Inception Capital: Why did we invest in Unisat?

Unisat,Inception Capital: Why did we invest in Unisat? Golden Finance, UniSat is the preferred platform for Bitcoin inscriptions and runes.

JinseFinance

JinseFinance

Japan's cryptocurrency market presents unique characteristics in terms of regulation, investment, and innovation. From risk aversion to tax policies, all aspects are working to promote the development of the industry. Strict but positive regulation provides a relatively stable environment for entrepreneurs and investors. However, high tax burdens and long approval processes remain major challenges to the development of the industry.

In the crypto market, closedness and independence are the inherent impressions of many people about Japan. In many cases, its presence is not strong and it is easy for people to ignore it. Compared with other markets in the Asian region, Singapore, Hong Kong and South Korea are more mentioned and paid attention to.

However, as the world's third largest economy and a country that established the status of cryptocurrency and formulated a regulatory framework earlier, Japan has unique advantages and market characteristics. As the government vigorously embraces encryption and promotes the development of the industry, new changes and opportunities are gradually coming.

Japan has a strong and sound financial system, which has laid a solid foundation for the development of blockchain and Web3 technologies in the country. In discussions about the Japanese cryptocurrency market, regulation has become a key focus.

The country maintains strict regulatory measures to maintain investor stability, market security and overall integrity. While these regulatory measures are intended to protect the industry, they may pose a barrier to the entry and expansion of smaller cryptocurrency businesses due to the compliance complexity and large tax burdens associated with cryptocurrency-related earnings. In addition, the lengthy token listing approval process may lead to the perception of reduced market activity.

Japan is an island country in East Asia, located in the northwestern Pacific Ocean. It is part of the Ring of Fire and spans an archipelago of 14,125 islands, of which the five main islands are Hokkaido, Honshu (the "mainland"), Shikoku, Kyushu and Okinawa, and there are nearly 4,000 smaller islands. Japan is closest to the Siberian region of Russia, while South Korea and China are located further south. Tokyo is the country's capital and largest city, followed by Yokohama, Osaka, Nagoya, Sapporo, Fukuoka, Kobe and Kyoto.

According to the United Nations, Japan has a population of nearly 125 million, of which nearly 122 million are Japanese nationals (2022 estimate), accounting for 98.1% of the country's population, and the rest are a small number of foreign residents, including indigenous Ainu, Ryukyuans, Koreans, Chinese, Filipinos, Brazilians of mostly Japanese descent, and Peruvians of mostly Japanese descent.

Japan is the fastest aging country in the world, with the highest proportion of elderly people of any country, accounting for one-third of its total population, with an accompanying increase in life expectancy and a decline in birth rates. Japan's total fertility rate is 1.4, below the replacement rate of 2.1, and is among the lowest in the world; the median age is 48.4 years, the highest in the world. The Japanese government expects that by 2060, there will be one elderly person for every person of working age. Immigration and fertility incentives are sometimes suggested as solutions to provide younger workers to support the country's aging population.

Japan is the world's fourth largest economy, after the United States, China and Germany (Germany surpassed Japan to become the third largest economy in 2023), and its economic composition is mainly based on services, manufacturing and import and export businesses. Japan's economic characteristics reflect its high degree of industrialization, strong external dependence, and unique economic structure and corporate organization:

The service industry accounts for about 70% of Japan's GDP, and it is famous for wholesale and retail trade, real estate services, and professional, scientific and technical activities;

It has a high degree of industrialization and is in a leading position in the global electronics and technology fields, and agriculture does not occupy a major position;

It is mainly engaged in processing trade, importing raw materials and fuels, and exporting products to open up international markets. It is the world's fifth largest exporter and fourth largest importer;

The industry is mainly distributed in the narrow strip along the Pacific coast and the Seto Inland Sea coast, which is conducive to the import of raw materials and the export of products;

The close combination between manufacturers, suppliers and distributors forms a strong corporate alliance with close teamwork;

In addition, changes in the demographic structure have a significant impact on its economy. Japan is facing problems such as a decline in the proportion of its labor force, an aging population, and a decline in the birth rate. These factors have led to a decline in housing demand, suppressed capital accumulation, and a lower return on investment, which in turn affects economic activities and innovation.

According to a report by Japan's Kyodo News on February 15, Japan's nominal gross domestic product (GDP) in 2023 was 4.2106 trillion US dollars, lower than Germany's 4.4561 trillion US dollars, falling to fourth place in the world. It is not accidental that Japan has lost its status as the "world's third largest economy", but the inevitable result of its long-term lack of stable growth momentum in the economy. In October 2023, the International Monetary Fund (IMF) predicted that Japan's nominal GDP would be surpassed by Germany in 2023. Therefore, when the results were officially released, there was no big public opinion wave or backlash, and Japanese society seemed to have accepted this result calmly.

The long-term lack of stable growth momentum in the Japanese economy is the deep-seated reason why Japan's nominal GDP was surpassed by Germany in 2023. How to find the long-term momentum to promote Japan's economic development may have become the top priority of the Japanese government. If the economy continues to be sluggish in the next three to five years, all of this will become a real problem for Japanese society.

