Janet Yellen's Progress in Building U.S.-China Relations

Janet Yellen's visit to China aimed to address China's dominance in the EV market and improve diplomatic relations, but definitive progress remains uncertain.

Miyuki

Miyuki

Author: Gwen, Corresponding Author: Bjeast, Enzo, Youbi Investment Research Team

About gold movement, US debt, interest rate cuts, balance sheet reduction and US election.

Since the end of March, gold and the US dollar have decoupled and both have risen. Mainly due to the recent excessive non-US geopolitical emergencies, uncertainty factors have led to a rapid rise in global risk aversion, and gold and the US dollar have shown safe-haven properties at the same time.

The behavior of central banks of various countries, led by China, starting to sell US debt and support gold suggests a trend of local resistance to US dollar hegemony and uncertainty in the demand for long-term US debt. Since other sovereign countries have earlier expectations of interest rate cuts, such as Europe and Switzerland, if inflation continues to remain high, the strength of the US dollar will continue.

In the short term, due to the Fed's mid-year slowdown in balance sheet reduction, the growth of the Treasury's TGA balance in April exceeded expectations, which will partially offset the liquidity impact of the Treasury's bond issuance. Attention should be paid to the specific bond issuance volume of the Treasury and the ratio of short-term and long-term bonds.

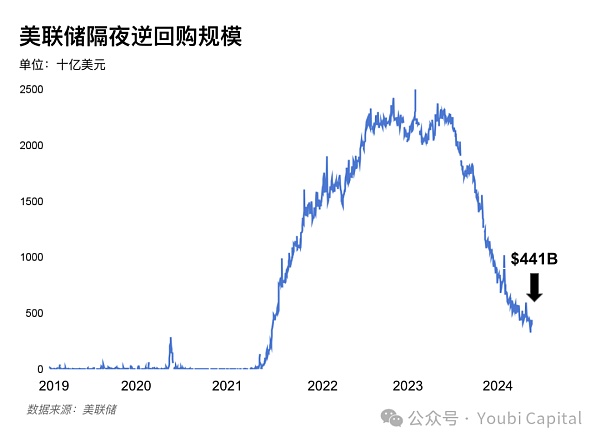

However, in the medium and long term, the US debt crisis has not been resolved. The current US government's fiscal deficit rate has soared, and the suspension of the ceiling bill will end in January next year. The market expects that this year's bond issuance demand will remain the same as last year. When the reverse repurchase is close to zero, the TGA account balance becomes a key indicator, and the bank reserve ratio should be kept vigilant.

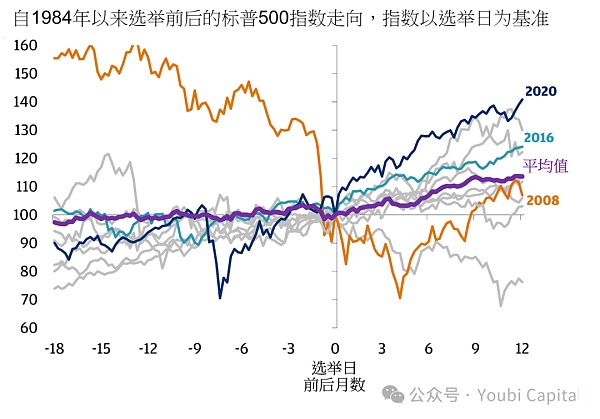

In the two months before the election year, due to the uncertainty of votes and specific policies, risk assets have historically tended to show a volatile decline. In order to maintain its independence, the Federal Reserve will try its best to maintain economic growth in the election year and keep the market in a state of ample liquidity.

