Author: By Severin, MT Capital

TL;DR

Messari performance in report They are very optimistic about the Solana, DePIN, AI + Crypto and Perps tracks.

Judging from the position distribution of analysts, Messari is still most optimistic about Solana and the AI + DePIN concept.

Key investment themes

Solana:

Rapid release of new products on Solana, on-chain liquidity The surge in revenue and the expanding availability of developer tools are always exciting to look forward to.

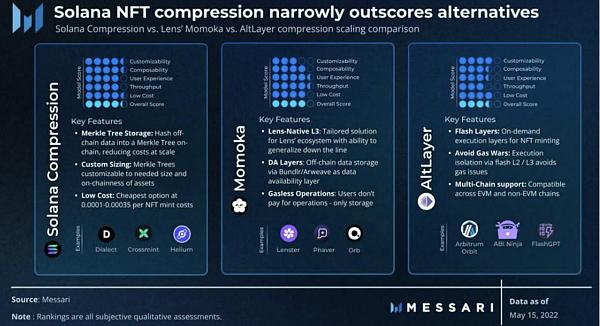

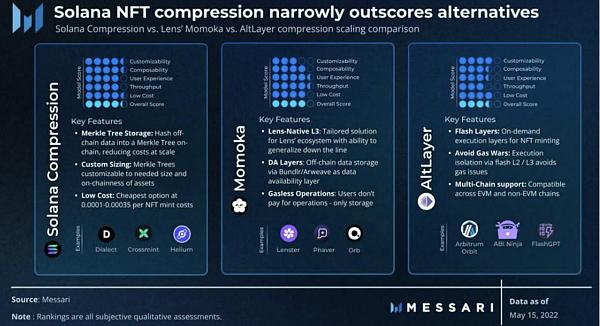

From a technical perspective, upgrades such as Local Fee Markets, QUIC, and Stake-Weighted QOS have significantly reduced the occurrence of Solana outages, making Solana's operation more robust. The emergence of technologies such as cNFT has significantly reduced the cost of NFT casting and management on Solana, allowing protocols such as Helium and Render to use cNFT to significantly reduce costs and promote the prosperity of the Solana DePIN ecosystem.

The market’s expectations for Solana in 2024 focus on the following: Aspects:

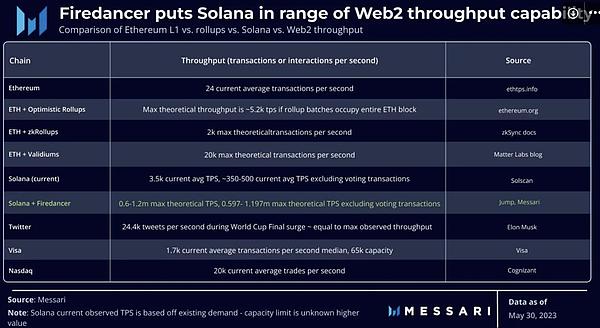

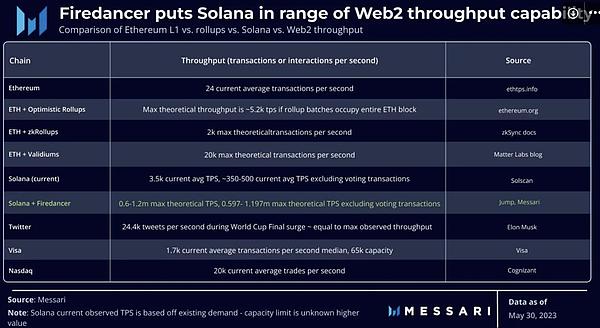

Achieve more than 10 times throughput and performance improvement through Firedancer and Sig clients. Firedancer enables Solana to process 1 million transactions per second. Improvements in user experience can attract more developers to participate in using and developing based on Solana, enriching Solana's prosperous ecosystem.

Developing light clients through Tinydancer allows verifiers to complete verification work at a lower cost and achieve a higher degree of decentralization.

Deploy token-22 standard to extend Solana’s token functionality. For example, token-22 will support interest-bearing tokens, allowing complex contract logic to be triggered when token transfers are made, etc.