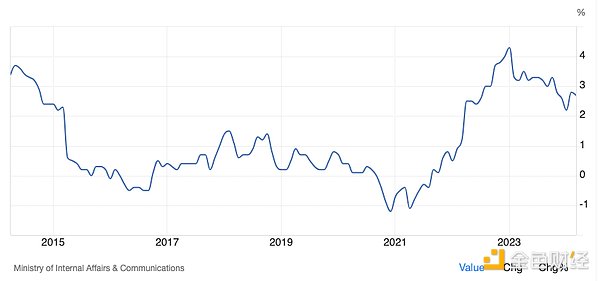

In March 2024, Japan's annual inflation rate fell to 2.7% from a three-month high of 2.8% in February, in line with market expectations. Prices of transportation (2.9% vs 3.0% in February), clothing (2.0% vs 2.6%), furniture and household goods (3.2% vs 5.1%), health care (1.5% vs 1.8%), communications (0.2% vs 1.4%), and culture and entertainment (7.2% vs 7.3%) slowed down. Meanwhile, inflation rates for food (4.8%), housing (0.6%), education (1.3%) and other (1.1%) remained stable. Meanwhile, prices for fuel and light sources fell the least over the past year (-1.7% vs -3.0%), while the pace of decline for electricity (-1.0% and -2.5%) and natural gas (-7.1% vs -9.4%) slowed,

The Bank of Japan ended its negative interest rate policy last month, moving away from a decade-long ultra-loose monetary policy. Markets are looking for clues on when the Bank of Japan will raise rates again. The Bank of Japan said a virtuous cycle of sustained and stable achievement of its 2% price target and strong wage growth was essential for policy normalization.

At the same time, the Bank of Japan will focus on whether service prices will rise along with wage growth. This year, Japanese corporate wages have risen by the largest amount in 33 years, but real wages adjusted for inflation have continued to fall in the past two years. A Japanese Internal Affairs Ministry official pointed out on Friday that the impact of recent wage increases has not yet been reflected in service prices.

Japanese yen (Japanese: 円, Japanese romanization: en, English: Yen), whose banknotes are called Japanese banknotes, is the legal tender of Japan. The yen is also often used as a reserve currency after the US dollar and the euro. The yen was created on May 1, 1871. There are four types of banknotes in circulation: 1000, 2000, 5000, and 10000 yen, and six denominations of coins: 1, 5, 10, 50, 100, and 500 yen.

What is special is that the issuer of Japanese yen banknotes is the Bank of Japan ("Bank of Japan - Japanese Banknotes"), and the issuer of Japanese yen coins is the Japanese government ("Japan"). In addition, Japanese yen coins do not have unlimited legal tender, so in principle, the legal upper limit for the use of coins of the same denomination in one transaction is 20 (that is, the maximum payment capacity of coins in principle is 1 yen × 20 coins + 5 yen × 20 coins + 10 yen × 20 coins + 50 yen × 20 coins + 100 yen × 20 coins + 500 yen × 20 coins = 13,320 yen). Merchants have the right to refuse to accept the excess according to law.

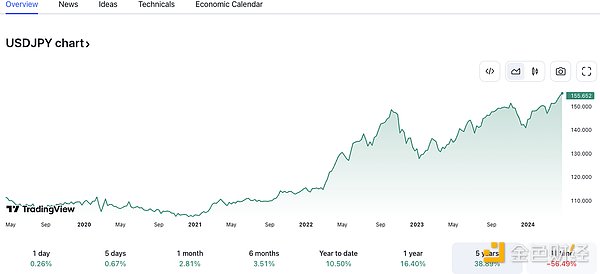

While the Federal Reserve and other central banks have aggressively raised interest rates in 2022 and 2023 to curb inflation, the Bank of Japan has kept interest rates at zero and continued to print a large amount of fiat currency. In 2023, Japan's core inflation rate rose by 3.1%, the largest increase since 1982.

Inflation has weakened the purchasing power of fiat currencies and prompted investors to put their funds into alternative assets that are attractive for value storage, such as Bitcoin and gold. Unless the Bank of Japan accelerates its planned exit from ultra-loose monetary policy, the dollar will continue to appreciate against the yen, making it more attractive relative to other assets.

Japan has been actively cultivating the web3 industry. The government has issued a web3 white paper, reformed taxes, and attracted investment. The Japanese government has also announced a five-year startup development policy, planning to increase the number of Japanese startups to 100,000 within five years and invest about 10 trillion yen to create 100 unicorn companies.

The Web3 project team of the ruling party of Japan released a white paper on April 6, 2023, regarding Web3 as a national strategy. To this end, the Japanese government has invested a lot of resources in promoting the research and application of blockchain technology. For example, the Cabinet Office of Japan has established several special funds to support the innovation and practical application of blockchain technology. In addition, the Japanese government is also actively promoting international cooperation, communicating and cooperating with other countries in the standard setting and regulatory framework construction of blockchain technology.

Japan's application in the field of blockchain covers many aspects, such as real estate registration, identity authentication, interbank clearing, Bitcoin insurance, supply chain finance, etc. Here are some specific cases:

Real Estate Registration: The Japanese government plans to integrate the country's real estate data, approximately 230 million plots and 50 million buildings, into a single blockchain ledger to improve data visualization, accuracy and security. The project is still in the testing phase and is expected to be completed within the next five years.