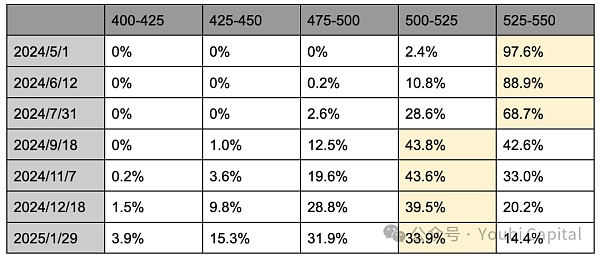

The US economy is showing strong domestic demand, inflation is recurring, and expectations of economic recession have dropped significantly compared to last year. Institutions' expectations of "preventive" interest rate cuts have collectively adjusted to the second half of the year or even after the new year. CME data shows that the market's expectations for interest rate cuts in September and November are as high as ~45%, while expectations for the first interest rate cuts in December and January are gradually increasing. Combined with the historical performance of interest rate policies in election years, interest rate policies before election months (i.e. September) are usually more cautious. In addition, the sufficient conditions for interest rate cuts are poor employment and weak inflation, and we should remain vigilant against tightening financial markets.

Balance sheet expansion can have a more direct impact on market liquidity than interest rate cuts. The Federal Reserve has considered slowing down its balance sheet reduction in advance. By slowing down the reduction of U.S. debt, the market generally expects to slow down its balance sheet reduction in May or June to hedge against liquidity tightening, and to completely stop its balance sheet reduction at the beginning of next year, followed by a balance sheet expansion cycle. At the same time, history shows that there is a high probability of a short-term reversal operation after the election.

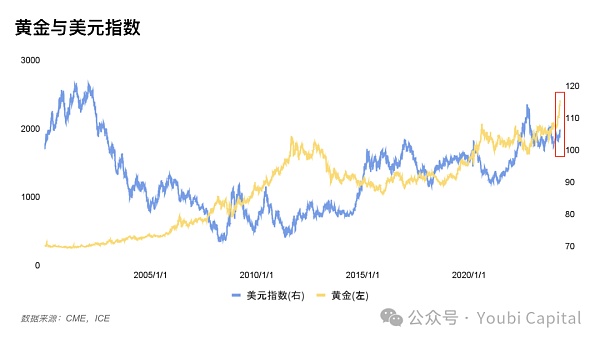

Figure 1: US dollar and gold price trend chart

In the past, the international gold price trend was usually negatively correlated with the US dollar index, but since the end of March, gold and the US dollar index have shown an abnormal rise in the same trend. The negative correlation can be explained by the three attributes of gold, namely commodity attributes, currency attributes and safe-haven attributes, which need to be discussed in combination.

Commodity pricing: The strengthening of the pricing currency will reduce the price of the priced asset, gold (the same applies to commodities)

Financial attributes: Gold is a substitute for the US dollar and a potential substitute for the decline in the credit of the US dollar. When the US dollar is weak, investing in gold may be able to obtain higher returns;

Safe-haven attributes: Usually, a strong US dollar indicates strong economic fundamentals, so the demand for safe-haven assets decreases. However, as a world currency, the US dollar also has safe-haven attributes. Specific risks need to be discussed specifically.

The recent abnormal rise in gold prices has attracted a lot of attention. There are two main reasons.

1) Market risk aversion caused by geopolitical wars. The Moscow air strikes, the Israeli air strikes on the Iranian embassy in Syria (the direct trigger), and Iran's direct attacks on Israel are all causing the world to begin to increase demand for gold purchases, which is one of the driving forces behind the rise in gold prices in the short term.

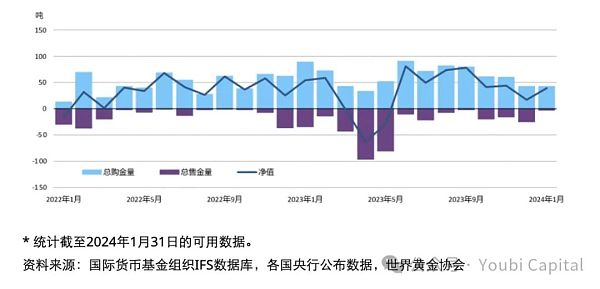

2) Central banks of various countries continue to buy gold, increasing demand. In order to avoid the risk of US debt, some central banks began to reduce their holdings of US debt and increase their holdings of gold, thereby pushing up the price of gold. This also indirectly reflects that there is a crisis of confidence in the US dollar, which may evolve into de-dollarization in the future. For example, the People's Bank of China's gold reserves increased by 10 tons in January, increasing gold reserves for the 15th consecutive month; the current total gold reserves are 2,245 tons, an increase of nearly 300 tons from the end of October 2022 when the reserve increase began to be announced again.

