Source: PolkaWorld Community

Key Insights

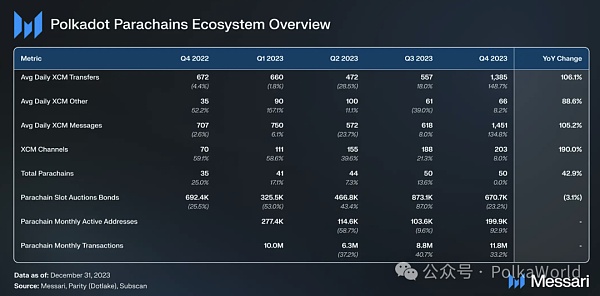

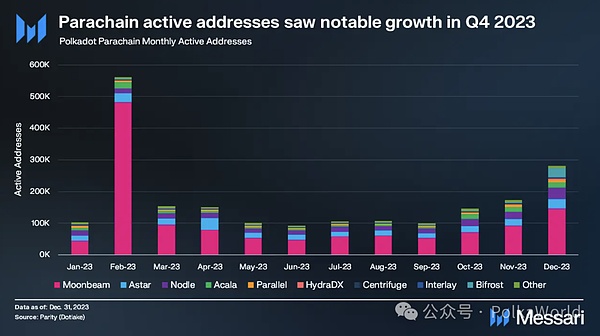

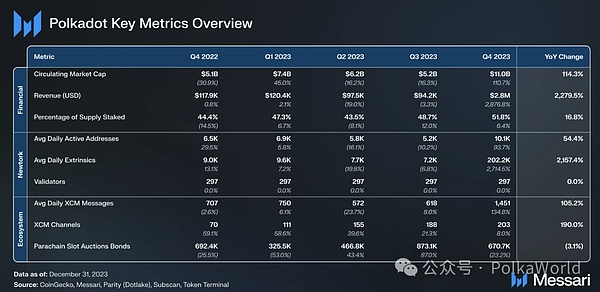

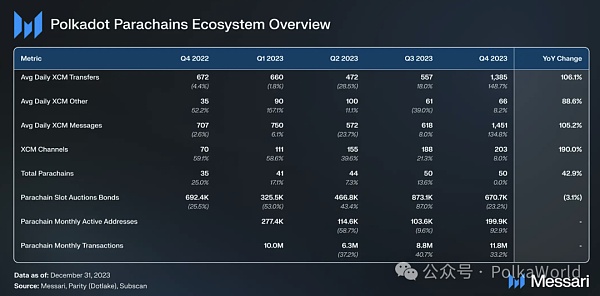

< li>The monthly active addresses of parachains increased by 93% year-on-year, from 104,000 to 200,000. This growth occurs across all major parachains.

XCM transfers grew 150% year over year, reaching an all-time high of 133,000. By the end of the year, the total number of active XCM channels reached 203, almost tripling in 2023.

As of December, Polkadot had 800 full-time developers and 2,100 total developers. According to data from Electric Capital, Polkadot ranks among thetop threeworld’s largest crypto ecosystems in terms of number of developers.

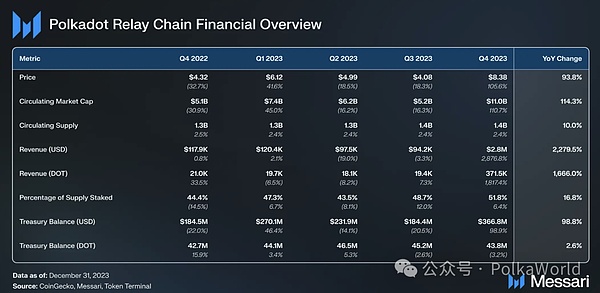

DOT’s outstanding market capitalization grew 111% quarterly to $8.38 billion. The growth in Q4 brought DOT’s year-over-year growth rate to 94%, making it one of the top 15 crypto projects by market capitalization.

