Author: Tom Mitchelhill, Cointelegraph; Compiled by: Songxue, Golden Finance

MicroStrategy Executive Chairman Michael Saylor has begun a four-monthsale of the value of his company MicroStrategy $216 million in sharesof the process, after he saidthat some of the shares would be used to buy more Bitcoin.

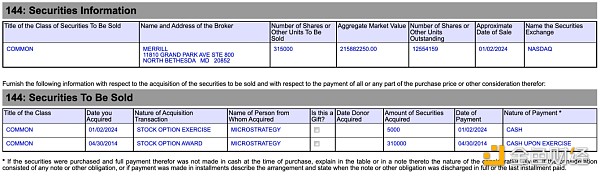

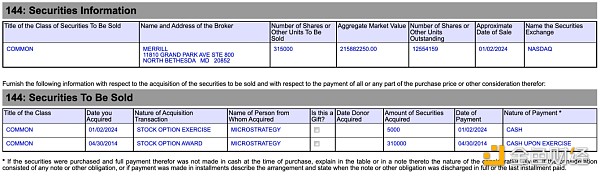

In a Jan. 2 filing with the U.S. Securities and Exchange Commission, Saylor disclosed that he had begun selling the 315,000 stock options first granted to him in April 2014. The stock options granted will expire on April 30, 2024.

Michael Saylor has begun selling his MicroStrategy stock. Source: U.S. Securities and Exchange Commission

According to the filing, Saylor began selling his first batch of 5,000 shares on January 2.

On MicroStrategy's third-quarter earnings call on November 2, Saylor said he planned to sell 5,000 MSTR shares per day over the next four months, which would be used to resolve "personal obligations" and Increase the number of Bitcoins he owns.

Saylor said on the call: “Exercising this option will allow me to meet personal obligations and obtain additional Bitcoin for my personal account.” He added that although he made a personal sale , but his stake in the company's equity remains "significant."

According to a Q-10 filing with the SEC on November 1, Saylor could sell up to 400,000 vested options between January 2 and April 26 of this year.

While Bitcoin has posted an impressive 170% gain since the beginning of last year, MicroStrategy has more than doubled the asset’s performance, rising 411% over the course of the year, according to TradingView data %.

On December 27, MicroStrategy purchased an additional 14,620 Bitcoins for $615 million. With this acquisition, MicroStrategy’s total Bitcoin holdings increase to a staggering 189,150 Bitcoins – worth approximately $8.5 billion at current prices.

XingChi

XingChi