Author: Krisztian Sandor, CoinDesk; Translator: Deng Tong, Golden Finance

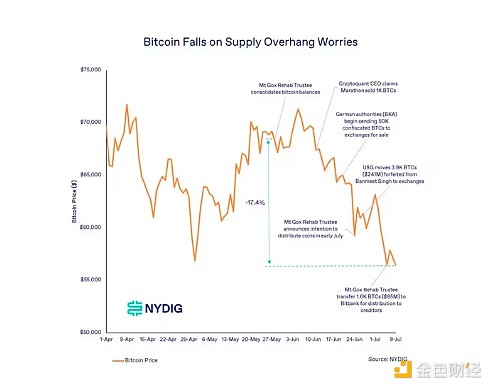

Bitcoin (BTC) has plunged 15% in the past month, with many market observers blaming selling pressure from bitcoin mining operators, Mt. Gox repayments and, more recently, Germany’s coin sales.

Claims that the aforementioned catalysts are behind the sharp price drop are overstated, NYDIG head of research Greg Cipolaro said in a report Wednesday.

“While sentiment and psychology may dominate in the short term, our analysis suggests that the impact of a potential sell-off on prices may be exaggerated,” he wrote.

“We are not unaware that other factors may be at play, but it is reasonable to think that rational investors may find this to be an interesting opportunity created by irrational fear,” he added.

Over the past few weeks, investors have focused on transfers to Bitcoin addresses associated with defunct exchange Mt. Gox, the U.S. government and the German state of Saxony, sparking concerns that more than $20 billion worth of reserves held by the three entities are about to be sold.

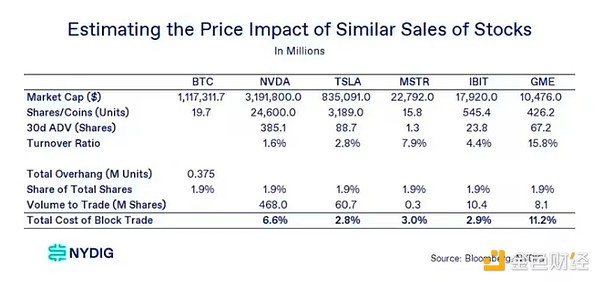

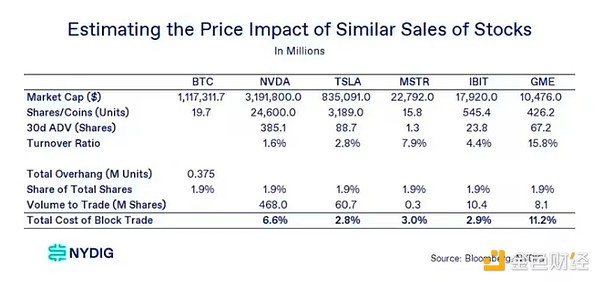

Even if they were to sell all of their assets at once (roughly 375,000 BTC as of June 9), Cipolaro found that BTC’s price has fallen more over the past few weeks than stocks based on Bloomberg’s transaction cost analysis (TCA), a common metric long used by traditional markets to assess the price impact of large sales of common stocks.

Estimated Price Impact of Block Sales Compared to Stock Sales (NYDIG)

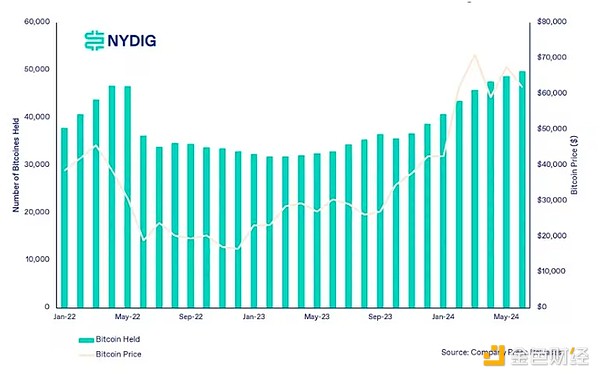

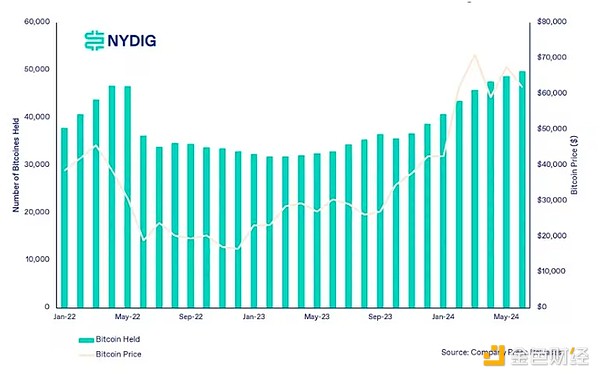

Cipolaro also believes that recent reports of miners collectively selling off their BTC reserves following this year’s halving event are not only exaggerated, but in some cases completely inaccurate.

Publicly traded mining companies actually increased their Bitcoin holdings in June, according to NYDIG. While BTC sales recovered slightly last month, they remain well below levels seen earlier this year and last year.

BTC held by public miners (NYDIG)

Cipolaro recommends not relying on blockchain data to determine miners transferring assets unless they understand the nature of these transactions. "Even if the transfer of bitcoins to exchanges or over-the-counter desks is correctly identified, it only tells us that the bitcoins have been transferred. That's all," he argued. "They may have been used as collateral or lent, not necessarily sold."

Joy

Joy