Author: Esme Zheng, OKX Ventures

In the current market environment, "Real-World Assets" (RWA) are rising rapidly. In July this year, CoinGecko pointed out in its second quarter 2024 crypto industry report that Meme Coin, artificial intelligence and RWA became the hottest categories, accounting for 77.5% of network traffic.

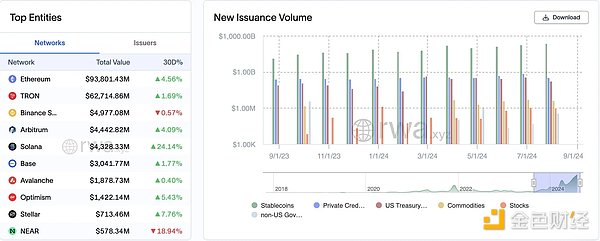

Traditional financial giants such as Citi, BlackRock, Fidelity and JPMorgan Chase have also joined the game. According to data from Dune Analytics, the growth rate of RWA narrative ranks second so far this year, up 117%, second only to Meme. This article will comprehensively sort out the development status and future opportunities of the RWA track.

TL;DR

RWA is one of the fastest growing DeFi sectors, with TVL doubling in 2023 and the value of on-chain assets growing by 50% from the beginning of 2024 to date, reaching $12 billion (excluding stablecoins). The fastest growing and largest sectors are the private credit market (76%) and U.S. debt products (17%), while the rest are precious metal stablecoins led by gold, real estate tokens, etc.

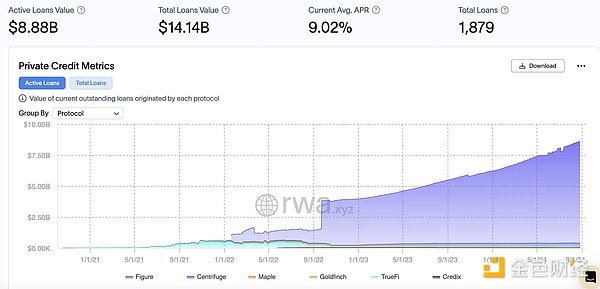

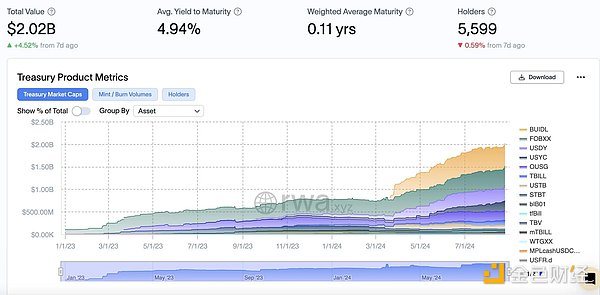

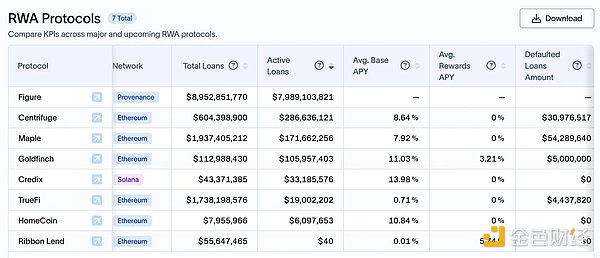

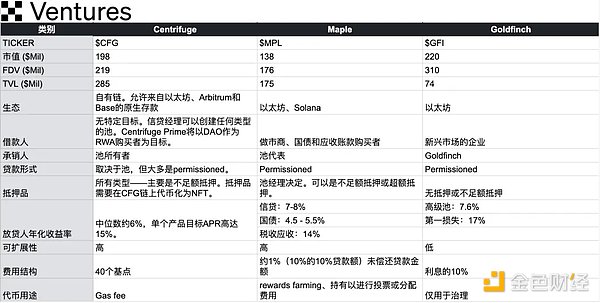

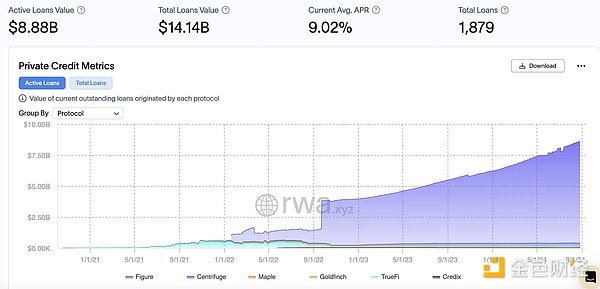

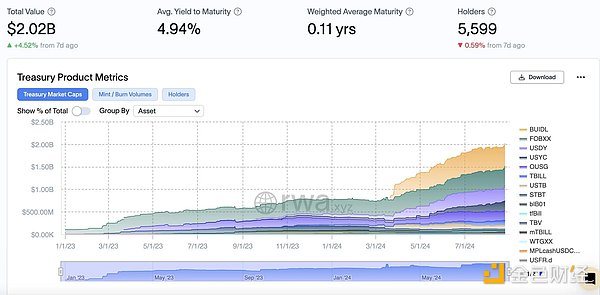

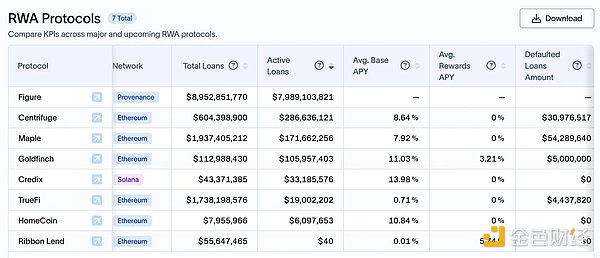

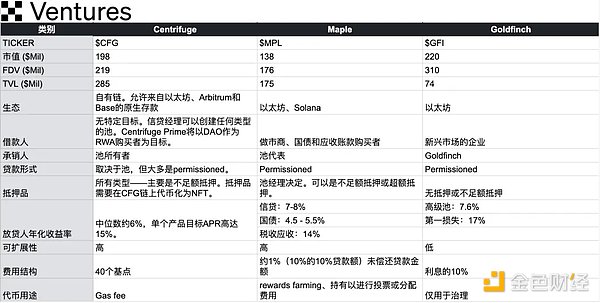

Currently, nearly 15 mainstream issuers offer more than 32 tokenized U.S. debt-related products, with total assets exceeding $2 billion, a 1,627% increase from the beginning of the year. The six mainstream on-chain credit protocols, Figure, Centrifuge, Maple, Goldfinch, TrueFi, Credix, etc., have a total active loan amount of $8.88 billion, a 43% increase from the beginning of the year.

Following the successful adoption of stablecoins on-chain and the attractive net interest margins obtained by off-chain centralized issuers, the next stage of RWA evolution will be driven by the issuance of tokenized US Treasury bonds. In this process, token holders obtain the largest share of net interest margins by directly investing in real-world assets with short maturities, strong liquidity and backed by the US government.

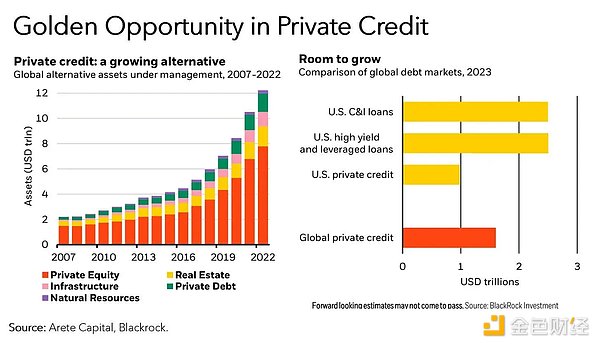

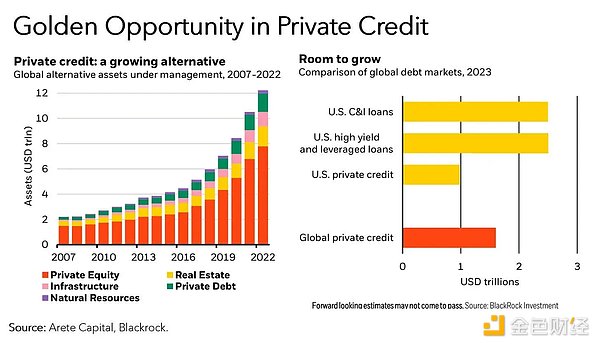

The on-chain private credit lending market has faced major challenges after the collapse of centralized financial bad debts. Now it is experiencing a recovery driven by the RWA narrative. Although the total amount of on-chain credit currently accounts for less than 0.5% of the traditional $1.5 trillion private credit market, the sharp upward trend indicates that the on-chain credit field has great potential for further expansion.

The application scenarios of real asset tokenization in the traditional financial field involve a large number of asset issuance, trading and other operations. For financial institutions that control core assets, compliance and security are the main demands. RWA needs to exist in "trusted finance" or "verifiable finance" and needs to be a "regulated cryptocurrency". Especially in the context of stablecoins, they still require a lot of participation from off-chain intermediaries for auditing, compliance and asset management, all of which require a trust foundation.

1. Current status of the RWA track

1. Market supply and demand

The core logic of RWA is to map the income rights of real-world financial assets (such as interest-bearing assets such as U.S. Treasury bonds and fixed-income securities, and equity assets such as stocks) to the blockchain, and obtain the liquidity of on-chain assets by mortgaging off-chain assets. For physical assets such as gold and real estate, it is to introduce them to the chain and use blockchain technology to improve the convenience and transparency of transactions.

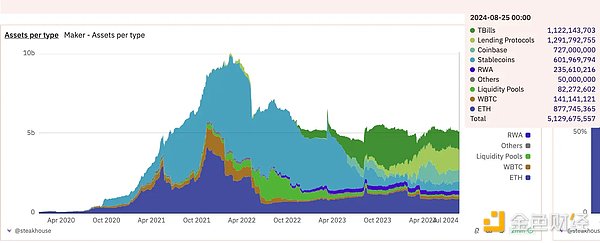

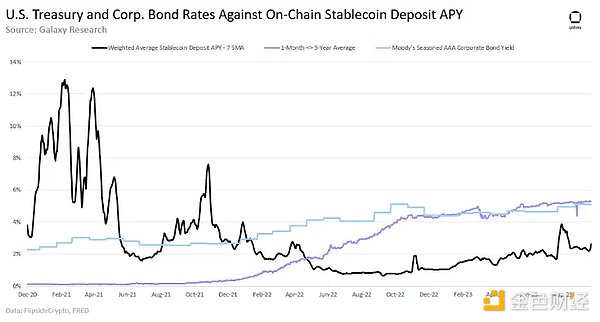

Under the background of the Fed's continuous interest rate hikes and balance sheet reduction, high interest rates have greatly affected the valuation of risk markets, and balance sheet reduction has greatly extracted liquidity from the crypto market, causing the yield of the DeFi market to continue to decline. At that time, the risk-free yield of US bonds as high as 5% became the hot commodity in the crypto market. The most popular behavior is similar to MakerDAO's large-scale purchase of US bonds as reserve assets. In addition to increasing asset diversity, stabilizing exchange rates, and reducing single-point risks, the most important thing is to meet the unilateral demand of the Crypto world for the yield of real-world financial assets.

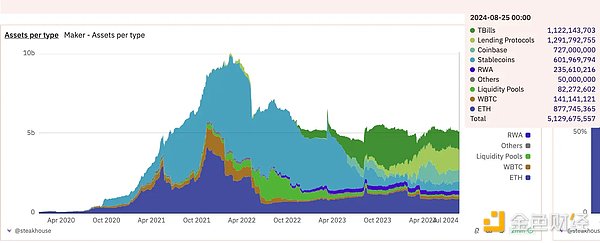

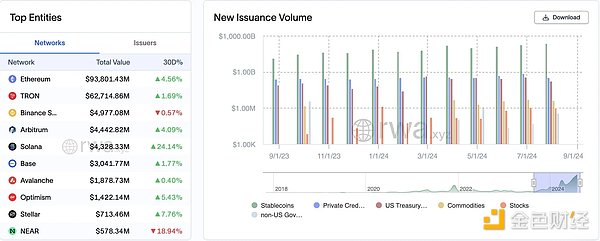

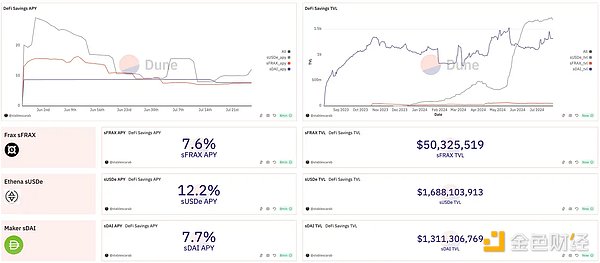

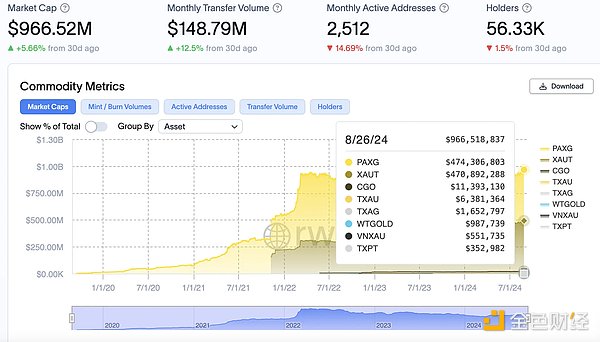

Source: Dune / @steakhouse

There are a large number of stablecoins circulating in the market. In a high-interest environment, holders do not get any benefits at all, and are actually paying opportunity costs. Centralized stablecoins privatize profits and socialize losses. More types of RWA assets are needed to effectively utilize these stablecoins, generate benefits for users, and bring more liquidity to the DeFi market.

For large, well-known asset managers such as Franklin Templeton and WisdomTree, tokenization represents opening up new distribution channels to reach new customer segments who prefer to store their assets digitally on the blockchain rather than in traditional brokerage or bank accounts. For them, tokenized treasury bonds are their "beachhead market".

The traditional financial sector is increasingly focusing on combining with DeFi technology to reduce costs and increase efficiency through asset tokenization and solve inherent problems in traditional finance. Mapping real-world assets (such as stocks, financial derivatives, currencies, equities, etc.) to the blockchain not only expands the scope of application of distributed ledger technology, but also makes the exchange and settlement of assets more efficient. In addition to exploring new distribution channels, more emphasis is placed on the significant efficiency improvements and innovations that technology brings to the traditional financial system.

2. Market size:

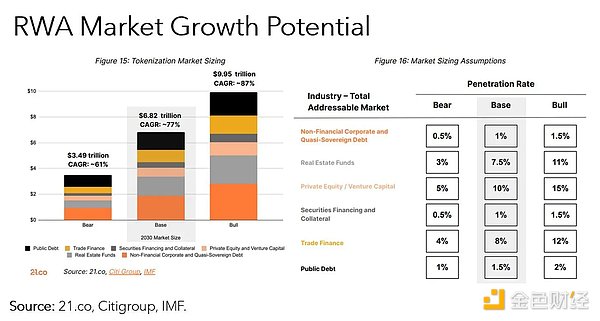

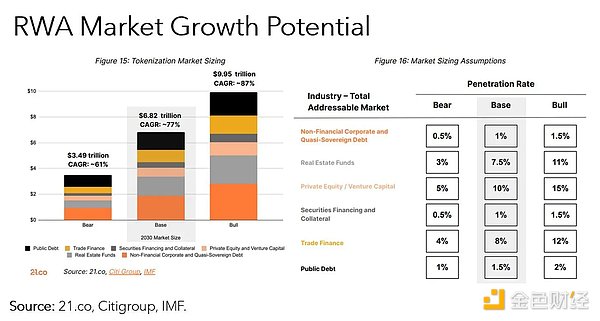

The asset size of RWA chain is about 12 billion, and the total market value of stablecoins exceeds 180 billion US dollars. Through blockchain technology, the digitization of traditional financial assets can not only improve transparency and efficiency, but also attract more users to enter this emerging market. According to reports from co, Citi and IMF, the total value of tokenized assets is expected to grow to 6.8 trillion US dollars in 2030 under basic market conditions.

Source: 21.co, Citigroup, IMF

Private credit and US Treasuries are the main assets for tokenization - the two markets have grown from millions of dollars to a total loan value of $8.8 billion (63% annual growth) and a Treasury market of over $2 billion (2100% annual growth). Tokenized Treasuries are still an emerging field with huge potential - Franklin Templeton, BlackRock and Wisdomtree are early leaders in this field.

Source: rwa.xyz

The Fed’s policies have a direct and significant impact on the expansion and pattern of the RWA DeFi field:

In the third quarter of 2022, RWAs backed by private credit accounted for 56% of the total RWA TVL, while RWAs backed by U.S. Treasuries accounted for 2. The share of RWAs backed by private credit falls to 0% in Q3 2023, while the share of RWAs backed by U.S. Treasuries rises to 27%. At the end of August 2024, as of the time of this article’s publication, RWAs backed by private credit account for 76% of total TVL, while the share of RWAs backed by U.S. Treasuries stabilizes at 17%.

Source: rwa.xyz

1) Market promoters:

The growth of income-oriented (interest-bearing, fixed-income) RWA is rapid. Since 2024, the on-chain value of non-stablecoin RWA has increased by US$4.11 billion, mostly from government bonds, private credit and real estate tokens. The current overall growth and ecological improvement are mainly attributed to the following three aspects:

Institutional interest and new products, such as

BlackRock, Superstate and other institutions launched new on-chain treasury products and T-bills funds.

Ondo launched USDY, Centrifuge cooperated with Maker and BlockTower, etc.

Improvement of infrastructure, such as

M^0 Labs developed institutional-grade stablecoin middleware, which can be used as a building block for other products.

Ondo Global Markets creates a two-way system to enable seamless transfers between on-chain tokens and off-chain accounts.

DeFi integration, for example

Morpho allows the creation of non-custodial vaults to pass RWA returns to DeFi users; combined with Centrifuge to support collateralized lending.

TrueFi launched Trinity, allowing users to deposit tokenized US Treasury bonds as collateral to mint USD-pegged assets that can be used in DeFi.

DAO's asset diversification (Maker)

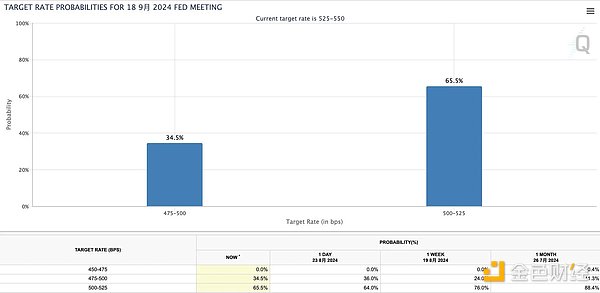

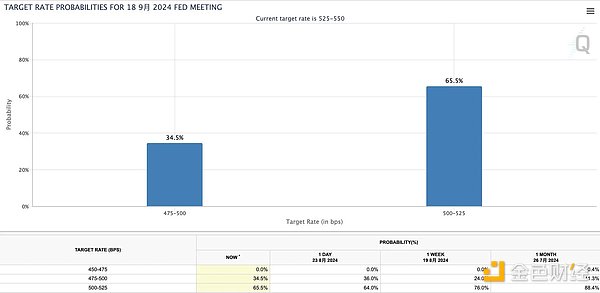

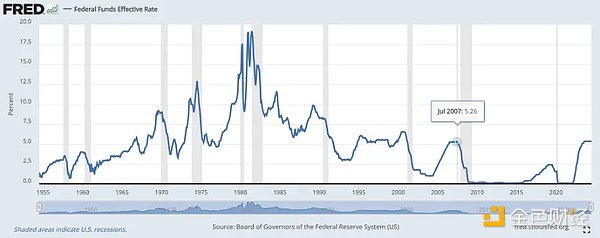

Given the latest statement by Fed Chairman Powell, the Fed has sent a dovish signal for the first time since the start of the rate hike cycle, indicating that its focus is shifting from controlling inflation to supporting economic growth and employment. The trend of a rate cut cycle has gradually formed, which is expected to stimulate the return of leveraged funds. At present, the CME Fed Observation Tool shows that a 25 basis point rate cut in September is the most likely. However, the August CPI and non-agricultural data are about to be released. If the data exceeds expectations, the probability of a 50 basis point rate cut in September will increase.

T-bill will still be the first choice for idle funds under the continued high interest rate policy, and the trend of continuous rate cuts will have a far-reaching impact on the market. On the one hand, the low interest rate environment may stimulate investors to seek higher-yield opportunities and drive funds into the high-yield DeFi field. On the other hand, the decline in the yield of traditional assets may prompt more RWA to tokenize in order to seek higher returns on the DeFi platform. By then, the market competition pattern may change, and more capital will flow into high-yield RWA application scenarios combined with DeFi technology, further promoting the development of the entire on-chain economy.

Source: CME FedWatch

2) Main user portrait:

According to Galaxy Digital's 2023 full-year statistics, most of the on-chain demand for RWA is driven by a small number of native cryptocurrency users, rather than new cryptocurrency adopters or traditional financial users turning to the chain. Most of these addresses that interact with RWA tokens were active on the chain before these assets were created. The following data is analyzed only for addresses holding tokenized treasuries and mainstream private credit assets:

Unique addresses: As of August 31, 2023, there were 3,232 UAs holding RWA assets. As of August 26, 2024, there were 61,879 holding addresses, an increase of 1,815%.

Average age of addresses: 882 days (about 2.42 years), indicating that these users have been active since around April 2021.

Average age of RWA: 375 days, indicating that these assets are relatively new compared to the addresses.

The oldest address interacting with RWA dates back to March 22, 2016, which is 2,718 days old.

The distribution shows that the wallet addresses are concentrated around 700-750 days old.

Number of addresses by age group:

<1 year: 17% (545 addresses)

1 to 2 years: 27% (885 addresses)

2 to 3 years: 36% (1,148 addresses)

More than 3 years: 20% (654 addresses)

According to the Transak report, the total number of RWA token holders on the Ethereum chain alone will exceed 97,000 in mid-2024, with a total of more than 205,000 unique addresses. These tokens have added about 38,000 holders in the last year.

Since the beginning of 2024, the overall DEX trading volume of RWA tokens has also seen a significant increase. The DEX trading volume in December 2023 was about $2.3 billion, and it soared to more than $3.6 billion in April 2024.

So far in 2024, with the significant increase in the adoption of RWA by traditional financial institutions, we can foresee that more and more traditional financial users will gradually enter the crypto field, bringing new growth momentum and incremental funds.

2. Detailed explanation of the six core assets

The tokenized RWA market is divided into six categories according to asset categories, and the ranking order according to market value is: stablecoins, private credit, government bonds (US bonds), commodities, real estate, and equity securities:

Source: OKX Ventures, rwa.xyz, Statista, 21.co

The total market value of on-chain real-world assets (RWA) is US$18.312 billion, while the total market value of off-chain traditional assets is US$685.5 trillion. Assuming that the total market value of off-chain traditional assets increases by 1 basis point (1bps, 0.01%) every day, this will bring an incremental amount of about $6.85 billion, close to 37% of the market value of on-chain assets. From this perspective, even a small increase in off-chain assets can have a huge boost to on-chain assets. Stablecoins show clear product-market fit (PMF) in the market and create significant monetization opportunities. For example, in the first quarter of this year, although Tether's assets under management are only a fraction of Blackrock's ($70 billion vs. $8.5 trillion), its profits exceeded Blackrock's ($1.48 billion vs. $1.16 billion).

