This article is a sequel to the previous two articles

The King of Sichuan is here and doesn't pay taxes?

Use tariffs to "bloodbath" the world?

As we all know, there are many economics named after people in the world, but not many of them are famous all over the world, such as Mugabe Economics, Chavez Economics, and Erdogan Economics.

Relatively speaking, Mugabe Economics and Chavez Economics are very low-end, and their essence is simple and crude, that is -

When you encounter any economic troubles, then print money;

If printing money can't solve the problem, it's because you don't print enough!

However, the one who can really summarize a set of bluffing theories is Erdogan's economics. This Turkish president, who is similar to Trump in many aspects, is also loved by the grassroots people in Turkey for "knowing everything".

The famous saying of Erdogan's economics is:

"Interest rates are the cause, inflation is the result, the lower the interest rate, the lower the inflation rate."

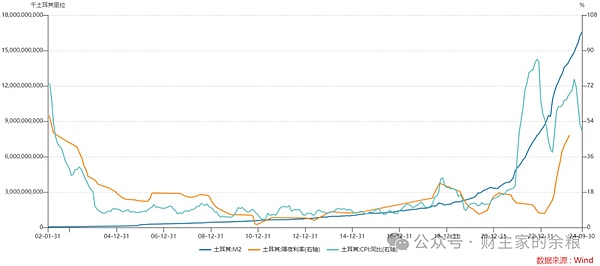

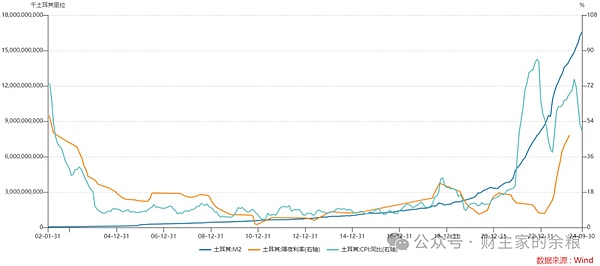

You see, since the Sultan of Turkey came to power (as prime minister in 2002), low interest rates correspond to low inflation, and high interest rates correspond to high inflation. The data has clearly demonstrated the "correctness" of Erdogan's economics...

Therefore, there is no relationship between printing money and inflation. From 2002 to 2024, even if Turkey's broad money supply soared from 45.8 billion liras to 16.55 trillion liras, inflation has nothing to do with printing money. As long as the Central Bank of Turkey can maintain low interest rates, Turkey's inflation will go down... Even if 100 trillion liras of banknotes are printed, there will be no problem.

During the presidential campaign, in addition to proposing policy proposals to reduce income tax and increase tariffs, Trump has been boasting that after he takes office, US interest rates will be significantly reduced, and US inflation will also be significantly reduced...

It suddenly made me feel that Trump turned into the Egyptian Sultan, and the two "Kings of Understanding" instantly merged into one.

So, we have to ask, after Trump takes office in 2025, is it possible to achieve low interest rates and low inflation?

We must first define the standard, what is low inflation and what is low interest rate?

Low inflation is easy to say. It is recognized by central banks around the world that a CPI growth rate below 2% can usually be called low inflation, so this standard is relatively easy to define.

What is the standard for low interest rates?

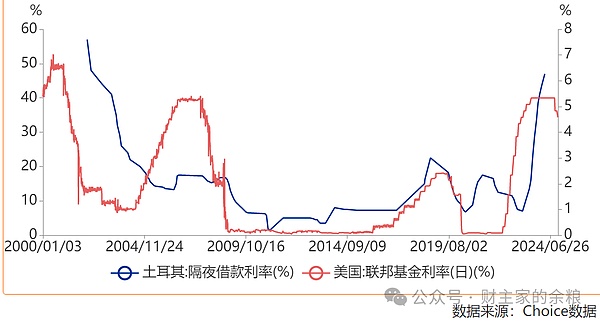

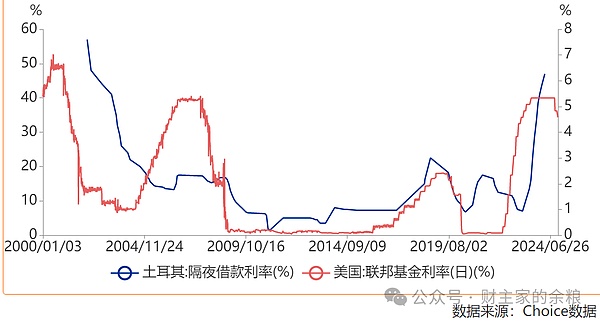

In Turkey under Erdogan's rule, the interest rate was less than 5% for less than one year in 23 years. Most of the time it was above 10%, and one-third of the time it was above 20%. Now it is as high as 47%. In Erdogan's view, 5% should be an extremely low interest rate.