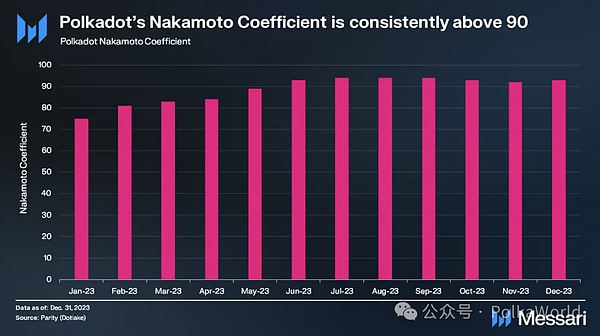

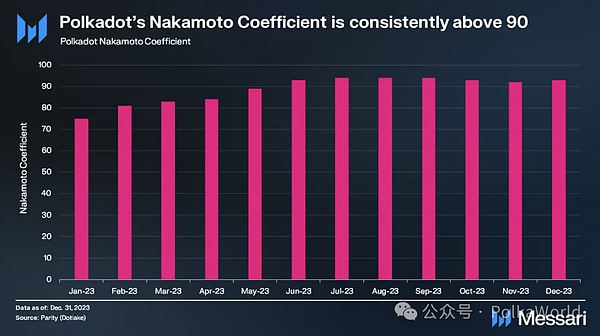

Polkadot has a Satoshi coefficient of 93. The validator reward model encourages nominators to stake to validators with lower stakes, effectively promoting a more decentralized set of validators.

Introduction to Polkadot

Polkadot (DOT) is a distributed blockchain computing platform that serves as the basis for other sovereign blocks The base layer of the chain (called Parachain) for verification and sharing security. Polkadot is built using the Substrate blockchain development framework. In addition, the base layer of Polkadot is called the RelayChain, which uses the Nominated Proof-of-Stake (NPoS) consensus mechanism, and its state machine is compiled into WebAssembly (Wasm).

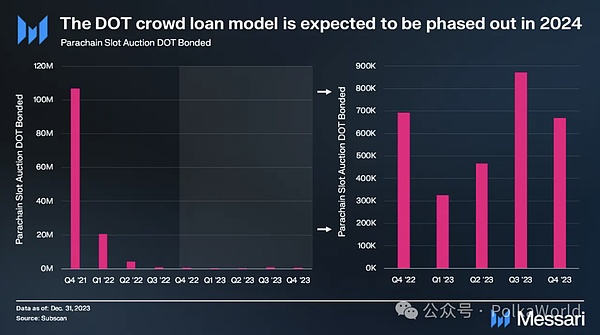

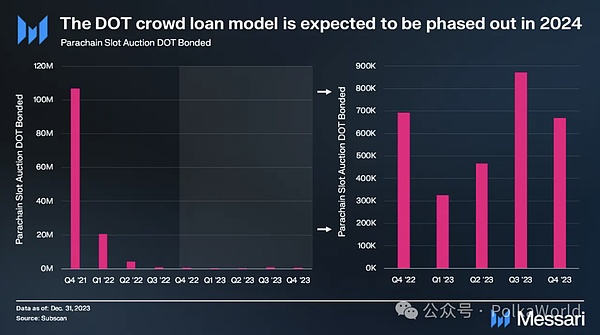

The core function of the Polkadot relay chain is to verify and provide security for its Parachain. Parachains are added to the relay chain via auction slots. The bidding process is a week-long candlelight auction where parachains "bid" DOT to win a parachain slot. However, this model will be canceled in 2024 and changed to Coretime’s model.

Finally, parachains on Polkadot can communicate with each other through the Cross Consensus Mechanism Format (XCM). XCM is a messaging format that standardizes messages between Polkadot’s parachains, allowing for greater interoperability.

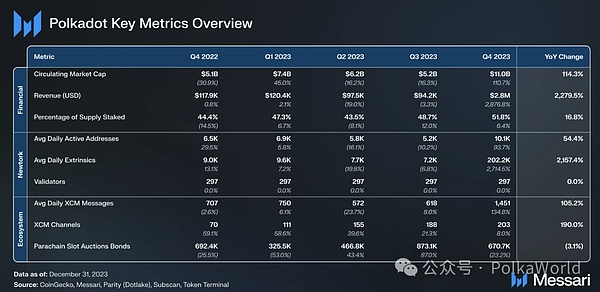

Key data

Financial analysis

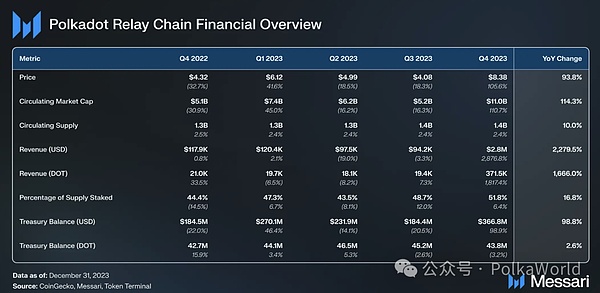

Market capitalization

In the fourth quarter of 2023, the market capitalization of the entire cryptocurrency market has experienced sharp growth, largely driven by expectations for spot BTC ETFs. DOT’s circulating market capitalization grew 111% quarterly to $8.38 billion,more than double the overall crypto market’s 54% growth. The growth in the fourth quarter brought DOT's year-over-year growth rate to 94%. DOT’s market capitalization ranks in the top 15 of all crypto projects.

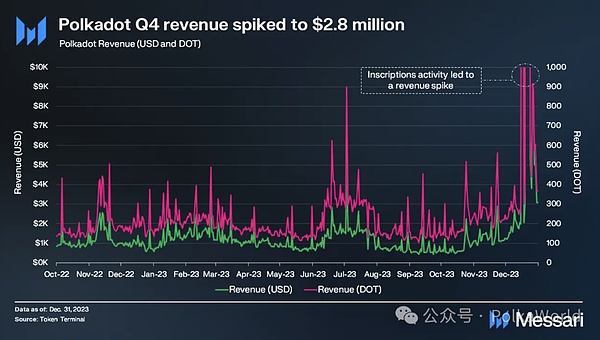

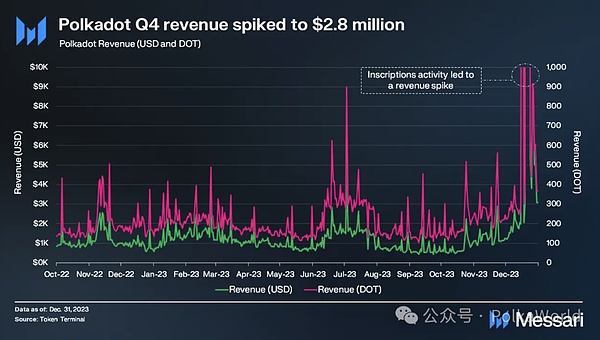

Income

In contrast to the typical per-gas transaction fee model, Polkadot adopts a weight-based fee model, where transaction fees are determined and charged prior to execution. The fee calculation has three components: a weight fee that reflects computing resources, a length fee based on transaction size, and an optional tip to incentivize block authors. These fees arise from various activities such as token transfers, staking, validator elections, governance voting, and parachain slot auctions. It is worth noting that this transaction fee model does not apply to transactions on parachains.

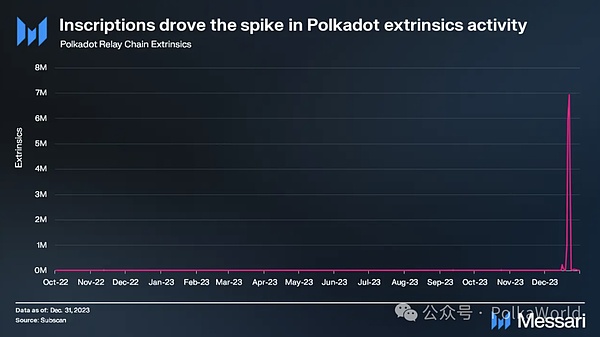

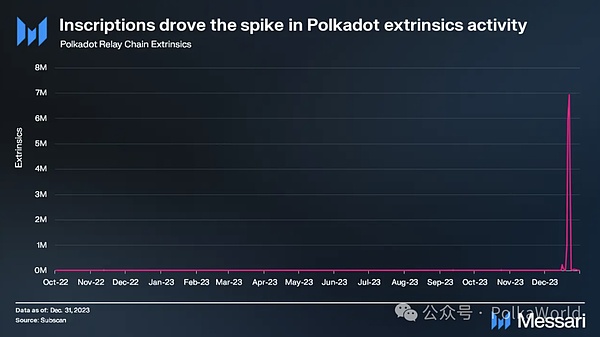

In the fourth quarter, Polkadot’s revenue reached $2.8 million, a year-on-year increase of 2880%. This surge is primarily attributed to a significant increase in external trading in late December, caused by the Polkadot inscription activity. Even excluding the four-day peak of Inscription activity, Polkadot’s revenue will double from the previous quarter. It’s worth noting that due to the structural design of the network, Polkadot’s revenue is generally lower compared to its competitors.

