After more than a decade of complex legal proceedings, the bitcoins recovered from the collapse of Mt. Gox have finally begun to be repaid to its creditors. This historic moment not only marks the end of a negative event that has been pending since 2013, but also brings an end to a major market suspense in the Bitcoin industry.

Summary

To date, 59,000 of the 142,000 bitcoins recovered from the Mt. Gox hack have been repaid to creditors through trading platforms such as Kraken and Bitstamp. This repayment process is not only a recognition of the patience of creditors, but also reflects the gradual maturity of the Bitcoin industry.

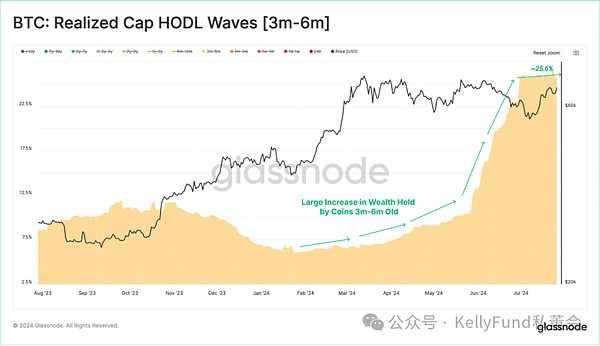

The proportion of assets held by new investors is declining, far below the levels seen at macro market tops in the past. This highlights a general shift in investor behavior towards long-term holding.

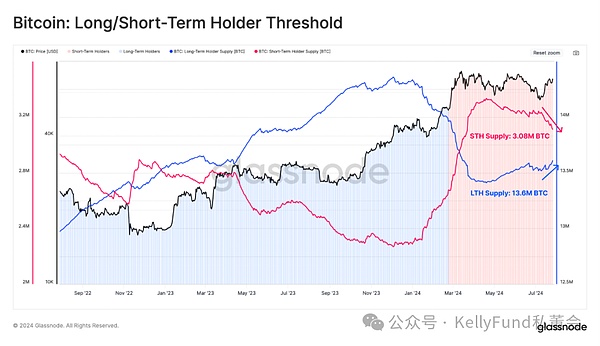

The long-term holder group currently holds 45% of the total Bitcoin assets in the market, which is still relatively high compared to the levels when the market is near the top of the cycle in the past.

Mt. Gox repayment is long overdue

After more than a decade of long legal proceedings, Mt. Gox's creditors finally ushered in their historic victory - the Bitcoin recovered from the collapsed Mt. Gox has finally begun to be repaid - and as they wished, it has returned to their hands in the form of Bitcoin rather than fiat currency, which is not only a reward for their long struggle, but also an affirmation of the value of Bitcoin.

From a psychological perspective, this marks the end of a major market suspense in the Bitcoin industry since 2013. In the end, more than 141,686 Bitcoins were recovered, of which nearly 59,000 have been redistributed to creditors, and the rest will be repaid in the near future.

Figure 9: Band realized market value of Bitcoin held statically (holding time March-June)

The figure below shows the current behavior pattern of long-term investors who hold Bitcoin for more than 6 months.

Figure 11: The watershed between long-term and short-term holdings

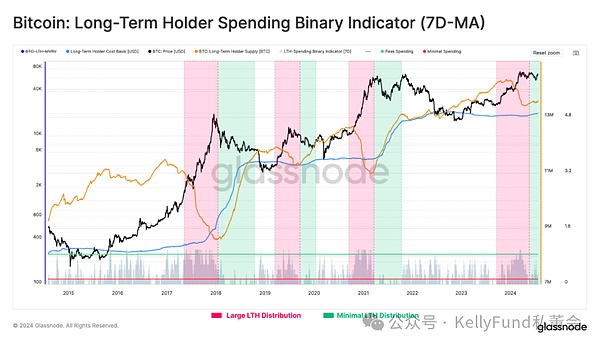

Finally, we use the binary spending indicator of long-term holders to analyze and visualize the allocation pressure of Bitcoin.

The allocation pressure of the long-term holder group is still relatively light and is still declining. This further confirms our argument that Bitcoin supply is still dominated by long-term holders with firm convictions. At present, continuing to hold firmly is still our preferred strategy. <span yes'; mso-bidi- font-size:10.5000pt;mso-font-kerning:1.0000pt;">

Figure 12: Binary spending indicator of long-term holders (7-day moving average)

Summary

Mt. Gox's repayment event is not only an affirmation of the creditors' long-term struggle, but also an important sign of the gradual maturity of the Bitcoin industry.

Although this event may bring some selling pressure to the market, this pressure may be effectively alleviated considering the general change in investor behavior and the stability of the market.

In the future, as long-term holders continue to dominate market supply and wait for higher prices to sell assets, the long-term development of the Bitcoin market is still full of potential.

Article source: https://insights.glassnode.com

Original author: UkuriaOC, CryptoVizArt, Glassnode

JinseFinance

JinseFinance

JinseFinance

JinseFinance CryptoSlate

CryptoSlate Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Catherine

Catherine Ftftx

Ftftx