Original title: MEVA and aPriori

Author: Paul Verdittakit, Pantera Partner; Compiler: 0xxz@Golden Finance

A prerequisite for any healthy market is regulation. Financial regulation allows seamless capital exchange, antitrust law controls rent-seeking, and intellectual property law encourages innovation. On the blockchain, since everything is code, those who write the code are the ones who make the law.

This power is particularly prevalent at the bottom of the blockchain stack - block builders. Stakeholders who compete to build blocks determine the success or failure of the blockchain itself; if block production stagnates or incentives encourage predatory behavior, the integrity of the blockchain collapses and users disappear. For example, when Solana faced an outage, users were unable to perform any transactions, which meant they could not deposit or withdraw tokens.

Block builders are those who physically take transactions out of the memory pool and build blocks of transactions that are then propagated to other blocks to reach consensus on the state of the blockchain. The design of how the stakeholders in the block building process interact with each other is up to the companies building these systems. On Ethereum, Flashbots (a Pantera portfolio company) is the top choice. On Solana, Jito is king. And when Monad launches, aPriori will dominate.

MEVA

The umbrella term used to describe the problem these companies are seeking to solve is “MEV” or “Maximum Extractable Value”. In short, the individuals who order transactions into these blocks are incentivized to maximize the fees they generate, which means they can maliciously reorder transactions to maximize their own profits and increase costs for users.

The design goals that the Miner Extractable Value Auction Infrastructure (MEVA) aims to address are gas fee stability, competition, and centralization. Much of this comes down to incentives; if stakeholders are financially compensated for adding positive externalities to block construction (or removing negative externalities), then they will do so. However, there is no perfect harmony.

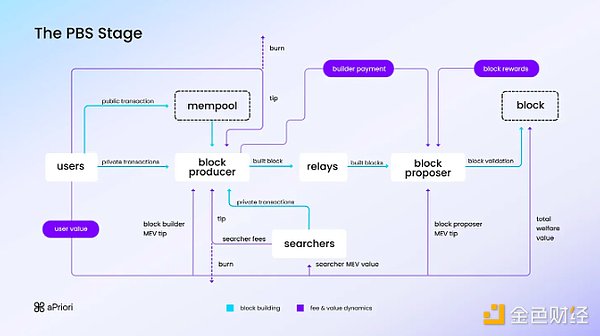

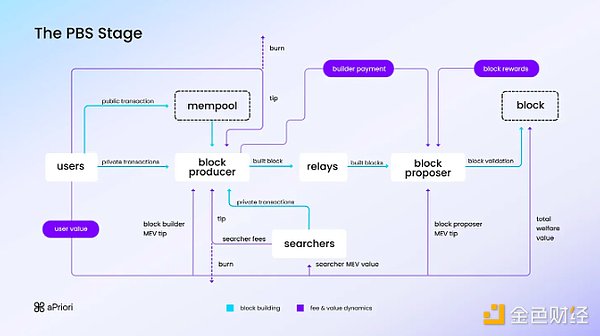

On Ethereum, block times are around 12 seconds, and all stakeholders have time to access all transactions and simulate all transactions to maximize their profits. With this in mind, the current gold standard approach on Ethereum is Proposer-Builder Separation (PBS). This setup splits the process into 5 stakeholders: Users, Block Producers, Relays, Block Proposers, and Searchers. By splitting the block welfare value across multiple stakeholders, they all have an incentive to share information with each other, allowing for competitive construction of blocks while ensuring that blocks remain profitable (thus minimizing failed transactions). But this has its own problems; block producers have become centralized, with the top two builders capturing more than half of the value from block construction. Applications have also realized that they can capture their own MEV through mechanisms such as the MEV tax, which allows them to participate in the transaction ordering process and reclaim value that would otherwise go to block proposers.

Monad

Monad is an upcoming new chain that will be the most performant EVM-compatible layer 1 blockchain ever, capable of 10,000 transactions per second, 1 second block time, single-slot finality, and low hardware requirements. One of the innovations to achieve this is the separation of the execution and consensus layers, which allows the current block to run its consensus while executing the previous block. Monad Labs has raised $225 million and is expected to become the next large L1. It has accumulated more than 300,000 followers on Twitter.

This brings three design challenges:

1. Uncertainty of state:

2. Limited time window to simulate a full block:

3. Uncertainty of execution:

The probabilistic nature of transaction ordering means that the current architecture may cause transaction bundles to be reversed on-chain, resulting in a higher transaction failure rate, which harms the interests of users.

Solving these problems means designing an architecture that is cheap and has a low transaction failure rate for users, while ensuring that block construction stakeholders remain profitable.

aPriori Team

aPrioriThe founding team is uniquely positioned to succeed:

Ray, CEO/Co-founder, special project experience at Jump Crypto, contributor at Pyth Network, quantitative trader at Flow Traders

Olivia, CTO, former senior engineer at Coinbase, Bridgewater Investments

Ed, Researcher, former data scientist at VCRED, project leader at Los Alamos National Laboratory

The rest of the aPriori team has backgrounds in high frequency trading, quantitative hedge funds, and other top crypto companies.

Liquid Staking

aPriori plans to leverage the infrastructure they have built to roll out liquid staking to platforms running their MEVA. Jito does exactly this, allowing users to stake SOL and receive a portion of the rewards earned by validators using Jito. Jito has a fully diluted value (FDV) of $2 billion and over $800,000 in monthly revenue.

Testnet Launch

aPriori will launch the liquid staking protocol on the Monad testnet once it goes live and completes some final integrations. aPriori also plans to release an initial version of the MEVA system during the Monad testnet, focusing on the following:

Onboarding searchers and block builders to participate in blockspace auctions,

Facilitating validator experimentation and stress testing client software.

Designing MEVA is a fundamental part of any blockchain's internal plumbing. Monad's ultra-parallel EVM L1 is a new ecosystem that requires constant innovation to ensure a good user experience and profitable block builders. The team has the experience, motivation and vision to continue doing so.

During this testnet phase, the team invites all parties to participate in testing and provide feedback to work on mainnet preparation as well as further roadmap items such as protecting rpcs from sandwich attacks and analytics dashboards.

Anais

Anais