Author: Jennifer Obem, Messari analyst; Translation: 0xxz@金财经

Key points of this article

Manta Network is a network ecosystem that provides a scalable execution environment for ZK applications. The Manta network consists of two different networks: Manta Pacific and Manta Atlantic. Both networks provide ZK tools to simplify ZK application deployment.

Manta Pacific provides an EVM native execution environment for ZK applications. Modular L2 leverages Celestia for data availability, offering cheaper deals. It also uniquely offers native yields on ETH and stablecoins (USDC).

Since the launch of the New Paradigm bridge in December 2023, users have transferred more than $750 million worth of assets to Manta Pacific through the bridge, with a cumulative TVL of more than $1.5 billion.

Manta Atlantic is a ZK-enabled Layer-1 being developed on Polkadot, aiming to provide composable execution for ZK applications through the zk-enabled SoulBound Token (zkSBT) environment.

ZK applications promise improved user experience with a focus on security at scale. However, ZK applications rely on zero-knowledge proofs (ZKP) for cryptographic verification, which makes them computationally expensive. Therefore, they need platforms that can efficiently scale their operations to achieve multiple uses without compromising performance.

Manta Network provides a flexible execution environment that can natively meet the different computing needs of ZK applications. Manta Network’s focus on cost efficiency and improving throughput of ZK applications has also made it a popular choice among other decentralized applications (dApps). Since its launch in September 2023, Manta Network’s L2 network Manta Pacific has launched more than 150 dApps, including nearly 15 native ZK applications. With the launch of the New Paradigm bridge in December 2023, L2 enables native yield generation on ETH and supports stablecoins. In less than two months after launch, users have transferred more than $750 million in assets to L2.

Background

Victor Ji and Kenny Li founded Manta Network in 2020 with the goal of improving on-chain privacy. In the same year, the founding team operating under the name p0x Labs received funding from the Web3 Foundation and began their development journey. Since then, Manta Network has grown into a universal ZK ecosystem, providing an L2 network for deploying and scaling ZK-enabled dApps.

As of September 2021, Manta has secured a parachain slot on Kusama for its ZK-enabled Canary network Calamari. In March 2023, Manta Network launched zksBT, a new asset class that facilitates secure on-chain verification. Leveraging its tooling infrastructure, Manta Network also launched Manta NPO, a platform for minting zkSBT, as well as wallet extensions for storing these assets.

In September 2023, Manta Network launched Manta Pacific, a ZK-enabled L2 that provides native composability for ZK applications in the Ethereum ecosystem. As of this writing, Manta Network has also secured a self-funded parachain slot on Polkadot for its ZK-based L1 network, Manta Atlantic.

In December 2023, Manta Pacific launched the New Paradigm bridge, introducing new ways for users to earn additional income through native earnings ETH and stablecoins.

Manta Network has raised over $60 million in pre-seed, seed, community and Series A funding. Series A financing is valued at US$500 million. Notable investors in these rounds include Polychain Capital, Qiming Venture Partners, CoinFund, ParaFi Capital, Hypersphere Ventures, DeFiance Capital and Multicoin Capital. Although the funding amount was undisclosed, Manta Network also received a strategic investment from Binance Labs.

