Author: Zoltan Vardai, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Analyst: Altcoins may bottom out in June

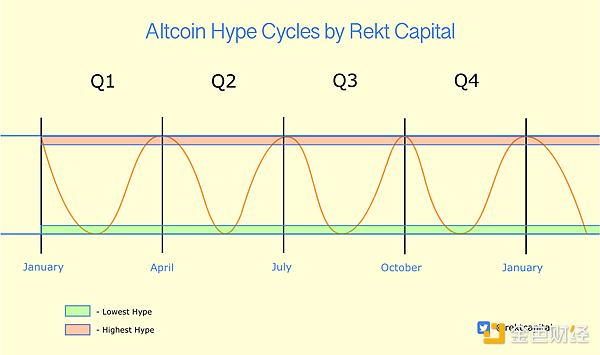

Popular cryptocurrency analyst Rekt Capital wrote in a May 8 article that based on historical chart patterns,altcoins may reach a price bottom around early June:

“Altcoins are following that plan perfectly. Altcoins bottomed out in early February. Altcoins were sold off during the Bitcoin halving. Altcoins will bottom out in early summer.”

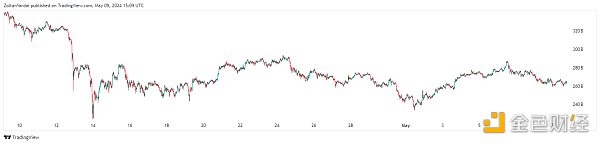

The altcoin market has been hit hard over the past month. The market capitalization of altcoins excluding the top ten cryptocurrencies fell more than 21% last month to $265 billion.

Altcoin market capitalization, source: TradingView

Despite the monthly plunge, altcoin market capitalization is still up more than 24% year to date (YTD) and more than 167% last year.

Historically, altcoin sentiment has correlated with Bitcoin price. Alex Onufriychuk, blockchain consultant and coach at QUBIC Labs Accelerator, said altcoins could bottom out around June as market sentiment and Bitcoin prices remain subdued amid declining inflows into U.S. spot Bitcoin exchange-traded funds (ETFs). He noted:

“Without sufficient new liquidity in Bitcoin ETFs in the U.S. and Hong Kong, it is possible that Bitcoin bottomed in June. This suggests that the consolidation period may be extended.”

Nansen: Bitcoin breakout will trigger altcoin bull cycle

Nansen Chief Research Analyst Aurelie Barthere noted that despite seeing a potential local bottom, the altcoin bull run first requires Bitcoin price to break out to the upside:

“Altcoins are high beta cryptocurrencies and they succeed when market sentiment is very bullish. Crypto investor sentiment has been less exuberant since mid-March. With BTC price consolidating around the 20-day exponential moving average (EMA), We need to break above this and clearly resume BTC’s uptrend to outperform.” BTC price has been making lower highs since mid-March. But many analysts believe this is a healthy consolidation period post-halving. Moreover, the chart hints that a multi-month bull flag is forming that will set new all-time highs later this year. BTC/USDT, 1-day chart. Source: Tradingview

QUBIC Labs’ Onufriychuk writes that, as altcoin sentiment is closely correlated with Bitcoin price, finding a local bottom will not necessarily translate into an altcoin rally:

“Even if altcoins bottom out around June, it does not necessarily mean the bull run will begin. Given the scarcity of new liquidity and heavy reliance on institutional reinvestment in new projects, more fundamental changes, such as increased retail and institutional investment and favorable regulatory developments, will be needed for a significant shift.”

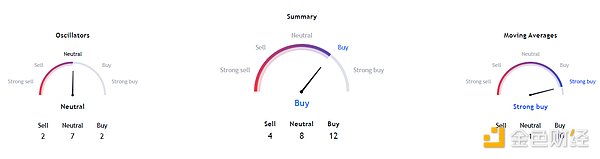

On the monthly chart, 10 of the 12 moving averages (MAs) are flashing buy signals for top altcoins, such as Ethereum.

Moving averages, altcoins. Source: TradingView

Altcoin prices could also rise as the M2 money supply turned positive year-on-year for the first time since November, suggesting that investors may soon start looking for opportunities to hedge against inflation or alternative investments.

The M2 money supply is an estimate of all cash and short-term bank deposits in the United States.

As the money supply of the world’s largest economy increases, some of this new supply may go into altcoins and memecoins, precipitating the start of an “altcoin season.”

Catherine

Catherine

Catherine

Catherine Huang Bo

Huang Bo JinseFinance

JinseFinance Bitcoinist

Bitcoinist Nulltx

Nulltx Nulltx

Nulltx Nulltx

Nulltx Nulltx

Nulltx Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist