Written by Patryk Krasnicki, Messari; compiled by 1912212.eth, Foresight News

Key Points

Sei positions itself as a high-speed L1 network, compatible with CosmWasm and Cosmos's IBC protocol.

The Twin-Turbo consensus mechanism reduces transaction latency through smart block propagation and optimistic block processing, increasing the speed of transaction execution and network consensus.

Parallelization increases throughput because transactions are executed independently of each other in parallel.

The upcoming Sei V2 upgrade will introduce multiple technical upgrades, namely full backward compatibility of EVM smart contracts and tokens, Optimistic transaction parallelization, and a re-architecture of the network storage interface.

Based on the 7-day moving average data on April 9, 2024, Sei has an average of 8,300 daily active addresses, 394,000 daily transactions, and its DeFi TVL reached $38.7 million.

Introduction

The last round of bull market exposed the limitations of blockchain, and the network experienced high gas fees and slow transaction speeds. However, in the recent bear market, a new L1 has emerged, and its technological innovations hope to solve these limitations. Sei Labs is L1, aiming to become the fastest network for exchanging digital assets. Sei's built-in technologies such as Twin-Turbo consensus and transaction parallelization can reduce transaction delays and increase transaction throughput. Sei competes with other alternative layer-1 networks, such as emerging non-EVM layer-1 networks such as Sui and Aptos, existing networks such as Solana, and the upcoming parallel EVM public chain Monad. As the network continues to mature, Sei Labs plans to upgrade Sei V2 and later technical upgrades by parallel stacks, which will further enable Sei to stand out and achieve growth.

Background

Sei was announced in May 2022 and was founded by Jayendra Jog and Jeff Feng. The two founders worked as software engineers at Robinhood and venture capitalists at Coatue Management. Sei Labs raised $35 million in two rounds of financing and conducted two incentivized testnets. The Seinami incentivized testnet (also known as Atlantic-1) went live in July 2022. In March 2023, the upgraded Atlantic-2 testnet went live.

Sei launched the Pacific-1 mainnet in August 2023 along with SEI, the native token airdropped to eligible users. Since the mainnet launch, network activity has continued to grow and the on-chain ecosystem has continued to expand with the help of the Sei Foundation. Sei Labs is working on a major technical upgrade to the public Devnet for the upcoming launch of Sei V2 in the first half of 2024.

Technology

Sei is an integrated universal layer-1 network. As an integrated zone blockchain, Sei combines execution, settlement, consensus, and data availability into a single network. The zone blockchain is compatible with Cosmos' Inter-Blockchain Communication (IBC) protocol and is built with a modified fork of the Cosmos SDK and Tendermint Core protocol. Sei's application layer supports CosmWasm smart contracts written in Rust. Although Sei is built using Cosmos technology, it is sovereign in terms of architecture and governance.

The network has built-in features that improve transaction efficiency and throughput to support Sei's goal of becoming the fastest digital asset exchange network. These features include the Twin-Turbo consensus mechanism for reducing transaction latency and transaction parallelization for increasing transaction throughput. In addition, the on-chain central limit order book (CLOB) supports liquidity across the network, although it has been deprecated. Sei's initial technical feature set will be expanded in the upcoming Sei V2 upgrade.

Consensus

Sei relies on a Proof of Stake (PoS) protocol based on Tendermint Core, a Byzantine Fault Tolerant (BFT) algorithm for consensus. Sei validators process transactions on the network and resolve state (account balances, smart contracts, etc.) changes. Validators are selected to generate blocks based on their total stake (self-collateralized plus delegated SEI tokens). Anyone who meets the hardware requirements can operate a validator node to protect the network.

Today, only the top 39 validators by total stake can participate in consensus and earn network transaction fees and staking rewards. If an active validator misbehaves, its total stake may be slashed or burned. SEI token holders can delegate SEI to existing validators, enabling the delegator to help secure the network. The delegator also shares the SEI rewards of the associated validator, minus the commission rate selected by the associated validator. Both validators and delegators must wait for a 21-day unlocking period before fully unlocking the staked SEI. Notably, non-vested tokens can be staked to secure the network.