Technology

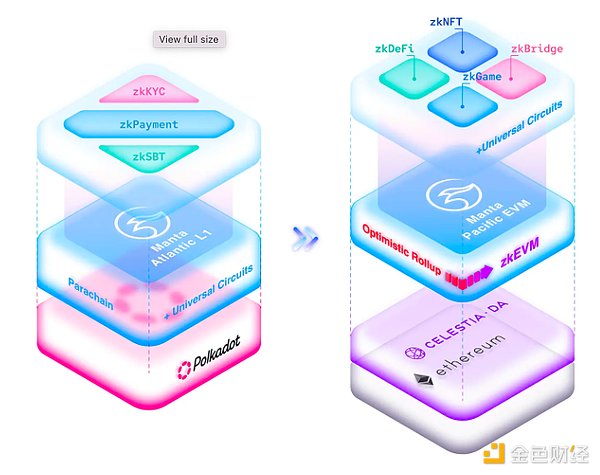

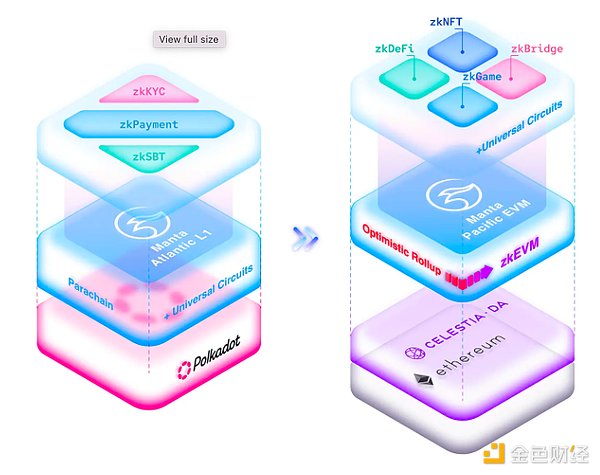

Manta Network’s ecosystem consists of Manta Pacific (modular L2 for Ethereum) and Manta Atlantic (ZK-based L1 chain on Polkadot). On every network, Manta Network provides a novel ZK-enabled tool infrastructure consisting of Universal Circuits, zkSBT, and Manta NPO.

Source: Manta Network Documentation

Network

Manta Pacific

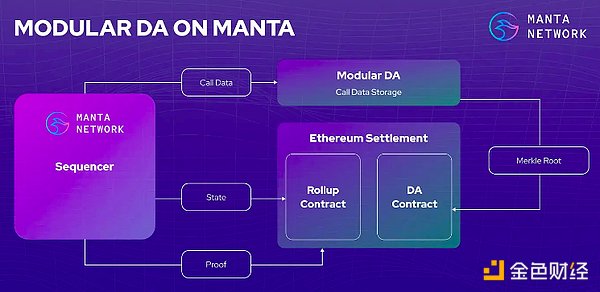

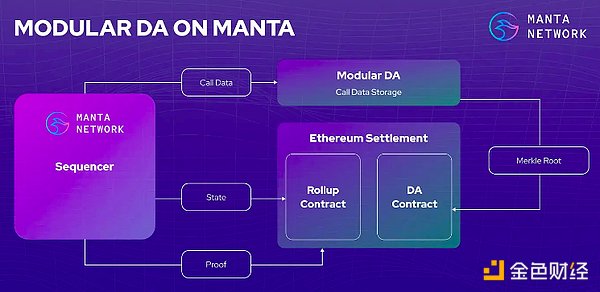

Manta Pacific is a modular L2 network that provides a scalable and cost-effective environment for EVM native dApps, including ZK applications. As of this writing, Manta Pacific operates as an optimistic rollup using Caldera's OP Stack Rollup, focusing on cost-effective scaling. To further reduce operating costs, Manta Pacific transitioned from using Ethereum for data availability (DA) to adopting Celestia’s professional DA solution in December 2023. This shift significantly reduced L2 network transaction fees, saving over $1.4 million in gas fees.

Source: Manta Tokenomics

zkEVMs are best suited for ZK applications because they combine the familiarity of EVM development with systems that already support opcode-level translation to ZK circuits. Manta Pacific plans to transition to zkEVM validium to enhance its network performance. Validiums is an Ethereum scaling solution that uses proofs of validity to verify transactions while using a separate DA outside of Ethereum to store transaction data. As a zkEVM validium, Manta Pacific will utilize Polygon CDK for execution while retaining Celestia for DA. This approach is designed to improve network throughput for deployed ZK applications, including high transaction volume applications such as Web3 games and social applications.

On Manta Pacific, users can connect profitable ETH and supported stablecoins (USDC) to L2 via the dedicated New Paradigm bridge. In addition to earning native returns on these assets, users can also earn additional benefits by leveraging these assets on supported decentralized applications on L2. This move addresses a significant limitation of L2 networks. Traditionally, assets such as ETH and stablecoins such as USDC do not generate any returns on L2, but ETH deposited on L1 can earn users 4% annual returns.

