With the birth of the Ordinal protocol in 2023, Bitcoin, as the former "digital gold", has ushered in a new type of asset - "inscription". If Bitcoin is gold, then inscriptions are similar to products processed with gold and have unique value.

This native asset issuance method on the first blockchain quickly gained market popularity, not only deriving more asset issuance protocols such as BRC20, Atomical, Runes, etc., but also giving birth to well-known inscriptions such as ORDI and SATS, as well as many native NFTs of Bitcoin.

For a time, the Bitcoin ecosystem ushered in its own spring again, attracting a lot of funds, users and developers. However, after a period of development, there are indeed more and more assets on Bitcoin, and people have gradually realized the limitations of Bitcoin as a Layer1. On the one hand, Bitcoin itself does not support smart contracts, so it is difficult to expand richer application scenarios on Bitcoin by relying on inscriptions and other technologies.

On the other hand, Bitcoin's performance and mining fees have also become a huge obstacle to the further development of the Bitcoin ecosystem. During the active period of inscription gameplay, the transfer fee of Bitcoin will increase rapidly, and even begin to affect the normal transfer of Bitcoin. Moreover, if there are more application scenarios, it will further cause network congestion and long-term high mining fees.

Naturally, the craze set off by inscriptions quickly spread to the track of Bitcoin expansion, which also opened up another hot track-Bitcoin Layer2.

From pursuit to falsification, where is the road for Bitcoin Layer2?

Some old Bitcoin expansion plans have been paid attention to again, and new Bitcoin Layer2 projects have been proposed more and more. Among them, the Bitmap Tech team, which has been deeply engaged in the inscription direction and is famous for the nested protocol BRC420 of inscriptions on the Bitcoin chain, took advantage of the fact that the inscriptions were still popular and took the lead in launching a Bitcoin Layer2, which was the Merlin Chain that became famous later.

Merlin Chain went online in February 2024 and soon launched the staking activity Merlin's Seal. In addition to Bitcoin and some inscriptions, the pledged assets also include BRC420 blue boxes and other assets, which also triggered a surge in blue boxes. Taking on the popularity of Bitcoin inscriptions, Merlin Chain has gained a large amount of TVL after the staking was opened (data source: https://geniidata.com/ordinals/index/merlin). Less than 30 days after the launch of the activity, the TVL exceeded 3 billion US dollars, and once reached 3.5 billion US dollars, becoming a popular star project in the Bitcoin ecosystem.

On April 19, the highly anticipated Merlin was finally listed. Its token MERL reached a high of 2USDT, but then quickly fell back and continued to fall in the following weeks. It has now fallen by more than 80% and is close to the cost price. This performance directly surprised everyone.

Soon after MERL was listed, Merlin opened the BTC unlocking function on April 25, and then its TVL fell precipitously. It has now fallen to about 1.3 billion US dollars, a drop of more than 60%. The blue box that participated in the staking before also plummeted from a maximum value of about 1 BTC to less than 0.05BTC.

As a star project of Bitcoin Layer2, it suffered a double plunge in currency price and TVL after listing, and many people who actively participated in Merlin were hurt. This can't help but make people doubt Bitcoin Layer2. Is Bitcoin Layer2 a real potential narrative, or is it just a short-lived hype topic?

In fact, the development of the entire blockchain industry is constantly groping forward between various doubts and recognitions. For the expansion of blockchain, Bitcoin is not the only ecosystem being explored. As a veteran dragon II, Ethereum was designed relatively early and also faced the dilemma of having to expand. However, as Ethereum, which began to explore expansion solutions after Bitcoin, its Layer2 can flourish and emerge with very active development. There must be something worth learning from it. We might as well look forward to the development of Bitcoin Layer2 through the development of Ethereum's Layer2.

Looking back on the road to Ethereum expansion

1. Learning and exploration

Ethereum's expansion plan initially drew on the experience of Bitcoin and explored methods such as state channels, lightning networks, and side chains.