Market situation:

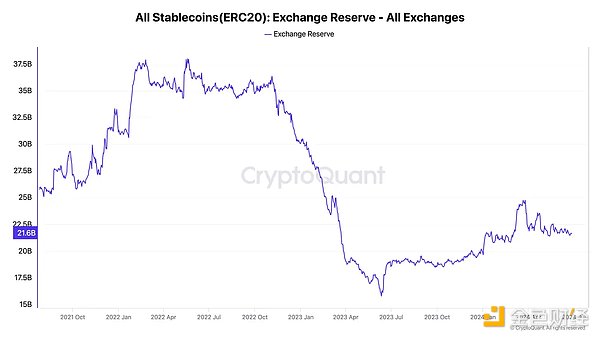

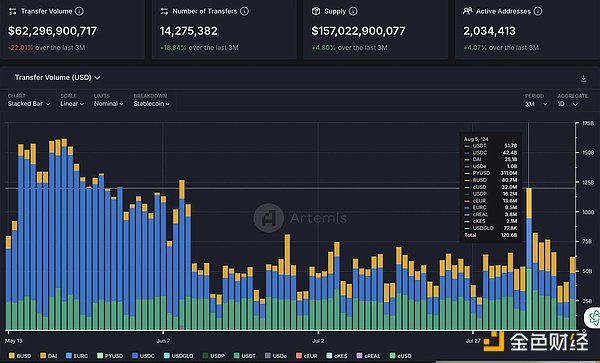

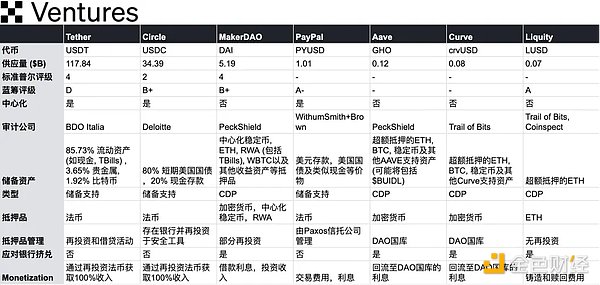

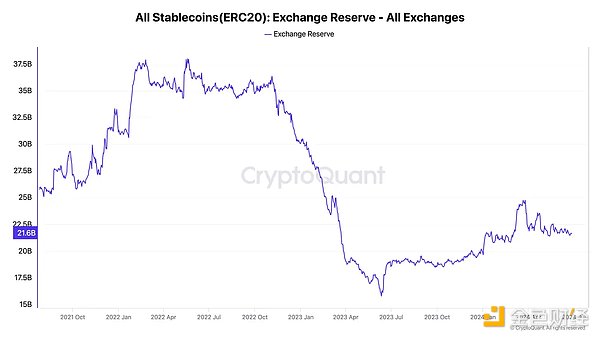

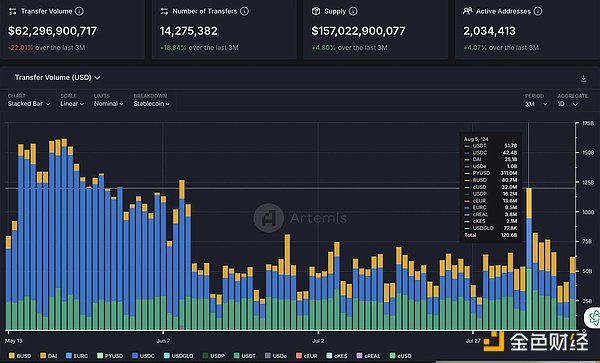

The current market value of stablecoins is about 170 billion US dollars, with a monthly transaction volume of up to 1.69 trillion, more than 17 million monthly active addresses, and a total number of holders exceeding 117 million.

Centralized stablecoins still occupy an absolute dominant position: USDT accounts for nearly 70% of the market share, about US$114.57 billion; USDC accounts for 20%, with a market value of about US$33.44 billion;

The market share of decentralized stablecoins remains stable: DAI accounts for 3%, with a market value of about US$5.19 billion; Ethena accounts for 2%, with a market value of about US$3.31 billion;

There are about 300 million stablecoins stored in centralized exchanges, accounting for 13.2% of the total supply; the remaining circulation of about 48.38% is on Ethereum, 35.95% is on Ethereum, and about 1%-3% is on BSC, Arbitrum, Solana, Base, Avalanche, and Polygon chains respectively.

Source: CryptoQuant, Artemis

Main market issues:

Imbalance in value distribution: Centralized stablecoins often privatize profits but socialize potential losses, resulting in uneven distribution of benefits.

Lack of transparency: Centralized stablecoins like Tether and Circle have serious transparency issues, and users are forced to take unnecessary risks. For example, during the SVB bankruptcy, the market had no way of knowing whether Circle or Tether had any financial exposure to SVB, nor was it clear in which banks their reserves were held. Similarly, Tether has been using part of its reserves for lending and investment activities. According to the audit report issued by TBO, about 5% of its reserves have been loaned out, about 4% have been invested in precious metals, and about 2.5% have been classified as other investments. Tether's operating model makes it vulnerable to bank runs, and liquidity crunch could become a potential black swan event.

Limited scalability of decentralized stablecoins: Decentralized stablecoins face scalability challenges because they typically require over-collateralization of large amounts of assets. As the demand for stablecoins grows, relying solely on a single crypto asset as collateral may not be able to meet demand. In addition, poorly designed algorithmic stablecoins have failed many times, exposing the risks of insufficient collateral and unstable mechanisms.

Hot players

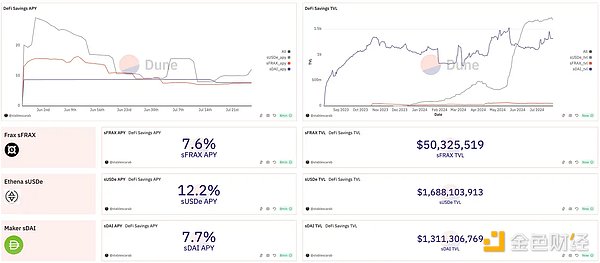

Ethena: Provides a relatively high APY of up to 12.2%, and the current sUSDe TVL is about 1.7 billion; the market value has increased by 978% since its launch at the beginning of the year. The Delta Hedge strategy adopted by Ethena is particularly attractive in a bull market environment. When long positions dominate, the funding rate is generally favorable for short holders. This strategy allows Ethena to remain stable while attracting traders who want to hedge against market fluctuations and profit from positive funding rates during bull markets. Maker (now Sky): APY 7.7%, current sDAI TVL is about 1.3 billion; more than 2 billion DAI are deposited in DSR, accounting for 38% of all DAI in circulation. Deposits have increased by 197% since founder Rune announced an 8% yield last August, and the market value has stabilized at just over $5 billion. The collateral TVL is $7.74 billion and the collateral ratio is 147%. Maker integrates U.S. Treasuries into its portfolio, diversifying its revenue sources and enhancing revenue stability. Integrate pledged stETH and use it as collateral to mint DAI. It also lifts the 15% slashing penalty for pledges, promoting stability and aligning the interests of holders with the sustainability of the ecosystem.

Source: Dune / @stablescarab

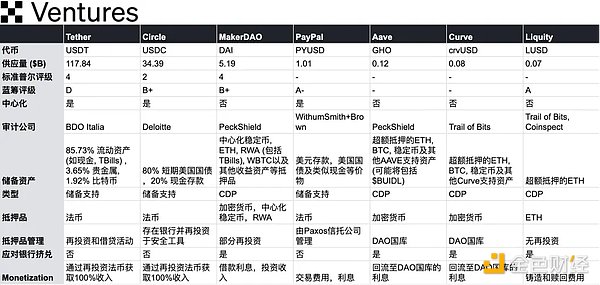

List of mainstream stablecoins

Source: OKX Ventures

Future Outlook:

Liquity, on the other hand, has chosen a completely opposite path. Its v2 $BOLD, a fully Ethereum-native stablecoin backed only by ETH (and LST), will attract a large amount of collateral according to the current mechanism. Will the insistence on maximum decentralization and elastic CDP make it a niche market product? We look forward to users voting with their real money.