Through cooperation with StakeStone and Mountain Protocol, Manta Pacific provides its users with liquid staking tokens (STONE) and yield stablecoins (wUSDM) respectively. These integrations allow users to deposit ETH and USDC on Manta Pacific and receive STONE and wUSDMw, which are instantly liquid and usable within the network’s DeFi applications.

As of this writing, deposits through the bridge have ceased. However, users who already have ETH and USDC connected to the network can leverage liquid versions of these assets in DeFi applications powered by Manta Pacific to earn additional yields.

Mnata Atlantic

Manta Atlantic is a ZK-based L1 chain launched in January 2024. Manta Atlantic provides a composable execution environment for ZK applications and natively hosts Manta Network’s ZK tooling infrastructure. It is built on the Substrate framework as a parachain in the Polkadot ecosystem, focusing on interoperable authentication and ZK application deployment.

Calamari, Manta’s pre-test environment

Calamari is Manta Atlantic’s canary network. As a parachain on Kusama, it promotes interoperability within the Kusama ecosystem. Operational ZK application deployment. It secured a parachain slot through a KSM crowdfunding loan, allocating 30% of its total KMA token supply (30 billion KMA) to over 16,000 contributors. Calamari provides a pre-test environment for ZK-enabled applications and tooling infrastructure developed by Manta.

ZK Tools

Universal Circuits

Manta Network’s Universal Circuits address the complexity of developing these applications by challenges, simplifying the development of ZK applications. Traditionally, developers have faced a steep learning curve when creating ZK applications. They need to develop a deep understanding of advanced encryption techniques, manually build complex ZK circuits, and learn new programming languages such as Circcom.

Universal Circuits addresses these challenges by providing a library of pre-built ZK circuits that developers can easily integrate into existing applications, especially those built using Ethereum Solidity. This approach simplifies the development process, allowing developers to add ZK functionality to their applications with minimal coding and without requiring in-depth cryptographic knowledge.

The ZK library consists of the following directories:

ZKP circuits are written in the Circcom programming language and are used to generate proofs .

Solidity smart contract to manage on-chain verification of ZK-enabled decentralized applications (dApps).

TypeScript SDK (Alpha) includes features to simplify key management.

Universal circuitry makes it easier for a wider range of developers to develop safe and efficient ZK applications. The product also unlocks ZK-enabled on-chain asset verification solutions such as POMP and ZK-enabled on-chain games such as Zypher Games. The ZK library provides game contracts such as zkShuffle, allowing developers to create trust-minimized on-chain games such as zkHoldem.

zkSBT and Manta NPO

ZK-enabled SoulBound Token (zkSBT) is an on-chain non-transferable NFT tied to an individual user’s identity. zkSBT uses ZKP to ensure user security. These assets are ideal for on-chain game items, identity and asset verification purposes. Additionally, developers can seamlessly integrate these assets into ZK applications without requiring expertise in cryptography or ZKP.

Manta NPO is a decentralized launchpad platform for minting and validating zkSBT. By leveraging Manta Network's zkAddress tool and universal circuitry, the NPO platform provides a user-friendly plug-and-play solution for deploying zkSBT in ZK applications.

It is worth noting that at the time of writing, the NPO launchpad has witnessed over 1.1 million zkSBT minted. However, most minting occurred in Q2'23 and Q3'23, with Q4'23 minting activity significantly reduced.

Tokenomics

Manta Atlantic’s native token MANTA is used for staking, transaction fees, and governance. Unlike Manta Atlantic, Manta Pacific uses ETH to pay gas fees. As of this writing, token holders can connect MANTA to four networks, including Manta Atlantic, Manta Pacific, Polkadot, and Moonbeam. On January 18, 2024, at the Token Generation Event ( TGE ), an initial supply of 1 billion MANTA was issued. Despite this, MANTA will expand at a rate of 2% per year.

MANTA initial total supply The distribution of 1 billion coins is as follows:

Ecosystem: The largest part (21.19%) of the initial total supply is dedicated to ecosystem development. TGE is 23.5% of this portion in circulation, with the remainder unlocked monthly over two years.