Supply

Polkadot’s native token DOT has three main uses: governance, staking, and parachain crowdloan. As of the end of Q4, Polkadot’s collateralization ratio stood at 52%. Since DOT uses inflation, there is no maximum supply. DOT's monetary policy is designed around the "ideal pledge rate", which refers to the DOT pledge ratio that the network hopes to achieve in order to maintain sufficient security. This pledge rate aims to balance network security and token liquidity. . If the staking amount falls below the ideal rate, the nominator’s staking reward increases, encouraging more staking. Conversely, if the staking rate exceeds the ideal value, the staking rewards will be reduced.

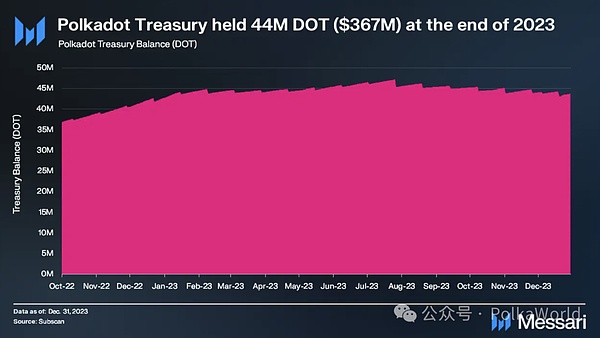

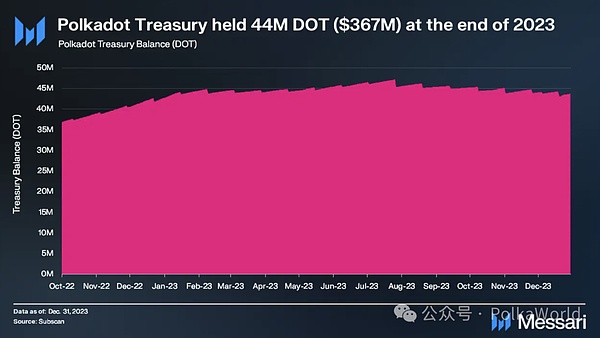

Treasury

Polkadot’s treasury is funded through block rewards, validator penalties, transaction fees, and staking inefficiencies. Treasury funds are held in a system account and used to allocate expenses within a 24-day spending cycle. Unused funds will be destroyed at a 1% rate. Notably, all treasury expenditures are automatically executed on-chain, ensuring transparency and accountability.

In Q4, the Polkadot treasury supported various initiatives. The introduction of OpenGov on June 15 revolutionized treasury management, allowing proposals on different tracks to proceed in parallel. As of the end of the quarter, the Polkadot treasury held approximately 44 million DOT (equivalent to $367 million).

Network Analysis

Using

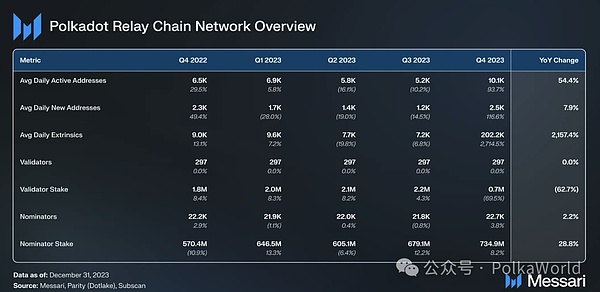

Polkadot Relay Chains have several primary functions, including securing and connecting parachains. As such, its end users typically transact and use the network through parachains.

Currently, the Relay Chain does support some end-user functionality, including token transfers, staking, validator elections, governance voting, and participation in parachain slot auctions. However, with the proposal of RFC-0032: Minimal Relay Chains, several subsystems are planned to be migrated to system parachains. By minimizing state transition logic on the relay chain by migrating state transition logic into the system chain, thePolkadot relay chain can maximize its main offering: secure block space.