Identity authentication: Japan's Financial Services Agency (FSA) has developed a blockchain platform that enables customers to share personal information between multiple banks and financial institutions and use a shared ID to open an account. In addition, SoftBank Group has partnered with TBCASoft to launch a blockchain-based identity recognition and verification project, using zero-knowledge proof and distributed ledger technology to protect personal identity information from theft.

Interbank settlement: Fujitsu has partnered with Mizuho Financial Group, Sumitomo Mitsui Financial Group, and Mitsubishi UFJ Financial Group to develop a peer-to-peer remittance service using blockchain, which improves the efficiency and security of remittances.

Bitcoin insurance: Due to the frequent hacker attacks on Bitcoin exchanges, resulting in customer asset losses, Japan's Sumitomo Mitsui Insurance Company has launched a Bitcoin insurance product with bitflyer to provide compensation services for Bitcoin assets and cover losses caused by internal company accidents and improper operations by employees.

Supply Chain Finance: Mizuho Bank and IBM Japan jointly developed a blockchain trade finance platform, which enables fast and secure exchange of digital transaction documents and supply chain transaction data, and improves the transparency and credit of all parties to the transaction.

Investment in Japan's encryption industry is often dominated by existing Web2 giants such as securities companies, telecommunications companies, and distributors, rather than venture capitalists (VCs), and there are few local venture capital institutions specializing in web3 investment. Among them, Japan's Web2 giant SBI Group participates in the encryption industry through joint ventures and subsidiaries:

SBI Digital Asset Holdings: Security Token Services

SBI VC Trade: Cryptocurrency Trading Services

SBINFT: NFT Business

Others that have established and developed subsidiaries and joint ventures specializing in the encryption industry include:

NTT DoCoMo (Japan's largest telecommunications company): NTT Digital

Sony (a leader in the electronics and entertainment industry): Sony Network Communications Corporation

SoftBank and Line: Z Venture Capital

Due to policy restrictions, Japan cannot directly invest in tokens and issue tokens, which limits the development of DeFi in Japan. Therefore, in Japan, NFT and blockchain games are widely regarded as major players in its cryptocurrency market.

Japan has a globally influential game industry and is one of the countries with the highest per capita profit in the game market worldwide. Its game industry has a long and rich history, which provides a solid foundation for the development of crypto games. Japanese players are also known for their willingness to pay for high-quality games. They have a special liking for games, which makes Japan's blockchain game market have huge profit potential.

Japan not only has a rich and long history of video games, but also has the most IP (intellectual property) in the world, including anime, comics, and video games. These cultures have transcended national borders and become globally famous. Because of this, Japan's NFT community also has unique aesthetics and preferences, which are different from other parts of the world. Moreover, Japan's hot spots are sometimes not synchronized with the world, and there will be a certain degree of mismatch delay. Previously, after the NFT craze in China and the United States passed, Japan's various NFTs experienced a wave of outbreaks.

The Japanese market is a relatively independent and closed market. Due to the language barrier (Japanese people's psychological barriers to English) and the cautious tendency of Japanese KOLs, it is difficult for crypto projects to be marketed in Japan. Overall, it is a market that is easy to defend and difficult to attack. The localization sentiment of Japanese crypto users is very obvious. However, due to the malicious harvesting behavior of some local projects, people's emotions towards local projects have begun to become complicated. Although they still tend to support domestic projects, they obviously lack confidence.

Compared with local projects, local users are not very enthusiastic about foreign projects. Overseas projects need to adapt their products and services to local regulations, translate information into Japanese, and cooperate with local KOLs and media to hold local events. By contacting localized audiences, projects can gain more popularity and users.

It is worth noting that Japanese users have a mindset of actively considering the project parties and merchants. For example, when merchants set very low prices, they will think about whether the merchants can recover their costs by doing so. If the crypto project is actively doing things, Japanese users will show a more tolerant and understanding attitude than users in some other markets, which will help create a healthy community atmosphere.

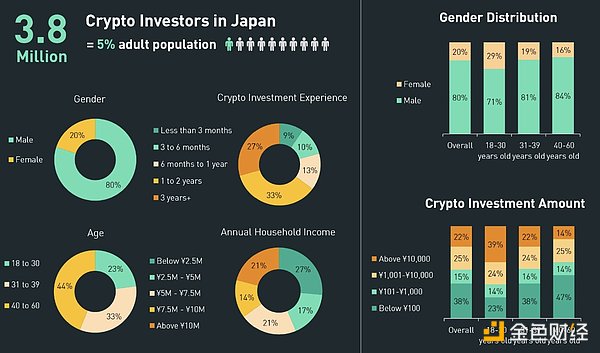

According to TripleA, more than 5 million people, accounting for 4.0% of the total population of Japan, currently own cryptocurrencies. This value has been verified by data from licensed exchanges. In addition, a May 2023 report by KuCoin showed that approximately 3.8 million cryptocurrency investors in Japan owned or invested in crypto assets in the previous six months, accounting for approximately 5% of Japan's adult population; in Japan, although BTC and ETH are still the favorite crypto assets of Japanese investors, people are very interested in diversifying into multiple fields, such as NFT, metaverse, stablecoins, public chains, DeFi, and meme coins.