Figure 2: Global central bank gold purchase trend

https://china.gold.org/gold-focus/2024/03/05/18561

1) The domestic demand of the US economy is stable, which has delayed the expectation of interest rate cuts. The economic data of the US in Q4 of 23 shows that the current economy has a certain resilience, while the Q1 of 24 shows that the current domestic supply in the United States is in short supply and needs to rely on overseas imports. In addition, the repeated inflation data reduces the necessity of interest rate cuts. The demand for maintaining a tight monetary policy to stabilize the US dollar has led to the rise of the US dollar.

2) The US dollar passively rises due to the influence of international exchange rates, such as Switzerland unexpectedly cutting interest rates ahead of schedule. If other currencies have monetary easing policies, the interest rate differential will cause the US dollar exchange rate to rise relative to other countries, thereby pushing up the US dollar index.

3) As the world currency, the US dollar undertakes part of the safe-haven demand. When the geopolitical crisis does not involve the United States, the safe-haven property of the US dollar will be partially revealed, and it will have the same effect as gold.

Reason 1: Both the US dollar and gold have the attributes of safe-haven assets. When sudden risk events occur in a concentrated manner, leading to the deterioration of geopolitical crises or economic crises, the market risk aversion is too strong, which will form a situation where both are strong. At the same time, the commodity and financial attributes of gold have less influence than the safe-haven attribute. For the US dollar, the United States maintains a tight monetary policy, while the currencies of other economies weaken, supporting the strengthening of the US dollar. Similar situations have also occurred in history, such as the failure of US foreign intervention in 1993, the European sovereign debt crisis in 2009, and the instability in the Middle East.

Reason 2: Although the US dollar has shown a trend of strengthening in the short term, the behavior of some central banks to reduce their holdings of US bonds and increase their holdings of gold also implies resistance to the hegemony of the US dollar. There is a trend of de-dollarization in some areas, and we should be vigilant against the US dollar credit crisis.

From the perspective of gold trends, the trend of gold in the short term mainly depends on whether Iran will retaliate against Israel on a large scale. If the geopolitical situation continues to deteriorate, gold may continue to soar. From the trend of the US dollar index, some other sovereign currencies currently have earlier expectations of interest rate cuts, such as the euro and the pound, and the Swiss National Bank has already cut interest rates in advance. Among them, the US dollar still has room for interest rate differentials and may still have certain support in the future.

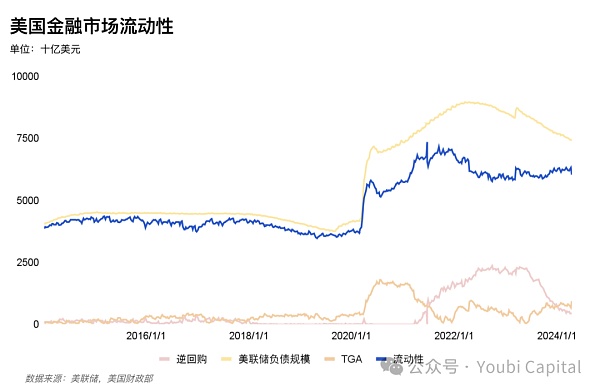

Financial market liquidity is an important indicator for us to judge future market trends. The bull market at the beginning of the year was also due to the liquidity of traditional funds brought by the passage of BTC ETF and the short-term increase in liquidity caused by the dovish remarks of the Federal Reserve. Finally, there was a pullback due to the lack of liquidity in the overall financial market.

The financial market often measures market liquidity through real liquidity index = Federal Reserve debt scale - TGA - reverse repurchase = financial institution deposits + currency in circulation + other liabilities. For example, in the figure, we can find that BTC and financial liquidity indicators in the last cycle are positively correlated, and there is even a trend of overfitting. Therefore, in an environment with abundant liquidity, the market's risk appetite will be improved, especially in the crypto market, where the impact of liquidity will be amplified.

Figure 3: BTC and financial liquidity indicators

The recent decline in the scale of reverse repurchase is mainly used to offset the decline in liquidity caused by the increase in the issuance of US bonds and the reduction of the Fed's balance sheet. The release of liquidity in March was also mainly contributed by the release of reverse repurchase. However, the scale of reverse repurchase continues to decline, and the Fed currently maintains a monthly scale of 95 billion. At the same time, in order to cope with the arbitrage space caused by low interest rates, the BTFP interest rate has been adjusted to no less than the reserve interest rate since January 25. After the arbitrage space narrowed, the use of BTFP turned to decline, and it was impossible to further increase the size of the Fed's balance sheet. In addition, April is facing the tax season, and the short-term rise in TGA accounts has reduced overall market liquidity. Since 2010, the median TGA account in April has increased by 59.1% month-on-month, and will gradually return to normal over time.

Figure 4: Liquidity in the US Financial Market

In summary, in the short term, the tax season ended in May, and TGA growth exceeded expectations. Institutions predict that the Federal Reserve will start to ease QT progress in the middle of the year and ease the trend of liquidity tightening. However, in the medium and long term, the market lacks new growth momentum for liquidity. The US financial liquidity has continued to decline due to the Fed's balance sheet reduction process and the near exhaustion of reverse repurchases, which will further affect risky assets. The adjustment of the Bank of Japan's monetary policy will increase the uncertainty of liquidity risk, which will bring certain downside risks to technology stocks, crypto assets and even commodities and gold.

The excessive volatility of US debt was an important cause of the "triple kill of stocks, bonds and gold" in March 2020. The recent surge in US debt yields has once again exposed the potential problem of imbalance between supply and demand in the US debt market.

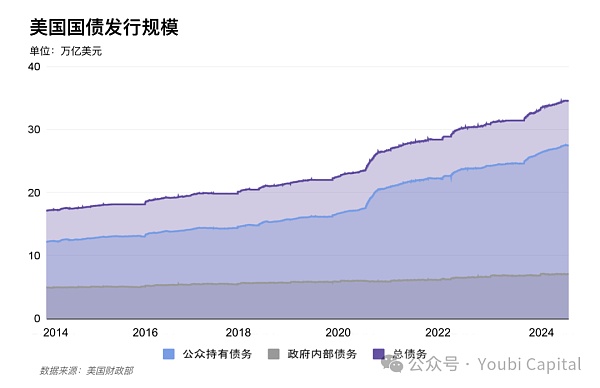

2.2.1 Oversupply

The deficit rate in 2023 reached -38%, up 10% year-on-year. The soaring high deficit rate means that there is a need to maintain the issuance of US debt this year. The high debt and high deficit fiscal situation caused by the epidemic is superimposed on the interest rate hike cycle. The weighted average interest rate of the total outstanding debt in fiscal year 2023 is 2.97%, which continues to increase the total interest that the United States needs to repay. In 2023, the new US debt will be 2.64 trillion, and in 2024, the new US debt will be 0.59 trillion, with the current total amount reaching 34.58 trillion.

In the short term, the refinancing expectations given by the Ministry of Finance on April 29 show an increasing trend, and the specific needs need to track the quarterly refinancing plan officially released by the Ministry of Finance. Although institutions represented by Nomura generally believe that the unexpected increase in tax revenue of the Ministry of Finance in April due to the increase in wage levels last year, the current Ministry of Finance TGA account has increased significantly, 205 billion US dollars more than expected, and Yellen may lower financing expectations.

In the medium and long term, the market generally expects that the United States will issue 2-2.5 trillion bonds this year, so this year will issue 1.41-1.91 trillion, which is close to the average speed of Q1 in 24 years. The bill to "suspend the US debt ceiling" will be stopped on January 1, 2025. In order to prevent the recurrence of the US debt crisis, before ending the suspension of the debt ceiling, the Ministry of Finance has the motivation to issue enough US debt to ensure short-term government spending and normal operation after the suspension. Wall Street expects that the U.S. government will continue to issue large amounts of bonds regardless of who wins the presidential election in November.

