Author: Paul Veradittakit, Managing Partner of Pantera Capital, Translated by: Wuzhu, Golden Finance

Abstract

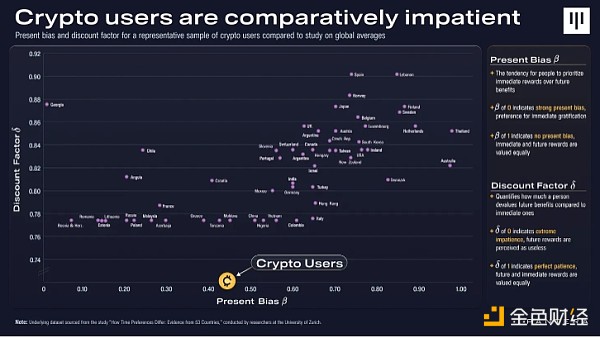

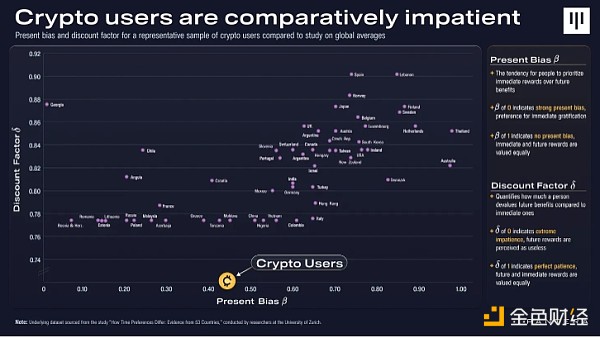

A study by Pantera Research Labs found that cryptocurrency users exhibited high present bias and low discount factor, indicating a strong preference for instant gratification.

The quasi-hyperbolic discount model, characterized by parameters such as present bias (ꞵ) and discount factor (?), helps understand individuals' tendency to favor immediate returns over future gains, a behavior that is particularly evident in the volatile and speculative cryptocurrency market.

This research can be used to optimize token distribution, such as airdrops used to reward early users, decentralize governance, and market new products.

Foreword

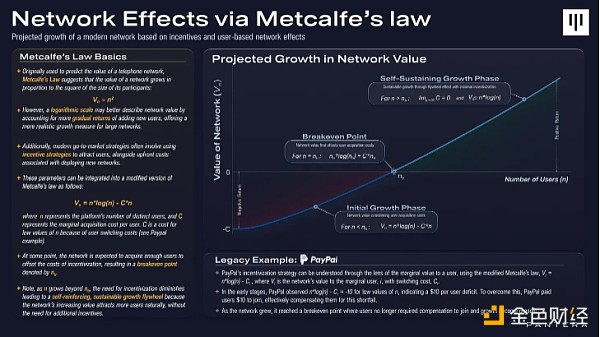

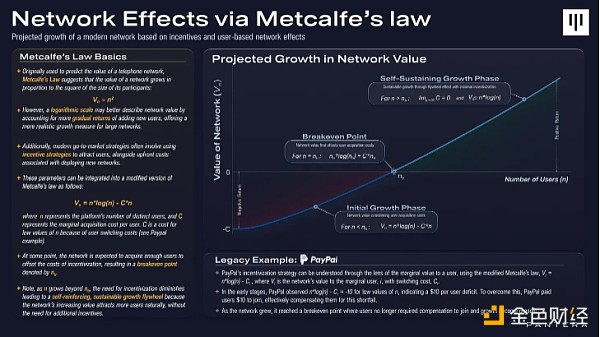

A classic story in Silicon Valley startup lore is that Paypal decided to pay users $10 for using its product. The reasoning is that if you can pay users to join, the network value will eventually get high enough that new users will join for free and you can stop paying. This does seem to work, as PayPal was able to stop paying and continue to grow, kickstarting its network effect.

In crypto, we’ve taken this approach and expanded it by using airdrops to pay not only people who join, but also often people who use our product for a while.

Quasi-Hyperbolic Discounting Model

Airdrops have become a multifaceted tool for rewarding early users, decentralizing protocol governance, and, frankly, marketing new products. Formalizing distribution criteria has become an art, especially when determining who should receive rewards and the value they should receive for their efforts. In this context, both the number of tokens distributed and the timing of their release (usually through mechanisms such as vesting or gradual release) play an important role. These decisions should be based on systematic analysis rather than relying on guesswork, emotion, or precedent. Using a more quantitative framework ensures fairness and alignment with long-term goal strategies.