Overview and investment experience of Japanese cryptocurrency investors

Based on the understanding of various regional markets, men are more interested in cryptocurrency investment. However, this phenomenon is most obvious in the Japanese market, where 80% of investors are men and only 20% are women.

Unlike several other markets, the majority of cryptocurrency investors in Japan are aged 30 and above, accounting for 77%. On the other hand, the younger generation aged 18 to 30 only account for 23% of cryptocurrency investors in Japan.

In addition, the maturity of cryptocurrency adoption in Japan is relatively high. Among the investors surveyed, 27% have invested in cryptocurrency for more than 3 years, 33% have been users for 1–2 years, and only 9% of the respondents are new to crypto assets.

Cryptocurrency investment is also more common among households with lower incomes, with 44% of investors having a household income of up to 5 million yen per year. However, only 21% of cryptocurrency investors in Japan have an annual income of more than 10 million yen.

Other main reasons why Japanese investors turn to cryptocurrencies include long-term wealth accumulation (40%) and diversification of investment risks and portfolios (38%). While 28% of investors participate in cryptocurrencies because they think it is fun, 26% of investors believe it can make them rich overnight. Only 21% of Japanese cryptocurrency investors believe that crypto assets are a means of preserving value against inflation.

Among them, 44% of investors believe that investing in cryptocurrency can grasp the future. The largest group in this category is investors aged 18 to 30, who invest in cryptocurrency because they believe in its cutting-edge technology and potential for financial innovation.

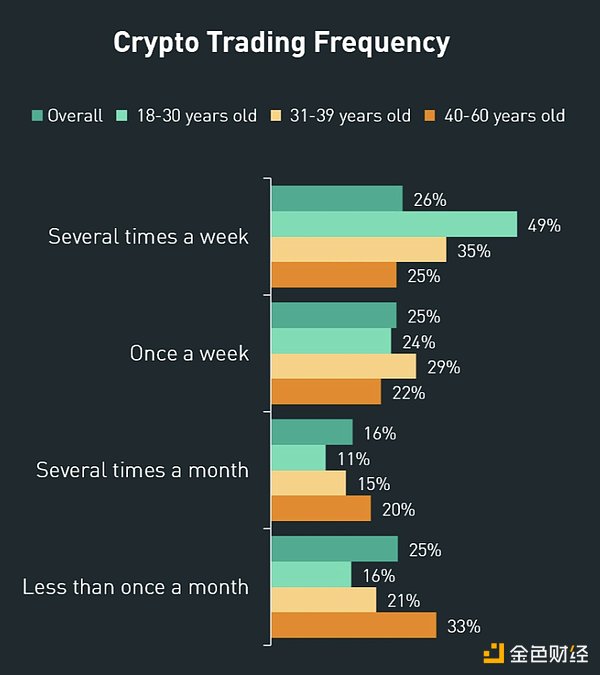

The transaction frequency is strongly correlated with age. Among them, young investors aged 18-30 are the most active, with transactions every week; users aged 40-60 trade once a month on average; and users aged 31-39 have no obvious characteristics, with transactions occurring once a week, multiple times a week, and multiple times a month.

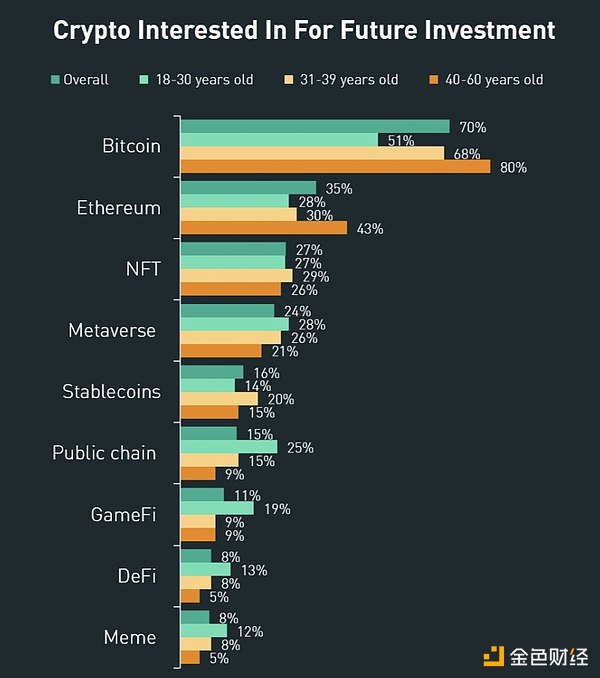

Like other regional markets, BTC and ETH account for the highest proportion of Japanese users' portfolios and cover all age groups. In particular, investors between the ages of 40 and 60 are most interested in these cryptocurrencies, with 80% of investors expressing interest in Bitcoin and 43% of investors interested in Ethereum.

