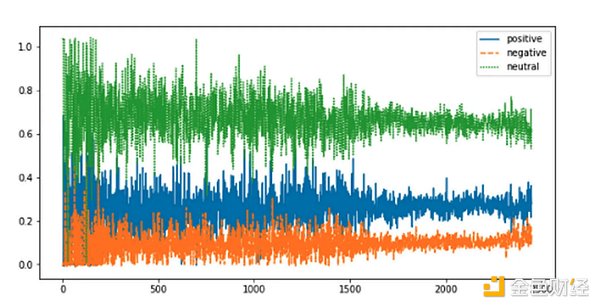

The second AI technology stack focuses on sentiment analysis. By leveraging a pre-trained 8 billion parameter large language model (LLM), Bumper is able to analyze large amounts of financial natural language processing (NLP) data to grasp market sentiment with unprecedented granularity. Through fine-tuning and advanced NLP techniques, Bumper gains valuable insights into speculators' attitudes, providing a deeper understanding of market dynamics and trends.

Bumper's pre-trained LLM ingests extensive financial NLP data, classifying sentiment into detailed scores and distributions to provide a nuanced understanding of market sentiment. The model is fine-tuned using Bidirectional Encoder Representations (BERT) to tag opinions, attitudes, and emotions, and is trained with specialized NLP to recognize specific financial vocabulary.

BERT is a state-of-the-art Natural Language Processing (NLP) model developed by Google. It understands the context of words in a sentence by considering both the words before and after the target word, rather than just the preceding word. This bidirectional approach enables BERT to capture the full context of a word, thus interpreting its meaning more accurately.

LLM is equipped with an attention mechanism that enables the model to weigh the importance of different words in a sentence when determining the context and a transformer-based structure, thereby effectively discerning market sentiment and investor behavior and predicting future market trends.

Technical Analysis

The third AI technology stack focuses on technical analysis. Bumper is developing a new approach that combines vision-based price image analysis with NLP-driven technical indicator interpretation by training a large language and vision assistant (LLAVA). This integration enables Bumper to make informed decisions based on historical price data and market trends.

The process involves converting historical Bitcoin price data into chart images. These images are annotated with technical markers such as support/resistance levels, relative strength index (RSI), and moving average convergence divergence (MACD). The LLAVA model processes these visual data points and related NLP technical indicators. This end-to-end multimodal model connects the visual encoder with a large language model (LLM), enabling the system to analyze and interpret complex market data. In addition, the model combines long short-term memory (LSTM) for historical time series forecasting, enhancing the ability to predict future market movements based on past trends.

Summary

The Bumper project is committed to providing more effective risk management solutions in the cryptocurrency market by integrating AI into its DeFi protocol. The project uses the three major AI technology stacks of price prediction, sentiment analysis, and technical analysis, combined with the agent-based modeling (ABM) method, to dynamically adjust premium pricing to adapt to real-time market fluctuations. Through this innovative approach, Bumper not only improves the economic efficiency of the protocol, but also creates a fairer, safer and more reliable environment for participants. The combined application of these technologies is expected to increase Bumper's protocol efficiency by 5-25%, effectively solving the balance problem between reducing premiums, increasing returns and enhancing solvency.

Miyuki

Miyuki

Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Brian

Brian Miyuki

Miyuki Weatherly

Weatherly Anais

Anais Weiliang

Weiliang Joy

Joy Alex

Alex