The state channel is like two objects A and B who want to trade opening a channel outside Layer1 that constantly updates the state. No matter how many times the two parties in the channel conduct transactions, they will not be affected by the performance and cost of Layer1. The reason for constantly updating the state is to upload the latest off-chain state to the Ethereum main chain as the final settlement basis to prevent malicious behavior. This can indeed greatly improve efficiency and reduce fees. For example, Connext Network is exploring on the basis of state channels.

However, its limitation is that it only applies to both parties in the channel, and both parties need to be online continuously and update the status continuously, otherwise there will be a risk of asset loss.

The Lightning Network is iterated on the basis of the state channel. If the state channel represents the line between two objects, then the Lightning Network connects a lot of lines to form a network, so that even if A and B are not in the same channel, they can be connected through multiple channels in series through the network.

The Lightning Network is equivalent to the network version of the state channel. Ethereum has introduced the Lightning Network based on Bitcoin's Lightning Network. However, the Lightning Network is an off-chain network and does not support smart contracts. Its main use scenario is still transfer and payment. In addition, the Lightning Network does not belong to the blockchain network, and its nodes are easily controlled by centralized groups, which has certain risks, so it still has many shortcomings.

The sidechain technology introduced later filled the gap of the Lightning Network. It is a form of blockchain that can also run smart contracts, so it has higher security and stronger scalability than the Lightning Network.

However, the sidechain also brought new problems. Due to its independence, the sidechain is only responsible for its own ledger and only transmits the transaction results back to the main chain, which may cause losses due to the sidechain's malicious behavior. For example, if the sidechain node tampers with the transaction record or refuses to execute the transaction, it may cause the wrong result to be transmitted back to the main chain, which in turn affects the security and reliability of the system. Therefore, the sidechain has data availability problems and is not widely recognized.

At this stage, Ethereum's expansion plan was basically implemented based on the idea of Bitcoin's expansion plan, but after many attempts, Ethereum did not stop exploring and began to take a more advanced step.

2. A ray of hope

In 2017, Joseph Poon (one of the proposers of the Lightning Network) and Vitalik Buterin proposed a new Ethereum Layer2 off-chain expansion framework - Plasma. Plasma refers to some designs of state channels and improves on the shortcomings of side chains. It adopts a tree-structured architecture consisting of many subchains forming a Merkle tree. Compared with side chains, Plasma will hash all transaction records that occur in these Plasma subchains, generate a Merkle root, and transmit it back to the main chain, so that the main chain can supervise transactions on Plasma. This Merkle root contains summary information of all transaction records that occur on the Plasma chain, and the main chain can be used to verify the integrity and validity of these transactions, thereby ensuring the legitimacy and security of the transactions.

Although Plasma seems to have solved some problems with state channels and side chains, Plasma still has certain data availability issues, and Plasma cannot support smart contracts, and its development has also fallen into a bottleneck.

It seems that the solution that finally saw hope has fallen into trouble again. However, a year after the birth of Plasma, a new solution was quietly born. It was this solution that opened up the explosion of Layer2 in one fell swoop, and this is the Rollup technology.

Although Rollup is also built using Merkle trees and subchain structures, compared to Plasma, Rollup will package and compress all transaction records in the subchain and pass them to the main chain, instead of hashing like Plasma. Nodes on the main chain can directly access and verify the details of all transactions, not just the hash summary, so it provides strong enough data availability and transparency, thereby increasing the credibility and security of the system.

With the introduction of Optimistic Rollup, projects based on this technology such as Optimism and Arbitrum have been launched one after another. Since OP Rollup solves key issues such as the availability of sub-chain data and can support smart contracts, its security and functionality have finally been widely recognized. Optimism and Arbitrum have attracted a large number of developers and projects, and users and funds have dared to participate in them. The two have quickly built their own ecosystems. Since then, Ethereum Layer2 has finally been on the right track and ushered in an explosion.