Sei also leverages its novel Twin-Turbo consensus mechanism to reduce transaction latency through two main components:

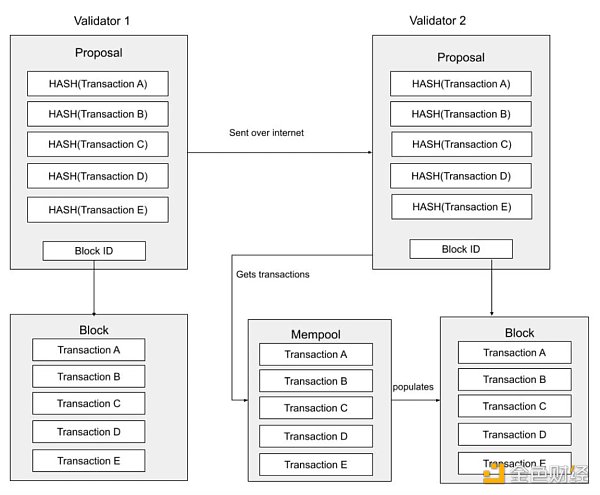

Smart Block Propagation: The block proposer creates a block of transactions that is distributed across the set of validators. These blocks are compressed to contain a hash of each transaction included in the block. Normally, validators need to wait for the entire contents of a proposed block to arrive before they can reach consensus. However, Sei's design allows for individual transactions in a proposed block to be received while validators can leverage the individual transactions already in their memory pool. If all necessary transactions are held in the memory pool, validators can reconstruct the proposed block locally without waiting to receive the entire contents of the proposed block. This reduces the time validators have to wait to reconstruct the proposed block, thereby reducing transaction latency.

Optimistic Block Processing: Normally, validators perform pre-voting and pre-committing steps before reaching consensus on a proposed block and committing it to the blockchain. However, on Sei, once validators have reconstructed the contents of a proposed block, they are optimistically considered valid. This processing occurs simultaneously with the pre-voting and pre-committing steps. Validators immediately begin processing the first block proposal they receive, even before the block has been confirmed by consensus. This process helps reduce transaction latency.

If the validator set fails to reach consensus on the optimistic acceptance of a proposed block, the network will reject the block and future rounds at that block height will not use optimistic block processing. It is worth noting that smart block propagation and optimistic block processing come with a trade-off of quadratic communication complexity. In other words, the number of messages sent between validator sets grows exponentially, making it difficult to increase the maximum validator set size due to the increased bandwidth and processing requirements.

Execution

Many chains have sequential transaction engines, where transactions are ordered and executed one by one. To speed up execution, transactions on Sei can be executed in parallel, allowing smart contracts to run without interfering with each other. This reduces network congestion and increases transaction throughput. Today, parallelization on Sei is optional and pessimistic. In order to take advantage of Sei's parallelization capabilities, developers must define the state used by the smart contract (account balances, smart contracts, etc.). If not defined, transactions are processed sequentially. If dependency maps are defined, the network is maintained to know which transactions can be run in parallel and which transactions cannot because they depend on each other. These dependency maps are created via directed acyclic graphs (DAGs). If dependencies are found between transactions (i.e., they read/write the same location in the Sei state), they are processed in sequence, allowing transactions on Sei to proceed synchronously.

Roadmap

In November 2023, Sei announced the Sei V2 plan, which will include three major upgrades to the network. In February 2024, Sei launched a public Devnet to test Sei V2 features. The upgrade is expected to be deployed to the mainnet in the first half of 2024. Finally, once Sei V2 is online, the team plans to launch Sei's parallel stack, which will extend the second layer network to Sei.