Solana’s Local Fee Markets and state compression technology make the following applications “only possible on Solana.”

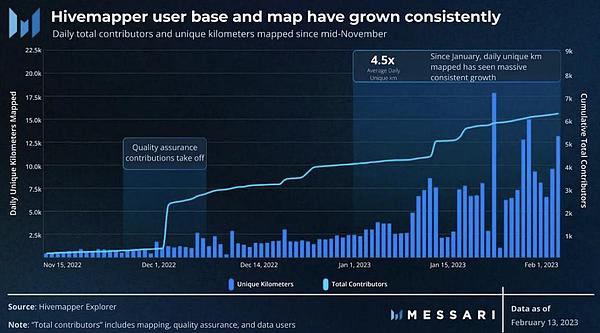

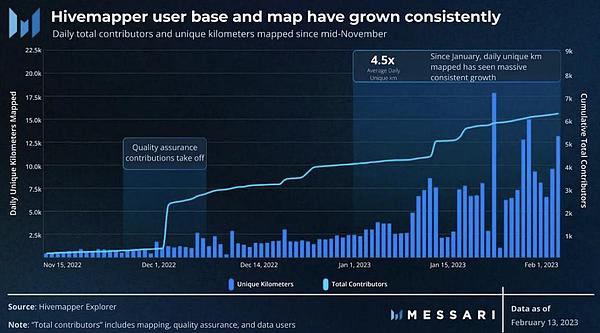

DePIN: Projects such as Helium, Hivemapper, Render, etc. have been migrated to Solana. Render ditched its own blockchain for Solana for compressible cNFTs, faster transaction speeds, and composable on-chain order books.

Payments: Solana has partnered with Visa to allow users to use Solana USDC to trade on Shopify at a lower cost and faster speed through the Solana Pay plug-in.

Consumer apps: Extremely low-cost cNFT can boost emerging consumer adoption with NFT as the core. Take DRiP, for example, which partners with artists to distribute NFTs to subscribers for free. It has minted more than 78 million cNFTs to 1.6 million wallets since the end of March, at a cost of only about $0.00036 per NFT.

DeFi: Extremely low transaction fees and faster final status confirmation enable the DeFi protocol on Solana to create a full-chain order book model and provide users with other blockchains A silkier user experience that the web can't support.

DePIN, DeSoc, DeSci

In the non-financial field, Messari is more concerned about the future development of DePIN, DeSoc and DeSci. The above three tracks have huge potential market sizes and can make more practical changes to the shortcomings of real-world business processes.

Messari pays special attention to the following four subdivided DePIN sub-tracks:

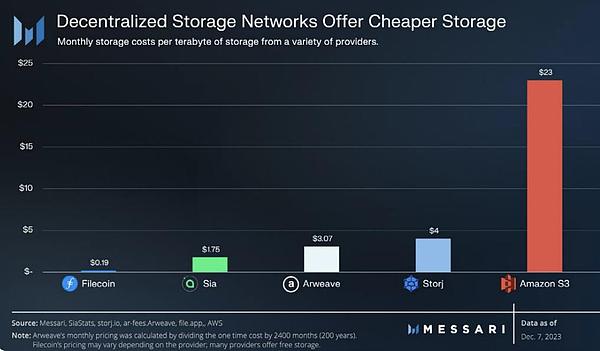

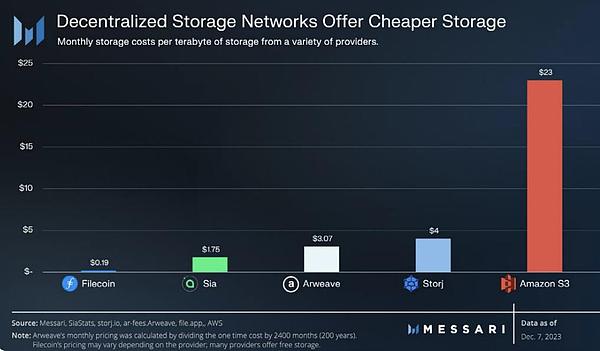

Decentralized Storage: current cloud storage The market has a market size of US$80 billion and continues to grow at an annual growth rate of 25%. Although the cost of decentralized storage services is 70% lower than that of cloud service providers such as Amazon S3, the current market share of decentralized storage is still less than 1%, and there is still a huge market opportunity for decentralized storage.