3. Let a hundred flowers bloom

The success of Layer2 such as Optimism and Arbitrum has also attracted more teams to explore different Layer2 solutions. For teams with strong technical strength, they may develop their own Layer2 solutions, but there are also some teams who may also want to operate their own independent Layer2, but their own technology is not enough, and such needs were first discovered by the Optimism team. Based on Optimism, they launched OP Stack, a tool that can release Layer2 with one click. Any team can use this tool more easily to release a Layer2 of their own. Other teams that have developed their own Layer2 are not to be outdone and have released Layer2 tools based on their own projects, such as Arbitrum Orbit of Arbitrum, ZK Stack of zkSync, Polygon CDK of Polygon, etc.

Thus, more Layer2 needs were excavated, forming a Layer2 feast. Currently, there are more than 50 Layer2 projects counted on L2beat alone, and the development of Layer2 has entered a stage of vigorous development.

On the other hand, the current mainstream Rollup solutions often have the problem of malicious sorters. The sorter in Layer2 is mainly responsible for sorting the transactions occurring on Layer2 according to certain rules, packaging them into blocks, and then submitting them to the main chain for confirmation. The sorter usually determines the order of transactions and ensures the validity of the blocks based on some rules, such as transaction fees, timestamps, etc.

Sponsored Business Content

However, since the sorter has the power to control the order of transactions, there may be a situation where the sorter acts maliciously and intentionally adjusts the order of transactions to obtain more MEV benefits. Therefore, some teams have begun to explore decentralized sorter solutions to make Rollup more secure and more mature.

Counting the development of Ethereum's Layer2, it is not difficult to find that Ethereum's expansion is not smooth sailing, but it is exploring in the direction of greater decentralization, greater data availability and greater security. Only when the safer and more decentralized solutions reach a certain level will they gain more funds and user recognition and develop more rapidly.

In theory, Bitcoin's Layer2 can also refer to the development of Ethereum's Layer2 to find its own "chain", and will also usher in a flourishing like Ethereum after the security and decentralization levels reach a level that is widely accepted by the market.

So what are the current Layer2 solutions for Bitcoin, and what new changes are worth paying attention to? Let us turn our perspective back to the Bitcoin ecosystem with the development experience of Ethereum's Layer2.

Dilemmas and breakthroughs in Bitcoin ecology

1. The current Bitcoin expansion dilemma

We have not seen many professional organizations or institutions enter the Bitcoin ecology in large numbers, which is also because the security and decentralization have not reached the satisfaction of these professional players.

When we talk about the development of BTC Layer2, the draft of the Lightning Network white paper was released as early as February 2015. This is also the earliest Layer2 "payment protocol" based on BTC, and it also led to the conception of Layer2 itself by later generations. But as everyone knows, the Lightning Network does not support smart contracts. Therefore, it is impossible to develop ecological applications related to Bitcoin on the Lightning Network, and it can only be used as a payment expansion path.

Then in 2016, a company that was particularly optimistic about L2 on BTC received a $55 million investment led by Tencent. This company was later known as "Blockstream" in the industry, and their L2 product was called Liquid Network, which interacts with the Bitcoin main chain through two-way anchoring technology, and is also a well-known BTC side chain. However, Liquid's Bitcoin cross-chain solution is relatively centralized, using 11 certified multi-signature nodes to host Bitcoin. The overall solution is similar to a consortium chain with a permission mechanism, rather than a true public chain.

At the same time as Liquid Network, there was another side chain called RSK, which was born earlier and released a white paper in October 2015, but it did not become a solution that was later talked about, and it is no longer mentioned even now.

Also in 2016, a developer named Giacomo Zucco proposed the initial concept of the RGB protocol based on Peter Todd's ideas. However, it was not until 2019 that Maxim Orlovsky and Giacomo Zucco established the LNP/BP Standards Association to promote the development of RGB towards practical applications. Then in April last year, the RGB v0.10 version was released, which brought full support for smart contracts to Bitcoin and the Lightning Network. Since then, RGB has completed the important function of "implementation", and the popular "RGB++" some time ago has also been available. However, whether it is RGB or RGB++, there is still some distance to go in terms of real implementation.