The quasi-hyperbolic discounting model provides a mathematical framework for exploring how individuals make choices involving reward trade-offs at different times. Its application is particularly important in areas where impulsivity and inconsistency significantly influence decision making over time, such as financial decisions and health-related behaviors.

The model is driven by two population-specific parameters: the present bias ꞵ and the discount factor ?.

Present Bias (ꞵ):

This parameter measures an individual's tendency to prioritize immediate rewards over distant rewards. The parameter varies between 0 and 1, where 1 indicates no immediate bias, reflecting a balanced, time-consistent assessment of future rewards. As values approach 0, they indicate an increasing immediacy bias, indicating a stronger preference for immediate rewards.

For example, given a choice between $50 today and $100 a year from now, someone with a high immediacy bias (close to 0) would choose to receive the $50 immediately rather than wait for the larger sum.

Discount Factor (?):

This parameter describes the rate at which the value of a future reward decreases as the time until its realization increases, explaining why its perceived value naturally decreases with delay. The discount factor is more accurately quantified over longer, multi-year intervals. When evaluating two options over short periods of time (less than a year), this factor exhibits considerable variability because the immediate circumstances can disproportionately influence perceptions.

For the general population, research suggests that the discount rate is typically around 0.9. However, in groups with a propensity to gamble, this value is often much lower. Research suggests that habitual gamblers typically have an average discount factor of just under 0.8, while problem gamblers tend to have a discount factor closer to 0.5.

Using the above terminology, we can express the utility U of receiving reward x at time t by the following formula:

U(t) = tU(x)

This model captures how the value of rewards varies depending on their timing: immediate rewards are valued at full utility, while the value of future rewards is adjusted downward, taking into account present bias and exponential decay.

Experiment

Last year, Pantera Research Labs conducted a study to quantify the behavioral tendencies of cryptocurrency users. We asked participants two simple questions designed to measure whether they prefer to be paid immediately or to receive some future value.

This approach helped us determine representative values for ꞵ and ?. Our results show that a representative sample of cryptocurrency users exhibits a present bias slightly above 0.4 and a significantly lower discount factor.

Research shows that cryptocurrency users have a higher-than-average current bias and a lower discount rate, suggesting that they tend to be impatient and prefer instant gratification over future gains.

This can be attributed to several interrelated factors in the cryptocurrency space:

Cyclic Market Behavior: The cryptocurrency market is known for its volatility and cyclicality, with tokens often experiencing rapid fluctuations in value. This cyclical nature can affect user behavior, as many people are accustomed to riding through these cycles rather than adopting long-term investment strategies more common in traditional finance. Frequent ups and downs may cause users to discount future value at a higher rate, fearing that a potential downturn could wipe out profits.

Token Stigma:The survey specifically asked about tokens and their expected future value, which may highlight the deep-rooted stigma associated with token-specific transactions. This stigma is related to the cyclical and speculative nature of token valuations, reinforcing caution about long-term investments in the cryptocurrency space. Furthermore, suppose the survey used fiat currency or other forms of rewards to measure preferences. In this case, cryptocurrency users' discount rates may be closer to global averages, suggesting that the nature of the rewards may significantly affect observed discounting behavior.

The Speculative Nature of Crypto Applications:Today's crypto ecosystem is deeply rooted in speculation and trading, and these characteristics are prevalent in its most successful applications. This trend highlights that current users overwhelmingly favor speculative platforms, and the survey results also reflect this preference, indicating that users have a strong preference for immediate financial gains.

While the findings may differ from typical human behavioral norms, they reflect characteristics and trends of the current crypto user base. This distinction is particularly important for projects designing airdrops and token distributions, as understanding these unique behaviors allows for more strategic planning and reward system construction.

Take the approach of Drift, the perps DEX on Solana, which recently launched its native token, DRIFT. The Drift team included a time delay in its token distribution strategy, offering double rewards to users who waited 6 hours after the token was released to claim their airdrop. The added time delay was intended to alleviate congestion typically caused by bots at the start of an airdrop and potentially help stabilize the token’s performance by reducing the initial surge of sellers.

In fact, only 7,500 (or 15%) (at the time of writing) of potential claimers did not wait 6 hours to have their rewards doubled. Based on the research we presented, if the reward value was doubled, Drift would likely be delayed by a few months, which statistically should appease most end users.

JinseFinance

JinseFinance