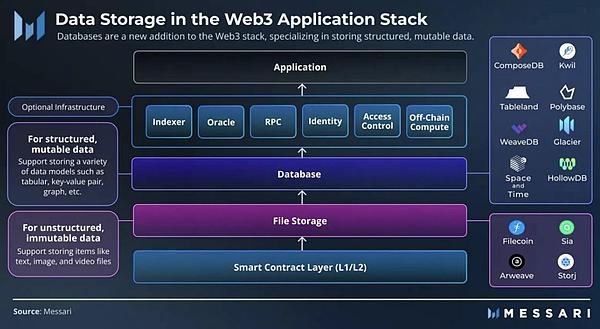

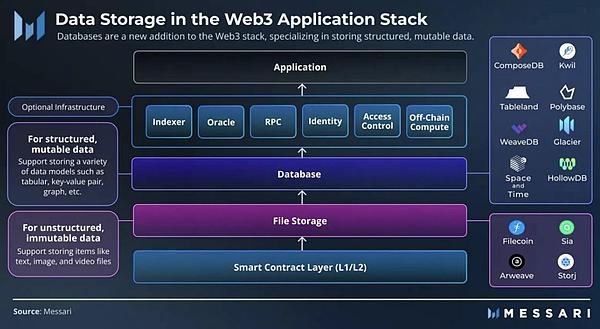

Decentralized Databases: Decentralized databases have been plagued by performance and latency, and these problems are expected to be solved in 2024. The emergence of DeSoc, games, dynamic NFT, ML, AL and other applications will greatly increase the demand for decentralized databases.

Decentralized Wireless Network: DePIN projects represented by Helium Mobile have gradually found their own PMF, causing user adoption rates to continue to grow. Take Helium Mobile as an example. In the early days, it attracted users by providing low-price services and tokens. The growth of users will further drive the growth of token prices, thereby attracting more users and paying, turning the growth flywheel.

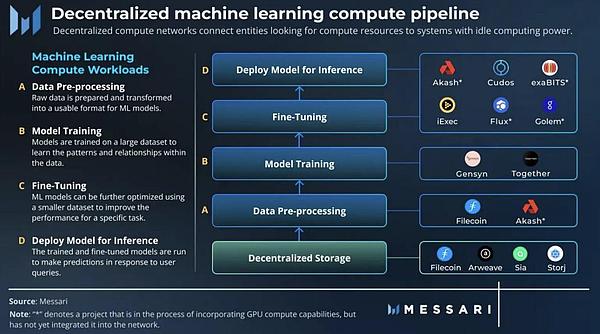

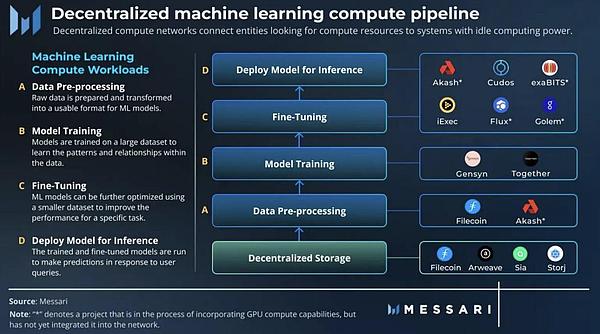

Decentralized AI Machine: The development of artificial intelligence currently faces constraints from computing bottlenecks and lack of collaboration. The DePIN project, which focuses on the field of AI, can solve these two problems well. Gensyn can provide sufficient decentralized computing power support for AI model training, and Bittensor can enable individuals to participate in open source AI model training. DePIN and AI have a natural combination scenario.

Except In addition to DePIN, Messari also pays additional attention to the DeSoc and DeSci tracks. Similarly, creators contribute $230 billion in revenue in social media, but only a small proportion of creators receive a corresponding share of the revenue. And Friend.tech has shared $50 million in revenue with its creators after only a few months of being online. Messari believes that DeSoc is expected to replicate the wave of the 2020 DeFi Summer.

In terms of DeSci, blockchain can effectively optimize key processes such as peer review and funding for scientific research, and can promote research and development in key scientific fields through DAO and token sales.

Although DeSoc and DeSci have not yet reached the out-of-circuit capabilities of DePIN, Messari is still optimistic about them and expects that the DeSoc and DeSci fields will also produce applications that bring Mass Adoption.

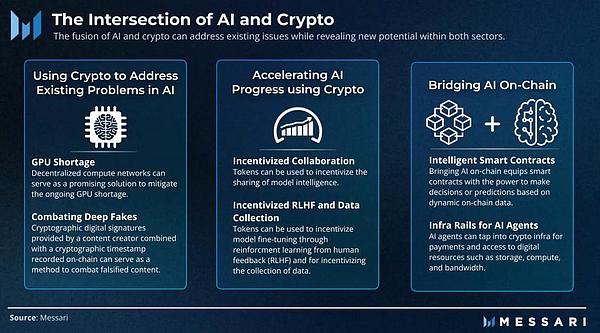

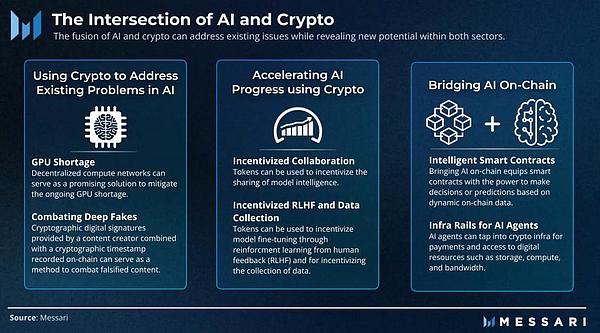

AI & Crypto:

Messari believes that the advancement of AI will increase the demand for cryptocurrency solutions, and cryptocurrencies represented by Bitcoin are also naturally suitable as AI Payment currency.

AI and Crypto have the following combination scenarios:

AI Agent can use encryption infrastructure for payment and autonomous transactions Provide access to digital resources.

Innovations such as zkML enable smart contracts to securely schedule AI Models to support more complex application logic.

Tokens provide a way to reward individuals for fine-tuning models and collecting valuable real-world data, making them a natural fit for integration with DePIN.

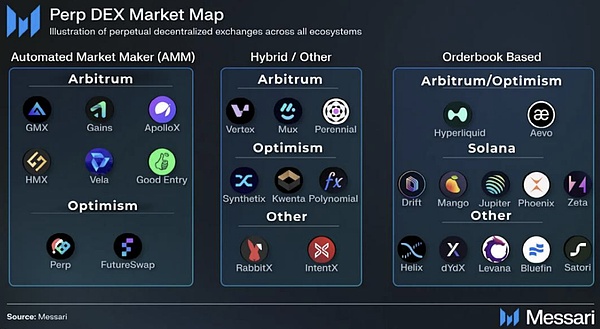

Perps

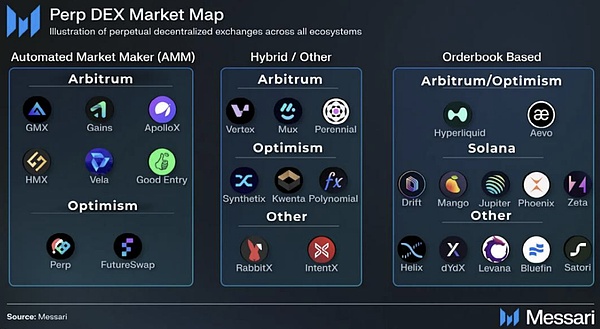

Messari clearly stated in his report that if you want to pay attention to a sub-track of DeFi this year, it should be Perp DEX.

As dYdX migrates to the customized Cosmos application chain, dYdX’s central limit order book can better provide a trading experience similar to CEX. And given the regulatory pressure CEX faces, the distance between dYdX and CEX may shrink further.