Of course, we can’t forget another important role - Stacks. As a well-known Layer2 that claims to truly support smart contracts and can realize decentralized application development on Bitcoin, it has been the leading player in the BTC Layer2 track since its launch in 2018. With the advent of the "Satoshi Upgrade", it has attracted enough attention in the industry, but the recent upgrade delay has put out the fire.

The BTC Layer2 solution that is closer to us is BitVM, which was proposed only last year. Its implementation method is exactly the same as Ethereum's Optimistic, so it has also received a lot of attention. However, BitVM's smart contracts run off-chain, and each smart contract does not share status, while BTC cross-chain uses traditional Hash locks to anchor assets, and does not achieve truly decentralized BTC cross-chain.

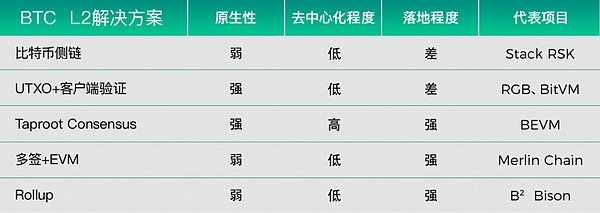

Through the above review, it is not difficult to find that BTC Layer2 actually developed much earlier than Ethereum, and these attempts have been continuously verified. Later generations stepped on the shoulders of their predecessors and continued to move forward, which led to today in 2024, and made the development of BTC L2 no longer a spark. We can see the current status and representative projects of several mainstream BTC Layer2 solutions on the market through the figure below, and we can intuitively see the current dilemma (thanks to netizens for providing the picture)

According to public information, there are no less than 10 BTC Layer2 projects that have received financing this year, and they are still growing. They can be called a star track, but so far, the truly impressive and publicly recognized BTC There are very few L2s, either they are trapped by technical bottlenecks and development is delayed, or they are like Merlin, which is high and low, and is complained by the community. In addition, because it is not decentralized enough, large funds are always afraid to get on board, and they only play a "cover" on the periphery.

As we analyzed above, the reason why ETH Layer2 has achieved today's success is that it has a good balance between "decentralization" and "nativeness", which makes funds willing to enter the Layer2 ecosystem, thus achieving the effect of "letting a hundred flowers bloom", and the current BTC Layer2 is also in such a dilemma and urgently needs to break through.

2. Possible breakthrough directions of Bitcoin ecology

The Bitcoin Hong Kong Conference has just ended recently. The author had the honor to go to the scene to listen to the sharing of these well-known BTC L2s in the industry. On the one hand, it is to attend the conference, and on the other hand, it is to answer his own doubts, hoping to find a BTC Layer2 direction with more decentralization, more data availability and more security. Among them, two emerging BTC Layer2s that have attracted widespread attention have entered the field of vision.

First, at the event, I had a chat with a friend from BEVM. Although I had seen the news that they had received financing from Bitmain before, and I also learned about Taproot Consensus because of my research on RGB, I was not particularly clear about the team background and specific situation.

In fact, they created ChainX in 2017, which brought BTC to Polkadot in a decentralized way and attracted more than 100,000 BTC to interact with the protocol. However, because it uses a multi-signature scheme of 11 people to host users' Bitcoin assets, there is a certain centralization risk. Later, because of Bitcoin's famous Taproot upgrade, BTC has a more efficient, flexible and private transmission method, which has enabled the ChainX team to see a new way to build BTC L2, and now the first BEVM network based on Taproot Consensus has been created.

