Source: Blockchain Knight

Capriole Investments founder and CEO Charles Edwards recently published a series of articles on “The Momentum Era” has begun.

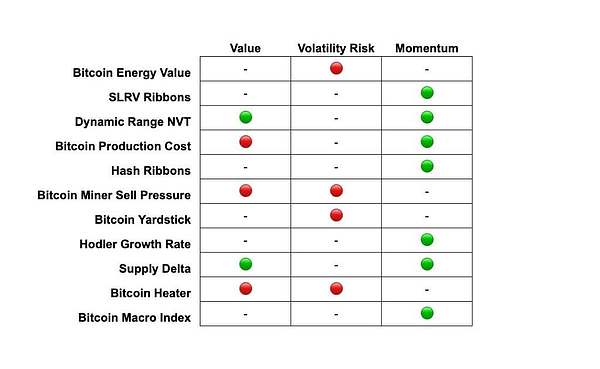

Edwards’ detailed analysis involves ten on-chain indicators he developed,which collectively indicate significant changes in the valuation and market dynamics of Crypto assets.

One of the core indicators is the energy value of BTC, which is now worth $70,000.

Edwards explained: “The intrinsic value of BTC is priced solely by the pure joule energy input into the network. BTC is currently valued at $70,000, which is the first fair valuation of BTC in two years.”

Another indicator proposed by Edwards, SLRV Ribbons, tracks the ratio of short-term holders to long-term holders. Current trends indicate that there is huge potential for high return periods on BTC investments.

Edwards also pointed out: "The SLRV Ribbon upward trend usually isolates the BTC venture investment period with the best returns, and the current trend still looks very strong."

The Dynamic Range NVT signal adds a value band to BTC’s “P/E Ratio,” a metric that compares on-chain volume to market capitalization.

According to Edwards, this metric has recently returned to relative value after being overvalued. This suggests that valuation indicators are normalizing after a period of overvaluation.

p>

In terms of "production costs", Crypto assets have exceeded their production costs, thanks to the increase in ordinal fees.

This shows that mining is once again achieving high profits and may lead to higher repricing.

Edwards pointed out: "In recent months, BTC has exceeded the cost of production, but the value era of BTC is over."

The hash band indicator has been What Edwards calls his first on-chain metric, which shows “expanding localized hashrate growth,” is an indicator of miner confidence and network health.

An important observation comes from the miner selling pressure indicator. Edwards noted: “The pressure is very high now, on par with 2017. This highlights a few things: miners are not profitable and are having trouble selling BTC, and ETF demand is consuming supply.”

BTC Yardstick and Hodler Growth The Rate indicator suggests that BTC may be in the early stages of a bull run, with more and more holders beginning to sell for profit.

However, Edwards suggested: “Based on the duration of previous cycle peaks, we should still have some time.”

Supply Delta and BTC Heater reveal short-term and long-term holders respectively ratio and the total market leverage ratio. Both indicators show what conditions have been like before large market moves historically.

Finally, Edwards is bullish on the BTC Macro Index, a machine learning model that aggregates more than 60 on-chain and macro indicators that currently indicates strong market expansion.

Edwards pointed out: “We are in the early stages of a typical BTC cycle, in a period of strong expansion.”

To sum up, Edwards’ analysis foresees a multi-month upward trend for BTC, although As the market accelerates in 2024 and the next halving approaches, there may be volatility and pullbacks.

Edwards boldly stated: "The consensus among all indicators is that a very large multi-month uptrend is likely to occur from here."

Edwards concluded: "The deep value of BTC has already Nothing remains, the ship has sailed, and you have two years to buy undervalued BTC."

"Instead, an exciting new chapter has begun, welcome to To the BTC Momentum Era."

Brian

Brian

Brian

Brian Joy

Joy Brian

Brian Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Brian

Brian Brian

Brian Alex

Alex