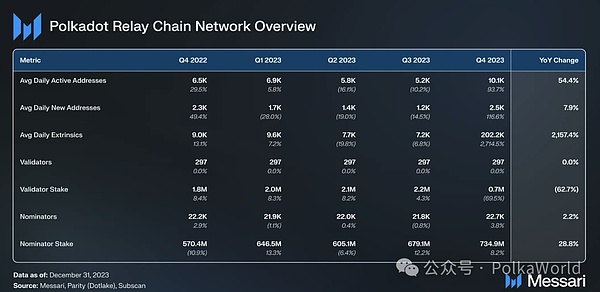

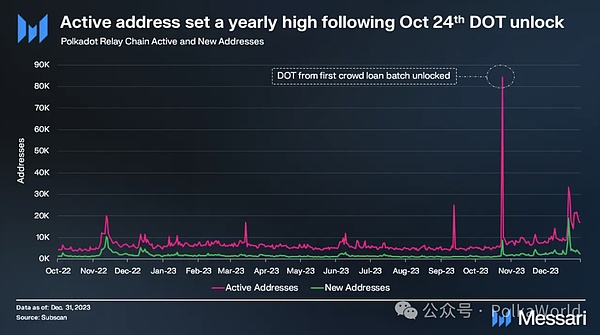

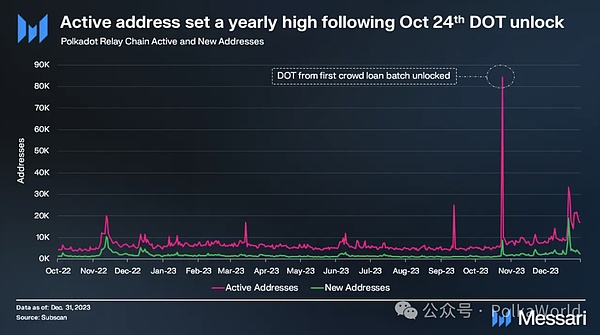

With the launch of OpenGov in June, there has been an increase in account activity on the Polkadot relay chain. This growth is attributed to increased governance activity, as the relay chain plays a key role in facilitating the governance process. In late October, the DOT locked in the first batch of parachain auctions two years ago was finally unlocked. This resulted in a yearly high for Polkadot relay chain active addresses on October 24, as users claimed their locked DOT tokens.

Overall, in the fourth quarter, Relay Chain’s average daily active addresses exceeded 10,000, a 90% quarter-on-quarter increase. Excluding activity related to the DOT unlock on October 24, the daily average of active addresses was 9,000, a 70% month-on-month increase.

Blockchain framework in Polkadot Among them, external transactions (extrinsic) are a key element that promotes the state transition of the relay chain. It acts as a universal transaction that encapsulates external data that the network needs to verify and track. Typically, external transactions carry signatures and reference specific functions, making interactions such as token transfers between accounts possible. Through external transactions, Polkadot efficiently processes external inputs to ensure the smooth operation of its blockchain network.

From December 20th to 23rd, there was a surge in external transactions due to the Polkadot inscription activity. During this period, the Polkadot Relay Chain processed an average of 4.3 million external transactions per day. The network successfully tolerated this increase in traffic without performance degradation. Excluding these dates, average daily external transaction volume still showed a sequential increase of more than 100%, with the average number of external transactions processed per day reaching 17,000.

Development

Polkadot has one of the largest developer bases in the crypto industry. According to data from Electric Capital, Polkadot's total developer count averaged nearly 2,100 in December 2023, with 792 classified as "full-time," placing the ecosystem insecond place behind Ethereum< /strong>.

Polkadot provides developers with comprehensive support through its open source technology stack, covering multiple categories such as user interfaces, tools, APIs and languages, smart contracts, chains and modules, network maintenance tools, consensus, and networks.

Highlights from Q4 include:

Cardano announced plans to adopt Polkadot's Substrate framework as its "collaboration chain" "Part of the plan to develop a globally interconnected blockchain network.

Launched the Decentralized Future Initiative with $20 million in funding and 5 million DOT tokens, specifically focused on promoting growth within the Polkadot ecosystem.

Expansion of the Polkadot Blockchain Academy (PBA), including founders’ courses and plans for further growth in the Asia-Pacific region.