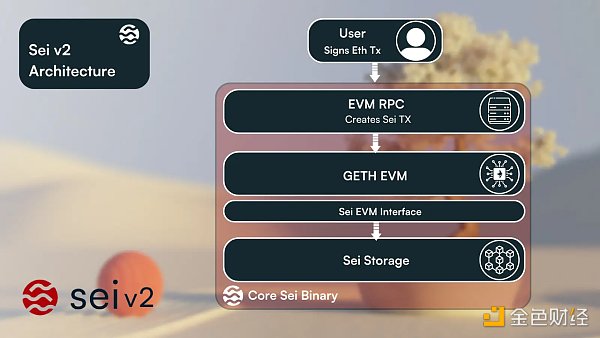

EVM Integration

Sei V2 plans to introduce compatibility for EVM smart contracts written in Solidity, including ERC-20 and ERC-721 token standards. EVM smart contracts will also be backward compatible, meaning that smart contracts on Ethereum and its second-layer network can be seamlessly redeployed on Sei.

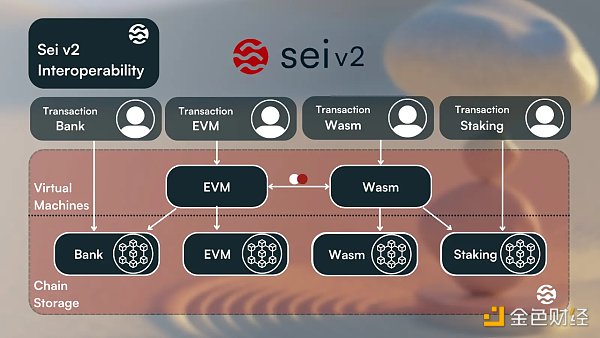

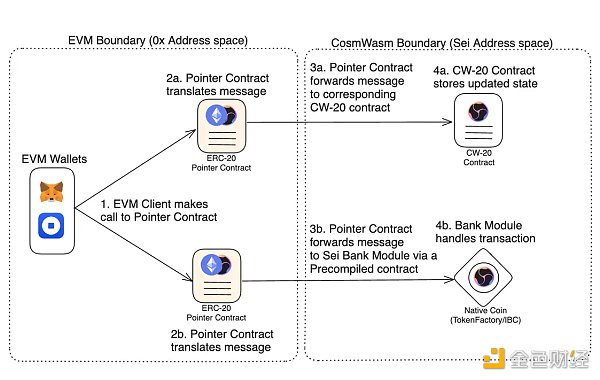

Sei will support both execution environments simultaneously. In addition, each user's EVM and Wasm addresses will be linked and share the same underlying account. By using pointer contracts and precompiled contracts, EVM smart contracts and tokens will interoperate with existing CosmWasm smart contracts and vice versa.

These contracts will make tokens accessible in both environments without the need for wrapped versions of the tokens. Essentially, pointer contracts act as translators between the two execution environments. They allow users to indicate which messages they want to send in either environment. With the introduction of EVM compatibility, Sei will be a suitable gathering place for deploying cross-chain EVM protocols.

Many of the leading protocols on Ethereum also exist on other EVM-compatible networks. This upgrade could lead to EVM infrastructure and DeFi protocols being deployed on Sei, bootstrapping a strong EVM ecosystem on the network. The upgrade will also enable EVM developers to build on the network.

According to Electric Capital’s 2023 Developer Report, 87% of multichain developers work on at least one EVM chain. This previously inaccessible developer ecosystem will be able to leverage Sei’s enhanced transaction efficiency and throughput to create novel EVM applications that are native to Sei. Evidence of this can already be seen through EVM applications built on Sei’s public Devnet.

Optimistic Parallelization

Parallelization on Sei is currently optional. In order to take advantage of Sei’s parallelization capabilities, smart contract developers must define the state (account balances, smart contracts, etc.) used by the smart contract. Sei v2 plans to change pessimistic parallelization by introducing optimistic parallelization, which will optimistically assume that all transactions are eligible for parallel processing. Similar to Sei’s optimistic block processing fallback, if there are dependencies between transactions (transactions that interact with the same part of the Sei state), they will be reprocessed in order. The change to optimistic parallelization will not require the definition of dependency mappings, thus easing the developer experience.