Figure 5: U.S. Treasury issuance scale

2.2.2 Weak demand

Foreign investors and the Federal Reserve are the largest buyers of U.S. Treasury bonds, accounting for half of the market share of tradable U.S. Treasury bonds. Although the Federal Reserve is currently considering slowing down its balance sheet reduction, the two have stopped increasing their holdings of U.S. Treasury bonds for a long time since 2022, and the supply pressure has been transferred to domestic investors in the United States, and the amount of investment purchased by the resident sector has increased significantly. Domestic investors prefer short-term bonds, and the amount of acceptance is limited and the volatility is large. The current issuance of short-term debt has exceeded the ideal range. Since the debt ceiling was suspended in June 2023, the Treasury's short-term bills accounted for 53.8% (85.9% in November 2023). The Treasury's Borrowing Advisory Committee recommends that the proportion of short-term bonds should be maintained at 15-20%.

<Long-term bond buyers>

The Fed's balance sheet reduction process is continuing. From Q1 22 to Q4 23, a total of 1016B has been reduced. In the short term, the process of balance sheet reduction may be slowed down, but it will not suddenly turn. According to the March FOMC meeting, the FOMC unanimously agreed to reduce the monthly balance sheet reduction by about half, the MBS reduction limit remained unchanged, and the reduction of US Treasury bonds was reduced. If the Fed slows down the balance sheet reduction process as expected in the near future, it will offset some of the demand for long bonds.

Japan, China and the United Kingdom are the top three permanent buyers, holding more than 1/3 of foreign investors holding US debt. The demand of major foreign investors had rebounded at the end of 2023, but has recently shown a downward trend again, especially China, which sold 20 billion US dollars of US bonds again in the first two months of 2024.

Due to changes in local monetary policy and the current strengthening of the US dollar index, the European Central Bank is expected to cut interest rates in June, and the yen exchange rate has depreciated sharply again and has not reversed the trend. When the yen fell below the 150 mark in October 2023, the monetary authorities chose to sell US bonds to maintain the stability of its sovereign currency exchange rate;

Recently, the United States has experienced repeated inflation. The actions of some central banks represented by China to sell US bonds and increase their holdings of gold indicate that they are de-dollarizing and reducing the risk of asset depreciation. At present, China has not reversed the trend and increased its holdings;

The uncertainty of the geopolitical crisis also affects the demand for US bonds.

Therefore, if the Federal Reserve slows down the reduction of its balance sheet in advance, the US dollar begins to weaken or geopolitics eases, or the demand for some long-term US bonds may be restored.

<Short-term debt buyers>

The purchase of bonds by the household sector is unstable, among which individual investors and hedge funds have alleviated the current imbalance between supply and demand. However, there is an upper limit for domestic individual investors to purchase, and hedge funds are sensitive to interest rates, easily affected by the market, and there is a possibility of large-scale selling, so the demand of the household sector in the future has an upper limit and instability.

The liquidity buffer caused by the larger short-term debt comes from money market funds. The characteristics of money market funds are flexible deposits and withdrawals. The demand is overnight reverse repurchase or short-term treasury bonds with a maturity of less than half a year, and there is very little demand for long-term treasury bonds. At the same time, the floating loss of money market funds' assets is easy to cause market runs, so in more cases, they tend to choose overnight reverse repurchase with more stable interest rates. In the future, when the US bond market fluctuates greatly, money market funds are also likely to sell US bonds.

After the suspension of the US bond ceiling in Q2 2023, money market funds have increased their holdings of short-term US bonds by 203 billion. By transferring ON RRP to undertake part of the demand for short-term US Treasuries, the scale of reverse repurchase will drop by 271B again in 2024. Morgan Stanley expects the scale of reverse repurchase to drop to zero in August, and the Fed will start to reduce QT in June. However, it is not ruled out that the Fed will slow down the reduction of the balance sheet in advance and postpone the time point of zeroing the scale of reverse repurchase to Q4.

Figure 6: Overnight reverse repurchase scale of the Federal Reserve

In summary, there are many medium- and long-term factors that lead to imbalances in supply and demand on both the supply and demand sides. If the Federal Reserve starts to plan to slow down the process of balance sheet reduction in May, the US dollar begins to weaken or geopolitics is eased, there is a chance to alleviate the US debt crisis from the long-term debt demand side. However, the downward trend of the reverse repo scale will not be reversed in the short term. After the reverse repo scale is close to zero, the trend of TGA will become a key indicator for releasing liquidity. At the same time, we should be alert to changes in the reserve ratio of US depository institutions. 3 Monetary policy trends 3.1 Impact of the US election on risky assets The biggest impact of the US election on risky assets is the negative impact in the first two months (September-October) and the positive impact in the last month (December). Due to the uncertainty of the election results in the first two months, the market usually shows a risk-averse sentiment, which is particularly evident in years with fierce competition and low vote differences, such as 2000, 2004, 2016 and 2020. After the election, the market tends to rebound as the uncertainty subsides. The influencing factors of the election year need to be combined with other macro factors for judgment.

Figure 7: The trend of the S&P 500 index before and after the election day, from JPMorgen

https://privatebank.jpmorgan.com/apac/cn/insights/markets-and-investing/tmt/3-election-year-myths-debunked

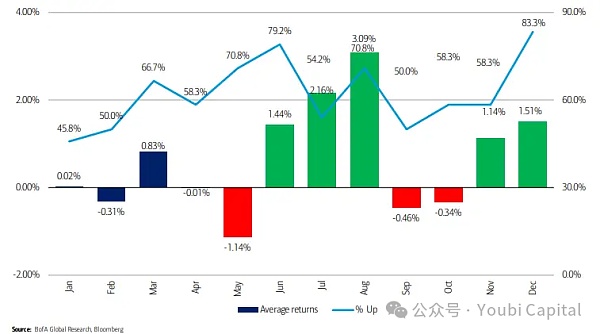

Bank of America analyst Stephen Suttmeier analyzed the average monthly returns of the S&P 500 index in election years and found that the month with the strongest growth in election years is usually August, with an average increase of just over 3% and a winning rate of 71%. Subsequently,. Meanwhile, December is usually the month with the highest profit opportunities, with a winning rate of 83%.

Figure 8: Average return rate in the election year, from Stephen Suttmaier, an analyst at Bank of America

https://markets.businessinsider.com/news/stocks/stock-market-2024-outlook-trading-playbook-for-crucial-election-year-2024-1

In addition to the uncertainty of the results caused by the difference in votes/party disputes, there are also differences in the specific policies of the candidates. Biden and Trump will remain the main candidates in 2024, and their economic policies have also diverged greatly.

Biden's re-election will basically maintain the status quo, continue to impose higher corporate taxes, and ease the deficit, but it will be bearish for the stock market from a fundamental perspective. At the same time, compared with Trump, Biden retains greater independence for the Federal Reserve.

Trump advocates comprehensive tax cuts while increasing infrastructure spending. During his last term, the effective tax on corporate income dropped significantly, while the deficit rate rose rapidly, which in turn increased the pressure on US debt. At the same time, the coordination between monetary policy and fiscal policy may increase, and inflation risks will exist for a long time, accelerating the depreciation of the US dollar's credit.

The normalization of interest rates depends on economic fundamentals (such as growth, employment and inflation) and financial conditions. Therefore, most of the market's expectations for the Fed's rate cuts are "preventive" rate cuts, judging whether a rate cut is needed based on the strength or recession of the US economy, although this approach is often susceptible to the Fed's erratic expectation management.

So does the US economy need prevention? From the current GDP data, the economy is stable, the possibility of recession is small, and the need for preventive rate cuts has been postponed. The US's revised real GDP in the fourth quarter of 23 was 3.4% quarter-on-quarter on an annualized basis, 0.2 percentage points higher than before, and real personal consumption expenditures increased by 3.3% quarter-on-quarter, an increase of 0.3 percentage points. Consumption also continued to provide momentum for economic expansion, and even the GDP data before the revision was in a state of economic growth (GDP grew by 2.9% in Q4 2022). Although the GDP data for Q1 2024 was lowered to 1.6%, the main reason for the decline was the high growth of imports and the weakening of inventories, indicating that the current domestic demand in the United States is still strong, and there is a market situation where the domestic economy is in short supply. As a result, major professional financial institutions have postponed their expectations for interest rate cuts. Goldman Sachs expects a rate cut in July, Morgan Stanley also believes that it will be after June, and CICC predicts that the rate cut node will be postponed to Q4. According to the latest pricing of CME interest rate futures, traders currently predict that the probability of a 25 basis point rate cut in July has dropped to 28.6%, a 25 basis point rate cut in September has reached 43.8%, and a 25 basis point rate cut in November has reached 43.6%. As a result, the market's expectations for rate cuts in September and November are close, but expectations for the first rate cuts in December and January of the following year are increasing.

Table 1: CME rate cut expectations, as of April 29, 2024

However, the arrival of the rate cut window undoubtedly requires non-agricultural employment gap and weak inflation data, that is, the economy cools down, or financial conditions need to be tightened again. Uncertainty comes from the US election in November. First of all, the Fed's change in monetary policy before the election is suspected of affecting the election results. Therefore, the distribution range of the federal funds rate changes in the election year is smaller than that in the non-election year, and the decision to cut interest rates in September will be more cautious. At the same time, it is not ruled out that some Fed officials will maintain a "dovish preference" in order to maintain growth and employment, and support rate cuts when economic data is still resilient. However, historically, studies on the past 17 US elections and US monetary policies show that the probability of the Fed conducting a reversal operation before the election (before November of the year) is low, while the probability of starting a reversal operation in the short term after the election is relatively high. Only twice did the Fed change from raising interest rates to lowering interest rates within a year, and four times did the federal funds rate or monetary policy change immediately after the November election month. In summary, the US economy has stable domestic demand and repeated inflation. Financial institutions' forecasts of interest rate cuts have generally shifted to the second half of the year or even next year. CME data show that the expectation of interest rate cuts in September and November is the largest, but the probability of December and January of the following year is increasing. However, it is still necessary to be vigilant that the sufficient condition for interest rate cuts is a poor economy, so there may still be a tightening of financial markets before the interest rate cut policy comes. At the same time, historically, interest rate policies and monetary policies (i.e., interest rate cuts in September) are usually more cautious before the election month, and the possibility of a reversal in the short term after the election month is higher. 3.3 Fed's balance sheet reduction cycle Is the expansion of the balance sheet more effective than the interest rate cut?

Currently, the market's attention is mostly focused on the expectation of interest rate cuts, but in fact, balance sheet expansion has a greater direct impact on market liquidity than interest rate cuts. The above mentioned market liquidity indicator = Fed's debt scale - TGA - reverse repurchase scale. Balance sheet expansion means that the Fed expands its balance sheet, increases reserves in the banking system and currency in circulation by purchasing assets such as Treasury bonds or mortgage-backed securities in the form of liabilities, and creates incremental money to directly expand market liquidity, so it is also called "printing money". Interest rate cuts, on the other hand, encourage companies and individuals to increase investment and consumption by reducing borrowing costs, and transfer funds to risk markets to improve liquidity.

When will monetary policy change?

The progress of balance sheet normalization depends on the supply and demand of reserves. According to the article "Scarce, Abundant, or Ample? A Time-Varying Model of the Reserve Demand Curve" published in 2022 by New York Fed President Williams and others: "The reserve demand curve is nonlinear. The adequacy is measured by the ratio of reserves to bank assets. 12%~13% is the critical point between overabundance and moderate abundance, and 8%~10% is the warning line for shortage." Financial market performance is often nonlinear, which has been reflected in the market. After approaching 13% in 2018, the reserve ratio quickly fell nonlinearly to 8%. When the Fed announced a slowdown in balance sheet reduction, it had fallen back to 9.5%, and finally restarted balance sheet expansion in October 2019.