Other popular categories favored by Japanese investors include: NFT (27%), Metaverse (24%), stablecoins (16%) and public chain projects (15%);

In addition, GameFi (11%), DeFi (8%) and Meme coins (8%) are also gradually becoming the crypto investment choices of Japanese users;

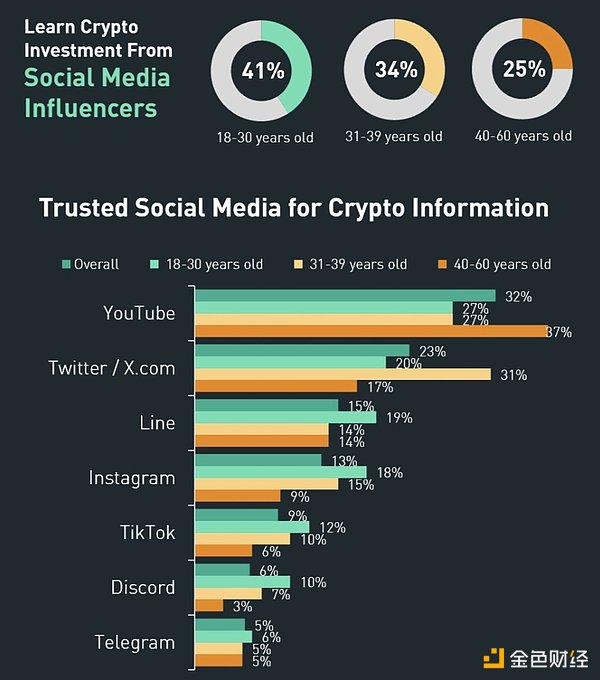

Most Japanese investors learn about cryptocurrencies through social media and KOLs, and this trend is highest among younger groups, with 41% of investors aged 18-30 relying on influencers to learn about cryptocurrency investments.

Social media that people trust and use include: YouTube (32%), Twitter (23%), Line (15%), Instagram (13%) and TikTok (9%). From the data, we can see that more technical social channels such as Discord, Telegram and Reddit are not trusted by Japanese users, who believe that these channels are more risky.

According to the requirements of local regulators, cryptocurrency exchanges need to obtain a license from the Japan Financial Services Agency (JFSA). Most licensed cryptocurrency exchanges are registered in Tokyo or Osaka.

Binance Japan was launched in August 2023 and was renamed after Binance acquired the local licensed CEX Sakura Exchange BitCoin in November 2022. The move marks Binance's return to the Japanese market after the country's financial regulator warned it again in 2021 that it was operating without a license. Currently, Binance Japan is known for its rich and diverse token types and is loved by many users.

Bybit has a secure platform that hosts more than 1,000 cryptocurrencies and complies with Japan's strict regulations, facilitating seamless entry into cryptocurrency trading. It offers direct local yen deposit options, including bank transfers, JCB cards, and Line Pay, simplifying investment access.

Bybit's competitive advantages include low transaction fees (starting at 0.01% for market makers and 0.06% for takers), ample liquidity, more than $30 billion in daily trading volume, and a vibrant community of more than 20 million users, which confirms its market-leading position.

Founded in 2014, Coincheck is the largest cryptocurrency exchange in Japan with more than 2.5 million users. In 2018, it was acquired by Monex Group, a Japanese financial services company founded in 1999, which operates diversified businesses including online brokerage, asset management and cryptocurrency services.

Coincheck offers a variety of cryptocurrency trading services, attracting a large number of local and international users in Japan. With its user-friendly interface and no transaction fees, Coincheck has become one of the most popular trading platforms in Japan

Bitflyer is known for its advanced trading tools and features, and its Bitcoin trading volume ranks first in the country. It cleverly caters to different user groups, from newbies to experienced traders, by offering two tailored trading experiences: the intuitive bitFlyer Exchange for beginners and the advanced BitFlyer Lightning for more complex trading strategies.

BitFlyer has broadened its appeal with innovative features, including a unique crypto credit card, the opportunity to earn BTC, and the Bitcoin T-Point Exchange. These initiatives have solidified bitFlyer's reputation as Japan's third-ranked cryptocurrency exchange, balancing accessibility and depth for a broad range of investors.

Bitbank is the highest-rated cryptocurrency trading application in the Japanese Apple App Store and one of the few digital asset exchanges in Japan that provides instant account verification services, which are usually completed within a few minutes.

In addition to trading functions, Bitbank also provides lending services, allowing users to lease assets to Bitbank with a return rate of up to 3%. Third-party institutions have highly praised Bitbank's security performance. The platform uses offline cold wallets and Multisig technology to ensure resistance to hacker attacks and protect users' asset security with advanced technology.

Zaif has more than 500,000 users. Founded in 2014, the platform offers a variety of cryptocurrencies such as Bitcoin, Ethereum and other cryptocurrencies. Known for its focus on privacy and security, Zaif attracts traders who prioritize these features.

It allows users to buy and sell various cryptocurrencies in Japanese yen, and also allows margin trading, which is suitable for beginners and those who want to trade quickly. Since its inception, Zaif has been in a continuous development process, and it has added several new features such as trading, payment services, and currency reserves.

The project types in Japan's crypto market are relatively low. Although there are public chains and DeFi projects, they are mainly non-fungible tokens (NFTs) and gaming projects. These projects are largely focused on localization and long-term community building.

Japan Open Chain (JOC) is a practical-focused Ethereum-compatible Layer1 public chain that works with trusted companies to provide reliable blockchain infrastructure for businesses and local governments. Japan Open Chain is a blockchain infrastructure operated by Japanese companies that complies with Japanese law and provides a secure environment for developing web3 businesses.

INTMAX is a new type of zkRollup as an Ethereum L2 network for various web services and finance. It will enable Ethereum to enable all online citizens to participate in the economy through payment infrastructure and Internet-native ownership using NFT and community-governed tokens. NTMAX has made significant innovations in ZK implementation, making it a unique Layer2 rolling network with low cost, security, adjustable privacy, and, most importantly, scalability.

Palette is a blockchain network for issuing, managing and distributing digital items. Users can freely transfer the ownership of digital items and use them in applications. Palette allows digital items to be processed as NFTs on its own blockchain, Palette Chain. Palette Chain is a blockchain designed specifically for the issuance, management and distribution of digital items in the entertainment field, designed to adapt to business models. In addition, Palette Chain can be connected to multiple blockchains, including Ethereum, and can serve as a cross-chain platform as a center for the issuance and distribution of NFTs.

HashPort is a cross-chain interoperability layer that supports fast and secure cross-network transmission of digital assets. It is developed and provided by the eponymous HashPort Co., Ltd., which was established in 2018 with the vision of asset digitization and provides blockchain technology consulting and solution services to customers.

KEKKAI is a Web3.0 security plug-in that detects dangers by analyzing transaction simulations, aiming to eliminate fraud in the growing Web3 field. If users use KEKKAI, they can obtain the risk judgment information it provides in transactions - if there is any abnormality, KEKKAI will display a risk warning on the page.

Takashi Murakami is a renowned Japanese artist known for his colorful works and unique artistic style. The Murakami.Flowers project (M.F for short) he initiated is a comprehensive project covering art, design and digital creation. The project is centered on the number "108" (composed of 108 backgrounds and 108 small flowers), which echoes the numbers related to the afflictions or worldly temptations in Buddhism, meaning that the artist is trying to transcend worldly constraints through digital art.

Crypto Ninja Partners (CNP) is a Japanese ninja-themed NFT series that originally originated from a community called NinjaDAO. Although NinjaDAO is not a DAO organization in the strict sense, this community brings together many cryptocurrency enthusiasts from Japan. Two core figures, Ikehaya (Japanese NFT KOL and Web Marketer) and Road (another core contributor), jointly promoted the development of CNP.

The vision of the project is to establish a digital fashion brand and empower creators. The core concept of the project is "I GOT YOUR BACK", which symbolizes MetaSamurai's commitment to supporting its NFT holders. The phrase "I GOT YOUR BACK" originated from a story about two people standing back to back in battle, protecting each other; the spirit of the samurai is to resolutely dedicate himself to protecting the lord; the loyal dog Hachiko has been waiting for his deceased master for more than ten years. These are the inspirations for MetaSamurai's works.

Skyland Ventures (SV) is a venture capital (VC) fund headquartered in Shibuya, Tokyo, focusing on seed-stage startup investments. As of 2022, it has invested in more than 120 startups, mainly in Japan. Starting in 2022, the fund will target equity/token investments in startups in the Web3 field (cryptocurrency, NFT and blockchain). The fund invests from about $50,000 to $500,000 at the pre-seed stage, to investments at the seed stage and beyond, ranging from $100,000 to $1,000,000. Its founders are Max Kinoshita, Yonkuro Masanori Ikeda, and Yuan Xiaohang.

They work with Hash Global, OKX Ventures, Foresight Ventures, MH Ventures, and Generative Ventures, among others.

Investment History:

Raised $4 million venture fund for seed startups in 2012.

Invested in 16 companies.

Trasnlimit (provides BrainWars brain battle game, 13 million installations worldwide, supported by LINE and Braindots, with a total of 23 million downloads)

Hachimenroppi (provides a fresh food market supported by Recruit and Yahoo! Japan)

Kaumo.jp / Curazay.com (targets popular websites in Japan, with 4-5 million unique users)

The venture capital firm is a boutique early-stage venture capital firm based in Silicon Valley, with investments in areas such as information technology, financial services, gaming, insurance, infrastructure, cryptocurrency, cybersecurity, blockchain and fintech, with investments in the United States, Canada, Europe, Israel, East Asia, South Asia and Southeast Asia, including Japan. Its co-founder is Zirui Zhang, and its managing partners are from Japan and China.

Some of its major investments include OpenSea, 1inch and Lit.

CGV is an Asia-based fund management company that focuses on investments in crypto funds and crypto studios. CGV FoF consists of family funds in Japan, South Korea, mainland China and Taiwan, headquartered in Japan, with branches in Singapore and Canada. The founders are Steve Chiu and Kevin Ren.

They work with Waterdrip Capital, LK Venture, ZC Capital, Satoshi Lab and Blockchain Founders Fund.

Among their portfolio, some projects include AlchemyPay, Bitkeep, Metis, TheGraph, Avalon and Celestia, as well as recent Bitcoin ecosystem projects — Bitcoin wallet infrastructure UniSat, bitSmiley and BTC second-layer network ZULU.

BDASH Ventures is a venture capital firm based in Tokyo, Japan, investing in seed, early and late-stage startups that will become the core of the next generation of technology. The company's CEO is Hiroyuki Watanabe.