According to official information, BEVM has realized a trustless BTC network solution through Taproot Consensus, and Taproot Consensus consists of three core functions: first, Schnorr Signature allows Bitcoin multi-signature addresses to be expanded to 1,000 (greatly improving security compared to ChainX's 11-person solution), thereby realizing the decentralization of multi-signature addresses; second, MAST is used to realize the coding of multi-signature management, which does not rely on people to sign, but relies on code-driven; finally, Bitcoin Light Node Network is used to drive multi-signatures through Bitcoin light node network consensus, realizing completely decentralized Bitcoin cross-chain and management.

Logically speaking, the implementation of Taproot Consensus is neither like the traditional side chain method nor the popular RGB, and it seems to have opened up a new technical implementation logic. Of course, the author is not a professional technician and cannot judge from the technical advantages and disadvantages and code level, but at least I have seen a brand new solution. In addition, the core developers of BEVM also mentioned BEVM-Stack at the event. This concept, which is somewhat similar to OP Stack, has caused a lot of discussion. After all, if one-click Layer2 is implemented on BTC, it may bring a new pattern to the development of BTC Layer2.

Another project that is often mentioned in Hong Kong is Mezo, which also completed a $21 million Series A financing in April. The investors are also very impressive, led by Pantera Capital, and participated by Multicoin, Hack VC, Draper Associates, etc. It can be said to be a true representative of Western BTC Layer2.

Mezo uses tBTC as its basis, and tBTC is a bridge that has been born for several years to link Ethereum and Bitcoin DeFi. tBTC allows any user with BTC or ETH to create tBTC by using a signer network. Unlike previous solutions, there is no centralized custodian for the locked Bitcoin. Signers are randomly selected, and different signer groups are selected for each minted tBTC. Signers provide collateral to ensure that they cannot easily run away with the funds, while ensuring the normal operation of the network through over-collateralization.

Therefore, as an ETH equivalent to the value of BTC, tBTC acts as a bridge between Bitcoin and Ethereum. BTC holders can deposit BTC into smart contracts and receive tBTC. Mezo also uses tBTC to implement the functions of BTC Layer2. Although it is innovative, it is more like a "technical stitching monster", and the team that raised funds this time is also the development team Thesis behind tBTC.

In addition, from the currently known information, Mezo's security method seems to be a multi-signature method, which is not very decentralized in a sense and is worth discussing.

Of course, the trust issue of BTC Layer2 is the stumbling block that hinders its development. Although the old saying goes "attack your shield with your own spear", we cannot use the advantages of others to belittle the disadvantages of the other party. From the perspective of the development of the industry, how to expand the track and set an example are the goals of any project. To put it another way, if BTC Layer2 can achieve the effect of ETH Rollup, why worry about the development of the ecosystem and why worry about not being able to achieve a BTC Layer2 of hundreds of billions?

Prospects

Although the recent macro-financial changes have brought a lot of impact on the cryptocurrency ecosystem, and the market value of Bitcoin has fallen back to around 1.2 trillion US dollars, this cannot stop the industry from moving forward, nor will it make people lose confidence in the development of the Bitcoin ecosystem. Although projects like Merlin seem to have set a "bad head" for the BTC Layer2 track, this will not prevent people from continuing to build BTC Layer2.

It is important to know that the development of ETH Layer2 is also full of difficulties, and even one or two bull markets are needed to consolidate this trend. However, once the technical direction and technical path are confirmed, its rising index will grow exponentially. Currently, BTC Layer2 is probably in this difficult climbing period.

From the perspective of utility, we need more ecological projects like BEVM that are "trustless", "native" and "safer". We also need old players like Stacks who continue to build to contribute fresh blood, and innovative projects like Mezo to add bricks and tiles to the track. Only when a hundred flowers bloom in the ecological situation, BTC Layer2 can usher in a new spring.

"Pessimists are always right, and optimists always move forward." As long as we go in the right direction, we will most likely see a real explosion in the Bitcoin ecosystem, rather than a short-lived hype. After all, the magic box of this 100 billion track has been opened. In addition to embracing expectations, we can also be more patient and perseverant.

Alex

Alex

Alex

Alex Beincrypto

Beincrypto Others

Others Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph