Author: flowie, ChainCatcher

On October 9, U.S. federal prosecutors filed market manipulation and fraud charges against four cryptocurrency "market makers" and their employees, and the SEC and FBI also participated in the investigation. Gotbit, the market maker behind the so-called "meme DWF", Bonk, and Neiro, is on the list.

Currently, Gotbit's CEO Aleksei Andriunin has been arrested in Portugal, and two of Gotbit's employees in Russia have also been indicted.

As early as a year ago, the chain detective ZachXBT had exposed Gotbit's market-making methods and warned users to be wary of any project that cooperated with Gotbit. Since then, Gotbit has also been controversial because of the suspected rugs involved in multiple tokens involved in market making.

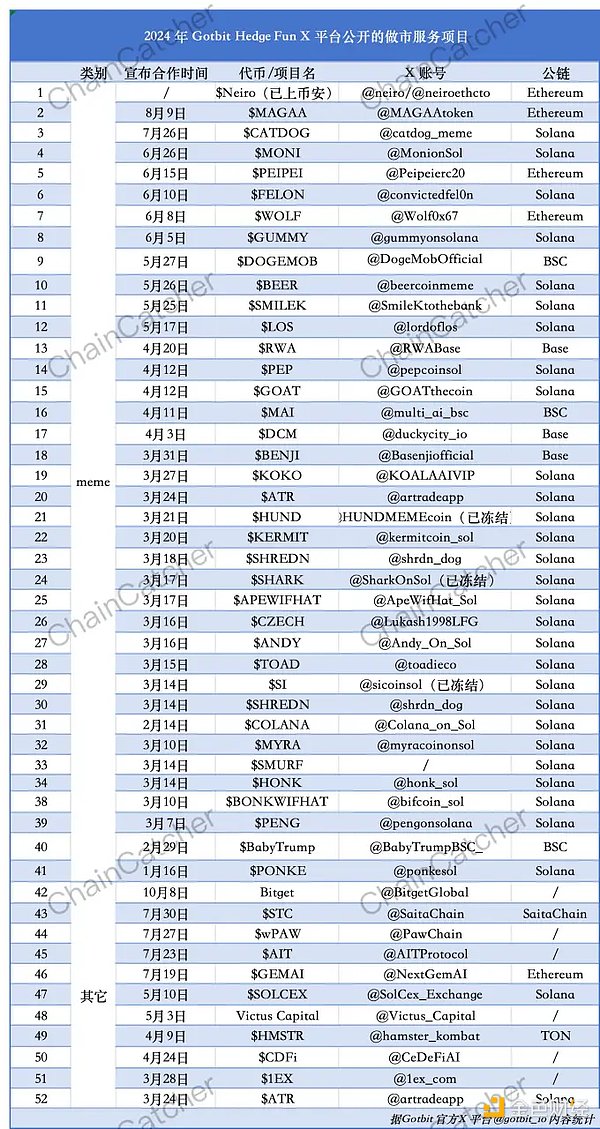

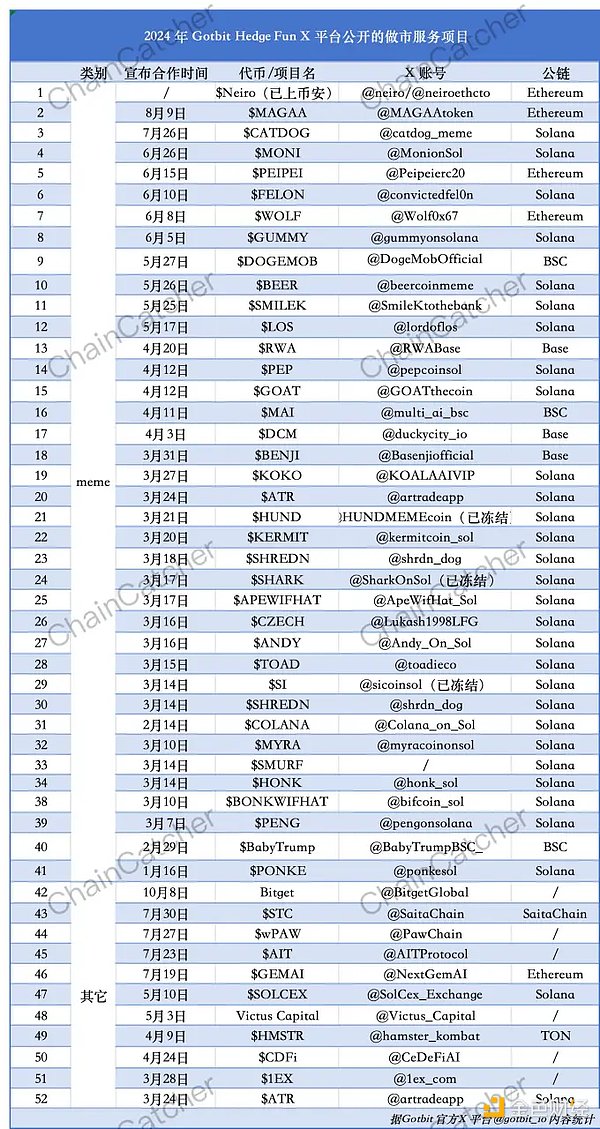

However, Gotbit's market-making service still attracted a large number of project parties and meme teams. According to Gotbit's official X platform, Gotbit has provided market-making services to about 50 project parties such as Neiro and Hamster Kombat this year, most of which are memes.

Started out by forging transactions and became famous for market making for memes

According to the official introduction, Gotbit is a hedge fund that specializes in helping tokens achieve market value growth, with two main business segments: market making and venture capital. Gotbit manages $1.3 billion in assets and has more than 400 cooperative institutional clients.

According to RootData data, Gotbit has also invested in decentralized cross-chain IDO platform Poolz Finance (POOLX), Layer1 5ireChain (5IRE), and Solana Meme project analoS.

Gotbit was founded in 2018 when ICO was popular. At that time, its founder Alexey Andryunin was a 20-year-old college student who had just enrolled.

In 2019, CoinDesk revealed Gotbit’s fake trading behavior in an article, that is, by programming robots to trade tokens back and forth, creating the illusion of an active market, to help customers list on at least two unknown exchanges and achieve the purpose of listing on CoinMarketCap.

Alexey mentioned that the exchange was aware of this manipulation, but had no interest in stopping it. At that time, there were 300 to 500 projects on CoinMarketCap that belonged to Gotbit’s customers. Alexey also bluntly stated that he did not have long-term hopes for the development of this business, because crypto regulation would inevitably pay attention to the fake transactions of these unknown exchanges.

But Gotbit did not slow down its business because of this. At the end of 2022, the first meme coin on the Solana chain, Bonk, was launched. As the market value of Bonk soared, Gotbit, as the market maker behind it, also surfaced.

At the end of 2023, during the Solana reversal meme craze, ANALOS, which Gotbit made the market, created a wealth myth of 3,700 times in a week, and Gotbit once became the wealth code of meme players.

In 2024, as memes continued to be popular, Gotbit also shifted its focus to providing market making services for memes. Gotbit is behind many popular memes such as BEER and WATER.

The earliest tweet of Gotbit’s official X platform was on March 14. According to the statistics of the cooperation content released by its X platform on March 14, Gotbit has publicly cooperated with more than 50 projects, more than 90% of which are meme projects, and most of them are memes on the Solana chain.

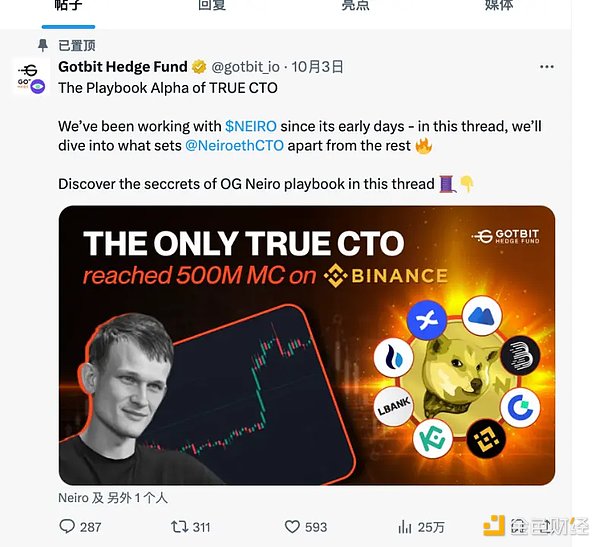

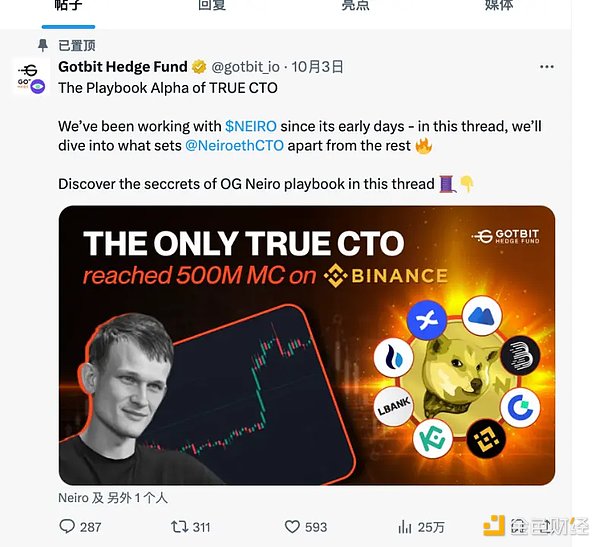

The top tweet of Gotbit’s official X platform is about the recent launch of Binance’s lowercase Neiro (First Neiro on Ethereum), and revealed the cooperative relationship with the Neiro team.