B Dash Ventures hosts a biannual summit for senior tech industry executives and startup founders, called B Dash Camp. It is now one of the largest invitation-only tech events in Japan, attracting more than 700 guests from inside and outside Japan.

The crypto venture capital fund is part of GMO Internet Group Inc., which is listed on the Tokyo Stock Exchange. Also part of the group is GMO Coin, a licensed cryptocurrency exchange in Japan that lists 28 cryptocurrencies.

MZ Web3 Fund was founded by Yusaku Maezawa, known as the Japanese Musk, and focuses on Web3 project investment. It is the most active crypto fund in Japan. MZ Web3 Fund has invested in 24 start-up projects in the Web3 field, including the decentralized storage project SINSO, payment tools Slash and Transak, development community WEB3DEV, game public chain Oasys, and Web3 user growth platform Aki Network. MZ Web3 Fund will provide the community resources of MZ Club and MZ DAO to the invested projects to help them quickly expand in the Japanese market.

In the global crypto market, Japan is a unique market, especially in the financial and investment fields, with great potential. However, since the crypto market was often attacked by hackers in the early days, the Japanese government has a conservative attitude towards the crypto industry and regulates it cautiously. On the other hand, Japan's strong sense of crisis has led the authorities to try to use emerging technologies such as blockchain to maintain its position as the world's third largest economy. Japan's blockchain industry regulatory policy, on the contrary, is mature and stable, making the blockchain entrepreneurial atmosphere very good.

In 2016, the Japanese Cabinet passed an amendment to the Funds Settlement Act, which came into effect in April 2017. It provided a legal definition of cryptocurrency and recognized the legality of cryptocurrency. Under the Funds Settlement Act, digital currency is defined as any of the following:

property value recorded electronically on electronic devices or other items;

transferable using electronic information processing organizations;

not a currency-denominated asset such as domestic currency or foreign currency;

can be used to unspecified persons when purchasing, renting items or receiving services;

can be purchased or sold to unspecified persons;

that is, Japan recognizes cryptocurrency as a legal means of payment. The Funds Settlement Act is the world's first bill to incorporate digital currency into the legal regulatory system, which is of great significance to the digital currency market.

In January 2022, Japan's ruling Liberal Democratic Party established the Digital Society Promotion Headquarters, and at the same time the Japanese government launched the "National Strategy". Since then, its Web3 project team has been directly proposing legislative and regulatory reforms to the ruling party. Many of these reforms have been adopted, but others are still pending.

In terms of corporate taxation, in order to promote a "token financing-friendly environment" for companies, Japan's Web3 policy team proposed two reforms. First, exempt "tokens that are continuously held by the issuing company" from "corporate income tax based on year-end market value"; second, exempt "tokens issued by other companies and held by third parties that are not for short-term trading purposes" from tax. The first reform takes effect in June 2023, and the second has just been proposed by the FSA for inclusion in the 2024 legislative agenda and adopted by the Ministry of Economy, Trade and Industry (METI). The adoption of these two measures could ease the long-standing disadvantage that domestic corporate investors in Japan have been at compared to overseas investors who can rely on more favorable tax treatment.

In terms of personal taxation, income from crypto asset transactions is taxed as "miscellaneous income" and when "income tax and resident tax" are combined, its "minimum tax rate is 55%." And this tax is levied not only when the crypto assets held are converted into fiat currency, but also when they are converted into other crypto assets, resulting in a large outflow of taxpayers and discouraging taxpayers from filing taxes. The Web3 policy team proposed four reforms. First, a uniform 20% tax is imposed on crypto asset transactions; second, "gains and losses" are taxed only when converted to fiat currency, thereby exempting "exchanges of crypto assets" from taxation; third, individuals are allowed to carry forward losses for up to three years; and fourth, the same tax rate is applied to "crypto asset derivative transactions." However, these reforms were excluded from the 2023 agenda, and it is unclear whether these proposals will become part of the 2024 legislative agenda.

According to the amendment to the Funds Settlement Act, institutions engaged in cryptocurrency transactions need to apply for a license from the Japanese Financial Services Agency and be subject to its supervision. If you want to engage in digital currency exchanges in Japan, generally speaking, you need to meet the following four basic conditions:

Subject: Co., Ltd. or foreign digital currency trading institutions (with business premises and representatives in Japan);

Registered capital: with property basis, registered capital of more than 10 million yen, and positive net assets;

Company system: a company system that can properly and accurately execute business (such as isolating user assets from company assets, establishing an effective risk management system, and preventing risks such as hacker attacks, system failures, money laundering, and terrorist financing);

Compliance: comply with relevant laws and regulations, protect user privacy, fulfill anti-money laundering obligations, and cooperate with the inspection and investigation of the Financial Services Agency;

In addition to the supervision of the Financial Services Agency, in order to improve the credibility and transparency of the industry, protect the interests of investors, and promote the healthy development of the cryptocurrency market, Japan established the Japan Virtual Currency Exchange Association (JVCEA) in April 2018 with the approval and authorization of the Financial Services Agency to conduct self-regulation. The association has formulated a series of self-regulatory rules and guidelines, including:

Classify the cryptocurrencies provided by exchanges and determine their listing conditions based on factors such as security, liquidity, and transparency;

Carry out risk assessments on exchanges, set leverage limits, margin ratios, forced liquidation mechanisms, etc.;

Disclose information on exchanges and require them to disclose trading rules, fee standards, customer complaint handling methods, etc.;

Educate consumers on exchanges to improve their understanding of digital currencies and risk awareness;

September 2019 In June, the JVCEA issued the "Rules on New Coin Offerings" and supporting guidelines, allowing the public issuance and sale of tokens for financing (IEO and ICO). This is the first time that Japan has established a clear regulatory framework for cryptocurrency issuance financing. According to the rules and guidelines, if you want to issue and sell tokens in compliance with regulations in Japan, you must mainly meet the following conditions:

The issuing entity or underwriting entity must be a licensed exchange and report relevant matters to the Financial Services Agency and the association;

The issued tokens must comply with the security, liquidity, transparency and other standards set by the association and pass the review of the association;

The issued tokens must have a reasonable pricing mechanism and fully disclose relevant information to consumers;

The issued tokens must be sold out within a certain period of time, and the sales situation must be reported to the association;

At present, under the "Rules on the Issuance of New Coins", the frequency of ICO/IEO in Japan is not high. On September 26, 2023, in order to better improve IEO In view of the situation, JVCEA further released an initial proposal for the direction of IEO reform.

To sum up, Japan is a country that is open and positive about blockchain technology and digital currency. It has formulated relatively complete and clear regulations in terms of laws, taxes, licenses, self-discipline, etc., and is still constantly exploring and innovating to adapt to the rapid changes and diversified application scenarios of blockchain technology, and attempts to gain a foothold in the development of the global blockchain industry. For blockchain entrepreneurs, although Japan has a strong localization sentiment, it is still a good soil for the crypto industry to gain a foothold and develop.

As early as 2017, Japan officially recognized BTC as legal tender, and in April 2023, the ruling party's Web3 project team released a white paper, indicating that the government's investment in the industry has continued to increase, making Japan's crypto market increasingly prosperous. However, restrictions such as prohibiting direct investment in tokens and the inability to launch token issuance projects within Japan have restricted the development of DeFi-type projects and businesses in Japan, and instead formed an industry feature centered on NFT and games.

In terms of compliance, in order to ensure the stability of the investment market and the safety of investors' assets, Japan has strict laws and regulations in the field of encryption. However, the high cost of compliance and the high tax burden have hindered the entry and development of projects. In particular, the lengthy approval process for token listings often makes people think that the market lacks vitality and loses confidence in this field. It also limits the innovation of enterprises and the flexibility of the market, causing Japan's cryptocurrency industry to lag behind other countries.

With the penetration and development of the crypto industry around the world, Japanese institutional investors have also shown great interest in the crypto market and have a clearer understanding of the potential of this industry. The participation of institutional investors has brought more liquidity, stability and credibility to the Japanese crypto market, which is promoting the development of the Japanese crypto industry and attracting more interest from retail and institutional investors.

In the regional competition in the crypto market, Japan has unique advantages in regulatory compliance, GameFi and NFT, and its strong and sustainable community is also an indispensable tool for the development of the industry. However, overly stringent tax policies and investment and financing restrictions still pose a strong obstacle to the rise and development of the crypto industry in the country. If the policy level can be moderately open under the premise of regulatory compliance, it will be more conducive to the rooting, innovation and development of the crypto market. In particular, Japan's unique cultural characteristics combined with a strong financial system will have the opportunity to make it a global leader in GameFi and NFT, leading the future of the global crypto industry.

Unisat,Inception Capital: Why did we invest in Unisat? Golden Finance, UniSat is the preferred platform for Bitcoin inscriptions and runes.

JinseFinance

JinseFinanceFlock is an end-to-end AI co-creation platform that integrates decentralized federated learning with blockchain.

JinseFinance

JinseFinanceIO.Net is ArkStream Capital's important investment in the artificial intelligence (AI) and decentralized infrastructure (DePIN) tracks, demonstrating our expectation that artificial intelligence will become the focus of innovation in this market cycle.

JinseFinance

JinseFinanceWith Bitcoin’s halving expected to occur in late April 2024, we believe the confluence of these positive factors will provide a strong impetus for the next bull run.

JinseFinance

JinseFinanceLD Capital announced the Solana Ecological Fund, which focuses on investing in Solana ecological projects. It aims to deeply participate in the development of the Solana ecosystem, support innovative projects and teams, and promote wider blockchain applications and adoption.

JinseFinance

JinseFinanceSince its launch, Celestia's specially built data availability layer has been increasingly selected and applied by public chains. This article will sort out the current ecological development status of Celestia.

JinseFinance

JinseFinanceA look inside Sam and Caroline’s grab-bag of crypto, etc.

Financial Times

Financial TimesIdentifying the Best Early Stage Venture Funds in Crypto Today

Stratos

StratosSeparately, the CEO of Genesis' parent company disclosed that it had a roughly $575 million liability to Genesis.

Coindesk

CoindeskVenture capital DAO is reshaping the way venture capital works.

Ftftx

Ftftx