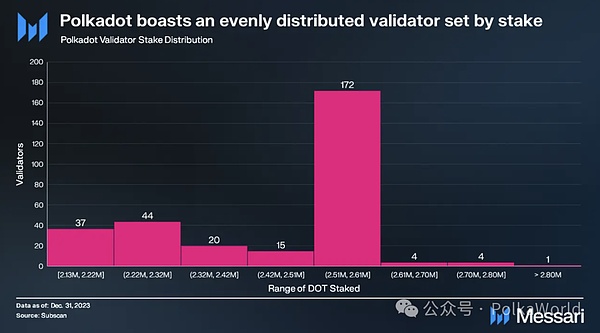

Decentralization and security

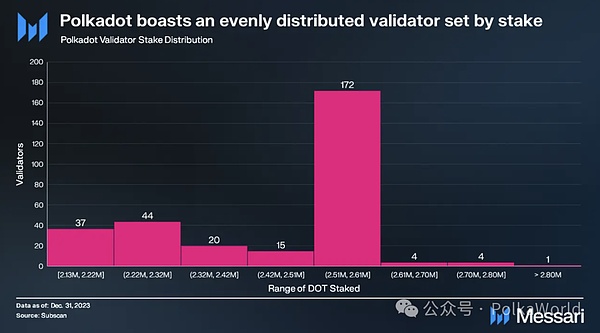

Polkadot uses a unique consensus mechanism called Nominated Proof of Stake (NPoS). Validators are paid every 24 hours based on payable actions they complete (called era points). Every four hours, a subset of validators are randomly selected to validate all parachains and double their era points. The combination of era point and random parachain verification provides probabilistic guarantees for validators to earn nearly identical rewards. Because validators earn nearly equal rewards, and these rewards are distributed proportionally to their nominators, nominators are incentivized to select validators with lower stakes to earn higher rewards. This validator + nominator reward model is designed to decentralize Polkadot’s validator set.

The active validator set on Polkadot has remained stable at 297 for years, with no immediate plans to change. In Q4 2023, the validator reward model continued to prove its effectiveness in promoting decentralization of validator staking. Of the 297 validators, 296 have stake amounts between 2.13 million and 2.73 million DOT.

The equal reward distribution of the validator model incentivizes node operators to operate multiple validators. This strategy has been adopted by several entities.

The Satoshi coefficient refers to The minimum number of entities required to control a significant portion of the network's resources, which often results in consensus failure. For PoS blockchains, this threshold is associated with the ability to control more than 33% of the total staked volume. By the end of 2023, Polkadot's validator model has resulted in aSatoshi Coefficient of up to 93, higher than other major networks in the industry.

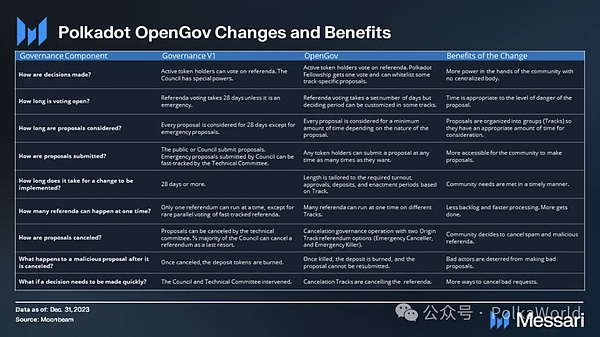

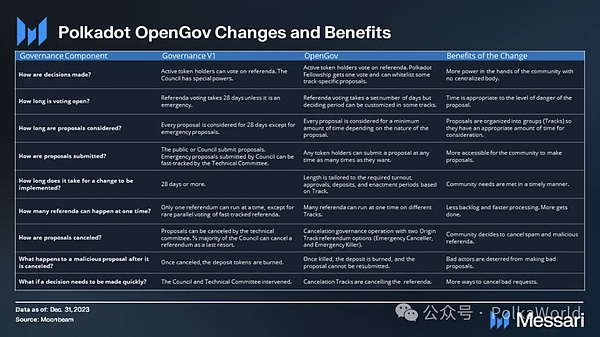

Governance

OpenGov, Polkadot’s new governance model launched in Q2 2023, marks a major milestone after months of anticipation. In the OpenGov system, referendums undergo a structured life cycle for implementation, including an introduction period for proposal submission, a decision-making period for voting and approval, and an implementation period for execution. OpenGov allows multiple referendums to be held simultaneously, thus speeding up the passage of bills. In the first six months of OpenGov running on Kusama, the number of proposals more than quadrupled compared to the previous year.

In the OpenGov system, the Board of Directors and Technical Committee are replaced by Fellowship, which acts as a developer DAO and ensures decentralization through community voting and power checks and balances. Additionally, the new model introduces the flexibility of agency, allowing users to delegate their voting power based on belief and token amount.