It is worth mentioning that on July 19, Gotbit’s official X platform also tweeted that it would provide market-making services for NextGemAI, a project created by the FBI for this “fishing enforcement”.

Continuing to make markets for memes has also made Gotbit notorious and faced fraud charges from US prosecutors.

Market-making fake meme harvests players, Gotbit is finally targeted by the FBI

An FBI agent provided an investigation document that mentioned two cases in which Gotbit was involved, both of which were made by exaggerating the trading volume of crypto companies, manipulating crypto trading prices to induce purchases to raise crypto prices, and selling at high prices to make profits.

Gotbit has repeatedly helped the cryptocurrency company Robo Inu increase its daily trading volume by more than one million US dollars. Web3 technology company Saitama has also earned tens of millions of dollars through Gotbit's "market-making" service.

In September 2023, the chain detective ZachXBT also shared a document on the X platform that exposed Gotbit's market-making strategy.

Gotbit will push the token price up to 10 times in the first few minutes of the price discovery phase to create FOMO, attract as much buying power as possible, and sell all tokens in the subsequent peak.

In the first 12 trading hours, Gotbit aims to take advantage of existing arbitrage opportunities and focus on making quick and substantial profits;

On the launch day, Gotbit's target trading volume is more than 50 million US dollars, and most transactions are generated on CEX for free through the generation system.

Gotbit is committed to reaching 20 times the first peak after the token opens, and 25 times within the first month of trading.

ZachXBT once said that there were problems with the market-making service provided by Gotbit, and reminded users to be wary of projects that cooperated with Gotbit.

But Gotbit remains active and has cooperated with multiple meme projects to harvest large amounts of funds from a large number of users.

At the end of 2023, within 2 weeks of ANALOS's cooperation with Gotbit, the market value began to plummet to $19 million after reaching a peak of $150 million, and then the token disappeared and could not be purchased. The top 10 holders who purchased ANALOS made a total profit of more than $7 million.

In May of this year, the beer-themed MEME token BEER pre-sold 30,000 SOLs, worth nearly $5 million. After the launch, the price of BEER tokens soared, with the highest increase of 30 times and the market value reaching 500 million US dollars.

A month later, the price of BEER tokens fell by more than 90% from the high point, and the market value also fell back to around 50 million US dollars. According to LookonChain monitoring, the associated addresses of the BEER team had shipped several times after the price was raised, and a total of more than 3 million US dollars were sold.

After BEER, Gotbit copied the BEER routine. MEME coin WATER, which participated in market making, raised more than 41 million US dollars in the pre-sale stage, attracting more than 26,000 wallet addresses to participate in this pre-sale. After Solana was launched, the WATER token rose nearly 10 times in a short period of time, and its market value once exceeded 1 billion US dollars, but then fell all the way within a few hours.

Lookonchain revealed the insider trading behavior of its development team. The team transferred 844 million WATER tokens to 11 wallets that did not participate in the pre-sale, and then sold the tokens. An on-chain sniper lost more than $710,000 in this opening.

In addition, HUND, SHARK, SI, SOMBRERO, MACHO, SIMBA, etc., which Gotbit participated in market making, are also suspected of being rug.

Meme and crypto market makers become the focus of regulatory crackdowns?

From Gotbit's manipulation behavior, the popularity of meme has also made meme a hard-hit area for fraud.

Regarding Gotbit’s fraud lawsuit, crypto KOL @WazzCrypt believes that “this is bad news for memes. As one of the largest meme market makers, Gotbit supports conspiracy memes and scam coins. It becomes difficult to promote meme coins without committing a crime.”

But in the view of CryptoQuant founder Ki Young Ju, this may be a positive signal, “Regulation will help eliminate its gambling stigma.”

At present, a trend that cannot be ignored is that crypto market makers may become the focus of crackdowns by US regulators.

Following the SEC, FBI, and the US Department of Justice jointly accusing Gotbit, ZM Quant, CLS Global, and MyTrade, four crypto market makers. The SEC has also accused Cumberland, a veteran market maker founded in 2014, of operating as an unregistered securities dealer.

As an important participant in the liquidity of the crypto market, crypto market makers are too close to money and are also the focus of accusations of market manipulation and fraud. Previously, DWF, a new market maker that emerged in this cycle, was repeatedly investigated by the Wall Street Journal and other media for suspected wash trading, false propaganda, market manipulation, etc.

With the successive actions of US regulatory authorities, it is expected that more crypto market-making "conspiracy" groups will surface.

Jixu

Jixu