The growing popularity of low-volatility assets in the stablecoin space. After the education of the last cycle, the market has become more conservative and rigorous in the underlying risk control of crypto-financial assets, especially in the selection of collateral and risk control measures behind currency issuance. Most of the high-risk algorithmic stablecoin projects represented by LUNA, which used high volatility and endogenous assets as collateral in the last cycle, have disappeared.

Due to the clear and simple business lines, the regulatory costs are more controllable and consistent. Large financial companies are beginning to target relatively profitable and easy-to-enter stablecoin businesses. Paypal's PYUSD has reached a circulation of 1 billion, and its market value has increased by 155% since it announced its entry into Solana on May 29. The supply of PYUSD on the Solana chain has also increased by nearly 4685%. Similarly, JD.com's plan to launch a stablecoin pegged to the Hong Kong dollar is also an attempt to get a piece of the pie while seeking new growth points for digital finance.

The community is still waiting for more legislative guidance, especially in terms of reserve reporting and liquidity requirements. Circle has always emphasized transparency and switched from Grant Thornton to Deloitte for audits to increase confidence in its reserves. Tether's transparency issue has long been controversial. While Tether claims that all of its USDT is backed by an equivalent amount of fiat currency reserves, there has been a lack of transparency about the specific details and independent audits of its reserves. In 2024, US regulators are pushing for more transparency and compliance requirements, and Tether is expected to be subject to these requirements as well.

Private Credit:

Through the tokenization of credit agreements, financial institutions provide loans to businesses through debt instruments.

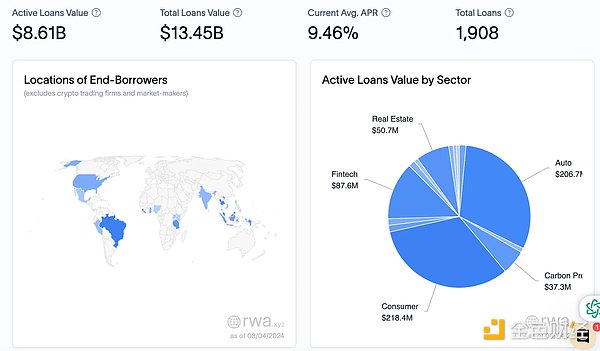

In traditional finance, private credit is a huge market worth $1.5 trillion. Crypto credit agreements have tokenized more than $13 billion in loans, and currently more than $8 billion is loaned to real-world businesses, creating returns for on-chain lenders. For on-chain traders, private credit is attractive due to its higher yield potential. For example, lending stablecoins through protocols such as Centrifuge can earn an average annualized yield of 8.7%, exceeding the usual 4-5% annualized yield of platforms such as AAVE, but of course the risk also increases.

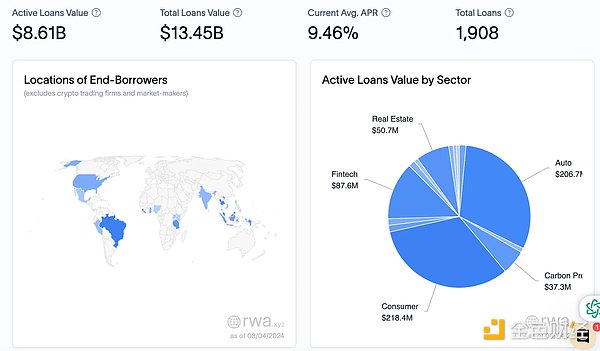

Source: rwa.xyz

In the entire loan portfolio, Consumer loans accounted for $218.4M, the largest proportion, showing its strong demand in the overall loan. Automotive industry loans followed closely with an amount of $206.7M. The amount of loans to the fintech industry was $87.6M. Although it accounted for a relatively small proportion, it showed rapid growth, reflecting the impact of technological innovation on the financial market. Real estate - including residential and commercial real estate financing ($50.7M) and carbon project financing ($37.3M) are smaller but also play an important role in their specific areas.

The advantages of on-chain credit issuance and distribution are most evident in significantly reduced capital costs. More efficient institutional DeFi infrastructure can significantly save capital costs and provide new distribution channels for existing and new private credit products. Driven by the tightening of banking business, an important niche market is being carved out in the traditional financial sector. This shift to non-bank lending provides good opportunities for private credit funds and other non-bank lenders, attracting the interest of pension plans and endowments seeking smoother and higher returns.

Private credit as a part of alternative assets has grown significantly over the past decade, and although it currently accounts for a relatively small proportion of the global debt market, it has huge room for growth as an expanding market.

Demand-side logic

Financing needs:

Enterprises: In the real world, many companies (especially small and medium-sized enterprises) need low-cost financing to support operations, expansion or short-term capital turnover.

Financing difficulties: The loan procedures of traditional financial institutions are complicated and time-consuming, making it difficult for companies to quickly obtain the funds they need.

Tokenization of Credit Agreements:

Tokenization: By tokenizing credit agreements, financial institutions can convert debt instruments into tokens that can be traded on the chain. These tokens represent debt instruments such as loans or accounts receivable of enterprises.

Process Simplification: Tokenization simplifies the financing process, allowing companies to obtain funds faster and more efficiently.

Lender Logic

Related Opportunities:

High Yield: Investing in private credit can often yield higher returns than traditional debt instruments, as companies are willing to pay higher interest rates in exchange for quick financing.

Diversified Portfolio: Private credit provides users with diversified opportunities and spreads risks.

Risks and Challenges:

Difficulty in Understanding: Users may find it difficult to understand the operating mechanism of private credit, especially the part involving off-chain assets.

Default risk: Users worry that borrowers may run away, resulting in loan defaults. Especially if the off-chain asset audit is not transparent, borrowers may use an accounts receivable voucher to borrow money on multiple platforms, increasing the risk of default.

Source: OKX Ventures

Representative projects:

Maple Finance: Provides on-chain private credit, provides rapid financing for enterprises through tokenized credit agreements, and provides high-yield investment opportunities for lenders. Similar models include TrueFi (which also provides U.S. Treasury products like Maple) and Goldfinch.

Centrifuge: Matchmaking platform; tokenize accounts receivable and other debt instruments, match lenders and borrowers through the on-chain market, simplify the financing process, reduce financing costs, and meet the credit needs of small and medium-sized enterprises.

Use cases of on-chain supply chain finance:

Smart contract automatic payment: After the predefined conditions are met, the smart contract can automatically issue payments to suppliers. Set a clear default handling mechanism, which is automatically triggered by the smart contract to protect the interests of users.

Invoice tokenization: Invoices can be tokenized to facilitate their transactions and provide liquidity for suppliers.

Transparent audit: The blockchain provides an immutable ledger, which simplifies auditing and due diligence. However, it is still necessary to conduct strict audits of off-chain assets through independent third-party auditing agencies to ensure the authenticity and uniqueness of assets and reduce the risks of multi-platform borrowing.

Risk assessment: Introduce a credit scoring system based on the chain to conduct risk assessments on borrowing companies and help users make more informed decisions.

Problems solved on the chain:

Slow and opaque transactions: Blockchain improves the transparency of supply chain finance and speeds up transactions, benefiting all parties involved.

High transaction costs: Smart contracts can automate many processes in supply chain finance, reduce paperwork and middlemen, and thus reduce costs.

Credit channels: DeFi can provide more democratic financing channels for small and medium-sized enterprises (SMEs) that traditionally have weak bargaining power.

Treasury products:

Tokenized government debt instruments. Referring to the concept of ETF, this type of asset can be likened to BTF (Blockchain Transfer Fund). The RWA U.S. Treasury product tokens on the chain represent the right to hold and distribute the income generated by these debts, rather than the ownership of the Treasury itself, which involves more deposits and withdrawals and compliance issues.

In a high-interest environment, some cryptocurrency players have begun to focus on traditional financial assets to achieve configuration diversification. As interest rates rise, demanders seek safe and stable assets, and products like Treasury bonds naturally become their choice.

The wave of adoption of tokenized Treasury bonds is driven by the following two factors: fewer DeFi income opportunities (because of the reduced demand for on-chain leverage); and traders' shift in demand for short-term monetary instruments that benefit from tight U.S. monetary policy. This trend is also reflected in the large inflow of off-chain bank deposits into money market funds, driven by low bank deposit rates and long-term exposure to unrealized asset losses. The emergence of institutional DeFi infrastructure is expected to further drive the growing global demand for safe, income-generating and liquid real-world assets.

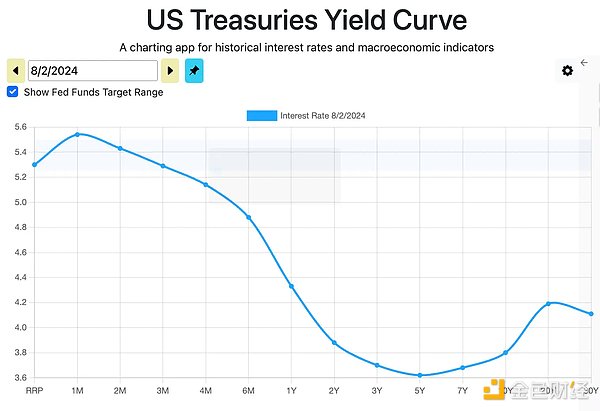

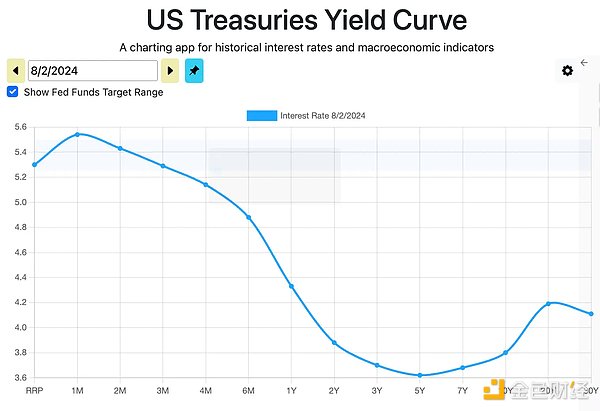

The shape of the current yield curve indicates higher short-term interest rates and lower long-term interest rates. Most products choose to hold 1-month to 6-month Treasury bills, and some even hold overnight reverse repo and repo securities in search of higher returns.

Why choose US bonds:

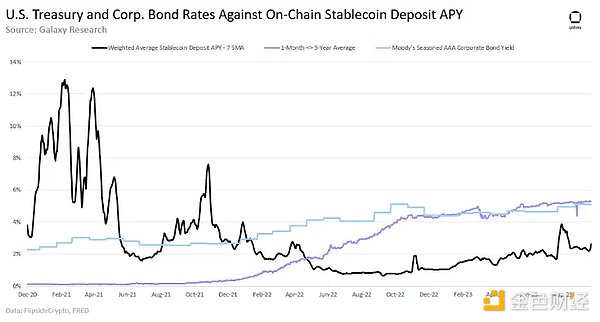

Yield: Short-term US Treasury bonds > AAA corporate bonds > DeFi stablecoin deposits (tokenized treasury bonds are attractive)

Source: Galaxy Research

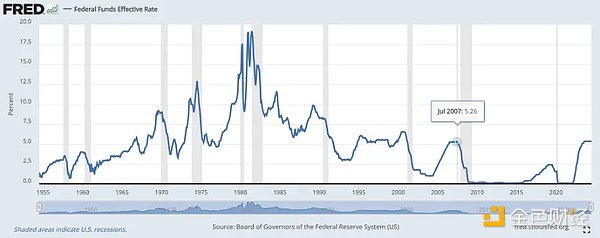

The Federal Reserve’s drastic shift in monetary policy has pushed up the benchmark interest rate to its highest level since 2007 (5.33). This has created new demand for certain types of RWAs for native-DeFi users seeking higher returns on crypto assets

Source: fred.stlouisfed.org

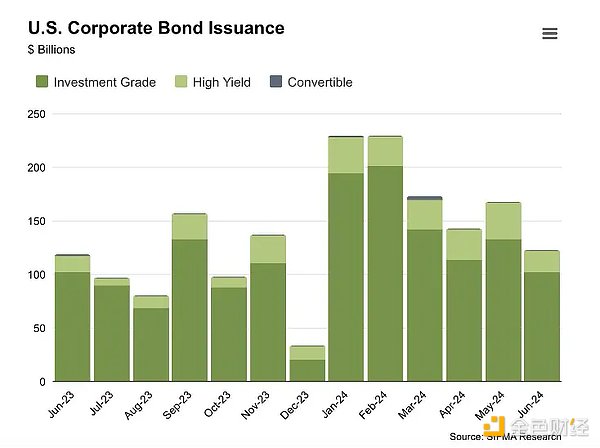

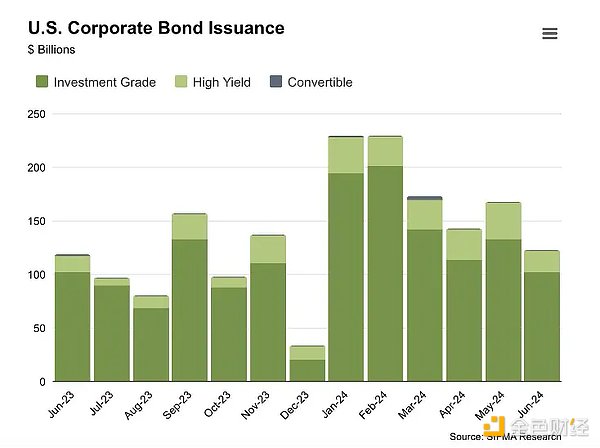

U.S. Treasuries are government-backed debt securities (widely considered a relatively safe and reliable type of income asset, with the only risk being a default by the U.S. government). In contrast, corporate bonds are debt securities issued by companies that may offer higher yields than Treasuries, but are also more risky. The global bond market grew to approximately $7 trillion, up 5.9% year-on-year, indicating that the global fixed income market is still growing significantly. In the first two quarters of 2024 alone, US companies issued $1.06 trillion in corporate bonds (more than the first three quarters of 2023 combined, $1.02 trillion).

Source: SIFMA Research

Rising interest rates have stimulated the launch of projects to tokenize US Treasury bonds, such as:

Franklin Templeton: Launched the Franklin On-Chain U.S. Government Money Fund (FOBXX) in 2021, the first public chain fund registered in the United States. With a yield of 5.11% and a market cap of $400 million, the fund ranks among the largest on-chain U.S. Treasury products.

BlackRock (Securitize): Launched the BlackRock USD Institutional Digital Liquidity Fund ($BUIDL) on Ethereum in March 2024. It currently leads the market with over $500 million in AUM.

Ondo: Launched the Ondo Short-Term U.S. Government Bond (OUSG), which provides access to short-term U.S. Treasury bonds with a yield of 68% and a market cap of approximately $240 million. A large portion of OUSG is invested in BlackRock's BUIDL. Ondo also offers the USDY yield stablecoin with a market cap of over $300 million.

As interest rates rise and U.S. Treasury yields become more attractive, this category has seen significant growth. Other projects include Superstate, Maple, Backed, OpenEden, and others.

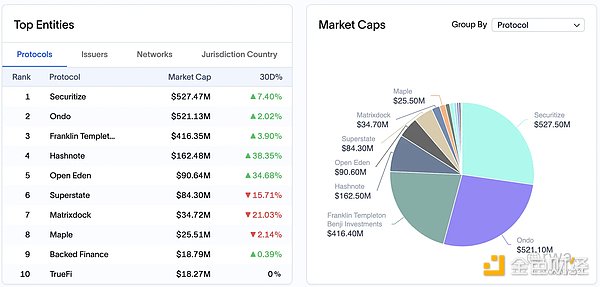

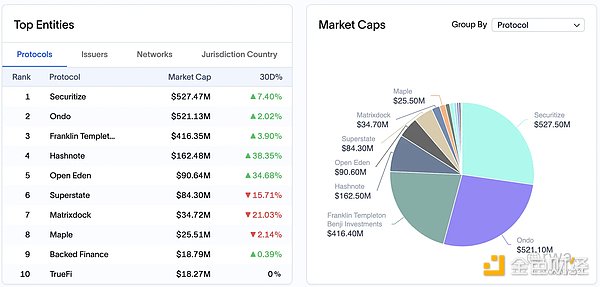

Market capitalization and market share:

Source: rwa.xyz

According to market capitalization, the top five protocols are Securitize, Ondo, Franklin Templeton, Hashnote and OpenEden; and the highest single product issuance is:

$BUIDL (BlackRock fund issued through Securitize), $510 Million, a quarterly increase of 74%;

$FOBXX (Franklin $USDY (Ondo), $332 Million, quarterly growth of 155%; $USYC (Hashnote), $221 Million, quarterly growth of 156%; $OUSG (Ondo), $206 Million, quarterly growth of 60%; $TBILL (OpenEden), $101 Million, quarterly growth of 132%.

Asset Classification:

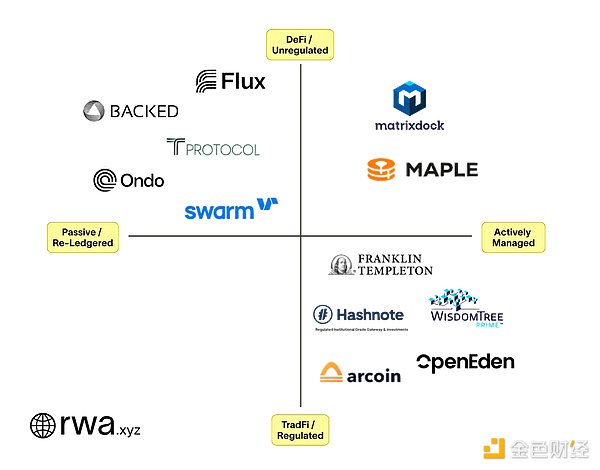

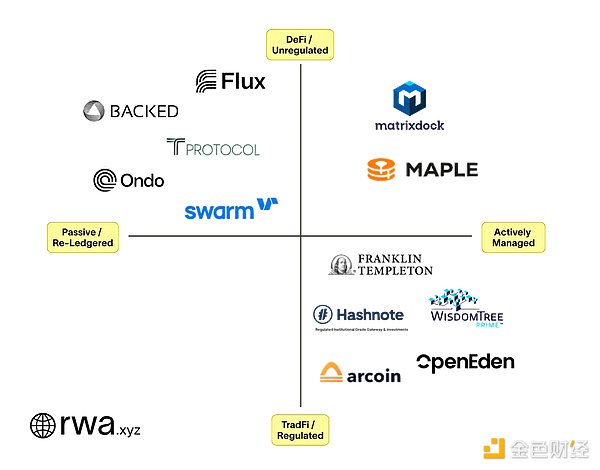

Actively Managed

Definition: U.S. debt products are actively managed by portfolio managers designated by the company, who are responsible for managing the portfolio of underlying assets.

Features: Optimize returns and manage risks through active investment strategies, and the management method is closer to traditional actively managed funds.

Reledgered on the Chain

Definition: U.S. debt products are designed to simply represent or mirror a certain financial instrument, such as a publicly listed ETF, which itself is not on the chain.

Features: Usually passively managed, the purpose is to re-register existing financial instruments through blockchain technology so that they can be traded and managed on the chain.

Source: rwa.xyz

Ondo Finance, Backed and Swarm are all mapping BlackRock/iShares Short-Term Treasury Bond ETFs. Ondo purchased from a US issuer on Nasdaq (CUSIP: 464288679), while Backed and Swarm purchased from an Irish issuer/UCITS (ISIN: IE00BGSF1X88). To put it simply, Ondo does not actively manage a portfolio of Treasury bonds. Instead, it "outsources" that management to SHV, which in turn is managed by BlackRock/iShares. Companies like Ondo will act as distributors for BlackRock because DeFi protocols do not interact directly with asset managers. This is simpler for BlackRock, which does not have to manage the compliance of thousands of projects that want exposure to its funds.

Source: OKX Ventures, rwa.xyz

For each product under the protocol, institutions and qualified investors can make corresponding decisions based on three most important criteria: 1) principal protection; 2) maximum return; 3) convenience.

Principal Protection:

Some large institutional products operate in regulated jurisdictions, ensuring minimal legal and compliance risks; they rely on regulated fund managers and custodian service providers, providing greater transparency and investor protection. Some other products rely more on investment managers to perform their management duties, and investors need to carefully evaluate the legal environment and regulation in the jurisdictions where these products are located.

Yield Maximization:

Actively managed products rely on the investment strategy and execution capabilities of fund managers to optimize the portfolio and maximize returns. These products are mainly concentrated in short-term Treasury bonds and repurchase agreements, which is consistent with the current shape of the yield curve. Re-registration products outsource portfolio management to ETF managers, and investors can directly view the historical performance of these managers and choose products that match their return goals and risk preferences.

Convenience:

Some large institutional products provide access through official mobile applications, which enhances the user experience and simplifies the investment process, making them suitable for self-managed retail investors. Some other product processes are more complex, involving multiple steps of manual operation and requiring high learning costs.

In the future, actively managed products may weaken the competitive advantage of on-chain re-registration products by compressing their pricing. In addition, users should also consider whether these U.S. Treasury tokens are simply used as certificates of their investment holdings, or whether they can also be used as payment tokens or collateral to expand usage scenarios and increase sources of income.

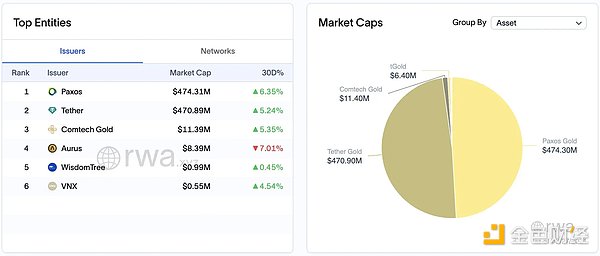

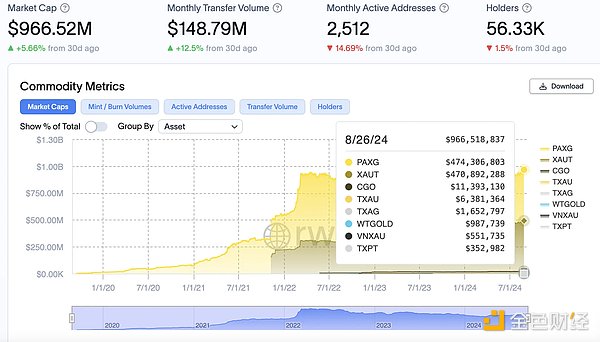

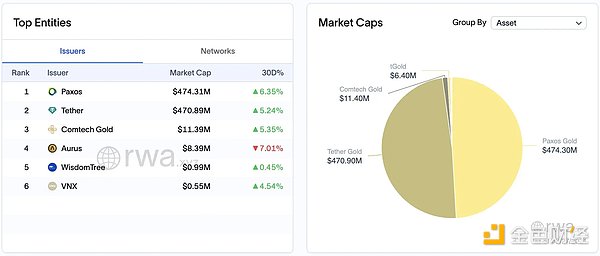

Commodities

Tokenization of natural resources, representing the rights and interests of actual commodities. The total market value of the current commodity token market is close to $1 billion, among which precious metals (especially gold) have received the most attention. Gold-backed stablecoins such as PAX Gold (PAXG) and Tether Gold (XAUT) account for nearly 98% of the market value of the tokenized commodity market. With the price of gold breaking through $2,500 per ounce, the total market value of gold in the world has exceeded $13 trillion, which also provides a huge market space for the tokenization of gold and its integration in DeFi platforms.