Following the launch, Parity Technologies shared details of its ongoing relationship with Polkadot and the evolution of its role within the network. Parity stated that “marketing will be more effectively driven by the broader Polkadot community” and as such, “its marketing function is being downplayed to make room for the emergence of new ecosystem leaders that will transcend Parity.” According to the team According to , future plans will focus on “delivering Polkadot’s next-generation technology, improving the developer experience, and cultivating a strong developer community.”

Ecosystem Analysis< /h2>

XCM

Cross Consensus Message Format (XCM) is a standardized message format and language that enables parachains and other Consensus systems can communicate seamlessly. XCM plays a vital role in facilitating interoperability and complex cross-consensus interactions. It allows the blockchain to be used for multiple purposes such as exchanging messages, performing operations, and transferring assets.

The launch of XCM V3 on June 15th generated huge excitement. This new version of the message format introduces advanced programmaticity, bridging capabilities to external networks, cross-chain locking, improved fee payment mechanisms, and support for non-fungible tokens (NFTs).

In Q4, Polkadot’s XCM transfer volume increased by 150% quarterly, from 557 to 1,385 per day. Non-asset transfer use cases, classified as “XCM Other,” grew at a daily rate of 8.2%, from 61 to 66. Non-asset transfer use cases fell to 5% of total XCM message volume, down from 10% in the previous quarter. At the end of the year, the total number of active XCM channels reached 203, almost triple the number in 2023.

Parallel chain

In the fourth quarter, Polkadot conducted eight additional parachain auctions, bringing the total to 58. The result of these auctions was 671,000 DOT ($5.6 million) locked. Of the eight bids, six were renewals for Centrifuge, Clover, Parallel, HydraDX, Interlay and Phala. The other two slots were won by two new projects: Polimec, which focuses on decentralized financing, and Logion, which introduces the concept of legal proof for asset transformation.

As part of Polkadot 2.0, parachain auctions and the general model will be overhauled. It introduces amarketplace for allocating “Core Time” via NFT, allowing for more flexible and on-demand access to resources. The new approach aims to address shortcomings and encourage seamless application deployment and collaboration across chains. This shift will shift the focus within the Polkadot ecosystem from chain-centric to application-centric.

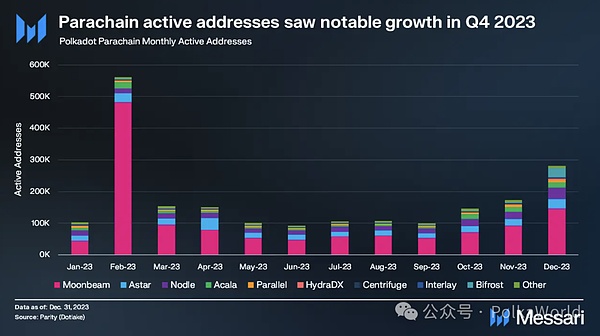

In the fourth quarter of 2023, Parachain active addresses increased significantly, with a quarterly increase of 93%, from 104,000 to 200,000. This growth occurs across all major parachains.

Moonbeam maintains its position as the top parachain, with monthly active addresses reaching 103,000 (81% quarterly growth). For more detailed information about Moonbeam’s fourth quarter performance, you can refer to the “Moonbeam Fourth Quarter 2023 Status” report (https://messari.io/project/moonbeam/quarterly-reports/q4-2023). Nodle and Astar took second and third place respectively with 27,000 (quarterly growth of 75%) and 24,000 (quarterly growth of 51%) monthly active addresses.

In Q4, Bifrost Finance experienced the most significant growth among the top parachains, with quarterly growth reaching 1,400%. This growth was primarily driven by a surge in user activity in November, when users staked liquidity with the DOT they unlocked from the first round of slot auctions, bringing Bifrost’s total liquidity staked DOT to over 3 million.