SeiDB

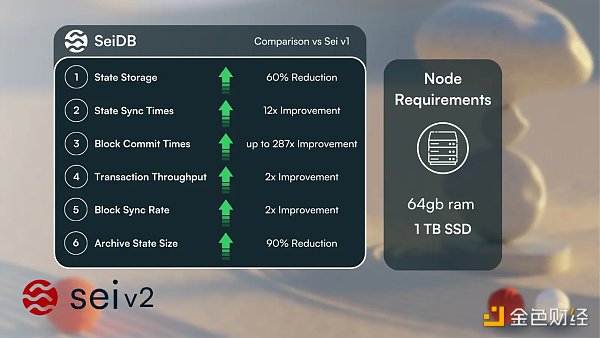

Sei V2 plans to re-architect the network's storage interface. SeiDB will introduce a new storage layer on top of Sei that decouples the State Commitment (SC) layer and the State Storage (SS) layer. This is expected to:

Improve state read/write performance, thereby increasing state sync time and reducing commit time, resulting in faster finalization.

Reduce state bloat by reducing the metadata that needs to be stored.

Reduce hardware requirements for node operators.

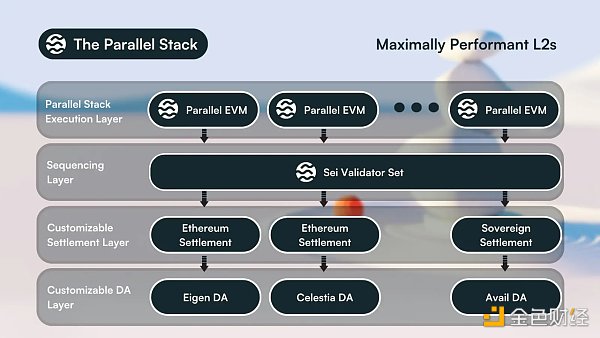

Parallel Stacks

Modular blockchains separate one or more of the tasks of execution, settlement, consensus, and data availability. Modular blockchains are on the rise in 2022 with the launch of Ethereum Layer-2, which is dedicated to being an execution layer. In 2023, networks dedicated to being a DA layer begin to launch. Sei plans to join the modular blockchain space once Sei v2 is live and Sei is compatible with the EVM. Specifically, Sei's upcoming open-source parallel stack initiative enables developers to launch modular layer-2 blockchains as parallel EVM execution layers. These layer-2s can use Sei's validator set for ordering services and customize their settlement and DA layers.

SEI Token

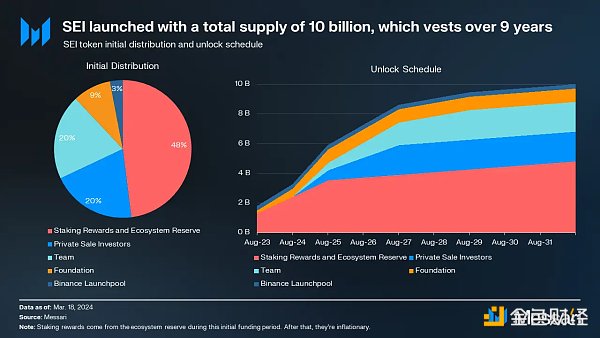

SEI is Sei's native token, launched on August 16, 2023, when the Pacific-1 mainnet goes live. SEI currently has a maximum token supply of 10 billion. As of April 9, 2024, the total supply of SEI tokens is approximately 8.7 billion, of which approximately 65.18% is staked (approximately 5.67 billion) and approximately 31.72% is in circulation (approximately 2.76 billion). The remaining approximately 1.3 billion SEI is planned to be minted over 10 years and distributed to Sei's active validator set as inflation token rewards. SEI tokens provide Sei with multiple functions, including

Sponsored Business Content

settlement of network transaction fees;

staking by validators and delegators;

rewarding validators;

participating in governance.

Token Economics

SEI Tokens Are Allocated to Five Areas

Ecosystem Reserve (48% of Total Supply): 4.8 billion tokens are allocated to the Ecosystem Reserve controlled by the Sei Foundation. This reserve is intended to fund staking rewards, ecosystem initiatives, airdrops, and incentives. Of these, 27% are available at the TGE, while the remaining 73% is subject to variable vesting over nine years.