Figure 10: Ratio of bank reserves to total assets of commercial banks

Currently, the reserve ratio in the United States has reached 15%, which is still in an overabundant state. As liquidity tightens and the reverse repurchase scale is exhausted to zero, the reserve ratio will continue to decline. Institutions tend to predict that the balance sheet reduction will end at the beginning of next year. Goldman Sachs expects to start reducing QT in May and end the balance sheet reduction in Q1 2025. Morgan Stanley believes that when the reverse repurchase scale is close to zero, QT will be reduced and QT will be completely ended in early 2025. CICC predicts that the critical point will be reached in Q3. If the Fed slows down in advance in May, the critical value can be postponed to Q4. At the same time, historically, the Fed tends to make a monetary shift in the short term after the end of the US election month.

In summary, the Fed has released a signal that it is considering slowing down the balance sheet reduction. The market generally predicts that it may slow down the balance sheet reduction in May or June, stop the balance sheet reduction at the beginning of next year to end QT, and then usher in a balance sheet expansion cycle. The current risk uncertainty still lies in the increase in the supply of US bonds, and the scale of reverse repurchase is close to zero, which has caused large fluctuations in the US Treasury market. Especially in the election year, economic stability is particularly important. The Fed may stop the balance sheet reduction in advance and advance the schedule of balance sheet expansion to avoid the market from experiencing the "repurchase crisis" in 2019 again.

Gold and the US dollar have both risen recently. In addition to geopolitical emergencies, we should keep an eye on the trend of some central banks selling US bonds and increasing their holdings of gold, suggesting that local de-dollarization has occurred.

In the short term, the increase in TGA balances and the expectation that the Fed will ease the balance sheet reduction will partially hedge the liquidity tightening caused by the issuance of US bonds. In addition, we need to keep an eye on the total amount of refinancing and the ratio of short-term and long-term bonds in the second quarter. In the medium and long term, the imbalance between supply and demand of US Treasuries has not been fundamentally resolved. Due to the rising deficit ratio and the bill to stop suspending the ceiling next year, there will still be a large demand for US Treasuries in 2024. The scale of reverse repurchase will maintain a downward trend, and we should keep an eye on the trend of TGA balance and the nonlinear decline of bank reserve ratio.

The US economy has stable domestic demand but repeated inflation, and expectations of interest rate cuts are generally postponed to the end of the year. The expectation of stopping the balance sheet reduction remains at the beginning of next year for the time being. Combined with history, monetary policy tends to remain vigilant before the US election, and the probability of a short-term shift after the election is relatively high.

Janet Yellen's visit to China aimed to address China's dominance in the EV market and improve diplomatic relations, but definitive progress remains uncertain.

Miyuki

MiyukiIn an interview on CNBC on Wednesday, Yellen pointed out that under U.S. law the SEC and the Commodity Futures Trading Commission have tools at their disposal to protect consumers and investors.

Others

OthersYellen told an event hosted by the New York Times DealBook that it was important to ensure that crypto assets had adequate customer protections.

Others

OthersHer remarks largely echo concerns voiced by banking regulators at two days of congressional hearings.

Others

OthersThe U.S. Treasury Secretary said the crypto sector is in need of "very careful regulation" while some lawmakers are already preparing to propose tougher rules.

Coindesk

CoindeskThe head of the U.S. Treasury Department does not recommend that "most people" invest their retirement funds in digital assets.

Cointelegraph

CointelegraphA head of the Treasury would not recommend investing the retirement money into digital assets “to most people.”

Cointelegraph

CointelegraphTerra's UST dropped as low as $0.29 and Tether's USDT stablecoin briefly de-pegged from the dollar to hit $0.96 on Wednesday.

Cointelegraph

CointelegraphThe U.S. Treasury secretary highlighted the department’s cryptocurrency monitoring efforts during a hearing of the House Financial Services Committee on Wednesday.

Cointelegraph

CointelegraphThe U.S. Treasury secretary emphasized the department’s crypto monitoring efforts at a House Financial Services Committee hearing on Wednesday.

Cointelegraph

Cointelegraph