Author: Revc, Golden Finance

I. Introduction

The crypto market sentiment has not yet recovered from the plunge on August 6, and a piece of news about Plustoken on August 7 once again touched the sensitive nerves of the crypto market.

According to Lookonchain's monitoring, hundreds of wallets that have been dormant for 3.3 years have begun to transfer large amounts of Ethereum (ETH), possibly involving 789,533 ETH, or about $2 billion. On-chain tracking shows that the funds came from a wallet called "Plus Token Ponzi 2". The wallet dispersed 789,533 ETH into thousands of wallets in 2020, and has not moved since April 2021.

AndAccording to on-chain analyst Ember's monitoring, most of the Plustoken-related wallets have been sold in 2021, and only 25,757 ETH have been collected so far. Random market sentiment was appeased.

Arkham then stated on the X platform that the Plustoken wallet was associated with dozens of wallets, and $464.7 million of ETH had been transferred in the past 12 hours alone.

II. Plustoken Incident Review

Case Background

PlusToken was launched in May 2018, claiming to be a multi-functional cross-chain decentralized wallet and "smart dog brick moving" arbitrage platform. By promoting eye-catching slogans such as "coin king", "thousand-fold coin", and "82 times increase in 8 months", it quickly attracted a large number of investors to join. The platform uses a pyramid scheme model to invite new members through referral codes and requires a minimum of $500 in cryptocurrency as a threshold to obtain platform benefits.

Development process

May 2018: PlusToken was launched

The platform attracted a large number of investors under the guise of "blockchain wallet" and "smart brick moving". In just one year, the number of registered members reached 2.7 million, and the maximum level reached 3,293.

June 27, 2019: Withdrawal problems exposed,operation stagnated

PlusToken began to be unable to withdraw cash normally, causing panic among investors. Although the platform officials did not explain this, some investors still chose to believe in the platform, causing more funds to continue to pour in. After the platform stopped operating, the Plustoken account still received 150 million yuan worth of cryptocurrency,

November 26, 2020: Second-instance judgment

On November 26, 2020, the Intermediate People's Court of Yancheng City, Jiangsu Province, made a second-instance judgment on the PlusToken case, ruling to confiscate the cryptocurrency seized in the case and to turn over the funds and proceeds to the state treasury in accordance with the law.

III. Where the Funds Went

PlusToken defrauded global investors of $2 billion to $2.9 billion in cryptocurrencies through a Ponzi scheme. The platform mainly relies on over-the-counter (OTC) channels for large-scale capital inflows and outflows, and evades tracking through complex on-chain asset transfers and currency mixing services. Part of the funds were used to purchase real estate and luxury cars, while others were cashed out through the OTC market.

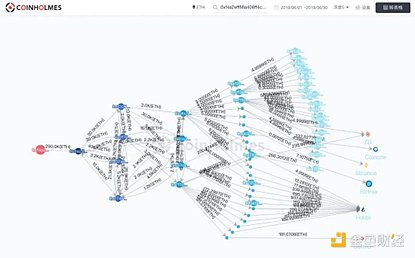

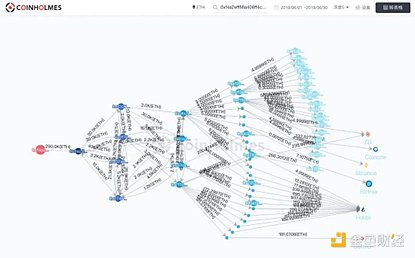

In June 2020, 789,500 Ethereum (ETH), worth approximately $191.9 million at the time, were transferred from a PlusToken wallet and dispersed through hundreds of intermediary wallets.

Between June and September 2021, most of the Ethereum (ETH) in Plustoken wallets was transferred to the Bidesk exchange (which closed down at the end of 2021) through multiple addresses. Subsequently, these ETH were transferred from the Bidesk exchange to the Huobi exchange. The amount of ETH transferred through only four Bidesk deposit addresses reached 268,843.

Funds Confiscated to the National Treasury

The total value of the cryptocurrencies involved in Plustoken exceeded 15 billion yuan. According to the ruling, law enforcement agencies seized a total of 194,775 bitcoins, 833,083 ethers, 1.4 million litecoins, 27.6 million EOS, 74,167 DASH, 487 million XRP, 6 billion DOGE, 79,581 BCH and 213,724 USDT. In the end, the organizers involved in the case were sentenced for pyramid scheme fraud, and the platform funds were confiscated according to law.

Summary

The activities of Plustoken wallets continue to touch the sensitive nerves of investors and affect the recent trend of ETH. According to the analysis of on-chain data, this wallet transfer is more likely to come from the operation of persons who have been released from prison in the case. In addition to the impact on the market, people are more concerned about the huge losses suffered by investors in the incident. Since the outbreak of the case, the price of cryptocurrencies has risen dozens of times. However, in the early stages of the crypto industry, many investors failed to keep their wealth. If the current crypto industry is compared to the gold rush era in North America, it is releasing a broad space for development and wealth growth. Investors need to ensure the safety of their assets and avoid falling into Ponzi schemes so as to enjoy the dividends of the development of the times.

WenJun

WenJun