300 million SEI (3% of total supply) are allocated to airdrops from the Ecosystem Reserve allocation. Eligible users include those who participated in the Sei Incentivized Atlantic Testnet. The project team did not specify the eligibility criteria, but official mission activities during the testnet included Dawn NFTs, Dusk NFTs, and Sunken Treasure NFTs. Additionally, active users of Solana, Ethereum, Arbitrum, Polygon, Binance Smart Chain, and Osmosis that bridge assets to Sei are also eligible.

1.5 billion SEI (15% of total supply) are allocated to be minted over 10 years as inflation token rewards distributed to Sei’s active validators.

The Sei Foundation has not yet disclosed how much of the remaining 3 billion SEI (30% of total supply) are allocated to each ecosystem reserve.

Private Selling Investors (20% of Total Supply): 2 billion tokens are allocated to private selling investors. There is a one-year lockup period followed by a three-year linear unlock. Sei Labs has raised $35 million in two rounds of funding.

In August 2022, $5 million was raised in a seed round led by Multicoin Capital and participated by Coinbase Ventures, Hudson River Trading, etc.

In April 2023, $30 million was raised in two rounds of strategic financing participated by Jump Crypto, Distributed Global, Flow Traders, etc.

In November 2023, Circle Ventures completed a strategic investment in Sei.

However, the project team did not disclose whether equity and/or tokens were sold in these rounds.

Team (20% of the total supply): 2 billion tokens are allocated to the team, subject to a one-year unlocking limit, followed by a five-year variable vesting period. Specifically, 76% of the tokens are unlocked linearly in the first three years, while the remaining 24% are unlocked linearly in the second two years.

Foundation (9% of total supply): 900 million tokens are allocated to the foundation. 22% of them are available at the TGE, and the remaining 78% need to be unlocked linearly over two years.

Binance Launchpool (3% of total supply): 300 million tokens are allocated to the Launchpool facilitated by Binance. Users can stake BNB, TUSD, and FDUSD within 30 days to receive a certain proportion of the SEI token share.

It is worth noting that non-vested tokens (such as tokens allocated to the team, foundation, and private placement investors) can be staked. These staked tokens can receive liquid SEI token rewards and have the ability to participate in governance and protect the network.

Governance

Sei uses an on-chain governance process, and proposals can influence network parameters. These include parameters related to the SEI's minting schedule or increasing the maximum number of active validators. Sei's governance does not have an official voting frontend, but can be interacted with through supported wallets such as Fin Wallet and Compass Wallet. The governance process is as follows:

Creating a Proposal: A proposal can be created to initiate a two-day deposit period during which SEI can be deposited to support pending proposals. Once the minimum deposit threshold of 3,500 SEI ($2,400 as of April 9, 2024) is met, the proposal will go to an on-chain vote. Proposals can be expedited by using the is-expedited flag, which halves the deposit period to one day but doubles the minimum deposit threshold to 7,000 SEI ($4,800 as of April 9, 2024).

Deposit Period: SEI can be deposited to support pending proposals. If the minimum deposit threshold is met, the proposal will go to an on-chain vote. If the minimum deposit threshold is not reached before the end of the deposit period, the proposal will be canceled and all deposits will be destroyed.

Vote on proposals: Users who stake SEI can vote on active proposals: voting power is equivalent to each user's respective tokens. The voting period is five days, and the quorum is 33% of the staked token supply. A simple majority of at least 50% of the voting power used for a proposal must vote in favor for it to be approved. If more than 33% of the total voting power is used to select "no_with_veto", the proposal will fail regardless of the other votes.

Since the launch of the Sei mainnet, as of April 9, 2024, 48 of the 53 active proposals have been passed. These include a small increase to the maximum number of active validators, an increase in governance deposit parameters, an update to the minimum network transaction fee, and an upgrade of the network software. It is worth noting that non-vested tokens can participate in governance through staking.