Foundation: 13.5% of the initial total supply is reserved for the Manta Foundation. The allocation will unlock linearly over six years starting in January 2024.

Airdrop: New Paradigm bridge users are allocated 6.5% of the initial total supply. 50 million of them are unlocked in the TGE, and the remainder will be released three months after the TGE. Early ecosystem participants are also allocated 5.6% of the initial total supply, which will be fully available on TGE. As of this writing, claims regarding this airdrop are still ongoing.

Public Sale and Launchpool: Public sale participants are allocated 8% of the total initial supply. At TGE, 40% of this allocation is available to participants, with the remainder unlocked linearly over 6 months. Additionally, seed funding from MANTA’s Binance launchpool represents 3% of the total initial supply of TGE.

Private investors: Private placement rounds, strategic sales and institutional allocations accounted for 12.94%, 6.17% and 5.00% of the total initial supply respectively, with one year's worth of investment respectively. Lock-in period and 3-year linear unlock period.

Teams and advisors: Project teams operating under p0x Labs receive 10% of the initial total supply, but there is an 18-month lock-in period, followed by four years Unlock period. Advisors are allocated 8.1% of the total initial supply. Among them, 30% are unlocked in TGE, and the remaining 70% have a 2-year linear vesting period.

Ongoing inflation and transaction fees

MANTA’s 2% annual inflation rate is generated entirely by the Manta Atlantic block Trader obtains. Only the top 63 registered collectors with total equity can participate as block producers. To qualify as a Collector, users must issue at least 400,000 MANTA as bonds and meet the network’s hardware requirements. Token holders can also participate in block rewards by delegating MANTA to collectors.

Network transaction fees are allocated as follows:

10% is allocated to block producers

18% is credited to Manta Network’s community treasury to guide network development

72% is retained as rewards and distributed to projects within the Manta ecosystem.

Governance

The governance of Manta Network will go through two stages. In the first phase (Manta Governance 1.0), which is live at the time of writing, Manta Network has established a community forum for stakeholders to raise and discuss project-related matters. However, the final decision-making and execution power of the proposal lies with the Manta Foundation.

Subsequently, in the second phase (Manta Governance 2.0), the network will transition to the "Five Councils" governance model:

-

Legislative Committee: This committee is composed of MANTA token holders and plays a key role in shaping the future of the network. They actively make decisions about the network's direction, vision, token economics, and intended uses.

Executive Committee: Managed by the Manta Foundation, the Executive Committee translates the decisions of the Legislative Council into feasible steps. They oversee network operations, educational programs, and research and development projects.

Judiciary Committee: Responsible for overseeing the allocation of grants and implementing governance tools to ensure that network resources are distributed fairly and follow democratic procedures.

Supervisory Committee: This committee is responsible for managing the election process of Manta Foundation members, ensuring that the election process is democratic and holding those in power accountable.

Control Committee: As the audit department, the Control Committee supervises the entire governance process to ensure the transparency, fairness and integrity of the network.

As of this writing, the project team has not revealed when Manta Governance 2.0 will launch.

Network Activity

Since the launch of the mainnet in September 2023, Manta Pacific has processed more than 10 million transactions. Despite being a relatively new L2, it has attracted over $1.5 billion in TVL and is firmly in the top three L2s at the time of writing. This surge is mainly driven by the launch of the New Paradigm bridge in December 2023. The launch reportedly attracted more than 200,000 new Manta Pacific participants, representing more than 70% of the network’s TVL.

In terms of dApp activity, over 2.5 million dApp transactions on Manta Pacific in the past three months came from:

DeFi – 1 million transactions (39.8%) came from DeFi dApps such as ApertureSwap DEX, PacificSwap AMM, LayerBank Money Market Protocol and QuickSwap DEX. As of this writing, LayerBank leads the category, accounting for more than 25% of Manta Pacific's $1.5 billion TVL.

Bridges – 651,000 transactions (26.%) from Bridges such as Orbiter, dappOS, Rhinofi and Owlto. As of this writing, Manta Pacific's total bridge value exceeds $900 million, and L2's official bridge has over 40,000 unique users.