In the United States, the highest federal funds rate in the past 20 years was only 5.5%, and most of the time it was maintained at an extremely low level of 0.25%. Therefore, the low interest rate in Trump's eyes is definitely not the current interest rate of about 5%. During Trump's first presidential term in 2018, when the Federal Reserve only raised the benchmark interest rate to 2.5%, Trump shouted that he would fire Powell and explicitly asked Powell to lower the interest rate.

According to this, we can believe that an interest rate below 2.5% is the low interest rate that Trump expects, so we might as well set the low interest rate standard at 2.5%.

With these two standards, I can deeply analyze the relationship between low interest rates and low inflation in American history.

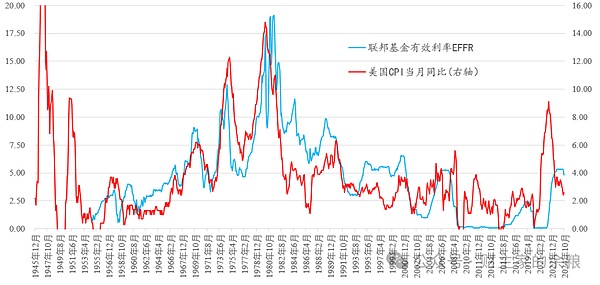

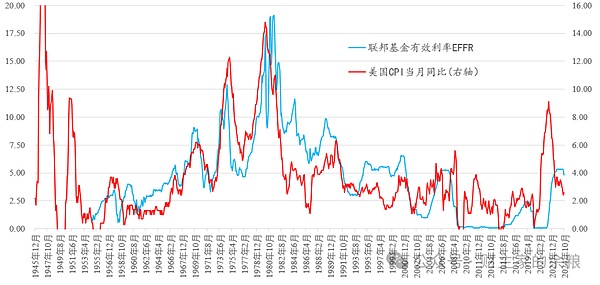

The following chart is a comparison of the US federal funds rate and the monthly CPI inflation rate every day in the past 70 years.

Data source: choice

Without considering the absolute control of the federal government over interest rates during World War II, and without considering the situation at individual points in time, there are seven time periods in which the U.S. interest rate was below 2.5% and the inflation rate was below 2%:

(1) January 1949-July 1950, lasting for 1.5 years;

(2) October 1952-April 1956, lasting for 3.5 years;

(3) October 1960-April 1961, lasting for 2.5 years;

(4) October 1970-April 1971, lasting for 1.5 years;

(5) October 1980-8 (4) October 2001 - April 2004, duration: 2.5 years; (5) November 2008 - February 2011, duration: 2.5 years; (6) May 2012 - November 2016, duration: 4.5 years; (7) December 2018 - February 2021, duration: 2 years.

Period (1) was the end of World War II, coupled with the slowdown of the Marshall Plan to aid Europe, and the economic recession caused by overcapacity in the United States. The inflation rate was significantly lower than during the war, coupled with the low interest rate set by the federal government. This period ended with the outbreak of the Korean War, which caused the inflation rate to rise again.

Period (2) was the end of the Korean War, and the economic recession caused by overcapacity in the United States. The inflation rate was significantly lower than during the war, coupled with the low interest rate set by the federal government. This period ended because the federal government delegated the right to decide interest rates to the Federal Reserve and the market, giving up the government's absolute control over currency and interest rates. This event also established the "independent status" of the Federal Reserve above other government departments.

Period (3) was the normal economic recession in the United States, which caused a low inflation rate. Then the Federal Reserve lowered interest rates to stimulate the economy, and there was a period of low interest rates and low inflation. This period ended with the outbreak of the Vietnam War.

Period (4) was the US economic recession after the 9/11 incident, which resulted in low inflation. The Fed then lowered interest rates to stimulate the economy, resulting in a long period of low interest rates and low inflation. This period ended with the hot US real estate market.

Period (5) was the deep economic recession after the outbreak of the global financial crisis, which resulted in low inflation. The Fed then lowered interest rates to 0 and added large-scale QE to stimulate the economy. This resulted in a period of low interest rates and low inflation. This period ended with the implementation of QE2.

Period (6) was very special. It was during the US economic recovery, when there was no economic recession. However, it was at a time when China's urbanization and manufacturing production capacity were advancing by leaps and bounds. It was also the peak of globalization after the outbreak of the Cold War. China's high-quality and low-priced goods flooded into the US, suppressing inflation, and the Fed was happy to keep interest rates low. This period ended when Trump came to power, lowered income taxes to stimulate the US economy, launched a trade war, and caused inflation to rise.

Period (7) was during the Trump administration. The last round of interest rate hikes in the United States reached its peak, but inflation had not yet risen and corporate debt had peaked. Later, the outbreak of the epidemic caused a sharp drop in the inflation rate. The Federal Reserve cut interest rates to 0 again and began to implement unlimited QE. This period ended with the rise in inflation caused by unlimited QE. In addition, the supply chain was interrupted by the Russia-Ukraine war, and inflation accelerated.

To summarize these seven periods of low interest rates and low inflation, one of the biggest common features is that the economy was in a state of recession. Among them,

(1)(2)(3)(4) periods, the United States was still the world's largest producer. Once the war ended or the economy prospered for a period of time, there would be overcapacity, resulting in low inflation. Then the government controlled and lowered interest rates, or the Federal Reserve stimulated the economy and lowered interest rates, resulting in a period of low interest rates and low inflation.

Because of the hollowing out of the manufacturing industry, the conditions of (1)(2)(3)(4) no longer exist in the United States.

(5) In this case, the US economy is in deep recession, low interest rates and low inflation due to the outbreak of the financial crisis. This should be a result that Trump does not want, so we don’t need to talk about it.

(6) In this case, because the globalization of mankind for thousands of years has reached its peak, coupled with the fact that the US economic recovery was not stable at the time, the Federal Reserve deliberately maintained a zero interest rate, which led to a period of low interest rates and low inflation. In other words, under the current hollowing out of the US manufacturing industry, only the largest scale of globalization can bring low inflation and allow the Federal Reserve to calmly lower interest rates.

(7) In this case, the US economy was close to recession in the early stage, and the epidemic crisis in the later stage caused the US economy to really fall into recession. Unless Trump wants to experience another US economic recession or a global epidemic crisis, this situation is also impossible to replicate.

Therefore, the low interest rate + low inflation promised by Trump means that the US economy will either fall into recession or be at the apex of globalization. According to the political correctness of current US politicians, it means decoupling from China, imposing tariffs, and going against globalization, which is completely contradictory to Trump's low interest rate + low inflation policy.

What's more, Trump also claimed to impose tariffs on a large scale and expel illegal immigrants.

Unfortunately, most of the daily necessities in the United States are now imported. Large-scale tariff increases will inevitably lead to price increases for daily consumer goods, which will make Trump's low inflation go down the drain.

It is precisely because of a large number of illegal immigrants that the price of US service inflation has been reduced. If, as Trump said, he would use the military to expel illegal immigrants as soon as he came to power, it would mean that countless cheap laborers engaged in the US service industry would disappear, which would lead to a surge in service inflation prices, and it would be even more impossible to reduce inflation.

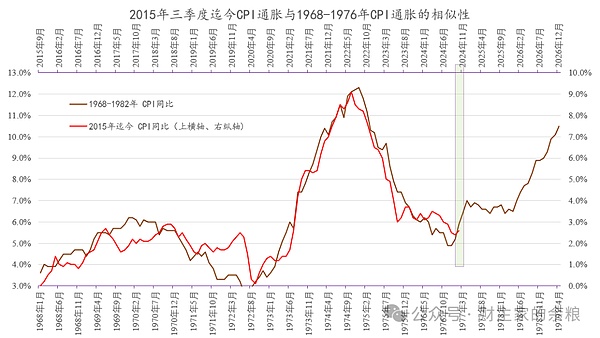

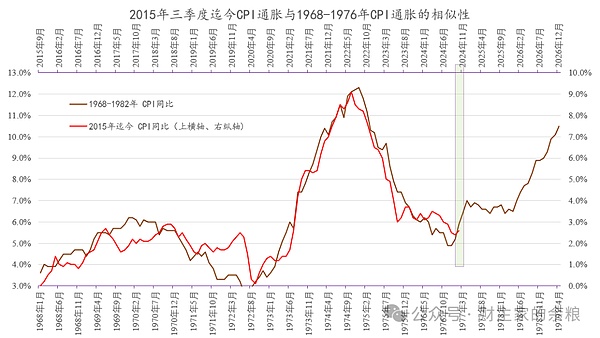

The worst thing is that the current decline in inflation in the United States is likely to be coming to an end...

Trump should think about his "role model" E. Sultan. Although he proposed the theory of "low interest rates lead to low inflation" that refreshed economic common sense, his government has been working hard to control Turkey's ultra-high inflation of more than 50% in the past three years. At this time, E. Sultan did not jump out and say that lowering interest rates can curb inflation. Instead, he acquiesced to the central bank governor he appointed to raise Turkey's lending rate to 47% (no decimal point), the highest in the world.

Even so, E. Sultan did not get the low inflation he wanted.

Not to mention that low inflation is difficult to achieve after Trump takes office, it is actually difficult for him to achieve low interest rates - because although the US president has great power, and in this election, the Republican Party won 4 of the 5 major power institutions in the United States (president, Senate, House of Representatives, Supreme Court), but unfortunately, the Federal Reserve is not something Trump can take down just because he wants to.

Because the Federal Reserve does have a certain degree of "independence", the US president cannot fully control the Federal Reserve.

Although Trump often clamors for Powell to step down, in fact, as long as Powell insists on not resigning (he has stated several times that he will not resign), Trump will be helpless. We will talk about this in another article.

Catherine

Catherine