Source: rwa.xyz

Other metals that have taken market share include silver and platinum. As the RWA tokenization space matures, we may see tokens for other commodities (such as crude oil) and even crops. For example, farmers in Uganda can use the same financial tools as New York traders to manage their coffee crops, thereby expanding market access. Global trade has the opportunity to move more to blockchain.

Real Estate

Tokenize physical assets such as homes, land, commercial buildings, and infrastructure projects. Making real estate tradable on-chain through tokenization introduces a novel investment model, improving accessibility, enabling fractional ownership, and potentially increasing liquidity. Nonetheless, real estate’s inherent illiquidity has limited the pace of its on-chain adoption. The long-term nature of real estate transactions and the small size of buyers make it challenging to connect sellers with buyers on-chain, especially given that the industry has traditionally operated on legacy systems.

Difficulties and Challenges:

Market Demand:

Real Estate Market Conditions: The success of tokenized real estate projects depends largely on the health of the real estate market. In some areas with sluggish real estate markets (such as parts of Japan and Detroit), the lack of speculative value and investor interest makes it difficult for tokenized projects to attract enough buyers and investors.

Long-term rental income distribution:

Continuous Management: Tokenized real estate involves the distribution of long-term rental income, which requires ongoing property management and maintenance. This increases the complexity and cost of operations and requires the support of a professional team to ensure the stability of rental income and the preservation of the property's value.

Operational friction: Difficulty in and out of fiat currency deposits and redistribution of rent, verification of whether the rent is actually paid and information transparency.

Insufficient liquidity:

Transaction challenges: Although tokenization has increased the accessibility and fractional ownership of real estate investment, the inherent illiquidity of real estate has limited its adoption speed on the chain. The long-term nature of real estate transactions and the small size of buyers make it challenging to connect sellers with buyers on the chain.

Traditional operation: The industry has traditionally operated on traditional systems, and switching to a blockchain platform requires time and adaptation, especially for market participants accustomed to traditional transaction models.

Platforms such as RealT and Parcl are committed to injecting liquidity into the market by simplifying property division, allowing sellers to easily divide assets and obtain tokenized shares. In addition, the Parcl platform also allows users to speculate on the value of real estate in different locations (such as different US cities) through its on-chain trading mechanism, further broadening the investment channels in the real estate market.

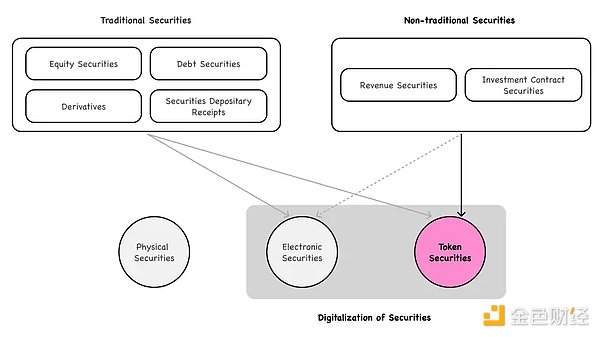

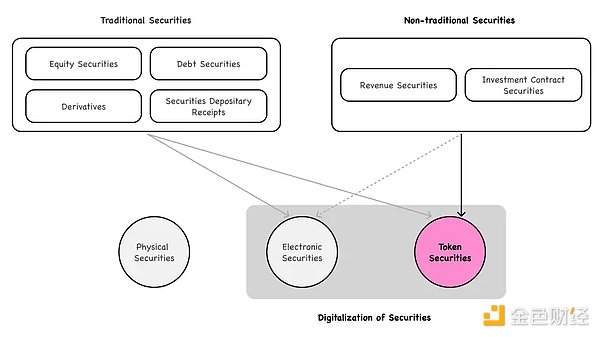

Stock Securities:

Security Token Offering is essentially the tokenization of some assets or rights of traditional companies that are difficult to IPO through blockchain technology, allowing users to invest in corporate securities by purchasing these tokens. However, the STO track has been around for quite some time, and many of the listed companies of STO projects are currently traditional companies, which often lack novelty and high growth potential, and are therefore not attractive enough to investors. In addition, STOs usually only allow users who have passed KYC verification to participate in transactions, with high investment thresholds and greater transaction complexity, and face compliance and regulatory barriers. It is very difficult to comply with laws across jurisdictions.

In contrast, direct crypto tokens are more flexible and active in trading, and often offer more profit opportunities. Therefore, they are far more attractive to many users than STOs.

Operation model, Source: Tiger research

Some projects such as Swarm and Backed have broken through regulatory restrictions and allowed global stocks and funds to be traded on the chain, such as COIN and NVDA in the US market, and index funds such as the core S&P 500. By tokenizing the income rights of equity and funds, Solv Protocol can also create FNFTs representing stocks and funds, making these assets tradable on the DeFi market; and also provide compliance tools for these assets, ensuring that all transactions comply with regulatory requirements through smart contracts and on-chain identity verification (such as KYC/AML).

Difficulty and Challenges:

However, if the business model of tokenizing existing securities is only to be tokenized, it will not be competitive and attractive enough in the long run, especially after the global financial giants intervene in the market. Because in the face of competition from large asset management companies, the initial profit model of charging service fees is difficult to maintain, the market will enter a price war, and the profit space will be compressed.

Assume that tokenizing existing securities (such as Tesla stocks) can make a profit by charging users a service fee (assuming 5 basis points). These fees are charged by the providers of tokenized services for processing and managing these tokens. However, if this service becomes very popular and gains a large number of users, large global asset management companies (such as Blackstone Group, etc.) may enter this market. These large companies have stronger capital and resources and can provide the same services at lower fees. As more companies enter the market, the fees for providing tokenized services will gradually decrease, which may eventually trigger a price war (race to the bottom), that is, competitors continue to lower fees to attract more customers. This will make the model of initially making profits by charging service fees unsustainable, because higher fees will be replaced by lower fees, eventually resulting in meager or even disappearing profits.

3. Future Outlook

The integration of DeFi and RWA: The combination of DeFi protocols and tokenized assets is one of the main trends in the future. By integrating DeFi protocols with tokenized assets, such as allowing U.S. Treasury tokens to be mortgaged and borrowed, more financial products will achieve composability and instant liquidity without redemption, which will stimulate the flywheel effect in the DeFi field. In particular, the combination of licensed products leveraging unlicensed products will bring a wider range of application scenarios and drive the growth of TVL. This innovation will not only attract institutional clients, but will also attract a wider range of crypto users, especially in the fields of payment and financial services, where tokenized assets are expected to replace some of the roles of centralized stablecoins.

Emerging services and professional needs: As asset tokenization advances, new service providers will emerge to meet the demand for professional skills and knowledge. For example, smart contract legal experts, digital asset custodians, on-chain financial managers, and blockchain financial reporting and monitoring providers will become key players and promote further market maturity. At the same time, the improvement of institutional compliance and regulatory frameworks will bring greater market access and trust to these service providers. It is arguable that anonymity may become an increasingly scarce asset in the future as institutional participation and regulatory transparency requirements will continue to increase.

Cross-border transactions and global markets: The cross-border transaction capabilities of blockchain technology will further promote the entry of tokenized assets into international markets and simplify the traditional international asset trading process. This is particularly important for emerging markets, enabling them to attract global capital and drive economic growth. In the future, RWA projects that can help achieve seamless interoperability between different blockchain platforms, especially those that provide a wider range of asset options and optimize liquidity, will have a clear competitive advantage.

Technological Advances and Process Optimization The success of RWA tokenization depends largely on efficient and secure technology. With the advancement of blockchain technology, especially in terms of scalability, security, and standardized protocols, RWA tokenization will become more efficient. The development of new protocols will simplify the tokenization process, enhance interoperability between platforms, and provide users with a more user-friendly experience. These technological advances will continue to drive the growth of RWA adoption in various industries, ultimately reshaping the global financial industry.

JinseFinance

JinseFinance