GameFi – 603,000 transactions (24.1%) came from GameFi dApps, such as the Element NFT market, zkHoldem game and Gabby World virtual world.

Social - 363,000 transactions (13.6%) came from social dApp such as DMail network notification service and POMP on-chain asset validator.

Ecosystem

At launch in September 2023, Manta Pacific announced MantaFest, a 5-week promotional event to Direct network activity. The event gives users access to a variety of newly integrated dApps in the Bridging, DeFi, SocialFi, and GameFi spaces. MantaFest attendees can earn points that can be redeemed for MANTA rewards at TGE.

In October 2023, one month after the launch of the Manta Pacific mainnet alpha, Manta Network launched the Uncharted Grants program. The initiative aims to guide early adoption and participation in Manta Pacific by rewarding ecosystem projects built on Manta Pacific. It allocates 5 million MANTA tokens to top ecosystem projects across categories, including bridging, social, GameFi, and DeFi. It also sets aside 1.5 million MANTA (30% of the grant allocation) for MantaFest participants.

< span style="font-size: 14px;">Source: Manta Network Medium Post

< span style="font-size: 14px;">Source: Manta Network Medium Post

DeFi

In the DeFi category, the top-ranked ecosystem projects gained provided 30% funding (1.5 million MANTA). As of this writing, the leading projects on Manta Pacific are lending protocols (LayerBank and Shoebill V2), accounting for 42.2% and 10.5% of TVL respectively. The surge in TVL is primarily due to the New Paradigm incident which increased ETH and stablecoin liquidity on the network. Decentralized exchanges (DEX) such as Quickswap and ApertureSwap are the next prominent DeFi category, although together they account for less than 5% of the network’s TVL.

Bridge

Since the launch of the Manta Pacific mainnet, multiple bridging protocols have launched bridging support for Manta Pacific, including LayerZero, dappOS, Orbiter, Rhinofi and Owlto. These integrations significantly improve the interoperability of the network, enable more efficient cross-chain liquidity, and enhance the user experience for decentralized applications on L2.

Similar to trends in the DeFi space, the New Paradigm bridge launch event in December 2023 played a key role in the increase in cross-chain transfers on Manta Pacific. As of this writing, the Manta Pacific bridge has facilitated deposits of over 280,000 ETH (worth approximately $700 million) and $132 million USDC since the incident.

GameFi and Social

Manta Pacific is positioned to attract performance-intensive dApps, including dApps in the GameFi and social fields. As of this writing, leading GameFi platforms, including Element NFT Marketplace, Gabby World, and zkHoldem, attract an average of 50,000 unique users per month. In the social space, the DMail network notification service and POMP on-chain asset validator have over 30,000 unique active addresses during the same period.

ZK Applications

Several ecosystem projects leverage Manta Network’s tools and infrastructure to build ZK-enabled applications. Notable projects include:

Proof of My Participation (POMP) - a platform that enables on-chain activity, identity and cryptocurrency, Assets such as NFTs and SBTs are privately verified. POMP runs on Calamari and Manta Pacific, ensuring trustless verification without revealing sensitive information such as user wallet addresses.

zkHoldem - Decentralized online gaming platform available on Calamari and Manta Pacific. It uses Manta Network’s zkShuffle contract to facilitate peer-to-peer virtual poker games.

AsMatch - AsMatch is positioned as a SocialFi app on Calamari and Manta Pacific, using users for a variety of purposes including dating, social networking, and professional networking. It integrates AI-generated content, Zero-Knowledge Proofs (ZKP) and zkSBT, offering a unique matching earning model and token-based incentives.

Aperture - an automated liquidity management tool provided by Manta Pacific designed to optimize liquidity operations.

Zypher Games - A gaming platform on Calamari, powered by Manta’s ZKP tooling infrastructure and AI, providing scalable gaming infrastructure for launching on-chain games.

It is worth noting that zkHoldem and POMP are the top three projects in dApp activity in their respective fields (GameFi and SocialFi). This trend may indicate the emergence of new on-chain applications leveraging zero-knowledge (ZK) technology.

On-chain authentication

To date, institutional users and blockchain ecosystems such as Binance, Galxe, Linea, Cyber connect and ReadON have issued through Manta’s NPO platform zkCredentials for secure and confidential on-chain asset and identity verification. Manta also integrates its on-chain verification tools with other networks such as Arbitrum, enabling secure on-chain authentication.

Competitive Landscape

Manta Pacific is the first modular L2 to integrate Celestia for data availability and the first L2 to support native yields on ETH and stablecoins (USDC). And famous.

Cost efficiency is an important factor that developers consider when choosing a network for application deployment. Manta's move to integrate Celestia for data availability offers lower transaction fees than overall L2, which could make it a good choice for developers. However, it will likely face stiff competition from other L2s employing specialized DA solutions. For example, Celo is transitioning to L2 using Eigenlayer's DA, while L2s such as Starknet and zkSync are building hybrid DA solutions.

As of January 2024, Mnata Pacific provides unique composable liquidity for primary income assets. However, this position is challenged by the upcoming launch of Blast in February 2024, which has already accumulated over $1 billion in TVL. While Blast's future offerings beyond basic yields are uncertain, Manta Pacific currently offers multiple yield opportunities for these assets in more than 100 applications on its network. It will be interesting to see the competitive dynamics between Manta Pacific and Blast once Blast launches.

Going forward, Manta Pacific plans to transition to zkEVM validium via Polygon CDK. While not the first in this space, it aims to differentiate itself from competitors like ImmutableX with its versatile circuitry.

Roadmap

Manta Pacific is transitioning from OP Stack rollup to zkEVM Validium using Polygon CDK. This shift expands the network's ability to provide an EVM-native execution environment for ZK applications while increasing the network's finality.

Source: Manta Documentation

The transition will occur in four phases:

< ul class=" list-paddingleft-2">

Phase 1 (Manta Pacific Alpha) - In this phase, Manta Pacific is an optimistic rollup that uses Ethereum to provide data availability.

Phase 2 (Manta Pacific Alpha II and Celestia DA) - In this phase, Manta uses Celestia to provide data availability.

Phase 3 (Manta Pacific Beta and Transition to zkEVM) - In this phase, Manta transitions from OP Stack Rollup to zkEVM Rollup. The network can leverage a multi-prover framework to combine the two types of proofs before fully transitioning to Polygon’s ZK prover.

The fourth phase (Manta Pacific mainnet production I (+Universal Circuits 2.0)-Universal Circuits will be upgraded to introduce ZK proof aggregation. This will further reduce Gas costs and improve user experience, and support for more zk-enabled use cases.

As of this writing, Manta Pacific has completed the second phase of its transition as an OP leveraging Celestia for data availability Stack Rollup is running. A full transition to zkEVM validium remains a core priority for the team in 2024.

By the end of January 2024, Manta Pacific plans to conclude the New Paradigm bridge launch event to be able to extract native validium on L2 Yield deposits.

Conclusion

Manta Network differentiates itself in the L2 and ZK development space by providing a scalable and flexible environment tailored for ZK applications. As of 2023 Since the launch of Manta Network's L2 in September, Manta Pacific has launched more than 150 dApps, including nearly 15 native ZK applications. With the launch of the New Paradigm bridge in December 2023, L2 has realized native revenue from ETH and stablecoins Generated. In less than two months since launch, users have moved over $750 million worth of assets to L2.

Manta Pacific’s future strategy includes transitioning to zkEVM Validium using Polygon CDK to enhance network throughput volume and finality to cater for a wider range of ZK applications. It also plans to expand its tooling infrastructure, such as universal circuits, to simplify the development of ZK applications. Doing so could make it a powerful tool for creating efficient and secure ZK applications. Ideal, especially in high-transaction areas such as Web3 games and social applications. To achieve long-term growth and success in the highly competitive ZK and L2 space, Manta needs to cultivate ongoing user engagement through initiatives such as New Paradigm and MantaFest.< /p>

JinseFinance

JinseFinance

< span style="font-size: 14px;">Source: Manta Network Medium Post

< span style="font-size: 14px;">Source: Manta Network Medium Post