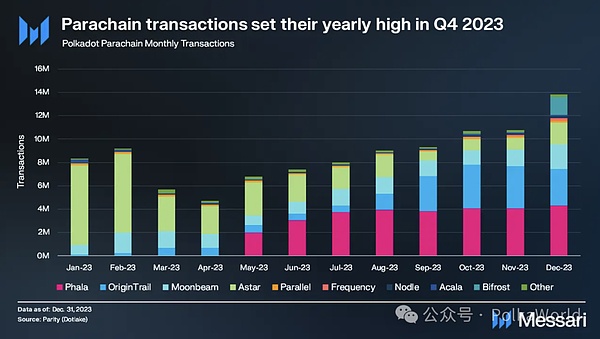

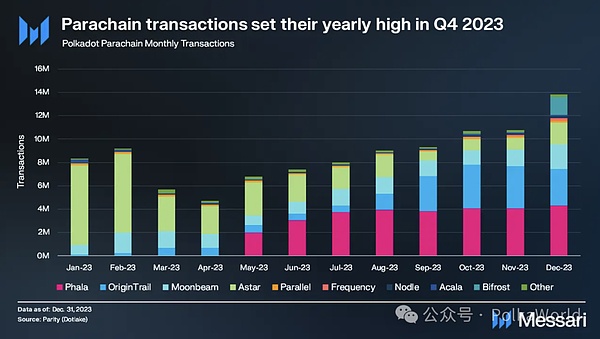

In the fourth quarter , the parachain transaction volume reached an annual high, with the average monthly transaction volume reaching 12 million transactions. The Phala network remains the leader with 4.2 million monthly transactions (up 15% quarterly), followed by OriginTrail with 3.5 million (up 150% quarterly), Moonbeam with 1.6 million (up 22% quarterly), and Astar with 1.3 million Pens (25% quarterly decrease). Notably, Frequency experienced the most significant growth, reaching 1,050% quarterly growth, driven by its support for MeWe migrations in October.

Other noteworthy parachain developments in Q4:

Visa-backed project Agrotoken< Announced that they are about to launch a parachain on Polkadot, making the tokenization of agricultural products possible. To date, Agrotoken has tokenized $105 million worth of grain.

Composable’s Liquid Staked DOT (lsDOT) is now live. In addition, lsdDOT will soon be connected to the upcoming Restaking Layer.

Grammy-nominated electronic music duo Disclosure have released 1,000 unique NFTs offering different versions of their track "Simply Won't Do" on Published on Beatport .

Snowbridge, a trustless bridge connecting Polkadot and Ethereum, is currently on the Roccoco testnet and will be released soon. Following the decommissioning of the Görli test network, it was connected to the new Sepolia test network.

Ecosystem data originates from Parity Data’s Dotlake platform.

Roadmap

Polkadot has completed and shared the official release of Polkadot 1.0, marking the completion of the Polkadot white paper. Additionally, the network’s code base has been fully transitioned to community-managed repositories through Polkadot OpenGov and the Technical Fellowship.

The next version of Polkadot, which is recognized by the community as Polkadot 2.0, will be determined by community discussion and consensus. Polkadot founder Gavin Wood proposed some ideas such as “providing additional, more flexible and capital-efficient mechanisms for Polkadot’s block space allocation, moving beyond the parachain model, and creating multiple zones. Optional 'treaty-like' agreements between blockchains, called 'accords'".

Additionally, in his Year-End Review, Gavin Wood laid out Parity's core technology priorities. These priorities include Agile Coretime, on-demand parachains, Ethereum Snowbridge, and Kusama Bridge. A fifth technology, Elastic Scaling, is also expected to be introduced in 2024. In addition, expansion of DAO primitives including new fellowships, multi-asset sub-treasuries, extended XCM, and the development of new primitives are ongoing. Sassafras, a fork-free block production consensus algorithm, has been developed and will be tested in 2024. Parity is actively working on a variety of new technologies, including CoreJam, to continue shaping the future of the web.

Summary

Polkadot ended 2023 with great momentum Official, each key indicator achieved significant growth. Parachain monthly active addresses grew 93% quarterly to 200,000. The top three parachains are Moonbeam, Nodle and Astar. Additionally, XCM transfer volume grew 150% quarterly, hitting an all-time high of 133,000. By the end of the year, the total number of active XCM channels reached 203, almost tripling in 2023.

In terms of development, Polkadot continues to have one of the largest developer ecosystems. Notably, Cardano announced plans to adopt Substrate, the Decentralized Future Initiative announced a $20 million fund, and the Polkadot Blockchain Academy expanded its presence in the Asia-Pacific region.

Looking ahead to 2024, Polkadot 2.0 will be shaped by its community. Polkadot founder Gavin Wood has made several forward-looking proposals. These include Agile Core Time, On-Demand Parachains, Ethereum Snowbridge, and Kusama Bridge. The fifth technology is elastic expansion. The Polkadot network is expected to have another strong year.

JinseFinance

JinseFinance