In addition to the Solana ecosystem’s Perp DEX (Drift and Jupiter), Synthetix also deserves additional attention. With the launch of the Synthetix Andromeda version, Synthetix will introduce cross-margin functionality, support for multiple new collateral types, and a series of improvements in trading, clearing, and more. Synthetix also removes years-long token inflation and potentially moves into token deflation. In terms of currency price, Synthetix is also the fourth best performing DEX year to date.

ETH

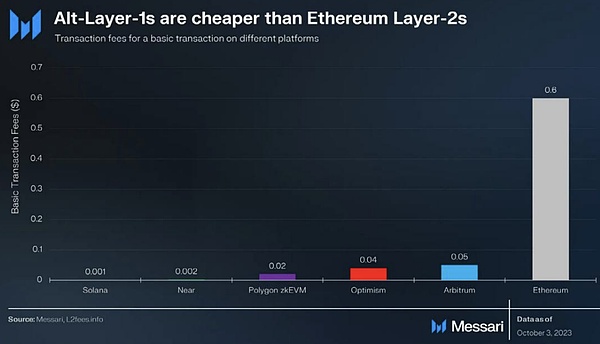

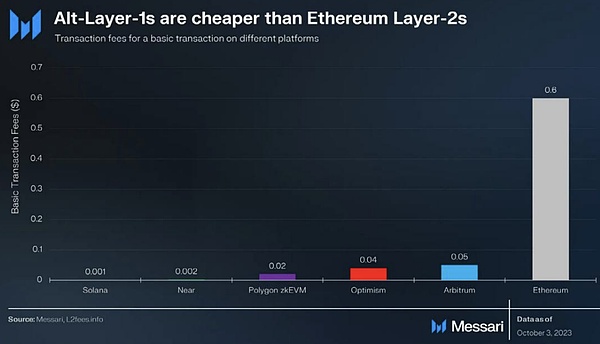

ETH Currently in a dilemma. It is not as attractive to institutions as the narrative of BTC digital gold, and other L0, L1, and L2 competing products are also gradually eroding the transaction volume on Ethereum. Although ETH’s investment performance-to-price ratio is currently low, ETH’s Cancun upgrade is still worthy of attention. Ethereum’s Cancun upgrade can reduce the transaction costs of Rollup by 90%-99%, making Rollup as cheap as other Alt L1s. The delivery date for the Cancun upgrade is one of the most noteworthy.

Analyst positions

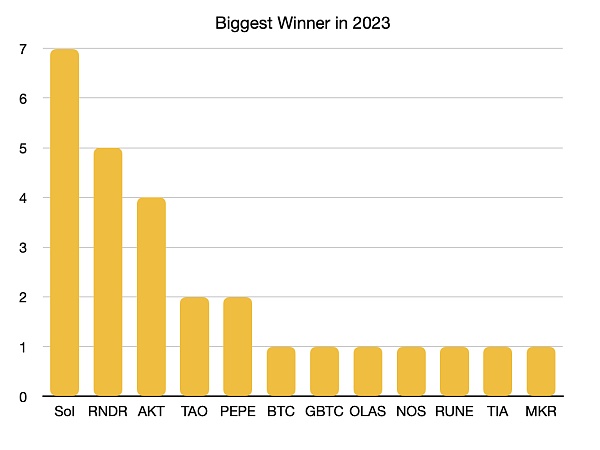

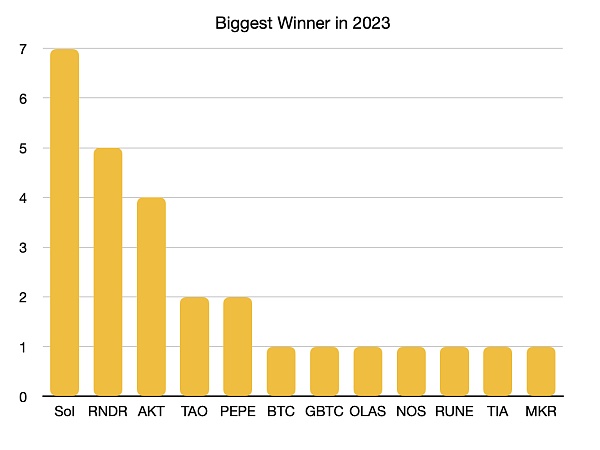

The most interesting thing is Messari’s public analyst positions. The picture below shows the distribution of currencies with the largest gains in Messari analysts’ positions in 2023. It can be seen that analysts’ main profits come from the Solana ecosystem and the AI + DePIN concept. This also reflects that analysts have captured the top narrative of this round of rising prices very well.

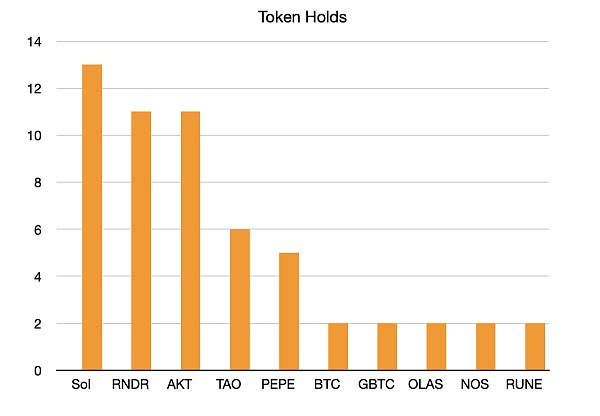

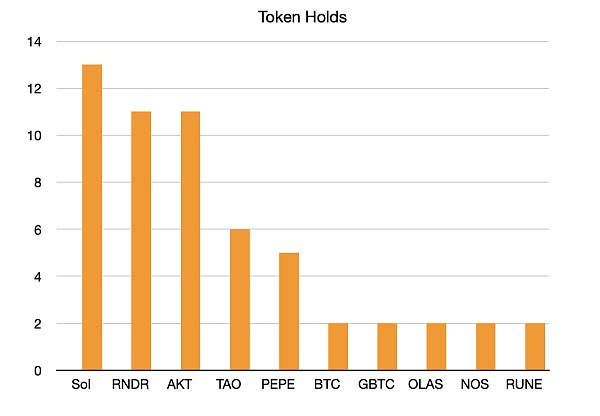

The picture below shows the current positions of Messari analysts Token distribution chart (currencies that appear only once have been removed). The main holdings of analysts are similar to the holdings with the largest increase in 2023, and are still concentrated in the concepts of Solana and AI + DePIN. Interestingly, for other tracks that analysts are strongly optimistic about, such as DeSoc, DeSci, Perps, etc., analysts do not hold any related tokens.

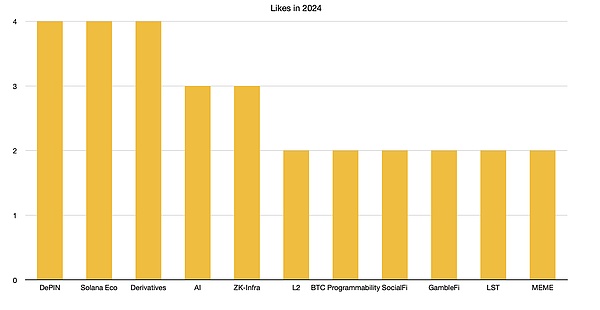

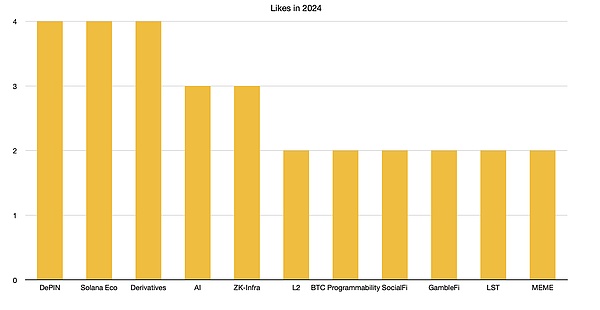

The picture below shows the game that Messari analysts like Road (the track that appears only once has been removed). Similar to the previous situation, Solana and DePIN concepts still dominate. However, decentralized derivatives have surpassed AI and become one of the favorite tracks of analysts, and the ZK concept has also reached an important level on par with AI.

Catherine

Catherine