SEI Ecosystem Status

Since Sei launched its mainnet in August 2023, various vertical protocols have been launched and boosted the ecosystem:

DeFi: As of April 9, 2024, Sei's TVL was approximately $38.7 million, with Sei lagging behind Solana, Sui, and Aptos. Sei's decentralized exchange Astroport has the most TVL, at approximately $38.3 million. Traders can use decentralized perpetual contract exchanges such as Levana Finance (with a cumulative trading volume of approximately $36.6 million), while lending protocols such as Hoyu and Kawa Finance run on Sei's public Devnet.

Liquidity Staking: Protocols such as Silo and Kryptonite enable users to liquid stake SEI tokens through their respective iSEI and stSEI tokens. As of April 9, 2024, Silo and Kryptonite have staked approximately $11.6 million and approximately $4.4 million of SEI tokens, respectively.

Wallets: As of April 9, 2024, Sei averaged approximately 8,300 daily active addresses and approximately 394,000 daily transactions. Wallets space includes Sei native wallets in Fin Wallet and Compass Wallet. SPACE ID provides a .sei name service, where over 20,300 NFTs representing human-readable names of Sei addresses have been minted.

NFTs: The NFT ecosystem on Sei is one of the most active on the network, with a total historical transaction volume of over $20 million. Sei native NFT marketplaces include Pallet Exchange, MRKT, Quik, and Dagora. NFT projects include (1) Seiyans, which is building MRKT, (2) The Colony, which is building AntSwap, and (3) WeBump, which offers a toolkit called Lighthouse that has been used to mint over 500,000 NFTs.

Gaming: The partnership with Pixel Realm hopes to bring their venture fund, gaming marketplace, and gaming studios to Sei.

DePIN: Nimble Network, first launched on Sei, aims to decentralize the training of AI models.

Other officially announced partnerships or integrations include Seijin (LaunchPad project), Kado (crypto on/off-ramp), Tenderly (EVM development toolkit), and Space and Time (data indexing), among others. Once Sei’s V2 upgrade goes live and Sei is compatible with the EVM, a variety of EVM applications are expected to be launched, including protocols such as Algebra DEX. In addition, the development of the ecosystem is constantly stimulated through several projects:

Ecosystem Fund: In September 2022, Sei announced the establishment of the Ecosystem and Liquidity Fund to help early founders and teams acquire users and scale. The fund was launched with $50 million in funding from Multicoin Capital, Flow Traders, Hudson River Trading and others. In January 2023, MEXC Global received $20 million in financing. In April 2023, Foresight Ventures received $50 million in financing.

Creator Fund: In April 2024, Sei announced the establishment of the Creator Fund, focusing on new and existing NFT and social projects. The fund is in partnership with Gitcoin, a well-known leader in community funding for multiple ecosystems.

Sei Launchpad Program: Managed by the Sei Foundation, this program aims to support founders to build on Sei through mentorship and investment. Those interested can apply here.

Ecosystem Reserve: Sei's Ecosystem Reserve is used in part to fund ecosystem initiatives, airdrops, and incentives. No additional ecosystem initiatives, airdrops, or incentives have been initiated since the creation of the SEI token. However, the Sei Foundation continues to own these tokens, which can be used to stimulate future growth of the network and its ecosystem.

Sei is a layer 1 blockchain that aims to be the fastest digital asset exchange network. It has novel technical features built into the blockchain. Namely Twin-Turbo consensus and transaction parallelization, which improve transaction efficiency and throughput. Since the launch of the mainnet in August 2023, Sei has seen the launch of an ecosystem of native projects and the emergence of a community.

To maintain momentum, Sei must successfully deploy the features of the Sei V2 upgrade program. EVM compatibility can unlock new opportunities by expanding Sei's developer ecosystem and supporting the deployment of established EVM protocols on Sei. Optimistic transaction parallelization will ease the developer experience, while SeiDB improves the performance of the network across the board.

After V2, Sei is setting its sights on a parallel stack that could facilitate further growth in the Sei ecosystem and validator usage as layer 2 EVM Rollups are launched by developers seeking improved user experience and novel design space.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Olive

Olive Beincrypto

Beincrypto Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist